Daily Sector Snapshot — 8/14/20

When a Few Basis Points Packs a Punch

US Treasury yields have been on the rise this week with the 10-year yield rising 13 basis points (bps) from 0.56% up to 0.69% after getting as high as 0.72% on Thursday. A 13 bps move higher in interest rates may not seem like a whole lot, but with rates already at such low levels, a small move can have a pretty big impact on the prices of longer-term maturities.

Starting with longer-term US Treasuries, TLT, which measures the performance of maturities greater than 20 years, has declined 3.5% this week. Now, for a growth stock, 3.5% is par for the course, but that kind of move in the Treasury market is no small thing. The latest pullback for TLT also coincides with another failed attempt by the ETF to trade and stay above $170 for more than a day.

The further out the maturity window you go in the fixed income market, the bigger the impact of the move higher in interest rates. The Republic of Austria issued a 100-year bond in 2017, and its movements exemplify the wild moves that small changes in interest rates (from a low base) can have on prices. Just this week, the Austrian 100-year was down over 5%, which is a painful move no matter what type of asset class you are talking about. This week’s move, though, was nothing compared to the stomach-churning swings from earlier this year. When Covid was first hitting the fan, the 100-year rallied 57% in the span of less than two months. That kind of move usually occurs over years rather than days, but in less than a third of that time, all those gains disintegrated in a two-and-a-half week span from early to late March. Easy come, easy go. Ironically enough, despite all the big up and down moves in this bond over the last year, as we type this, the bond’s price is the same now as it was on this same day last year. Start a two-week free trial to Bespoke Institutional to access all of our research and interactive economic tools.

B.I.G. Tips — Retail Sales Rock to New Highs

At the headline level, July’s Retail Sales report disappointed as the reading missed expectations by nearly a full percentage point. Just as soon as the report was released, we saw a number of stories pounce on the disappointment as a sign that the economy was losing steam. Looked at in more detail, though, the July report wasn’t all that bad. While the headline reading rose less than expected (1.2% vs 2.1%), Ex Autos and Ex Autos and Gas, the results were much better than expected. Not only that, but June’s original readings were all revised higher by around a full percentage point.

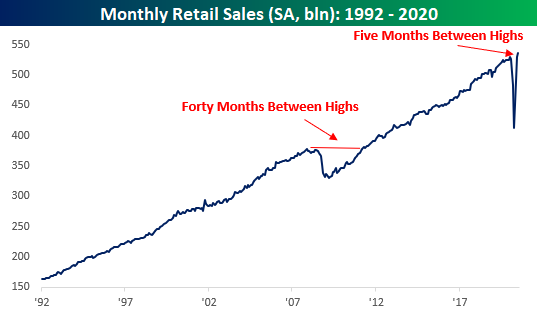

Besides the fact that this month’s report was better underneath the surface and June’s reading was revised higher, it was also notable as the seasonally-adjusted annualized rate of sales in July hit a new record high. After the last record high back in January, only five months passed until American consumers were back to their pre-Covid spending ways. For the sake of comparison, back during the Financial Crisis, 40 months passed between the original high in Retail Sales in November 2007 and the next record high in April 2011. 5 months versus 40? Never underestimate the power of the US consumer!

While the monthly pace of retail sales is back at all-time highs, the characteristics behind the total level of sales have changed markedly in the post COVID world. In our just released B.I.G. Tips report we looked at these changing dynamics to highlight the groups that have been the biggest winners and losers from the shifts. For anyone with more than a passing interest in how the COVID outbreak is impacting the economy, our monthly update on retail sales is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Bespoke’s Morning Lineup – 8/14/20 – Meet the New Boss, Same as the Old Boss

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“If most traders would learn to sit on their hands fifty percent of the time, they would make a lot more money.” – Bill Lipschutz

It’s not looking like a positive finish to the week for stocks as Thursday’s modest losses for the S&P 500 look set to continue today. Data overnight from China in the form of Industrial Production and Retail Sales were both weaker than expected. In Europe, Q2 GDP dropped 12.1%, which was in line with expectations while Employment declined 2.8% y/y. One bright spot is that futures are currently well off their lows from 5 AM (all times eastern).

