Bespoke’s Morning Lineup – 10/6/20 – Quiet Night in the Markets

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Beyond this, the problem is universal. It is that governments are now held responsible for the welfare of the people. The aspirations of the people can outrun their ability to pay for them, and nobody has yet found a way to create answers to the aspirations out of thin air.” – Adam Smith, The Money Game

It was a dramatic night on the political landscape with President Trump’s return to the White House, but in the markets, it was a quiet night ahead of a slow day for data. The only notable event on the calendar is a 10:40 eastern speech by Fed Chair Powell.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, German factory orders, trends related to the COVID-19 outbreak, and much more.

While the S&P 500 has convincingly moved back above its 50-DMA and traded to its highest level since September 16th, gold still has about another 1.5% to go to get back above its own 50-DMA. Gold prices have rallied $80 (4%) off their recent lows, but in the process are now bumping up right against a short-term downtrend from its recent high. How gold reacts in the next couple of days will answer whether this most recent bounce results in a fourth lower high or the beginning of a new leg higher.

September 2020 Headlines

Daily Sector Snapshot — 10/5/20

Chart of the Day – A Good Start to the Week

How COVID Upended the French Fry Industry

The third quarter has come to an end, which means that the Q3 earnings season will be in full swing before you know it. This week, though, only a handful of names are scheduled to report. One of the bigger names reporting is Lamb Weston (LW) which reports Wednesday before the open. What exactly is Lamb Weston? If you’re unfamiliar with the company, a google search comes up with the listing below, which shows that the company describes itself as a producer of “Innovative Frozen Potato Products,” or what most of us call French Fries. The company is one of the leading suppliers of french fries and other frozen potato products to the foodservice and retail sectors. In the retail sector, you may better know the company by its “Grown in Idaho” brand found in supermarket freezers.

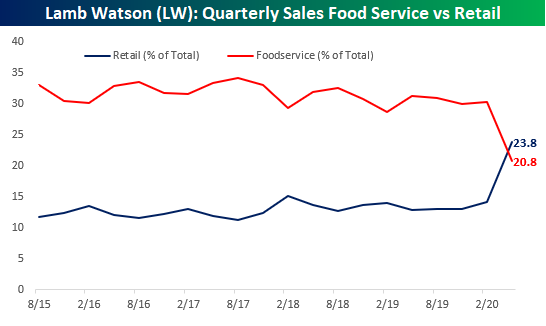

French fries have to be one of the most stable businesses in America. When given the option, who doesn’t choose a side of fries to go with their burger? One problem with french fries, though, is that unless you have a deep fryer in your kitchen, they’re never as good at home as they are at a restaurant. For that reason, companies like Lamb Watson (LW) have always had a much higher percentage of their sales coming from the food-service channel than the retail channel. That was until COVID. The chart below shows the quarterly sales breakdown for LW between foodservice and retail segments in the United States. The company also has other units like International which comprise the rest of its sales.

For years now, Lamb Watson has seen a pretty consistent trend of sales in its Foodservice and Retail segments. Foodservice consistently accounted for around 32% of total sales while the company’s Retail unit was much smaller accounting for less than 13% of total sales. In the span of just one quarter, though, LW’s sales mix completely reversed with Retail seeing its share of total sales nearly double from 14.1% up to 23.8% while Foodservice sales saw its share of sales plummet by a third falling from 30.2% down to 20.8%. With restaurants closed, subpar french fries were better than no fries at all and within a matter of weeks, french fries in the grocery store were just as scarce as toilet paper.

In the company’s last earnings conference call, it noted the shift from restaurants to retail but also noted increased costs associated with re-tooling manufacturing for the added demand, so the company should manage to adjust to the shifting demand profile. When you think about COVID and its impact on different sectors of the economy, french fries probably weren’t the first thing most people would think about, but just because it wasn’t top of mind doesn’t mean that the impact was insignificant. Earnings season is almost here. To stay on top of the latest trends with company reports, make sure to check out or Interactive Earnings Explorer tool. Click here for a free two-week trial!

Asset Class Performance This Election Cycle

We are now four weeks and one day away from Election Day 2020. Below is a look at our asset class performance matrix highlighting the total return of key ETFs over three time frames: since Election Day 2016 (11/8/16), since Trump took office on 1/20/17, and since the first US case of COVID was confirmed (1/20/20).

