Sentiment Holding Back Homebuilders

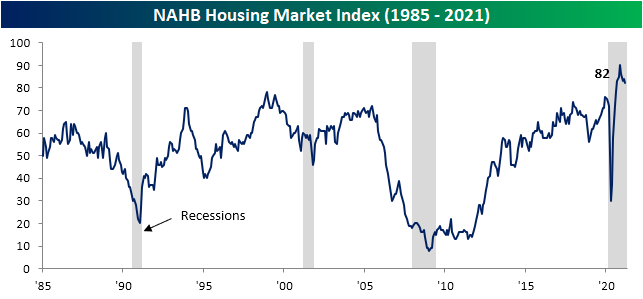

The National Association of Home Builder’s measure of homebuilder sentiment fell again in March. Although the index’s 2 point decline down to 82 leaves it 8 points off the November record high, the current level of sentiment is still a few points above the pre-pandemic record high.

A decline in present sales drove that decline as the index fell 3 points from 90 to 87. As with the headline number, although that is a decline from the peak of 96 in November, the current reading is still above anything recorded prior to the pandemic. Additionally, considering the indices for Future Sales and Traffic have held up better, that decline in Present Sales does not necessarily point to a broader downturn in demand. Even though Present Sales were lower, the index for Future Sales rose by 3 points recovering the ground lost in February while Buyer Traffic also avoided a decline as that index went unchanged from February. Again rather than a broader deterioration of conditions, the decline in Present Sales could be a result of issues like rising prices of things like lumber and higher mortgage rates which in turn means overall higher costs of a new home.

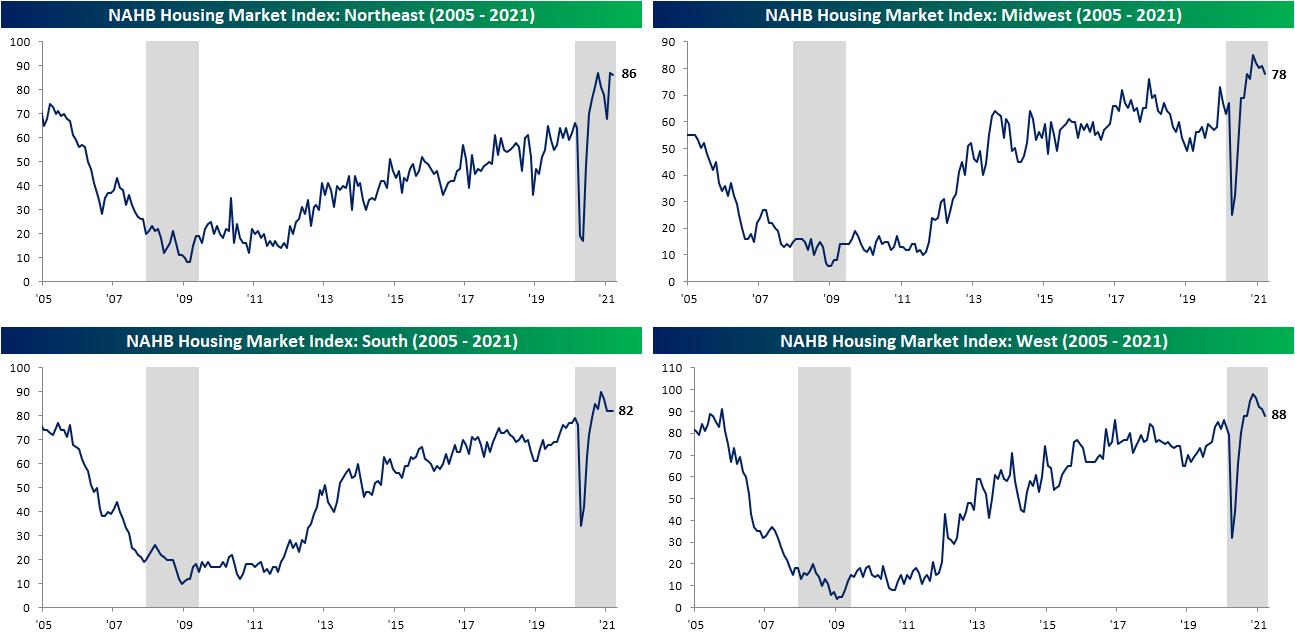

The South was the only region to avoid a decline in March. That index held steady at 82 for the third month in a row. The Northeast also fared a bit better than the other regions as the index only fell one point from last month’s level that was tied with October for a record high. The Midwest and the West fell more sharply with each index dropping 3 points. Regardless of those declines, both indices continue to come in at historically strong levels.

