Jobs As Plentiful As They Were Right Before the Pandemic

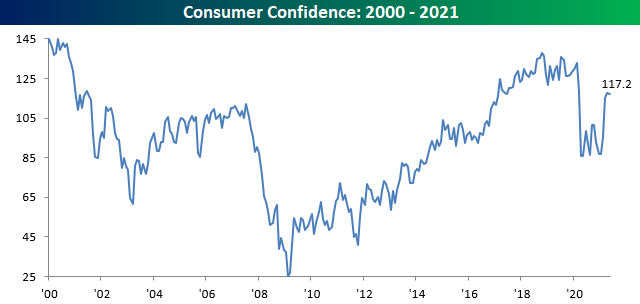

Consumer Confidence took a rest in May as the headline index dropped slightly falling from 117.5 (revised down from original 121.7) to 117.2 and more than a point and a half below consensus forecasts of 118.8. Despite the weaker than expected report, confidence levels have recovered more than half of the declines from the pre-COVID highs.

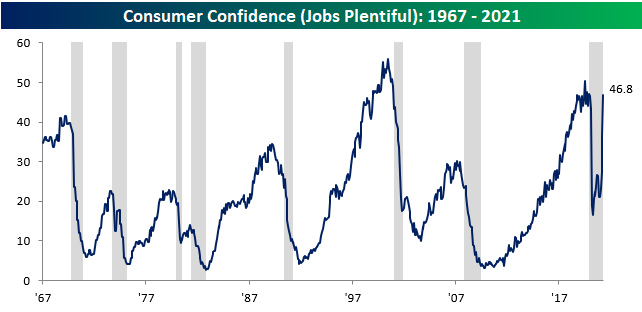

One very strong aspect of the report this morning was the Jobs Plentiful index which surged 29% versus April, marking the third straight m/m gain of over 19% during which time the index has doubled. That’s easily the largest ever three-month gain in the index. Jobs are so plentiful now that the index is actually higher than it was back in February 2020 when people were still figuring out what COVID was right before the WHO declared it a pandemic in March 2020. With a record number of job openings per the JOLTS survey and consumers viewing the ability to find a job just as easy now as it was before the pandemic, it once again leads back to the question of why there are 8.2 million fewer Americans working now than there were in February 2020?

On another note, it’s really just a matter of semantics at this point, but since the mid-1960s there has never been another period where the Jobs Plentiful index erased this much of its losses and the economy was still in a recession. The NBER is the organization in charge of dating recession start and end dates, and while it isn’t meant in any way to be a timing indicator, at this point the recession is not only over, but it has been for about a year now. Going back to 1980, the median number of days between the end of a recession and when the NBER makes the official announcement is 476 days. Based on that, we could expect the NBER announcement to come out sometime later this Summer. Click here to view Bespoke’s premium membership options for our best research available.

Chart of the Day: Seasonality Around Memorial Day

Bespoke’s Morning Lineup – 5/25/21 – Russell’s Turn

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Personally, I’d rather have bitcoin than a bond.” – Ray Dalio

Yesterday may have been a day you wanted to own bitcoin over a bond but not today. After one of its best days in years, bitcoin is down over 5% as of now. Right now, it’s flopping around trying to regain its footing and establish a new baseline after last week’s crash. In other news, equity futures are higher, and those 10-year US Treasures that no one wants to own are rallying to push the yield back below 1.6%.

In company-specific news, we’ve seen some positive news related to the re-opening this morning as both United (UAL) and Hawaiian Airlines (HA) had positive comments regarding passenger traffic levels.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of some positive economic data out of Asia and Europe and the latest US and international COVID trends including our vaccination trackers, and much more.

After multiple attempts at moving back above its 50-DMA, the Nasdaq was finally able to trade and close above that level yesterday as mega caps in the index provide leadership. Call it a moral victory for the index on its attempted journey back to record highs.

Today looks like it may be the Russell 2000’s turn to make a run and stay above its 50-DMA. Including yesterday, the small-cap index has made three attempts to trade above its 50-DMA, and each time, it sold off intraday day closing below that level. In yesterday’s email, we noted that breadth in the Nasdaq has been weak as smaller issues in the index have acted as a drag on the index. The fact that the Russell 2000 hasn’t been able to trade and close above its 50-DMA provides another illustration of that relative weakness. If the Russell can finally reclaim its 50-DMA today, though, that would help shift to a more bullish narrative for small caps heading into the holiday weekend.

