B.I.G. Tips: Analyst Sentiment Check Up

Bespoke’s Morning Lineup – 7/15/21 – Brackish Banks

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“Giving debt relief to people that really need it, that’s what foreclosure is.” – J.P. Morgan

Futures were lower heading into the open in Asia and have continued lower ever since. They’re currently near their lows of the morning as the 10-year yield reverses its increase from earlier in the week and oil prices trade lower. In economic data, we just got a ton of economic data. Jobless Claims were mixed with initial claims coming in slightly higher while continuing claims were lower than expected. Import Prices rose slightly less than expected while in the Manufacturing sector, the Philly Fed report missed expectations while the Empire Manufacturing report blew the doors off expectations. With the headline number coming in at 43.0, Empire topped expectations by a full 25 points. Going back to 2002, this month’s report was the second strongest relative to expectations on record. The only one stronger was last June. Futures popped a bit on this news with the Nasdaq moving positive while the S&P 500 and Dow remain in the red.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, economic data out of China, the latest US and international COVID trends including our vaccination trackers, and much more.

Despite what have been some generally positive earnings reports, we’ve seen a number of disappointing reactions to earnings from the banks. Two examples are Bank of America (BAC) and Citigroup (C). Given their recent history, the fact that both stocks declined in reaction to earnings shouldn’t come as too much of a surprise. As shown in the tables below, C has now traded lower on the day of its earnings report for six straight quarters while BAC has dropped for seven straight. In the case of C, this is the longest streak of negative reactions to earnings since 2005 while for BAC, it’s the longest since at least 2001 and perhaps ever.

Daily Sector Snapshot — 7/14/21

S&P 500 Equalweight Lagging Badly

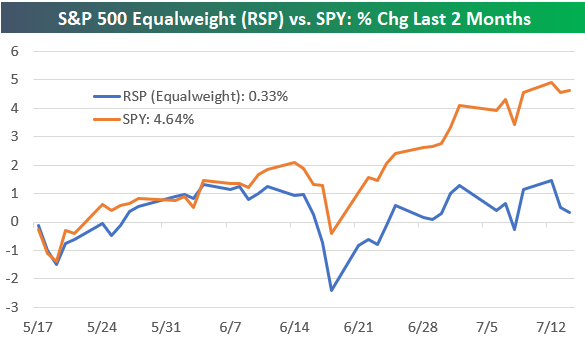

If you’ve been following the market over the last couple of months, you’ve likely noticed that the “mega-cap” stocks have been the main driver of the broad market’s move higher. You can really see this trend when looking at the performance disparity between the cap-weighted S&P 500 (SPY) and the equal-weight S&P 500 (RSP). (Just to be clear, the main S&P 500 index that’s tracked closely across the investment landscape is a cap-weighted index, meaning larger stocks have a bigger impact on its performance than smaller stocks. The lesser-followed equal-weight S&P 500 weights all 500 stocks in the index equally. In the equal-weight S&P 500, Apple (AAPL) — the largest stock in the index — and Unum Group (UNM) — the smallest stock in the index — have the exact same impact on the index’s performance.)

Yesterday was once again a bad day for most stocks as the equal-weight S&P 500 (RSP) fell more than 0.90% on the day. At the same time, the cap-weighted S&P 500 actually closed slightly higher on the day. As shown below, RSP has been stuck in a sideways pattern for the past two months, essentially going nowhere. SPY, on the other hand, has experienced a nice leg higher and is now very extended above its 50-day moving average. Over the last 12 trading days, SPY has closed at a new high 8 times while RSP has averaged a daily move of -0.02%. While the mega-cap growth stocks spent the time from late 2020 through early 2021 in consolidation, it’s not the smaller cap stocks in the index that look to have fallen asleep. Click here to view Bespoke’s premium membership options and sign up for a trial to any one of them.

While RSP has been trading sideways for the past couple of months, it’s actually still slightly ahead of SPY on a year-to-date basis.

As shown below, RSP’s YTD lead over SPY has been declining rapidly since peaking in May/June, however.

It’s the last two months that have caused RSP to give up nearly all of its 2021 outperformance versus SPY. As shown below, RSP is only up 0.33% over the last two months, while SPY is up 4.64%.

The recent underperformance we’ve seen from RSP is definitely outside the norm. Below we show the rolling 2-month performance spread between RSP and SPY since RSP began trading in 2003. There have only been two other periods where we’ve seen the 2-month performance spread turn more negative for the equal-weight S&P versus the cap-weighted S&P. The first was in late October/November 2008 when the entire market was falling rapidly during the Financial Crisis. The second was in late March 2020 during the COVID Crash. These two examples show that we normally see RSP significantly underperform SPY like this when the broad market is falling; not when it’s rallying to record highs on a seemingly daily basis. Click here to view Bespoke’s premium membership options and sign up for a trial to any one of them.

B.I.G. Tips – Years Like 2021: July Edition

Chart of the Day – Economic Indicator Diffusion Index Turns Negative

Bespoke’s Morning Lineup – 7/14/21 – More Inflation Data

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

“I continue to believe that the American people have a love-hate relationship with inflation. They hate inflation but love everything that causes it.” – William E. Simon

After yesterday’s doozy of a report on consumer price inflation, today the market is bracing for the latest read on prices in the producer sector. In addition to that, Treasury Secretary Jerome Powell will be addressing Congress later this morning.

Futures are higher heading into the report as Apple (AAPL) is leading the gains after it reportedly instructed suppliers to increase production by 20% this year. On the earnings front, the focus remains on financials where the market reaction to the reports has been mixed.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, the latest US and international COVID trends including our vaccination trackers, and much more.

After a brief decline immediately after the release of Tuesday’s June CPI, equity futures shook off the initial weakness and rallied solidly into the green. It wasn’t until the results of a 30-year bond auction at 1 PM that the equity market gave up the gains finishing in the red. The fact that equities and long-term treasuries were able to rally in the aftermath of the much stronger than expected CPI report and before the results of the auction was impressive, though. After all, at 5.4%, headline CPI rose at the fastest rate since July 2008 (5.6%) and before that 1991.

What’s also notable about the recent inflation pattern is that the y/y pace hasn’t declined in eight months now (longest streak since 2011), so the uptick in CPI has been persistent as the base effects from last year’s decline in CPI were in favor of larger increases. Looking back at 2020, the low point in CPI was May, and in June 2020 CPI rose by 0.5%, so while CPI was still well off its pre-COVID peak last June, this month’s report was the first y/y reading that wasn’t looking back at a period of declining CPI. To sum up, before this month’s report, all of the y/y readings were against relatively easy comps, but for June and going forward, the y/y readings will be looking back at periods where inflation was already back on the rise, so a continuation of these historically high readings against ‘tougher comps’ would likely quickly raise investor concerns.