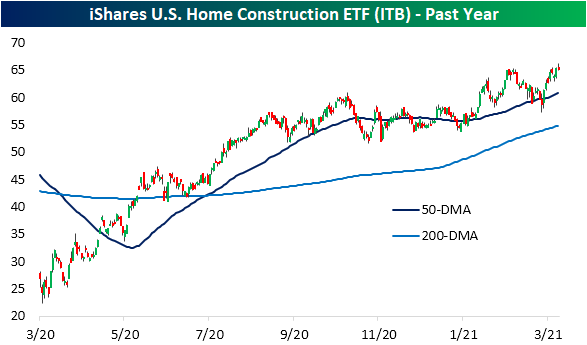

With the weaker headline release providing a bit of a headwind in terms of catalysts, the iShares Home Construction ETF (ITB) is fighting to break out and hold above its early February highs today. Last week it unsuccessfully tried to take out resistance, but still remains right below its prior highs.

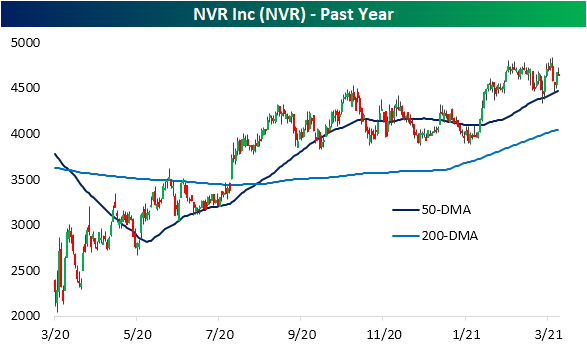

Looking across S&P 1500 homebuilder stocks, there are two in our Trend Analyzer tool that currently earn “good” timing scores: TopBuild (BLD) and NVR (NVR). Whereas the broader group is testing 52-week highs, BLD and NVR are some of the few that are not currently overbought having recently pulled back a bit. After taking a brief dip below its 50-DMA late last month, BLD has been fluctuating around its moving average over the past few days. NVR on the other hand was unsuccessful in breaking out last week which was followed by a successful bounce off of its 50-DMA yesterday. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

B.I.G. Tips – Retail Sales Whiplash

Viewed in isolation, the February Retail Sales report was terrible. With headline sales falling 3% on a month/month basis, it was the fifth-worst headline print in the history of the report going back to 1992. The only months that were worse were two in 2008 and two in 2020. Aren’t we supposed to be on our way out of the crisis?

In our just-released B.I.G. Tips report, we broke out the details of the February report including its bright and dark spots. For anyone with more than a passing interest in how the COVID outbreak is impacting the economy, our monthly update on retail sales is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

Bespoke’s Morning Lineup – 3/16/21 – Retail Sales Reset

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Change is the law of life and those who look only to the past or present are certain to miss the future.” – John F. Kennedy

In what seems like a change of pace from recent weeks, Nasdaq futures are leading the way higher this morning as it is actually the only one of the major indices indicated to open higher on the day. Futures weakened modestly following the release of the February Retail Sales report, and the 10-year yield is still slightly lower. The headline Retail Sales readings came in well below consensus forecasts, but mitigating factors like the storms that hit the midwest and a big upward revision to January’s report helped to soften the blow. Next up on the economic calendar is Industrial Production and Capacity Utilization at 9:15 Eastern and then Business Inventories and Homebuilder Sentiment at 10 AM.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, including a recap of moves in the rates market overnight, an update on inflation data out of Europe, Australian Housing and Central Bank data, economic sentiment, the latest US and international COVID trends including our series of charts tracking vaccinations, and much more.