Daily Sector Snapshot — 5/24/21

Chart of the Day – Amazon.com and Netflix Taking Naps

Mid-Cap Growth Picking Up

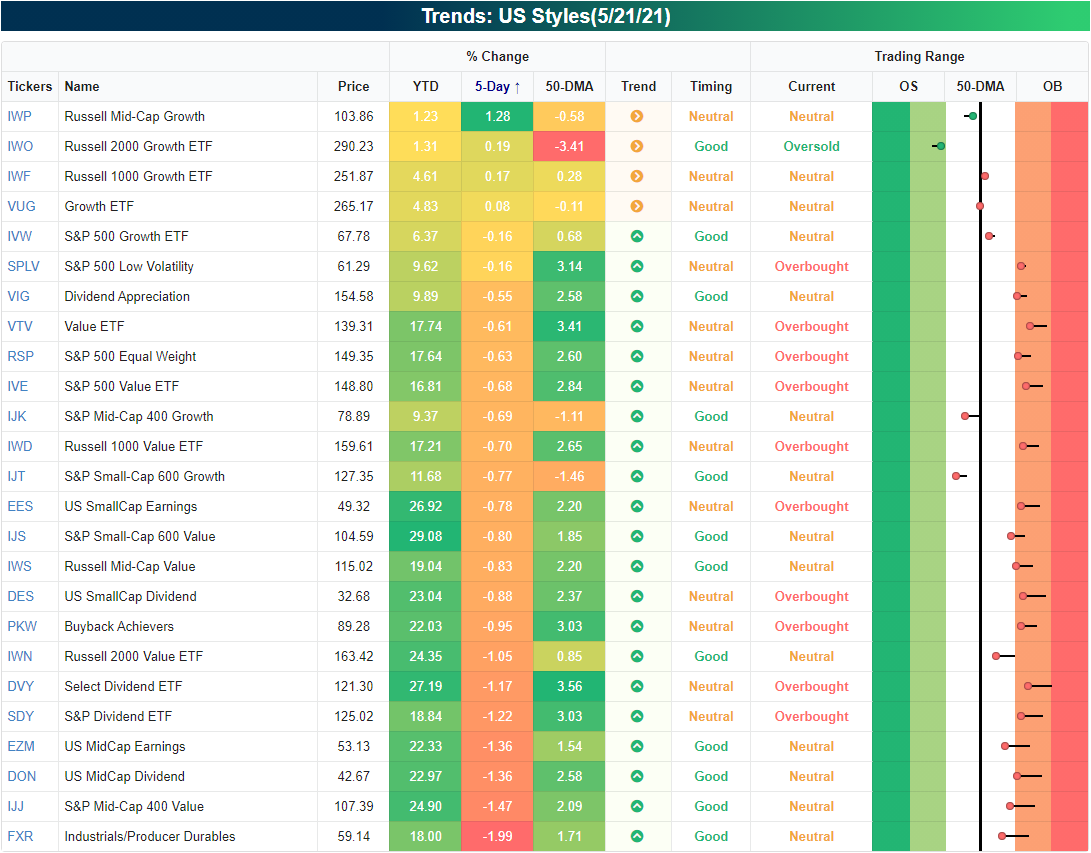

In the five days ending last Friday, by far the best performing major US index ETF in our Trend Analyzer was the Micro-Cap ETF (IWC) with a 1.65% gain. That also places it in the top spot in terms of YTD performance. In spite of that outperformance, it finished last week as one of just three ETFs in the screen that is below its 50-DMA. Up another 0.59% so far today, IWC is continuing to close in on getting back above its 50-DMA. While micro-caps have done well, other small-cap indices like the Russell 2000 ETF (IWM) and the Core S&P Small-Cap ETF (IJR) have done far worse. Yet worse still were S&P 500 Mid-Cap ETFs (IJH and MDY) which found themselves at the bottom of the list in terms of 5-day performance. But not all mid-cap indices were the biggest losers last week. The broader measure of the mid-cap space, the Russell Mid-Cap ETF (IWR)—which tracks the 800 smallest stocks in the Russell 1000 whereas the S&P mid-cap ETFs track the S&P 400—was likewise lower over the five days ending last Friday, but its loss was much smaller at 18 bps versus the over 1% decline for IJH and MDY.

Breaking that down further, growth was the key to this stronger performance for the Russell mid-caps. The Russell Mid-Cap Growth ETF (IWP) saw a standout performance with a 1.28% gain last week compared to a 0.83% decline in the value counterpart, the Russell Mid-Cap Value ETF (IWS). Other growth ETFs like the Russell 2000 Growth ETF (IWO), Russell 1000 Growth ETF (IWF), and the broader Growth ETF (VUG) were the only other tickers in the US Styles screen of our Trend Analyzer that were in the green last week, though, they all were up by a full percentage point less.

Again, in spite of also tracking mid-caps, the S&P’s ETF also underperformed with the S&P Mid-Cap Growth ETF (IJK) falling 0.69%. One possible reason for the outperformance of the Russell Mid-Cap Growth ETF could be a rotation into what has been this year’s losers. Although it outperformed in the past week, IWP is still the worst performer on the year with other growth ETFs not far behind.

Below we show the ratio of Russell Mid-Cap Growth (IWP) versus the value counterpart (IWS) and the broader Russell 1000 (IWB) over the past five years. When the line is trending higher it indicates mid-cap growth is outperforming and vice versa when the line is trending downward. In the first half of last year, growth took off relative to value but from the second half of 2020 into early 2021, that outperformance trailed off as the line moved sideways. Since February, there has been a sharp reversal with two significant legs lower with the most recent one lasting from the end of April through earlier this month. The recent bout of strength from mid-cap growth in the past week is basically just a blip within those declines, but it does mark a bounce from around the past few year’s trend in the ratio. It is a similar story relative to the broader Russell 1000 as well.

Taking a look at IWP’s chart, last week’s solid performance appears to be carrying into this week with IWP up another 1.15% today which puts it on pace to move back above its 50-DMA. But even though there has been strength in the very short term, IWP’s longer-term trend still has plenty of room for improvement. The 50-DMA has been trending sideways as the ETF has been in consolidation for most of the year since hitting a 52-week high in February. Currently, at its 50-DMA, IWP is right in the middle of that consolidation range. Click here to view Bespoke’s premium membership options for our best research available.

Bitcoin Volatility Explodes

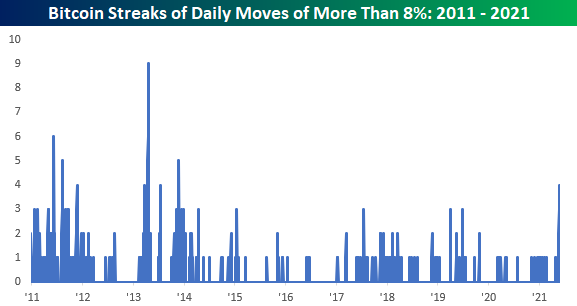

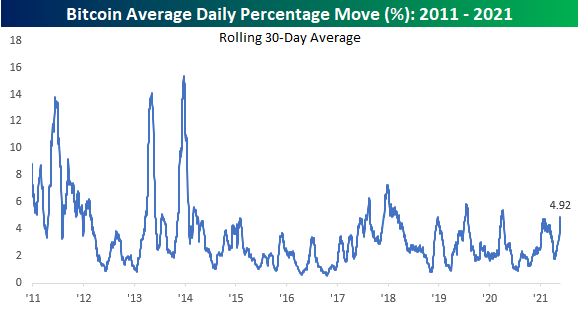

The last several days have been quite the roller coaster ride for bitcoin. Since last Friday, the one-day moves (remember it trades on the weekend) have been down 12%, up 8%, down 11.5%, and up 12.3% today! Even for bitcoin, this is some crazy volatility.

If today’s gain in bitcoin holds above the 8% level (or if it reverses and trades down 8%), it will be the first four-day streak of daily moves of 8%+ since 2013! Going all the way back to the start of 2011, there have only been four other periods where bitcoin experienced longer streaks of daily moves of 8%+. What makes the streak even more notable this time around, though, is bitcoin’s market value. The last time bitcoin experienced a similar streak, it was trading at under $300 per coin. Today, it’s more than 100 times that at over $38,000 for a total market value of more than $700 billion!

