See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Futures are off to the races this morning with the S&P 500 indicated to open up over 1%. It started last night after the close with some positive trial results from Moderna (MRNA) related to its COVID vaccine. Then this morning, futures received another boost when Goldman (GS) reported much better than expected earnings driven by strength in its sales and trading unit. It looks like Robinhood traders aren’t the only ones stuck at home and coining money!

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, the latest earnings reports, global economic data, trends related to the COVID-19 outbreak, and much more.

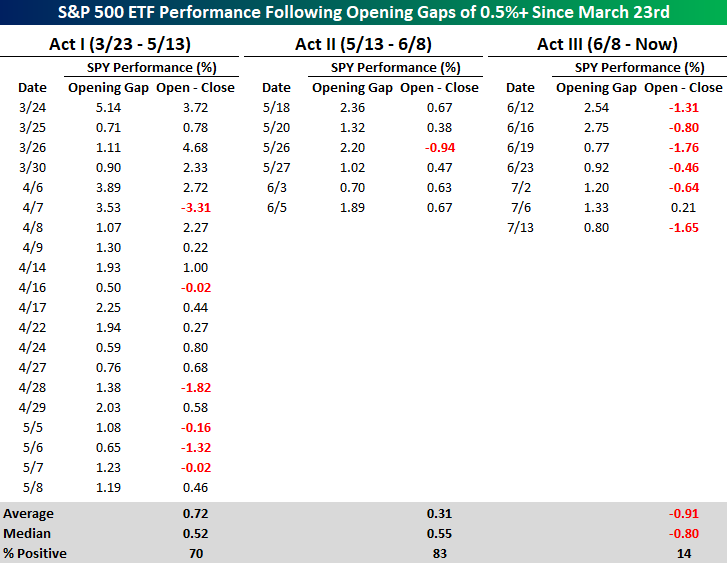

In last Friday’s Bespoke Report, we described the rally off the March lows as a series of three acts each represented by different market characteristics. With futures indicated higher this morning, we wanted to provide a snapshot of market performance following strong opens in each ‘act’ of the rally off the lows and how performance following these strong opens has differed in Act III relative to Acts I and II.

In both Acts I & II, strong opens were typically followed up with additional gains from the open to close. In Act I, the S&P 500 ETF (SPY) had 20 days where it gapped up at least 0.5%. On those days, SPY averaged an open to close gain of 0.72% (median: 0.52%) with gains 70% of the time. In Act II, performance was pretty much just as strong. In the six days where SPY gapped up more than 0.5%, SPY saw an average open to close gain of 0.31% (median: 0.55%) with gains five out of six times.

Act III, which includes the current period though (rightmost column), has been a completely different picture. On the seven prior days since June 8th where SPY gapped up over 0.5%, it has averaged an open to close decline of 0.91% (median: 0.80%) with gains only once. Whether the headlines related to COVID have been good or bad lately, investors have faded the initial market reaction.