In the US today, we also have a ton of data to contend with starting off with Retail Sales (mixed, headline missed but Control Group better than expected) , Non-Farm Productivity, and Unit Labor Costs at 8:30 (both much higher than expected). Then, at 9:15, we’ll get Industrial Production and Capacity Utilization, followed by Business Inventories and Michigan Sentiment at 10 AM. So, depending on how these reports come in, should shape how we finish the week.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

We’ve long been advocates that the days where the importance of transports acting as a leading indicator for the broader market have given way to the semis acting as the new transports of the digital 21st century. Lately, though, it hasn’t mattered which group you track. The chart below shows the relative strength of the DJ Transports and the Philadelphia Semiconductor Index versus the S&P 500 over the last year. For each index, a rising line indicates outperformance versus the S&P 500 while a falling line indicates underperformance. From late 2019 through this past Spring, the two indices moved in opposite directions from each other as semis trended higher, and transports lagged the market. Beginning in May, though, the Transports bottomed out and have started to outperform. With both indices now trending higher versus the market, it seems to be sending a signal that both the physical and digital economies are on the mend.

On a side note, it’s interesting to note that when all hell was breaking loose in the market in March, both the transports and semis saw their relative strength improve heading into the March 23rd low.

Bespoke Fox Business Appearance (8/13)

Bespoke co-founder Paul Hickey appeared on Fox Business Network’s “Making Money With Charles Payne” on 8/13 to discuss the election and stock splits. To view the segment click on the image below. Start a two-week free trial to Bespoke Institutional for full access to all of our research and interactive tools.

The Bespoke 50 Top Growth Stocks — 8/13/20

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 164.1 percentage points, which hit a new high this week. Through today, the “Bespoke 50” is up 309.0% since inception versus the S&P 500’s gain of 144.9%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Weekly Sector Snapshot — 8/13/20

Chart of the Day: Is the Market Pricing In Uncertainty on the Election Outcome?

Near Record Highs Brings Some Bulls Back

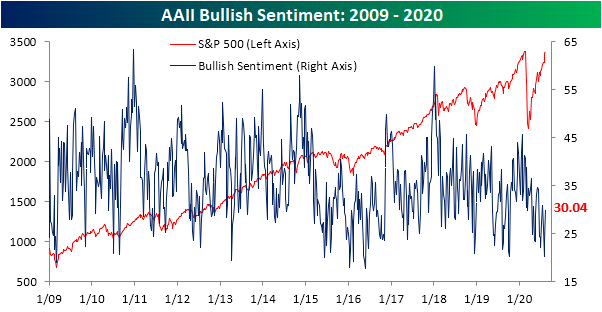

The S&P 500 has pressed ever closer to a new all-time high, but as we noted last week, sentiment remains fairly muted. Historically, when the S&P 500 has been at or within 1% of an all-time high bullish sentiment has sat around an average of 40%. Bearish sentiment, on the other hand, has typically been around 25.5%. With the S&P 500 less than a tenth of a percent away from its February 19th closing high today, bullish sentiment from AAII stands at 30.04%; roughly 10 percentage points away from what could be expected when the S&P 500 is so close to an all-time high. Although bullish sentiment is lower than might be normal for where the S&P trades, it did pick up considerably week over week, rising 6.75 percentage points in what was the largest single weekly increase since March 5th when it rose by 8.31 percentage points. Even after that increase, though, bullish sentiment was higher less than a month ago (July 16th).

Again, historically bearish sentiment has only been just over 25% when the S&P 500 is close to all-time highs. That is far from the case today as 42.12% of respondents in AAII’s survey reported as bearish. Conversely to bullish sentiment, though, bearish sentiment fell 5.48 percentage points. That was the largest week over week decline since May 21st’s 5.59 percentage point decline, leaving bearish sentiment at its lowest level since June 11th.

Those moves in bullish and bearish sentiments led the bull-bear spread to be cut in half, rising from -24.31 to -12.08. That is the most the spread has climbed in a single week since February when it rose from -1.35 to 14.93. Despite that large move, the spread still favors bears as the record streak of negative readings lives on. The bull-bear spread is now at its highest reading since June 11th.

