Weak Tuesday After Big Gains on Monday

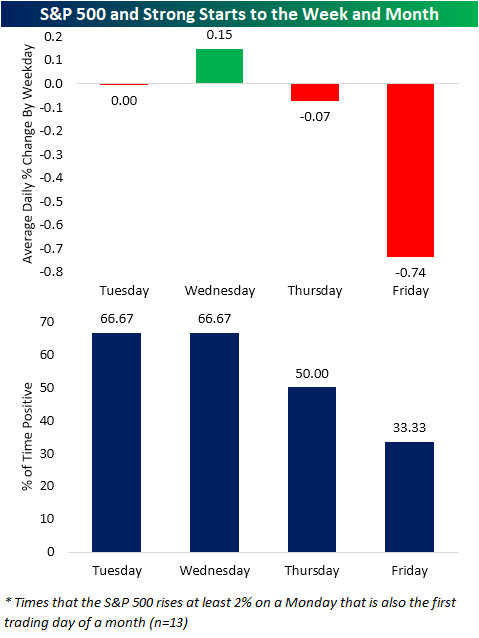

With the S&P 500 rallying 2.38% yesterday, the index notched its best first trading day of a month since last March when it rose 4.6%. As we noted in last night’s Closer, a strong start to a month has not necessarily been a great sign for the returns for the remainder of the month. Similarly, the next day has not been met with the best performance. As shown in the charts below, historically when the S&P 500 has rallied at least 2% on a Monday, Tuesday has seen a pullback with an average daily decline of 10 bps and positive returns only half the time. As for the rest of the week, Wednesday has been the only day to average a move higher with positive returns more than half the time. Thursday and Friday, on the other hand, have averaged declines of 6 and 7 bps, respectively, with positive returns only 48.68% of the time.

Of these instances, including yesterday, there have been 13 times that the 2% or larger gain on a Monday also happened to be the first trading day of a month. On the Tuesday after these past occurrences, the S&P 500 has on average been flat with positive returns two-thirds of the time. Once again, Wednesday is the only day with an average gain and like Tuesday has seen positive returns two-thirds of the time. As for the second half of the week, returns are again negative with the weakest day being Friday which has averaged a 74 bps decline with positive returns only a third of the time. Click here to view Bespoke’s premium membership options for our best research available.

There’s Gold and There’s Everything Else

Despite concerns over inflation, the last week hasn’t been particularly good for commodity prices. The snapshot below from our Trend Analyzer shows major commodity-related ETFs and where they’re trading relative to their trading ranges. Over the last five trading days heading into today, all of the commodities in the snapshot are down, but the biggest losers by far are the gold and other precious metals-related ETFs. The top six ETFs listed in the snapshot below are all tied to either gold or other precious metals and they’re all down over 4% in the last week. Of the other eight ETFs shown, just two are down even more than 2%.

While it has been a rough week for commodity-related ETFs, outside of the gold and precious metal ETFs, it’s been a great year with gains ranging from 6.5% for the DB Agriculture Fund (DBA) to 23.25% for the DB Oil Fund. The gold ETFs, meanwhile, are all down close to 10% while the Precious Metals ETF (DBP) has dropped almost 8% and the Silver Trust (SLV) is barely up (0.12%).

Looking at where each ETF is trading relative to its trading range, it’s been a tale of two markets as well. While most of the ETFs shown are in overbought territory or at least still above their 50-DMAs, the gold and precious metals ETFs are all at ‘extreme’ oversold levels. What happened to all the gold bugs? Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/2/21 – Dribbling Along

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“It is said that good things come to those who wait. I believe that good things come to those who work.” – Wilt Chamberlain

59 years ago tonight, Wilt Chamberlain set one of the greatest records in sports by scoring 100 points in a single game against, who else, but the New York Knicks! One often overlooked aspect of the 100-point game was that Chamberlain also set the record for most free throws made in a single game with 28 in 32 attempts even as his career average was closer to 50%. The most amazing aspect of the record, though, is that it wasn’t televised and there’s no video footage. There weren’t a lot of witnesses to it either as the Hershey Arena, where the game was played, was half empty that night, and there was no one from the New York Press even at the game.