While the last four days have been incredibly volatile for bitcoin, its volatility over the last month hasn’t been nearly as extreme. Over the last 30 days, bitcoin’s average daily move has been just under 5%. This is now just barely above its most recent peak earlier this year but still above the prior peak of 5.5% seen last April. Click here to view Bespoke’s premium membership options for our best research available.

Bespoke’s Morning Lineup – 5/24/21 – Green on the Scene

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“I see life almost like one long University education that I never had — every day I’m learning something new.” – Richard Branson

Outside of the crypto space, it was a relatively uneventful weekend for financial markets. Equities are looking to kick off the week on a positive note with the Nasdaq leading the way higher. Both the economic and earnings calendars are quiet, but the pace will pick up tomorrow.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of overnight economic and earnings data, a look at the change in total market cap for the crypto universe during the recent sell-off, and the latest US and international COVID trends including our vaccination trackers, and much more.

Heading into the new week and the last week before the unofficial start of the Summer season, we wanted to provide a quick update on the market’s breadth. Starting with the S&P 500, its cumulative A/D line has tracked price very closely with breadth actually holding up modestly better than the price.

Bespoke Brunch Reads: 5/23/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

COVID

A COVID Outbreak Is Plaguing Climbers on Everest by Dewan Rai and Ben Ayers (Outside)

At least 22 climbers and Sherpas at the Everest Base Camp have COVID diagnoses, forcing expeditions to abandon their climbs and complicating an already complicated logistical backdrop at the foot of the world’s tallest mountain. [Link]

Statewide Reopening During Mass Vaccination: Evidence on Mobility, Public Health and Economic Activity from Texas by Dhaval M. Dave, Joseph J. Sabia & Samuel Safford (NBER)

Reopening in Texas did not accelerate COVID cases because individuals did not change behavior in aggregate after the policy shift; that also means that claimed benefits related to employment did not materialize either. [Link]

Investing

Trump Allies Promote Portfolios Targeting ‘Unwoke Investors’ by John McCormick (WSJ)

In an age reaction, for every action there is a pushback. In this case, ESG strategies are getting a counterweight with portfolios designed to overweight stocks perceived as appealing to conservative values. [Link; paywall]

Fidelity’s Pitch to America’s Teens: No-Fee Brokerage Accounts by Justin Baer (WSJ)

The brokerage company is aiming to introduce teens to investment with debit cards and brokerage accounts for the children of existing Fidelity clients. [Link; paywall]

EVs

The 2022 Ford F-150 Lightning Is the Future of America’s Workhorse by Brian Silvestro (Road & Track)

A review of the Ford F-150 Lightning fully electric pickup, unveiled this week in Michigan, offers 230-300 miles of range and between 420 and 560 horsepower, along with a front trunk, crew cab, and super-affordable price point relative to competitors. [Link]

Zero-emission, all-electric flight is closer than you think by Justin Gerdes (Energy Monitor)

A small regional airline that operates seaplane flights along the coast of British Columbia is in the process of certifying battery-powered planes, with multiple test flights per week run since the end of 2019. [Link]

Getting Out Of Hand

Amazon’s Ring is the largest civilian surveillance network the US has ever seen by Lauren Bridges (The Guardian)

10% of American police departments can access video footage from Amazon’s Ring doorbells…without any warrant. Tens of thousands of requests have been made, offering police a work-around that skirts Fourth Amendment protections. [Link]

‘Collectibles versus commodities’: As Target halts sales of trading cards, collectors reckon with fast-changing hobby by Jacob Bogage (WaPo)

Target is taking playing cards off the shelves after a dispute over collectibles outside one of its Milwaukee stores led to violence and multiple arrests. [Link; soft paywall]

Panhandle Boom

ECP Airport has highest passenger numbers in April since its original opening by Madalyn Bierster (My Panhandle)

Northwest Florida Beaches International, just north of Panama City, is seeing all-time record traffic as foreign tourism takes a back seat to domestic destinations. Booming arrivals are fueling a renaissance in Florida Panhandle tourism. [Link]

Philanthropy

Giving Billions Fast, MacKenzie Scott Upends Philanthropy by Nicholas Kulish (NYT)

After receiving 4% of outstanding AMZN shares in her divorce two years ago, MacKenzie Scott is breaking the mold of philanthropy by actually giving away money, a stark contrast to the traditional approach of foundations that pay out as little cash from their holdings as possible. [Link; soft paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!