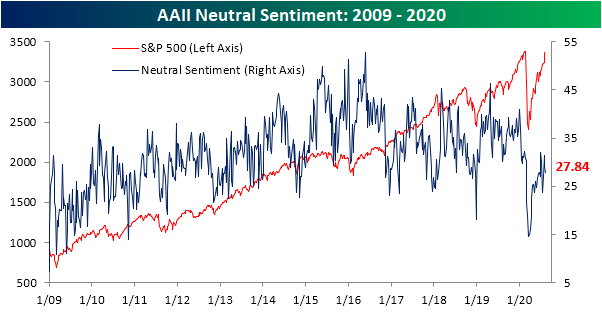

Meanwhile, neutral sentiment was slightly lower, dropping 1.27 percentage points to 27.84%. That only leaves it at its lowest level since July 23rd. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

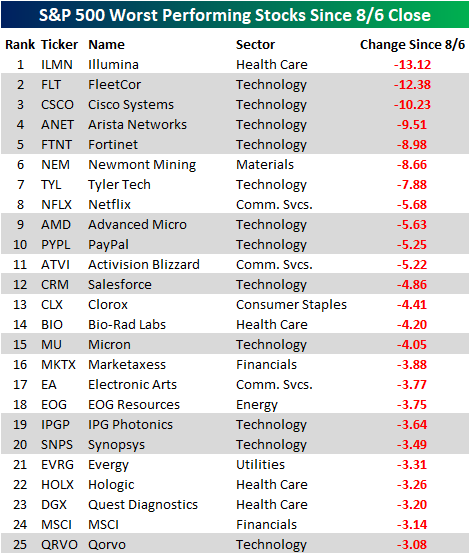

The Strangest Top 25 List In Some Time

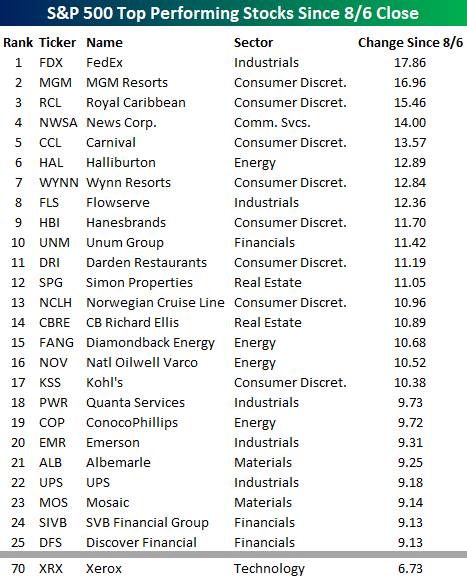

Look closely at the list of the top 25 performing S&P 500 stocks since last Thursday’s close and tell us what’s wrong with it? Do you see it? Keep looking, you’ll figure it out. Yup. That’s it! Not a single one of the 25 best performing stocks over the last week is from the Technology sector. In looking through the list of names, it’s littered with stocks that were left for dead at varying points in the last several months. FedEx (FDX) is up nearly 18%. Casinos and cruise ships have been collecting dust and rust for the last five months, but the stocks of MGM and Royal Caribbean (RCL) are the second and third best-performing stocks in the S&P 500 over the last week.

Not only are there no stocks from the Technology sector in the top 25, but there aren’t even any in the top 50. To find a Tech sector stock on the list, you have to go all the way down to spot number 70 where Xerox (XRX) sits with its gain of 6.73%. Yeah. We were surprised too. Not only is XRX still a public company, but it’s considered a tech stock.

If you want to find a lot of stocks from the Technology sector, they are on the list of the 25 worst performers since last Thursday. Of the 25 names listed below, 12 are from the Technology sector. Not only that, but even many of the non-tech stocks listed like Illumina (ILMN), Netflix (NFLX), Activision Blizzard (ATVI), Marketaxess (MKTX), Electronic Arts (EA), and Hologic (HOLX) have very high tech characteristics behind their businesses. Like what you see? Start a two-week free trial to Bespoke Institutional for full access to our research and interactive tools.