Yesterday, we highlighted the fact that semis have been lagging the broader market rally. Despite the weakness, the SOX had a positive start to the week yesterday and actually managed to close back above its 50-DMA for the first time since late February. It’s a start.

Lastly, if you didn’t catch it yesterday, make sure to check out yesterday’s CNBC segment with Paul Hickey discussing markets and the state of business travel in the future.

Chart of the Day: Range Risers

Daily Sector Snapshot — 3/15/21

Chart of the Day: Beware the Ides of March?

Big Expectations Out of New York

This morning the New York Fed released its monthly reading on the region’s manufacturing sector. The headline index was expected to move up to 15 from February’s reading of 12.1. Instead, the increase was even larger as the index rose 5.3 points to 17.4. In addition to that being the ninth consecutive month that the region’s manufacturing sector expanded, it also surpassed the summer high of 17.2 making for the strongest reading since November 2018.

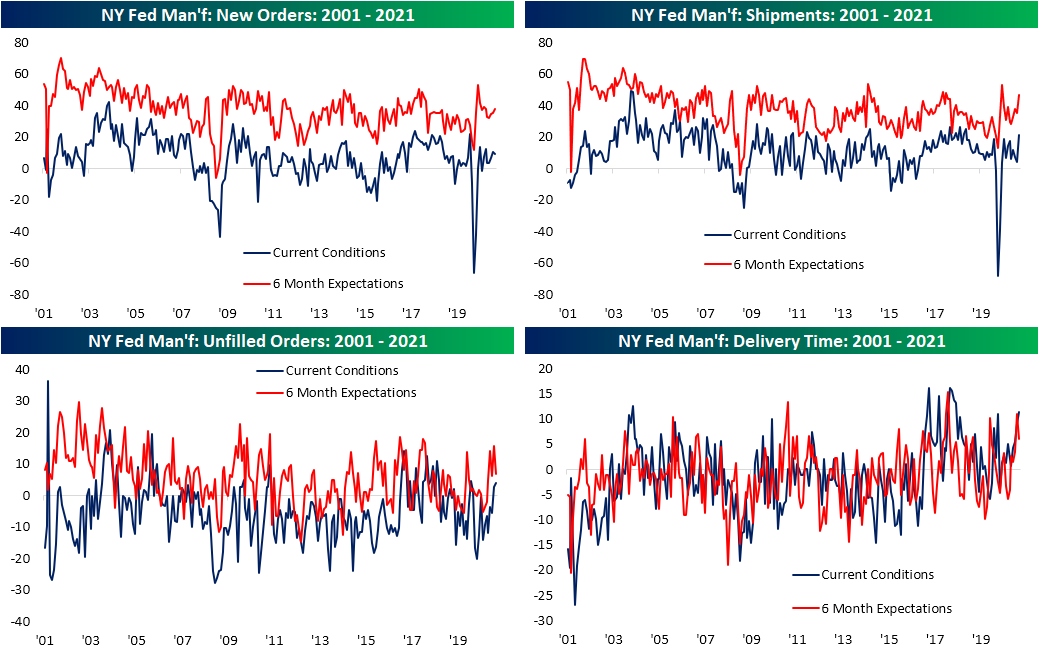

In addition to the headline number moving higher, every other indicator also continues to show expansionary readings painting a broadly positive picture for the region’s manufacturers. The only indices to show any deceleration in March were those for New Orders and Number of Employees. Six-month expectations also remain positive, although there were more of these that were lower on a month-over-month basis.

As previously mentioned, New Orders was one of just two areas in the report to experience a deceleration in March. Falling to 9.1, this month’s reading sits in the middle of its historical range still consistent with a seventh straight month of growth in new orders. Other related indicators remain much stronger though.

