Daily Sector Snapshot — 2/12/21

Presidents’ Day Seasonality

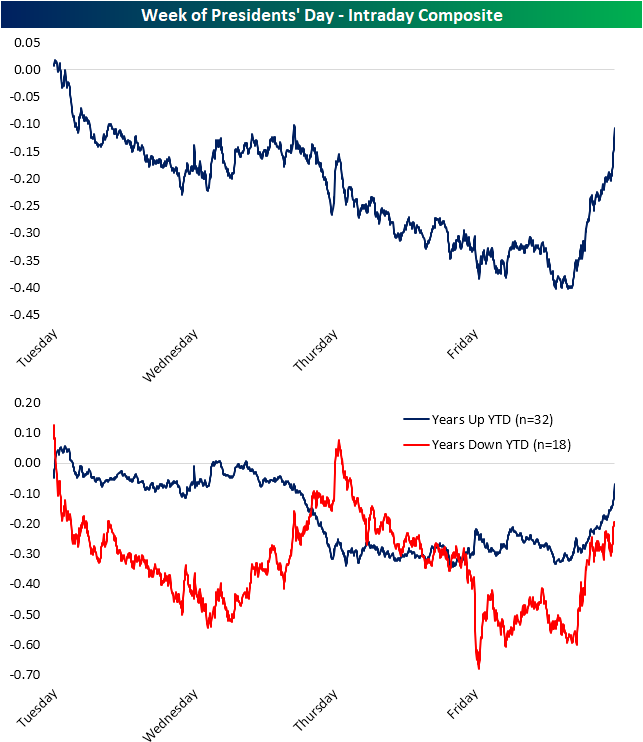

The US equity market will be closed on Monday in observance of the Presidents’ Day holiday. Since 1971 when the Uniform Monday Holiday Act set the third Monday in February, rather than on George Washington’s birthday (February 22nd) as the Federal holiday, equity market performance during the week of Presidents’ Day has been pretty mixed. From the Friday before President’s Day through the Friday after, the S&P 500 has traded higher half the time for an average decline of 5 bps. Taking a closer look, in the chart below we show the median returns by day for each trading day in Presidents’ week. Tuesday and Thursday have both averaged declines of 13 bps and 7 bps, respectively. Wednesday averages flat performance but the S&P 500 has only been higher 40% of the time. Despite weakness throughout most of the week, equities have tended to catch a bid by week’s end with an average 6 bps gain on Friday with a move higher 58% of the time.

In the charts below, we show the average intraday performance of the S&P 500 during Presidents’ Day week since 1983 when our intraday data begins. We also include looks for years when the S&P 500 was up and down YTD headed into the holiday. Again, the general pattern has been a steady drift lower until Friday when the S&P 500 has tended to rebound. We would note that the Friday rebound is not an all-day event. As shown, performance is pretty flat in the first several hours of trading with the biggest ramp higher occurring in the final of hours of tradings. That pattern is also consistent for both up and down years, though, in years that the S&P 500 was down YTD headed into the holiday there was a bit of a rebound midweek which was reversed by the end of the week. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 2/12/21 – A Global Tide

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Wherever we look upon this earth, the opportunities take shape within the problems.” – Nelson A. Rockefeller

It’s another quiet morning in the equity markets as futures are little changed ahead of the three-day weekend. There’s also little on the data calendar today besides Michigan Confidence at 10 AM. The key data point to watch in this release will be inflation expectations to see how sentiment towards prices is trending among consumers.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, economic data out of the UK, an update on the latest national and international COVID trends, and much more.

This market rally that started at the beginning of February has been a global tide lifting all boats. As shown in the chart below, the Bloomberg World Index has seen all green in its daily candlesticks and through Thursday was up nine days in a row taking the index to new highs.

At nine days and counting, the current winning streak for the Bloomberg World Index is the longest since early 2018 and one of only a few that have lasted this long since 2004.

The Bespoke 50 Top Growth Stocks — 2/11/21

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 472.7% excluding dividends, commissions, or fees. Over the same period, the S&P 500 is up in price by 180.4%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Weekly Sector Snapshot — 2/11/21

Bull-Bear Spread Spiking

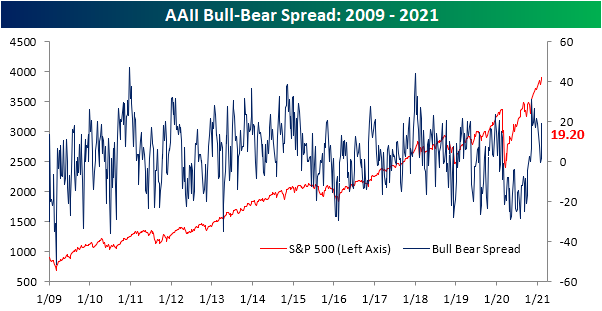

Equities have been on a hot streak recently with the Dow and S&P 500 snapping six-day winning streaks earlier this week and the Russell 2,000 ended a seven-day winning streak on Wednesday. As a result, sentiment has understandably followed price action. The percentage of investors reporting as bullish in the AAII’s weekly survey has risen to 45.5% from 37.4% this week. That is a return back to similar levels to the end of 2020. The 8.1 percentage point jump this week was the largest for bullish sentiment since a 17.88 point increase on November 12th.

Inverse to bullish sentiment, bearish sentiment collapsed by 9.3 percentage points coming in at 26.3%. That is the lowest reading since the week of December 24th when less than a quarter of respondents were bearish. This week’s decline was in the bottom decile of weekly changes since the beginning of the survey and was also the largest drop in bearish sentiment since the week of October 17th when it fell by 12.91 percentage points.