In some ways, the night of March 2, 1962, was a lot like the market and investing. It’s usually the little things that often get overlooked (like free throws) that make a big difference in performance, and the biggest moves usually come when nobody is expecting them.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, an update on major market trends in Asia and Europe, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

Monday was an encouraging day for the Nasdaq 100. After closing out last week below its 50-day moving average (DMA), there was a decent amount of concern on the part of the bulls over the weekend. Yesterday’s rebound, though, helped to put those concerns at ease, and the longer QQQ can hold above its 50-DMA, the more emboldened the bulls will become.

Daily Sector Snapshot — 3/1/21

Bespoke’s Matrix of Economic Indicators – 3/1/21

Our Matrix of Economic Indicators is the perfect summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke Market Calendar — March 2021

Please click the image below to view our March 2021 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Chart of the Day: March Seasonality

Construction Spending – What Pandemic?

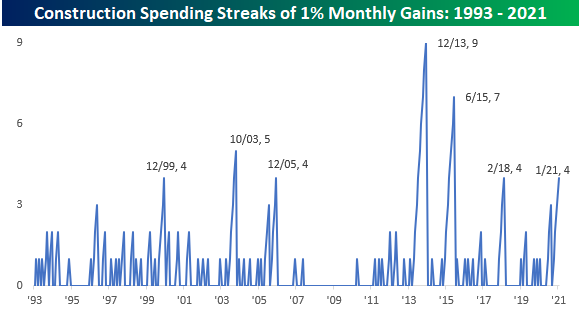

The month of March is no doubt starting off on a positive note for economic data. In addition to the ISM Manufacturing report, which moved to its highest level since January 2018, the latest update on Construction Spending for the month of January was also incredibly strong. While economists were expecting the headline index to rise by 0.8%, the actual level of growth was more than double that at 1.7%. The chart below shows the headline index going back to 2005, and the latest leg higher has been incredible, rising by 11.1% from its May low and leaving the pre-COVID peak in the dust. It’s also worth pointing out that the decline in Construction Spending was actually smaller and shorter than the decline we saw during 2018!

Also notable about Monday’s report on Construction Spending is the fact that January marked the fourth straight month where the headline index grew more than 1% m/m. Since 1993, there have only been three streaks that were longer and another three that were as long. In case you needed a reminder, the economy is humming. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 3/1/21 – In Like a Bull

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“A market downturn doesn’t bother us. It is an opportunity to increase our ownership of great companies with great management at good prices.” – Warren Buffett

Futures markets are doing their best to forget last week’s decline in the equity market. Futures are 1% higher as March is certainly coming in like a bull. There’s a decent amount of good news related to the economy and COVID trends, including the approval of J&J’s one-shot vaccine. The J&J news was expected, though, so it will be interesting to see how the rally holds up once the opening bell rings. The Nasdaq 100 tracking ETF is set to open up at around $318.5 which is a bit shy of its 50-Day Moving Average ($320) so that potential resistance still looms overhead.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, earnings reports from around the world, Markit PMI Data, trends in unionization, an update on the latest national and international COVID trends, including a new series of charts tracking vaccinations, and much more.

Treasuries had a nice rebound on Friday, but the rally did little to dig them out of the hole they’ve dug for themselves, especially at the longer end of the curve. Including Friday’s rebound, the iShares 20 Plus Year Treasury Bond ETF (TLT) is down 9.6% over the last 50 trading days. That’s an improvement from Thursday’s reading of -12.7%, but it still ranks as one of the sharpest drawdowns over a 50-trading day period since the ETF’s introduction in 2003. Before last week, the last time the ETF was down by as much over a 50 trading day period was in December 2016 just after the election. The recent sharp downside move in long-term US treasuries has been a big wake-up call for investors, but at the same time, it has hardly been unprecedented.

Bespoke Brunch Reads: 2/28/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Health Research

Could Fruit Flies Help Match Patients With Cancer Treatments? by Michele Cohen Marill (Wired)

Fruit flies are remarkably similar to humans in many ways, making them a useful model for mass testing of treatments for cancers that are tailored to the individual patient. [Link; soft paywall]

What’s Safe After COVID-19 Vaccination? Don’t Shed Masks Yet by Lauran Neergaard (NBC4)

While widespread vaccination will eventually return society to pre-COVID “normalcy”, a first dose of a vaccine is not a free pass to stop all the behaviors which help spread the virus. [Link]

Scarcity

Future Vaccines Depend on Test Subjects in Short Supply: Monkeys by Sui-Lee Wee (NYT)

Macaques are a critical species for early-phase research on drugs of many kinds, and the recent explosion of COVID R&D has made them increasingly difficult to get a hold of. [Link; soft paywall]

Where Have All the Houses Gone? by Emily Badger and Quoctrung Bui (NYT)

Skyrocketing demand for homes has been one fact in extremely low inventories, but a lack of supply driven in part by fears over COVID is also a major factor in the lack of available houses. [Link; soft paywall]

Lumber Prices Are Soaring. Why Are Tree Growers Miserable? by Ryan Dezember and Vipal Monga (WSJ)

While demand for US lumber is absolutely soaring and forcing sawmills to run flat out, there’s such a huge backlog of timber on the market that timber growers are struggling despite the massive rise in prices. [Link; paywall]

How Did We End Up With This Chip Shortage? by Anjani Trivedi (Bloomberg)

The auto industry is being forced to curtail production because it can’t get its hands on enough semiconductors, part of a global shortfall in semis that comes down to a basic planning failure. [Link; soft paywall]

Equity Market Madness

Dot-Com Survivors Have Wisdom for the GameStop Crowd by Joe Nocera (Bloomberg)

Looking back on the traders that were caught up in the last stock market bubble to try and find some lessons for the current crop of desperate stock market bidders. [Link; soft paywall]

A Stock-Trading Dupe Is Born Every Minute by Andy Kessler (WSJ)

The history of pump-and-dumps and the way that the GameStop saga fits into the classic narrative…and doesn’t. [Link; paywall]

Are We In a Stock Market Bubble? by Ray Dalio (LinkedIn)

The head of the world’s largest hedge fund thinks that the signals are mixed as to whether the current equity market is in a bubble, though certain areas of the market are certainly looking carried away. [Link]

Speculation In Everything

‘Nyan Cat’ flying Pop-Tart meme sells for nearly $600,000 as one-of-a-kind crypto art by Grace Kay (Business Insider)

An Ethereum-based piece of digital animation has sold for six figures, in one of the more head-scratching trades we’ve seen recently. [Link]

What Are NFTs and How Do They Work? by Ollie Leech (Coindesk)

Non-fungible tokens aka NFTs are a new approach to blockchain assets that are each unique; unlike other forms of crypto, which are fungible when combined or divided into larger or smaller values, NFTs are each unique. [Link]

How Did A LeBron James Video Highlight Sell For $71,455? A Look At A Burgeoning Product Called NBA Top Shot. by Tommy Beer (Forbes)

One application of NFTs is the NBA’s new digital trading card system. Blockchain-based Top Shot is a way to collect unique and tradable highlights. [Link]

Sneakerheads Have Turned Jordans and Yeezys Into a Bona Fide Asset Class by Joshua Hunt (Bloomberg)

Tight supply and booming demand for street shoes have driven a spectacular run for middlemen and speculators alike when it comes to sneakers. [Link; soft paywall]

What is Grenadine Made From? by Darcy O’Neil (Art of Drink)

The fabled cocktail syrup grenadine is popularly assumed to be derived from pomegranate, owing to the literal translation of its name, but in point of fact its origins are far more obscure. [Link]

Economic Myths

Potential Output: Little Explanation for a Big Number by Alex Williams (Employ America)

Recent debates about fiscal stimulus have revolved around the sizes proposed relative to the output gap, but that concept is dependent on an estimate of “potential” GDP which is little more than a gussied-up shot in the dark about how much the economy can produce. [Link]

Sports

Why Athletes’ Birthdays Affect Who Goes Pro — And Who Becomes A Star by Tim Wigmore (538)

Children born in a specific time of the year are much more likely to be active in elite amateur sports, owing to the fact that they are initially selected for size and development and then up-streamed to further training. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!