The Bespoke Report – 2/26/21 – Poker Time For Bonds & The Fed

Stocks closed out the week in a full-throated test of uptrends after a week of historic volatility in interest rate markets. We discuss in detail the scale, nature, and implications of the move in interest rates, as well as some of the knock-on effects for equity markets. The rotation out of momentum and in to value has continued, with some of the most impressive gainers of recent years under harsh pressure in recent weeks. That’s going to cause a shake-up in terms of what stocks are included in momentum indices which are currently underperforming. We also take a deep dive into renewables, discussing some of the major stocks in the sector and their recent declines.

We also recap earnings results, discuss economic data here and abroad, make the case that the recent bond market move is a test for the FOMC, and more in this week’s Bespoke Report.

This week’s Bespoke Report newsletter is now available for members.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

Daily Sector Snapshot — 2/26/21

February: In With a Bang, Out With a Whimper

The month of February has been a tale of two markets for global investors with the first half of the month seeing nothing but gains and the second half seeing pretty much nothing but declines. The Bloomberg World index of more than 4,000 global companies was up eleven days in a row to start the month for a gain of more than 6%! Since February 15th, though, the index has fallen on eight of nine trading days for a decline of more than 4%. As it stands now, the index is still up 1.9% for the month, but the second-half declines have now left the index below its 50-day moving average for the first time since Election Day 2020 (11/3). Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Crash Confidence and Irrational Exuberance

B.I.G. Tips – Treasury Turmoil

Bespoke’s Morning Lineup – 2/26/21 – Uneasy Markets

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“We will ensure that there is no unwarranted tightening of financing conditions,” – Isabel Schnabel, ECB Board Member

Well, that didn’t take long. Just days into a market growing uneasy with the rise in government bond yields and Christine Lagarde noted that the ECB is ‘closely monitoring’ the situation in fixed income markets, Isabel Schnabel, a prominent member of the ECB tried to reassure markets that the ECB “will ensure that there is no unwarranted tightening on financing conditions”. She went on to add that the central bank would add further support to the markets if rising yields threaten to hurt growth. On both sides of the Atlantic, central bankers are doing their best to reassure markets that they will keep rates low, but for now, at least, the market isn’t so confident.

Futures have been volatile this morning and depending on when you look they may be up or down, and they are currently on the downside for both the S&P 500 and the Nasdaq. The economic calendar is busy with Wholesale Inventories, Personal Income, and Personal Spending at 8:30 AM. At 9:45, we’ll get the release of the February Chicago PMI, and then at 10:00, we’ll close out the week with the University of Michigan Sentiment Index.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, ARK Invest fund flows, economic data out of Europe, an update on the latest national and international COVID trends, including a new series of charts tracking vaccinations, and much more.

Also, Paul Hickey appeared on CNBC’s Squawk Box this morning to discuss the current moves in interest rates and what they mean for the market. You can see that segment here.

Thursday was a day many bulls would rather forget as the S&P 500 dropped over 2%, and the Nasdaq 100 fell more than 3%. Historically, declines of these magnitudes usually see a modest bounceback the following day, but believe it or not, the distribution of returns based on the day of the market decline varies widely. The charts below show the S&P 500’s and Nasdaq 100’s average next-day return (top charts) and the percentage of time each index is up (bottom charts) following days when they experience sharp declines.

When the S&P 500 declines more than 2% on a Thursday, the average next-day return is just 0.02% with positive returns 50.6% of the time. Of all the days of the week, that is the second weakest next day return and the second-lowest percentage of positive returns.

For the Nasdaq 100, it’s a similar setup. When that index declines more than 3% on Thursdays, the average next-day return is a gain of 0.05% with positive returns just 47.3% of the time. More than any other day of the week, when the Nasdaq 100 drops 3% on a Thursday, the likelihood of a down Friday is the highest.

The Bespoke 50 Top Growth Stocks — 2/25/21

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 468.1% excluding dividends, commissions, or fees. Over the same period, the S&P 500 is up in price by 177.6%. Always remember, though, that past performance is no guarantee of future returns. To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bespoke’s Weekly Sector Snapshot — 2/25/21

Chart of the Day: S&P 500 Dividend Yield vs. 10-Year Treasury Yield

Kansas City Fed Goes Out With A Bang

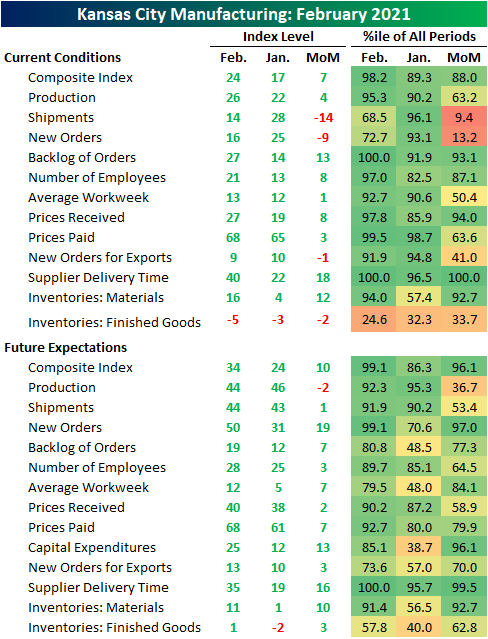

The last of the regional Fed manufacturing reports for the month of February went out with a bang. The Kansas City Fed’s composite manufacturing index rose from 17 to 24 in February, exceeding expectations by 9 points. That brought the index to the highest level since June 2018 and is also in the top 2% of all monthly reading since the survey began in 2001. Expectations also remain historically optimistic with that index in the top 1% of all months, also rising to the highest level since June of 2018.

Not only was the headline index strong but most of the components of the report similarly came in at historically strong levels. Both Backlog of Orders and Supplier Delivery Times came in at record highs while all but three other indices are in the top decline of all prior readings. Most indices were higher month over month, though, there were a few components that fell like Shipments, New Orders, New Orders for Exports, and Inventories for Finished Goods.

Two of the weaker components of the report were the indices for New Orders and Shipments. While still at healthy levels, the declines this month meant that new orders and shipments both decelerated in February. But even though the indices for current conditions fell, expectations indices were much stronger. As shown below, both expectations indices for New Orders and Shipments were higher month over month with the former coming in the top 1% of all months. Although the reading in New Orders pointed to some slowing, Backlog of Orders accelerated rising to 27, the highest level on record.

The other index reaching a record high was Delivery Times. Higher readings in this index indicate longer lead times. The 18 point increase month over month in February left the prior record of 30 from March 2018 in the dust. Manufacturers also do not appear to have high hopes that supply chains will normalize in the near future either. The expectations index likewise came in at a record high of 35.

Alongside longer lead times, prices are on the rise as has been observed in other manufacturing reports. The indices for both Prices Paid and Prices Received were higher this month. Starting with Prices Paid, the current conditions index rose to the second-highest reading on record behind April 2011. Expectations were also at the highest level since April 2011. Consistent with other manufacturing surveys from the other regional Feds, Prices Received are more muted but are nonetheless at the highest level in some time. Rising to 27 this month, the index for Prices Received rose to the highest level since August 2008. Click here to view Bespoke’s premium membership options for our best research available.