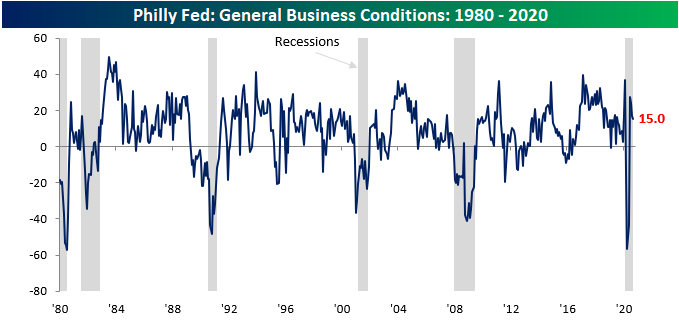

Philly Fed Flat

Unlike its neighbor to the north, the Philadelphia Fed Manufacturing Report lost a bit of steam in September. Economists were expecting the headline index of General Business conditions to remain unchanged at 17.5, but the actual level showed a modest decline to 15.0. Nothing to get alarmed about, but still weaker than expected. Even at current levels, though, it’s worth pointing out that September’s reading was still above the predominant levels we were seeing in the year leading up to the COVID outbreak.

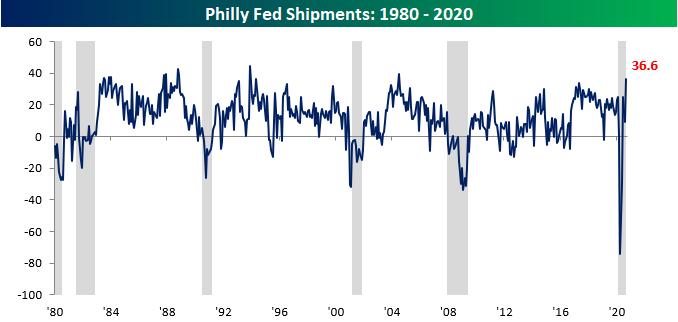

Breadth in this month’s report was also positive. Besides the index of General Business Conditions, the only other indices that declined on a m/m basis were Inventories and Average Workweek. On the upside, the biggest gains were seen in Shipments and Prices Paid. In the case of Shipments, its current level now ranks in the 98th percentile of all prior readings while Delivery Times are also elevated in the 96th percentile of all other periods.

This month’s surge in shipments also ranks as the highest level in over 16 years (July 2004), and that comes just six months after the lowest reading on record.

Finally, in the report’s special questions this month, respondents were asked how Q3 production will compare to Q2, and the responses were positive. 22.2% of those surveyed expect production to increase by more than 10% while just 11.1% expect business to contract by more than 10%. While these results bode well for Q3, the outlook for Q4 doesn’t look as great. Only 6.7% of respondents expect Q4 production to increase significantly while 11.1% expect activity to decline by a ‘significant’ margin. In a trend that doesn’t bode well for the current high levels of unemployment, of those expecting activity to increase, only 17% plan to accomplish this by hiring additional staff. The rest plan to either increase productivity, the hours of current staff, or other measures. Click here to start a free trial to Bespoke to unlock full access to all of our research and interactive tools.

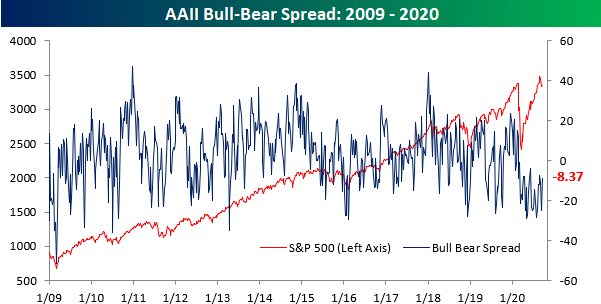

Bullish Sentiment Bounces

With the S&P 500 rallying in the first two days of the week and early on Wednesday, bullish sentiment on the part of individual investors saw a sizable uptick over the last week. According to the latest weekly survey from the American Association of Individual Investors (AAII), bullish sentiment increased from 23.71% last week to 32.02%. That 8.31 percentage point increase was tied for the largest weekly increase since January 16th but only marks a three-week high in optimism.

With the big move into the bullish camp, there was an exodus of equal magnitude from the bears as negative sentiment fell from 48.45% down to 40.39%. The last time bearish sentiment dropped that much in a week was on February 13th just before the Q1 stock market peak. Similar to bullish sentiment but in the opposite direction, though, bearish sentiment was actually lower four weeks ago.

Even after the shifts in sentiment this week, though, the bull-bear spread remains negative at 8.34 percentage points.

This week’s bull-bear spread now takes the current record streak of negative sentiment readings to 30 which is eight weeks longer than the prior record reading of 22 weeks back in late 1990. It’s been well-documented that the sample of this survey tends to skew bearish, but 30 weeks is a long streak! Click here to start a free trial to Bespoke to unlock full access to all of our research and interactive tools.

Chart of the Day: Rent-A-Center (RCII)

The Bespoke 50 Top Growth Stocks — 9/17/20

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 151.5 percentage points, which hit a new high this week. Through today, the “Bespoke 50” is up 297.5% since inception versus the S&P 500’s gain of 146.0%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Morning Lineup – 9/17/20 – Up or Down?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The person who turns over the most rocks wins the game.” – Peter Lynch

Futures are picking up right where they left off yesterday with downside momentum, although they’re modestly up from their overnight lows. It’s been a busy day for economic data already with Jobless Claims and the Philly Fed coming in roughly in line with consensus forecasts, Continuing Claims better than expected, but Housing Starts and Building Permits both weaker than expected.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, updates on Asian and European economic data, trends related to the COVID-19 outbreak, and much more.

Was yesterday an up or down day for the US equity market? With the S&P 500 finishing the day down 0.46% and the Nasdaq down over 1%, it was obviously lower, but the internals of the market were actually positive. The S&P 500’s A/D line was +128 which was actually an improvement from the prior day where the S&P 500 was actually up over 0.5%. Additionally, the S&P 500 equal-weighted index also finished the day higher by more than 0.6%. In fact, as the chart below from page two of our Morning Lineup illustrates, even though the S&P 500 was down moderately on the day, the percentage of overbought stocks actually increased while the percentage of oversold stocks declined.

Daily Sector Snapshot — 9/16/20

Chart of the Day: Homebuilders

B.I.G. Tips – Retail Sales Growth Slows But Still Positive

With the weekly $600 UI benefits expiring during the summer, consumer spending took a hit in August as Retail Sales showed slower than expected growth. At the headline level, Retail Sales grew 0.6% compared to forecasts for growth of 1.0%. Ex Autos and Ex Autos and Gas, growth came in slightly better at 0.7% but still shy of forecasts. In addition to the weaker than expected August reading, July’s sales were also revised lower from 1.2% down to 0.9%. While Retail Sales still showed growth, the report was underwhelming on just about all fronts.

While the level of growth was weaker than forecast, breadth within this month’s report was once again positive as nine out of thirteen different sectors saw m/m gains. The big leader by far was Bars and Restaurants which grew 4.7%, followed by Clothing, Furniture, and Building Materials which all saw month-over-month gains of over 2%. On the downside, Sporting Goods and Food and Beverage Stores both saw sales contract over 1%. Based on these moves, we’re still seeing a continuation of the trend of Americans returning to their prior spending habits before the onset of COVID.

While the monthly pace of retail sales is back at all-time highs, the characteristics behind the total level of sales have changed markedly in the post COVID world. In our just-released B.I.G. Tips report, we looked at these changing dynamics to highlight the groups that have been the biggest winners and losers from the shifts. For anyone with more than a passing interest in how the COVID outbreak is impacting the economy, our monthly update on retail sales is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

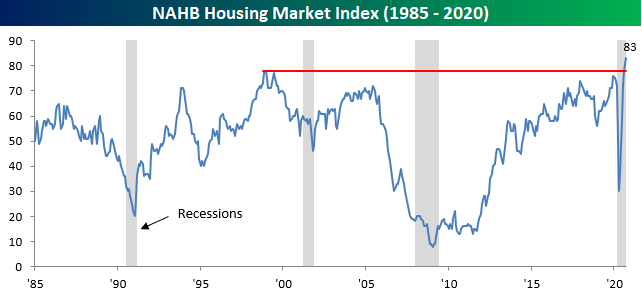

Homebuilder Sentiment Soars

Homebuilders had nothing to complain about in recent months, as the National Association of Homebuilders (NAHB) sentiment index was already tied for its best levels on record. Today’s release of the September update surpassed all expectations. While economists were forecasting the headline index to come in at a level of 78, the actual reading was five points higher at 83. Never before has the homebuilder sentiment index topped 80, let alone moved as high as 83. If this sentiment survey was a stock chart, technicians would consider it a textbook breakout.

The internals of this month’s report were also very strong. Both Present and Future sales as well as Traffic all surged to record highs, and on a regional basis, every region except the West increased. The decline in the West likely stems from the fires in California, but even with that decline, all four regions are now comfortably back above their pre-COVID levels. Click here to start a free trial to Bespoke to unlock full access to all of our research and interactive tools.

Bespoke’s Morning Lineup – 9/16/20 – Fed on Deck

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“The first one gets the oyster, the second gets the shell.” – Andrew Carnegie

US markets are looking to make it four days in a row of gains, but we still have to get through the FOMC later today. We just got the release of August Retail Sales, and the headline number came in weaker than forecasts (+0.6% vs 1.0%) as the impact of expiring $600 UI benefits works its way into the system.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, trends related to the COVID-19 outbreak, and much more.

The snapshot below is from our Trend Analyzer screen of international regional ETFs. Looking through the various ETFs listed, you may be asking yourself, what correction? Of the nearly 20 ETFs listed, all but one is up over 2% in the last five trading days, and all but four are at overbought levels. The only ETF currently not above its 50-DMA is Latin America (ILF).