The Nasdaq 100 (QQQ) has been by far the best performing US index ETF this Presidential Election Cycle. Since Election Day 2016, QQQ is up 146%, while the S&P 500 (SPY) is up 70.7% and the Russell 2,000 (IWM) is up 38.5%. Looking at US sectors, Technology (XLK) and Consumer Discretionary (XLY) are both up 100%+ since Election Day 2016, while the Energy sector (XLE) is down 48%. The Financial sector (XLF) has been the second worst performer under Trump with a gain of 33.9%.

International equity market returns (on a dollar adjusted basis) have been much weaker than the US since Trump’s victory. Country returns since Election Day 2016 range from double-digit percentage declines for Brazil (EWZ) and Mexico (EWW) to a 45.4% gain for China (ASHR). China’s gain, however, is still 25 percentage points worse than the S&P 500.

What may be more notable are equity market returns since COVID began. Since the first US case of COVID was confirmed on January 20th, the S&P 500 (SPY) has still managed to post a 3.4% gain. The Nasdaq 100 (QQQ) is up a remarkable 25.3% during the pandemic, while the small-cap Russell 2,000 (IWM) is down 6.8%. Value stock ETFs have also gotten hit hard during COVID, while growth has outperformed.

Looking at sectors, Energy (XLE), Financials (XLF), Utilities (XLU), and Industrials (XLI) are the sectors that remain in the red since COVID, while Tech (XLK) and Consumer Discretionary (XLY) are up 17%+. Gold (GLD) and silver (SLV) have also been two of the top performers during COVID along with longer-dated Treasury ETFs like TLT. Click here to try Bespoke Premium free for two weeks!

What Was the Service Sector Saying in September?

In an earlier post, we detailed the results of the September ISM Non-Manufacturing PMI. While the headline index and the sub-indices were indicative of general improvements in the services side of the economy more broadly, the commentary section offered some interesting minutia on specific areas of business. For starters, the commentary was conflicting. When discussing the broad outlook, adjectives used ranged from “bleak” and “uncertain” to “optimistic”. More specifically, the Arts, Entertainment, and Recreation sector, which remains largely closed appeared to have some of the most pessimistic commentaries while the Health Care and Social Assistance commentary, perhaps surprisingly for elective procedures to be exact, held a very confident point of view. Meanwhile, the Educational Services industry walks the tightrope noting that if students are sent home, the result would be “a drastic reduction in our revenue.” In other words, on an aggregate level, the report’s data surrounding the services sector has shown a continued recovery, but anecdotally, certain industries are still on shaky footing if not completely left out of the recovery so far.

The commentary also shed some light on a few COVID era trends. Circling back to the comments from the Health Care and Social Assistance industry, it noted that “productivity remains high, possibly higher, than when we are in our office,” giving fodder to the argument that work from home could be more permanent. The same comment made mention that a return to work is not in the plans until mid-next year. Additionally, as housing market data continues to impress, the Construction industry mentioned that it does not have appropriate labor levels to meet the pace of rising orders. Meanwhile, the Wholesale Trade industry noted the strength in sales for home-improvement. Besides that, the Insurance industry made mention that bad weather and protests—which have been pillars (outside of COVID) of current events over the past several months—have had an impact on business. The commentary also made note of some supply chain issues. The Health Care and Social Assistance industry noted vendor rejections and Retail and Wholesale Trade both detailed issues with suppliers. Those issues included port and rail delays, capacity problems, hiring difficulties, and adverse weather.

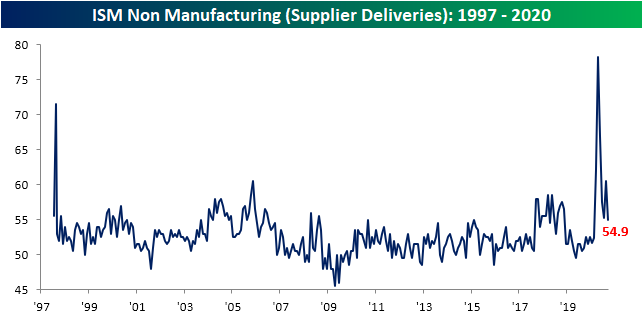

Those final comments from the Retail Trade and Wholesale Trade industries about supply chain issues are consistent with this month’s data from the report. As shown below, imports were lower with the index in contraction in September falling to 46.6. The index for Supplier Deliveries saw a drop larger than 99% of all prior monthly moves, but at 54.9 it is still historically elevated and is indicative of longer lead times.

