May 2021 Headlines

Chart of the Day – Energy Leads But Still Lags

Bespoke’s Morning Lineup – 6/7/21 – Drifting into Positive Territory

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.” – Winston Churchill

Futures started off with a negative bias this morning but have been drifting higher all morning and are now modestly positive for both the S&P 500 and Dow, while the Nasdaq is just barely lower. Treasury yields are higher, but the 10-year yield is still well below 1.6%, and even bitcoin is following the lead of equities and moving further into positive territory. It was a mixed weekend for the crypto-currency as China appears to be cracking down on the space while El Salvador said it will recognize bitcoin as legal tender.

Read today’s Morning Lineup for a recap of all the major market news and events including a discussion of the Global Minimum Tax, a recap of activity in Asia and Europe, and the latest US and international COVID trends including our vaccination trackers, and much more.

With the S&P 500 inching closer to new highs last week, the majority of sectors also traded higher. With crude oil continuing to rally towards 52-week highs, the Energy sector surged nearly 7% taking its YTD gain to nearly 50%. Behind Energy, four other sectors were up over 1%, and there are now four sectors that are already up over 20% YTD. Talk about a strong year!

On the downside, only two sectors were down last week (Consumer Discretionary and Health Care). Consumer Discretionary is the only sector trading more than 1% below its 50-day moving average and one of just two sectors (Utilities being the other) that finished the week below that level.

Bespoke Brunch Reads: 6/6/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

New Research

Why Do Borrowers Default on Mortgages? A New Method For Causal Attribution by Peter Ganong & Pascal J. Noel (NBER Working Papers)

What drives default on mortgages? The authors estimate that roughly 97% of all mortgage defaults take place because of an adverse shock which leaves borrowers unable to cover their monthly payment, not because they are strategically walking away from an LTV over 100. [Link; soft paywall]

How Teach for America Affects Beliefs about Education by Kathrine M. Conn, Virginia S. Lovison, and Cecilia Hyunjung Mo (Education Next)

TFA volunteers acquire a greater appreciation for societal inequality in educational under-attainment, reduces support for charter schools and vouchers, and raises optimism that an excellent education in the US is possible for all children. [Link]

Labor Markets

The Divergent Signals about Labor Market Slack by Troy Gilchrist & Bart Hobijn (FRBSF Economic Letter)

Using a broader snapshot of the labor market shows that on balance the U3 unemployment rate is roughly representative of where things currently stand…with the important caveat that dispersion across indicators is much higher than historically has been the case. [Link]

Restaurants, Supermarkets Can’t Find Enough Workers to Open New Locations by Jaewon Kang & Heather Haddon (WSJ)

Grocers and restaurants that rely on large pools of low-prerequisite labor are struggling to find enough workers to staff new locations. [Link; paywall]

Price Tags

Why dirt from Mars could be the most expensive substance known to mankind (Science Insider/Twitter)

Three different joint space missions are hoping to bring back a couple of pounds of soil from Mars at a price tag of more than $9bn, making it easily the most expensive way to grow tomatoes ever devised (note: that’s not what scientists will use it for). [Link]

Building a Home in the U.S. Has Never Been More Expensive by Marcy Nicholson, Dave Merrill, & Cedric Sam (Bloomberg)

A fascinating walk-through of how much prices have risen for key inputs to home construction. Lumber features prominently but many other costs have also soared. [Link; soft paywall]

Disease

Covid-19 Prevention Measures Are Keeping Childhood Diseases Like Chickenpox at Bay by Peter Landers & Miho Inada (WSJ)

While COVID and related responses have had lots of negative impacts on children, there are some positives: more handwashing, masks, and other non-pharmaceutical interventions have led to a collapse in case counts for diseases like flu, chicken pox, strep throat, and rotavirus. [Link; paywall]

Moderna to take mRNA flu and HIV vaccines into Phase 1 trials this year by Rachel Arthur (BioPharma)

The company behind one of the two mRNA vaccines that were first to market in the fight against COVID is starting Phase 1 trials for flu and HIV this year, with another vaccine against cytomegalovirus (which causes mononucleosis). [Link]

Matters of State

Shrinking California by Will Wilkinson (Substack)

In 2020 California’s population shrank by over 180,000 people, with an interesting array of implications for both that state’s politics and states where former residents of the Bear Flag Republic are heading to. [Link]

West Virginia Gov. Jim Justice Is Personally Liable for $700 Million in Greensill Loans by Julie Steinberg & Duncan Mavin (WSJ)

Companies owned by West Virginia’s two-term governor are on the hook for hundreds of millions in loans backed by coal receivables, and the financial liability may roll all the way up to the governor’s mansion. [Link; paywall]

Cheating

Inside The ‘World’s Largest’ Video Game Cheating Empire by Lorenzo Franceschi-Bicchierai (Vice)

A group that found exploits to Tencent’s Playerunkown Battlegrounds Mobile and sold them for millions ended up attracting the attention of Chinese police. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report Newsletter: Short Squeeze Round 2

This week’s Bespoke Report newsletter is now available for members.

The most heavily shorted stocks surged this week in a repeat of the action we saw in late January during the Gamestop (GME) saga. This week it was theater-chain AMC that surged, rallying more than 177% in less than two days at its intraday peak on Wednesday. We cover this week’s market moves, economic releases, and provide an in-depth sector analysis in this week’s Bespoke Report.

To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels.