The large moves in opposite directions of bullish and bearish sentiment led the bull-bear spread to leap from a barely positive reading of 1.8 all the way up to a five-week high of 19.2. That comes after it was actually negative only two weeks ago. The 17.4 point increase stands in the top 10% of all weekly changes in the spread and was the largest move higher in roughly three months since the week of November 12th when it rose 24.5 points.

Across the history of the AAII survey dating back to 1987, there have been 224 weeks including the most recent in which the bull-bear spread has risen by at least 15 points in a single week. Only 39 of those have occurred without another occurrence in the previous 3 months. Whereas historically, the AAII survey has been more of a contrarian indicator meaning more bullish sentiment has been followed by weaker returns and vice versa for more bearish readings, in terms of the second derivative of the bull-bear spread, big jumps have preceded stronger than normal returns. As shown below, past times that the bull-bear spread has risen at least 15 points in one week without another occurrence in the past 3 months, the S&P 500 has consistently traded higher over the next few weeks and months with average gains larger than the norm for each period. Moves higher have also been very frequent. One year after these past occurrences, the S&P 500 has traded higher better than 90% of the time.

While overall sentiment tipped bullish in a big way this week, neutral sentiment has also continued to rise. For the third week in a row, a greater share of respondents reported neutral sentiment. That reading rose to 28.3%, the highest since the week of Christmas. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Masco (MAS) May Move

Good and Bad From Jobless Claims

Last week’s initial jobless claims print was higher by 33K to 812K which means it was unchanged from the prior week’s reading. While this week’s number didn’t meet expectations of a decline to 760K, it is not all bad news considering claims did drop to 793K which is the lowest level since the first week of the year.

On a non-seasonally adjusted basis, consistent with seasonal patterns, claims continue to fall with a 36.6K drop this week down to 813.1K. That is the lowest level in the unadjusted number since the week of November 27th when claims stood nearly 100K lower.

As for other programs, initial jobless claims through the Pandemic Unemployment Assistance (PUA) program also declined by a little over 34K this week just as they did last week. At 334.5K, PUA claims are at the lowest level since the week of January 8th. Combined with regular state claims, total initial claims stood at 1.148 million, down by 71K week over week and marking a fourth consecutive weekly decline. While total initial claims remain off the lows of just above 1 million from November, this week’s print marked a five-week low.

Regular state continuing claims—lagged one week to initial jobless claims—persistently keep moving lower with the most recent week falling to a new pandemic low of 4.545 million from 4.69 million last week. That week over week decline was a fourth straight also meaning 18 of the past 20 weeks have been met with a decline in continuing claims.

The addition of other programs adds another week’s lag to the data. That means the most recent data on continuing claims across all programs covers the week of January 22nd. In spite of the consistent declines in regular state continuing claims, the overall picture including these other programs muddies the water. There have been significant upticks in other programs that led total claims to significantly rise from 17.87 million to 20.47 million; the highest level since late November. Again, that uptick was not on account of regular state claims. In fact, it was one of the only programs to see a decline week over week falling by 29.6K. On the other hand, PUA claims rose by 1.497 million which comes after a 1.636 million increase two weeks prior. That was not the only program to see a week over week increase of over 1 million though. Pandemic Emergency Unemployment Compensation (PEUC)—which is an extension program for those whose benefits have or are set to expire—saw claims rise by 1.173 million. That is the single largest uptick since the program began earlier in the pandemic.

Those surges between the two programs meant that they also account for much larger shares of total claims than before. While the regular state claims only account for around a quarter of total claims- the lowest share since the pandemic related programs began in March- PUA claims take up 42.6% of all claims and PEUC claims account for 23.3%. That is the most since mid-December for both of these programs. While those significant increases are a concern and should continue to be watched for a better read on how material of an increase they are, it is possible that the upswings are due to continued catching up in reporting after these programs narrowly avoided expiration at the end of last year. For example, looking at individual states, PEUC claims out of California alone nearly tripled rising by over 1 million between the weeks of January 16th and January 23rd. Ohio also saw these claims more than double. As for PUA claims, after reporting zero claims the previous week, Colorado and Ohio reported claims of 30,659 and 10,156, respectively. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 2/11/21 – All Quiet…Except Bitcoin

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Be willing to make decisions. That’s the most important quality in a good leader. Don’t fall victim to what I call the Ready- Aim-Aim-Aim Syndrome. You must be willing to fire.” – T. Boone Pickens

With China celebrating the lunar new year, Asian markets had a quiet overnight session with little in the way of market action or economic data. The quiet trend continued into European and US markets as well with major averages and futures markets little changed on the sessions.

The only area of real action right now is in the crypto space. Bitcoin just briefly rallied to record highs on news that Mastercard (MA) would support crypto-currencies in its network, and then just about a half-hour ago Bank of New York Mellon announced that it was establishing a digital asset unit to support and service the digital asset needs of clients. Bitcoin’s price is off its highs from earlier, but it is still up over 6% on the day.

In economic data, jobless claims were just released, and while they both came in higher than expected, they did manage to decline from last week’s upwardly revised readings.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, an update on the latest national and international COVID trends, and much more.

In yesterday’s Chart of the Day, we discussed the massive rally in crude oil over the last several weeks and how it stacked up to prior periods in the past. Another short-term aspect of the recent rally has been the fact that yesterday marked the fifth straight day that WTI closed more than two standard deviations above its 50-DMA. That’s the first time we’ve seen a streak like that in over three years. Looking at past streaks going back to 2010, these readings didn’t necessarily mark the top of a short-term rally, but they usually occurred closer to the end of a move than the beginning.