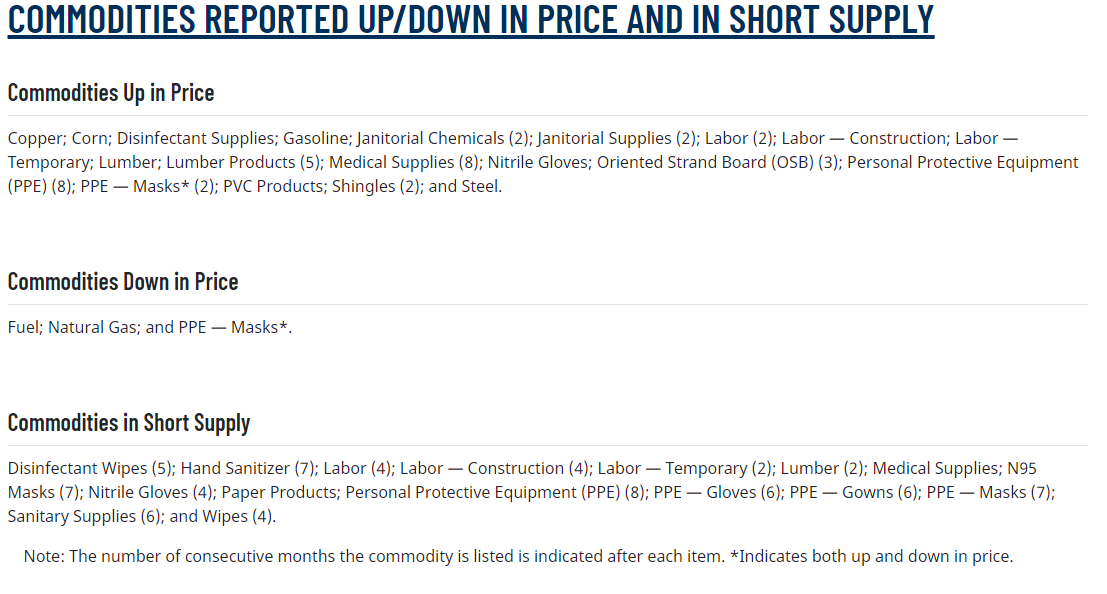

The ISM report also details the commodities that are reported as rising/falling in price and are in short supply. Preventative measures to stop the spread of COVID like cleaning supplies and personal protective equipment all remain in short supply, and consequentially, higher in price. Adding yet more reinforcement to how strong the housing sector of the economy has been, rising prices also applies to many commodities pertinent to the construciton sector like lumber, copper, steel, shingles, and labor. Finally, fuel and natural gas were reported as in short supply. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke Matrix of Economic Indicators – 10/5/20

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

ISM Services Shine

As we discussed in our Monring Lineup, the resurgence of COVID in some global economies resulted in a number of weaker readings in Markit Service PMIs; namely those in Europe. Meanwhile, the reading for the US released this morning met expectations at 54.6, unchanged from the flash reading but slightly lower than last month’s reading of 55.0. The ISM reading for the Non-Manufacturing sector, on the other hand, had a stronger showing in September with the headline index rising to 57.8 from 56.9 in August. That was also stronger than expected as forecasts were calling for the reading to decline to 56.2 which would have more closely resembled the Markit reading. At 57.8, this reading indicates that the service sector of the economy continued to expand sequentially for a fourth straight month in September and at a slightly accelerated rate from August. While not quite as strong as the reading from July, the services sector continues to bounce back at the strongest pace of the past couple of years.

While the ISM’s reading on services was stronger than expected, last Thursday’s release of the manufacturing counterpart was more of a disappointment, although, it was still consistent with further improvements in that area of the economy. Despite that decline, the composite of the two readings rose to 57.5 from 56.8. Just like the services index, outside of the July high that is at one of the strongest levels since 2018.

Breadth in the September report was mixed with a nearly an equal number of sub-indices rising and falling month over month. Despite this, there were only two indices, Inventories and Import Orders, that fell into or remained in contractionary territory. So overall, the report was consistent with continued improvement in the services sector across various metrics.

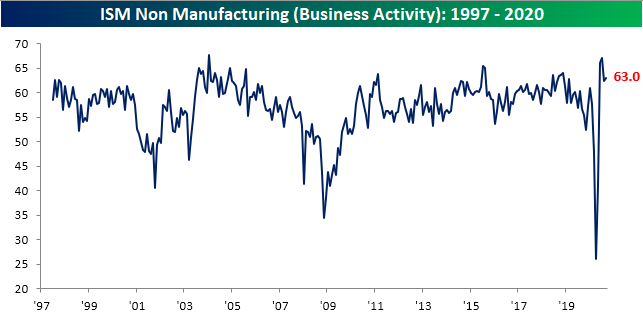

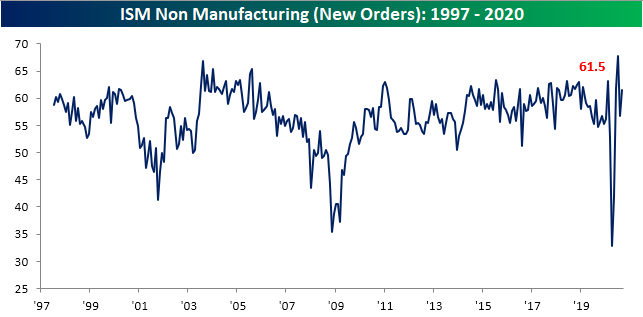

For starters, overall demand seems to have held up well in September with the indices for Business Activity and New Orders both rising and coming in the strongest levels of any of the individual indices of this month’s report. Similar to the headline number, these indices were higher in September after a drop in August from near-record levels in July. Currently, both are still off those highs but remain at the upper end of their historical ranges. The index for New Orders saw the largest improvements this month with a 4.7 point rise.

While businesses receive more orders and general business activity continues to ramp up (both for a fourth consecutive month), the rate of Backlog Orders has slowed. As shown below, that index fell to a barely expansionary reading of 50.1 in September. Outside of the 7.3 point decline in April, the 6.5 point drop this month was the largest since June of 2011. In other words, businesses saw a significant deceleration in existing orders in the month of September. Given new orders rose, that was likely thanks to higher production rather than softening demand.

With businesses working off their order backlogs, inventories have continued to decline. Although higher in September, the index for Inventories has now been in contractionary territory for back to back months. Those inventory declines are also consistent with what has been observed for the manufacturing sector.

One major positive of the September report was that for the first time since February, the survey showed Employment expanded. The index rose to 51.8 after half of a year of contractionary readings. Comments from respondents regarding employment noted that this increase in employment was bringing back furloughed workers and increased hiring to meet increased demand. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning LIneup – 10/5/20 – Flirting With the 50-Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“How many millionaires do you know who have become wealthy by investing in savings accounts? I rest my case.” – Robert G. Allen

It’s a new week, but the headlines remain the same as markets remain focused on the health of the President, possibilities for stimulus, and the election. This week’s calendar is extremely light in terms of both economic data and earnings, so expect news outside of the economy and earnings to be the main driver of movement this week.

Be sure to check out today’s Morning Lineup for a rundown of the latest stock-specific news of note, market performance in the US and Europe, updates to the latest Services sector data from Markit, trends related to the COVID-19 outbreak, and much more.

Heading into the new week and the first full week of the fourth quarter, all of the major US indices are currently battling with their 50-day moving averages as just one of the 14 major index ETFs is more than 1% above or below it’s 50-day moving average. The S&P 500 has been battling back and forth with closes above and below its 50-DMA over the last week and gone nowhere in the process. Hopefully this week, we’ll get some more clarity over which way the index will break.

Within the eleven S&P 500 sectors, the picture looks a little better. Through Friday’s close, seven sectors finished the week above their respective 50-day moving averages while just four finished below. Not surprisingly, the only one of those four that finished the week more than 2% below its 50-day moving average was Energy.