Daily Sector Snapshot — 6/4/21

Bespoke’s Morning Lineup – 6/4/21 – Last Call

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Public business, my son, must always be done by somebody. It will be done by somebody or other. If wise men decline it, others will not; if honest men refuse it, others will not.” – John Adams

If someone says that “you live in a bar,” the odds are that it’s not a compliment, but if you ever find yourself on the receiving end of that comment, you’re in good company. John Adams may not have been the first President of the United States, but he was the first President known to have taken up residence in a bar. On this day yesterday in 1800, President Adams moved into the Union Tavern in Georgetown while construction was being done on the White House. That means that on this day in 1800, President Adams became the first and only known sitting US President to ever wake up in a bar. There may have been others in the 220 years since, but to our knowledge, the lips of Secret Service agents have been sealed!

In market news this morning, US futures have moved into positive territory following the weaker than expected May Non-Farm Payrolls report, but the big move has been in the crypto space where bitcoin is down over 7% after Elon Musk tweeted a broken-hear emoji for the token. A 7% decline on an asset class worth about $700 billion over a tweet? If last year wasn’t 2020 and this year wasn’t 2021, we’d be surprised at a move like that.

Read today’s Morning Lineup for a recap of all the major market news and events including a recap of the RBI rate decision, economic data out of Europe, and the latest US and international COVID trends including our vaccination trackers, and much more.

Maybe it’s just because the topic is in the front of our minds lately, but it seems as though everywhere we look, the same rangebound pattern shows up. This morning’s example is the Russell 2000. All year now, the index has been in a relatively narrow range, and given the fact that the index closed yesterday right in the middle of that range, it doesn’t look like it’s going to break in one way or the other very soon.

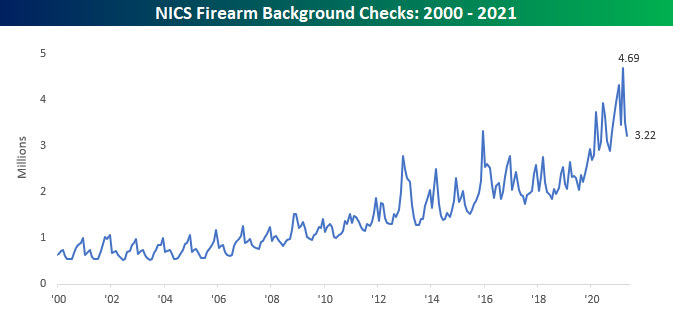

Gun Sales Capped

FBI Background checks for the month of May were just recently disclosed, and just as many aspects of the economy and overall society are starting to return back to more normal levels following the disruptions caused by COVID, so too are gun sales based on the latest data. For the month of May, background checks fell from 3.51 million down to 3.22 million which is the lowest monthly reading since last September.

While the m/m decline in background checks wasn’t particularly extreme, the two-month rate of decline was the largest ever, falling by nearly 1.5 million.

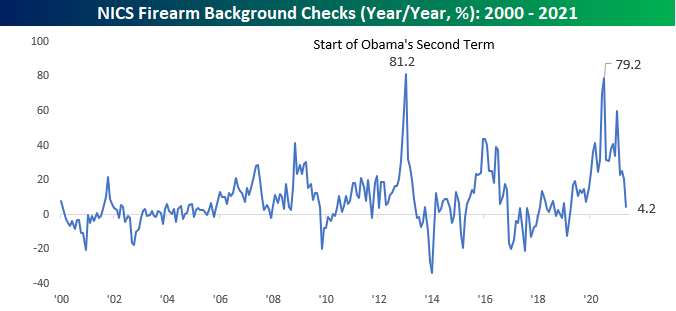

With the declines in background checks, the y/y increase has really started to collapse. At 4.2%, the y/y change in background checks has dropped to its lowest level in more than two years (March 2019).

While the pace of gun background checks has been declining, the prices of gun stocks have actually been on the rise. Below we show the one-year price charts of Sturm Ruger (RGR) and Smith and Wesson (SWBI) which are the two publicly traded pure-play gun manufacturers. Both stocks surged late last spring and into the early summer following the George Floyd killing and subsequent protests and riots across the country, but they quickly pulled back in the summer months and traded relatively rangebound over the following six months. Since late April, though, both stocks have started to attract investor interest, and RGR is actually close to 52-week highs while SWBI is close to taking out its high from early this year. Click here to view Bespoke’s premium membership options.

Bespoke’s Weekly Sector Snapshot — 6/3/21

The Bespoke 50 Top Growth Stocks – 6/3/21

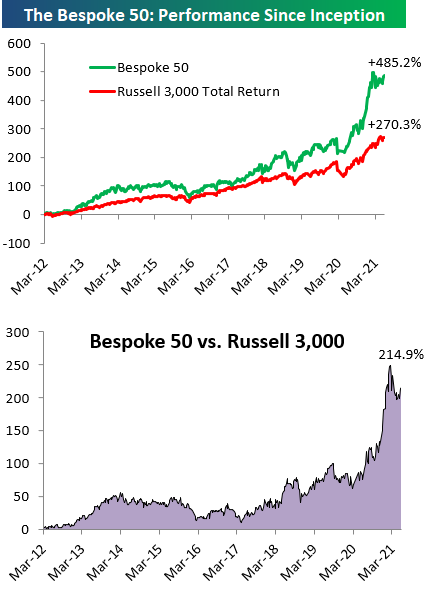

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” list is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” is up 485.2% excluding dividends, commissions, or fees. Over the same period, the Russell 3,000’s total return has been +270.3%. Always remember, though, that past performance is no guarantee of future returns. (Please read below for more info.) To view our “Bespoke 50” list of top growth stocks, please start a two-week trial to either Bespoke Premium or Bespoke Institutional.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, fees, or dividends are not included in the performance calculation. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities.