S&P 5%+ Rallies and Declines

We’ve heard a lot lately about the steadiness of the S&P 500’s rally over the last year. And steady it has been. As shown below, it has now been 307 calendar days since the S&P 500’s last 5%+ pullback. Over this time period, the index has rallied 38.75%.

While 307 days without a 5%+ drop may seem like a long time, we actually just experienced a streak that was nearly twice as long from mid-2016 through early 2018. As shown below, that streak from 6/27/16 through 1/26/18 lasted 578 calendar days and saw the S&P gain 43.6%.

There have been three other streaks of 500+ days without a 5%+ decline in the S&P’s history. The longest streak lasted 593 days from December 1957 through August 1959. During that time period, the S&P rallied 54.16%. The other two 500+ day streaks ran from November 1963 to May 1965 (538 days) and December 1994 to May 1996 (533 days).

The current streak of 307 days without a 5%+ pullback ranks as the 13th longest on record. It has been a good run, but it’s certainly not unprecedented either. Click here to view Bespoke’s premium membership options.

Bitcoin Seasonality – Following a Different Path

September has historically been a weak time of year for the stock market, but with the growing popularity of crypto-currencies, we wondered what the seasonal trends have historically been for bitcoin. The chart below shows a composite of bitcoin’s median YTD performance over the last ten years for every day of the year. Generally speaking, bitcoin has started off the year slowly. Based on the last ten years, its median performance during the first quarter of the year has basically been flat but then starts to accelerate to the upside in Q2. Strength has generally continued in the first half of Q3, but then the period from mid-August through mid-October has been the weakest time of the year when bitcoin’s median YTD change falls from over 120% to below 85%. While Q4 has historically tended to start off slow, the year has typically finished on a high note with steady gains from late October through year-end.

In terms of consistency, the chart below shows the percentage of time from every calendar day of the year that bitcoin has experienced positive returns over the following month (four weeks). Historically speaking, from 2011 through 2020, bitcoin experienced positive one-month forward returns the most frequently right around tax day as it traded higher from 4/14 over the following four weeks in all ten years. As for the current period of the year (second red dot in the chart), in the four-week period following 9/8, bitcoin has had positive returns 60% of the time.

Whenever we discuss market seasonality, we always stress that historical patterns should only be used as a guide. Just because something happened one way in the past doesn’t mean it will follow the same pattern in the future. Along these lines, bitcoin’s performance in 2021 is a perfect example of not following the historical pattern. The chart below is the same as the one above, but it also includes bitcoin’s performance so far in 2021. Compared to the historical pattern, bitcoin’s performance in much of 2021 has been nearly the exact opposite. Rather than starting off the year flat, bitcoin came out of the gate strong in 2021 and more than doubled before the end of Q1. Beginning in mid-April, when bitcoin has historically seen the highest consistency of positive returns over the next month, its price peaked and quickly gave up most of its YTD gains. In mid-July, bitcoin’s price finally bottomed out and started to rally right up through Labor Day weekend when it briefly traded above 50K before falling over 10%. If there’s ever a time of year when bitcoin bulls don’t want bitcoin to follow the seasonal script, it’s the next few weeks. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 9/8/21 – Mixed Market

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“A government big enough to give you everything you want is a government big enough to take from you everything you have.” – Gerald Ford

Labor Day is supposed to mark the unofficial end to summer and the time when people return to work from Summer vacations, but the second trading day of the holiday-shortened week is looking like another quiet one. Futures are indicated lower following a weak session in Europe, but here in the US, the only economic report on the calendar today is the JOLTS report, which is expected to show slightly more than 10 million job openings. In earnings news, the only reports of note are Lululemon (LULU), RH, and Gamestop (GME).

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

After Tuesday’s mixed start to the week, the technical picture for the major US indices remains mixed.

In the small-cap space, the Russell 2000 remains stuck in its range. After bouncing for a fourth time right around the $210 level, IWM has taken a pause in the last few days as it tries to digest its late August gains. If you’re bullish on small caps going forward, you’ll really want to see IWM quickly break the string of lower highs.

The Nasdaq 100 (QQQ) was the star of the show yesterday as it managed to eke out gains on an otherwise weak day for equities. With the recent upside, QQQ has become a bit extended as it breaks above its uptrend. The setup for the S&P 500 looks similar to the Nasdaq 100, but unlike QQQ, SPY stalled out just as it bumped up against that trendline resistance.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

US Economic Data Turning Negative

With a federal holiday yesterday and nothing on the docket today, our Economic Monitors are unusually light the first half of this week. While there is nothing that would have an impact so far this week, the Citi Economic Surprise Index for the US is reaching the lowest levels since May of last year, shortly after the index hit record lows as economic data saw drastic impacts from the onset of COVID. These surprise indices represent how economic data is coming in relative to expectations. Lower/negative readings indicate economic data is coming in worse than expected and vice versa for higher readings.

Last year saw record lows in the index which were followed by record highs that far surpassed any level with historical precedence. Since the peak in July 2020, the Surprise index has not only moderated but turned negative. The US is now at the lowest level in over a year and in the eighth percentile of its historical range. While it has yet to find a bottom, this negative of a reading won’t last forever. The economists providing estimates will eventually catch up to the downside, and they usually overshoot, which will allow for the surprise index to bottom and start heading higher again. Click here to view Bespoke’s premium membership options.

Daily Sector Snapshot — 9/7/21

Chart of the Day – Japan Jumping to Record Overbought Levels

Bespoke Stock Scores — 9/7/21

Bespoke’s Morning Lineup – 9/7/21 – Back to Work

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Only those who will risk going too far can possibly find out how far one can go.” – T.S. Eliot

Welcome back. While the weather outside may suggest otherwise, the unofficial end to summer has come and gone, football season is ready to kick off, pumpkin-flavored coffee, beer, and bread is everywhere you look, and before you know it, the leaves will start turning. Equity markets are heading into the fall season with more green than red, but treasuries are lower and yields are higher heading into what will be a quiet day in terms of data to kick off the holiday-shortened week.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

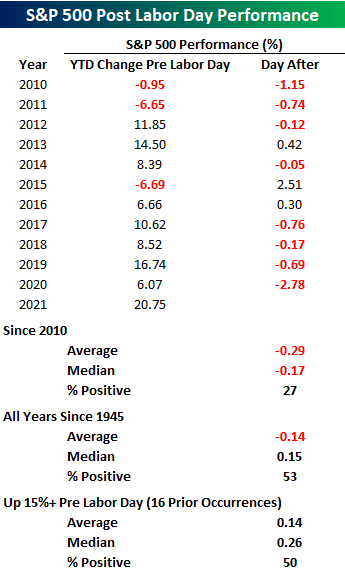

With the unofficial end to summer behind us, we wanted to provide a quick summary of how the S&P 500 has historically performed the day after Labor Day (we covered other post-Labor Day performances in today’s Morning Lineup). In the post-financial crisis period since 2010, there has clearly been a Labor Day hangover with the S&P 500 trading lower nearly three-quarters of the time for a median decline of 0.17%, including declines on this day in each of the last four years. From a longer-term vantage point since 1945, the day after Labor Day hasn’t been as negative with a median gain of 0.15% and positive returns 53% of the time. Lastly, with the S&P 500 up just over 20% already this year, we also looked at years where the S&P 500 was up at least 15% YTD heading into Labor Day weekend, and in these scenarios, returns were more positive. In the 16 prior years, the day after Labor Day had a median gain of 0.26% with positive returns half of the time.

Start a two-week trial to Bespoke Premium and read today’s full Morning Lineup.

Bespoke Brunch Reads: 9/3/21

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Technology

What the Metaverse is and why it matters to you by Andy Serwer with Max Zahn (Yahoo! Finance)

The hottest trend in Silicon Valley is an immersive series of platforms, experiences, and spaces that deepen the human experience beyond the physical world into untold layers of code. [Link]

The Silent Partner Cleaning Up Facebook for $500 Million a Year by Adam Satariano and Mike Isaac (NYT)

Accenture is widely known as a stodgy and quotidian consulting firm. It also sits at the center of a massive effort to make Facebook a tolerable place to spend time, at an equally massive human cost. [Link; paywall]

Leveraging Brands against Disinformation by Steph Hill (SSRC)

Social media and intensification of brands into value statements have created a two-way dialogue and placed non-political actors right into the middle of major efforts to shift society. [Link]

Afghanistan

Taliban Move to Ban Opium Production in Afghanistan by Sune Engel Rasmussen, Zamir Saar and James Marson (WSJ)

The lynchpin of the Afghan economy is being removed by its new rulers, which given the massive balance of payments crisis the company is going through may prove totally unsustainable. [Link; paywall]

Studies

J&J’s HIV Vaccine fails phase 2b, extending long wait for an effective jab by Nick Paul Taylor (Fierce Biotech)

Johnson & Johnson announced that its Stage 2 trial of an HIV vaccine did not demonstrate sufficient efficacy to continue trials in a setback for vaccines after a banner year. [Link]

The Impact of Mask Distribution and Promotion on Mask Uptake and COVID-19 in Bangladesh by Jason Abaluck et al (Innovations for Poverty Action)

A massive randomized control trial gives concrete and scientific evidence what had been strongly suggested by lower-level analysis: that masks, especially surgical masks, make a large difference in slowing transmission of COVID. [Link]

Regulation

McDonald’s McFlurry Machine Is Broken (Again). Now the FTC Is On It. By Heather Haddon (WSJ)

The Federal Trade Commission has reached out to McDonald’s franchisees in an inquiry related to the constant state of disrepair franchisees and the chain keep their machines in resulting in frequent breakdowns. [Link; paywall]

China Sets New Rules for Youth: No More Videogames During the School Week by Keith Zhai (WSJ)

After cracking down on for-profit education companies earlier this summer, Chinese authorities are now coming after students, setting rules for videogame time. [Link; paywall]

James Simons, Robert Mercer, Others at Renaissance to Pay Up to $7 Billion to Settle Tax Probe by Gregory Zuckerman and Richard Rubin (WSJ)

An inquiry into the treatment of investments as long-term capital gains as opposed to short-term capital gains (and therefore a massively reduced tax burden) has led to a massive $7bn settlement between investors in one of the . [Link; paywall]

Labor Markets

Need to Call and Airline? Your Hold Time Will Be Approximately One Zillion Hours by Allison Pohle and Krystal Hur (WSJ)

With massive demand and complex local regulations, airlines are struggling to accommodate high call volumes that are being further hindered by under-staffed call centers. [Link; paywall]

Amazon’s Answer to Delivery Driver Shortage: Recruit Pot Smokers by Spencer Soper (Yahoo! Finance)

With a complete lack of available labor for delivery trucks, Amazon is experimenting by featuring a lack of marijuana testing in its recruiting materials, part of an effort to reach into every crack of the workforce for potential candidates. [Link]

Ben Dugan Works for CVS. His Job Is Battling a $45 Billion Crime Spree by Rebecca Ballhaus and Shalini Ramachandran (WSJ)

Physical retail is facing a different kind of online competition: thieves are ripping off stores in order to sell goods online via platforms like Amazon or EBay. [Link; paywall]

Weird News

This company sold a copy of ‘Super Mario Bros.’ for $2 million. NFTs and a Triceratops skull could be next by Tom Huddleston Jr. (CNBC)

Video games are collectors items just like baseball cards: their rarity is the source of much of their value, and the values can get extraordinarily high when prestige buyers step up to the plate. [Link]

Coronal Ejections

A bad solar storm could cause an “Internet apocalypse” by Lily Hay Newman (ARS Technica)

A coronal mass ejection or solar storm could wreck havoc on electrical and electronic infrastructure that serves as the backbone of local and global commerce and industry, as well as badly damaging electrical grids. [Link]

Duration and extent of the great auroral storm of 1859 by James L. Green and Scott Boardsen (NCBI)

Just before the Civil War, a massive ejection of material from the sun drove an electromagnetic storm of epic proportions which knocked out massive swathes of telegraph infrastructure; a similar event today would have much further-reaching implications. [Link]

Indices

GameStop Stock’s Possible Return to S&P 500 in Hands of Anonymous Committee by Akane Otani (WSJ)

While the S&P 500 is widely used as a “passive” index, inclusion is largely dictated by human judgement rather than strict quantitative criteria that other indices tend to use. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – September Starting Soggy

This week’s Bespoke Report newsletter is now available for members.

There were a lot of convulsive headlines this week, ranging from Hurricane Ida to the Supreme Court to China to the Delta variant, but markets broadly yawned at events thrown their way. Even a massive miss from payrolls on Friday morning couldn’t derail the slow and steady grind that the US equity markets have trended on for the past several months. That steady grind is also impressive given the huge wave of hawkish Fed speakers in August and the very high likelihood of a taper starting before the end of the year.

In this week’s Bespoke Report, we cover a lot of different topics. Among them:

- Q3 performance drivers.

- The state of COVID in the United States.

- Very low real rates compared to prior economic recoveries.

- The hawkish August in Fedspeak and outlook for tapering.

- Easy financial conditions.

- The US auto industry.

- Policy and political developments in China.

- EM’s breakout.

- German elections.

- Earnings Triple Plays.

- And so much more!

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.