With orders still growing, the index for Unfilled Orders expanded for a second month in a row climbing to the highest level since February of last year. Shipments picked up even more significantly. The index rose 17.1 points to 21.1. That is the ninth-largest month-over-month increase since the start of the survey in 2001. The most recent moves of similar or larger size were 29.1 and 42.3 point increases in May and June, respectively, of last year. As with the headline number, that is now the highest level since November 2018. Although shipments are accelerating, Delivery Times were also higher. That index now sits in the top 3% of readings

In spite of those long lead times and high demand, inventories are rising with that index gaining 1.6 points to the highest level in just over a year. Like delivery times, that stands in the top decile of readings. Looking to the future, responding firms broadly expect higher inventory levels six months down the road. That index climbed 4.6 points to 19.5 which is the second-highest reading on record behind a print of 20.3 in January 2018.

Another area of the report that continues to come in notably high is prices. Generally speaking, price increases and expectations for price increases are being reported at one of the highest clips of the past decade. Both indices for Prices Paid and Received currently are in the top 3% of all readings. Starting with a look at Prices Paid, March marked the eighth month in a row that the index rose month-over-month as it has reached the highest level since May of 2011. Similarly, expectations came in at the highest level in nine years. While Prices Received have only risen three months in a row, it is also at the highest level since May of 2011 and expectations are at the highest level since April of 2011.

While current and future indices are moving in sync with one another with regards to prices, those for employment moved in opposite directions. The index for Number of Employees was still consistent with further employment gains in March, but the index fell to the lowest level since November. While hiring growth decelerated, responding firms are much more optimistic when it comes to employment six months down the road. That index climbed 14.8 points to 31.4. That was the fourth-largest uptick on record. The only larger one-month moves were in March 2008 (+22.8 to 31.9), October 2001 (+20.5 to 12.3), and September 2004 (+16.1 to 29.2). The index is now at the highest level since June 2010.

As for Average Workweek, things were a bit more modest with the current conditions index rising to the highest level since October. Again, the index for expectations was even stronger rising to a two-year high. Click here to view Bespoke’s premium membership options for our best research available.

B.I.G. Tips – Google Trends: Planes, Trains, and Automobiles

Bespoke’s Morning Lineup – 3/15/21 – Small Seeking Seven

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Capital isn’t scarce, vision is.” – Sam Walton

Small-cap stocks are looking to continue a big streak today with the Russell 2000 looking to extend its current winning streak to seven straight days. Right now, the streak’s prospects aren’t looking great as Russell 2000 futures, along with the Nasdaq, are marginally lower as Treasury yields rise.

The economic calendar is quiet today with Empire Manufacturing the only major report on the calendar. While consensus estimates called for a headline reading of 13.0, the actual print came in at 17.4, which was the highest level since October 2018.

Be sure to check out today’s Morning Lineup for updates on the latest market news and events, including a recap of moves in the rates market overnight, an update of moves in the Asian and European market, Chinese economic data, an update on the latest national and international COVID trends, including our series of charts tracking vaccinations, and much more.

Below, we show the intraday charts of the S&P 500, Nasdaq 100, Russell 2000, and the Philadelphia Semiconductor Index (SOX) over the last four weeks. For the first three indices, last week was a big one as they put an end to their streaks of lower highs last week. The one outlier was the SOX. It too rallied last week but not by nearly enough to break its own downtrend. For an index that historically acts as a leading indicator for the broader market, the relative underperformance of the SOX isn’t ideal.

Bespoke Brunch Reads: 3/14/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Cars

Standstill Traffic May Be the Only Thing Keeping Crash Deaths From Skyrocketing by Alissa Walker (Curbed)

Despite a pandemic-fueled collapse in the number of vehicle miles travelled, traffic deaths soared in 2020 as clear roads meant higher speeds and more death. [Link]

We Called 8 Dealerships Asking About EVs. Here’s What They Told Us by Adam Ismail (Jalopnik)

Whether or not dealerships embrace electric vehicles will be a key to how fast they roll out in the United States, and the early indication from this informal review of dealerships across the country. [Link]

Speculation

Young retail investors plan to spend almost half of their stimulus checks on stocks, Deutsche survey claims by Holly Ellyatt (CNBC)

A survey of retail investors suggest that the latest round of stimulus checks are in large part destined for the equity market, driven mostly by younger stock buyers. [Link]

The most frequently asked questions by Robinhood traders reveal ‘new type of uninformed equity-market participant’ by Andrew Keshner (MarketWatch)

During Robinhood platform outages, stocks that were widely owned by Robinhood traders became more liquid and less volatile, suggesting that high volume free to trade buyers and sellers on the platform are adding noise to market prices. [Link]

SPAC Pioneers Reap the Rewards After Waiting Nearly 30 Years by Amrith Ramkumar (WSJ)

Blank check companies were first introduced in 1993 but didn’t really catch on until the last few years; they’re now 70% of IPOs and have raised $75bn this year alone. [Link; paywall]

NFTs

The Whales of NBA Top Shot Made a Fortune Buying LeBron Highlights by Ben Cohen (WSJ)

Digital trading cards known as non-fungible tokens have proven to be a spectacular speculation, with unique clips (which are of course widely available on YouTube or other sites) trading for millions of dollars. [Link; paywall]

Why the NFT Craze Is a Bubble Waiting to Pop by James Surowiecki (Marker)

Unique digital assets are the latest mania fueled by blockchain technology and rabid speculator enthusiasm for the next big thing. [Link]

Tech

This Chip for AI Works Using Light, Not Electrons by Will Knight (Wired)

Instead of running electrons through transistors, a startup that got its beginnings at MIT is using light to build chips that have radically higher throughput potential…if they work. [Link; soft paywall]

Tesla Is Plugging a Secret Mega-Battery Into the Texas Grid by Dana Hull and Naureen Malik (Yahoo! Finance/Bloomberg)

A subsidiary of the electric vehicle company is developing a battery near Houston that can store 100 megawatts, enough to power 20,000 homes on a hot day in Texas. [Link]

POLITICO Playbook: Scoop: Biden taps another Big Tech trustbuster by Ryan Lizza, Tarra Palmeri, Eugene Daniels, and Rachael Bade (Politico)

The Biden Administration has made multiple appointments that suggest a tight focus on antitrust in the tech industry, with a White House economic advisor and a Federal Trade Commission member both falling inside that category. [Link]

Weird News

The bizarre tale of the world’s last lost tourist, who thought Maine was San Francisco by Andrew Chamings (SFGate)

Back in 1977, a German tourist got confused on a layover and mistook Bangor, Maine for San Francisco, sparking an international media frenzy over a very confused man who spoke no English. [Link]

Brood X cicadas are about to put on one of the wildest shows in nature. And D.C. is the main stage. by Darryl Fears (WaPo)

The Delaware Valley, central Midwest, Hamptons, and eastern Tennessee are all due to receive an unholy storm of cicadas this summer as Brood X emerges from its long slumber. [Link; soft paywall]

Tax Trouble

He Got $300,000 From Credit-Card Rewards. The IRS Said It Was Taxable Income. by Richard Rubin (WSJ)

A physicist who spent $6.4mm on gift cards which he rolled into money orders deposited to his bank. The transactions were so large and numerous that they were flagged by the Treasury Department, eventually leading to an IRS investigation. [Link; paywall]

Food & Drink

Union officials: Tate’s Bake Shop workers threatened with deportation if they unionize (Long Island News 12)

Undocumented workers for Long Island bakery Tate’s are being threatened with deportation in response to a unionization drive. Tate’s is owned by Mondelez. [Link; auto-playing video]

The True Cost of a Cocktail by John Debary (Punch)

Ever wonder why a drink at a cocktail bar hits your wallet so hard? A breakdown of the costs that a cocktail typically embeds in its high menu price. [Link]

Furniture

Booming furniture sales mean ‘unprecedented’ delays for sofas and desks by Abha Bhattarai (WaPo)

Huge demand for furniture to upgrade homes that Americans are spending far more time in than usual is driving an unprecedented disruption to supply chains. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!