Daily Sector Snapshot — 10/29/21

Microsoft (MSFT) Back on Top of Apple (AAPL)

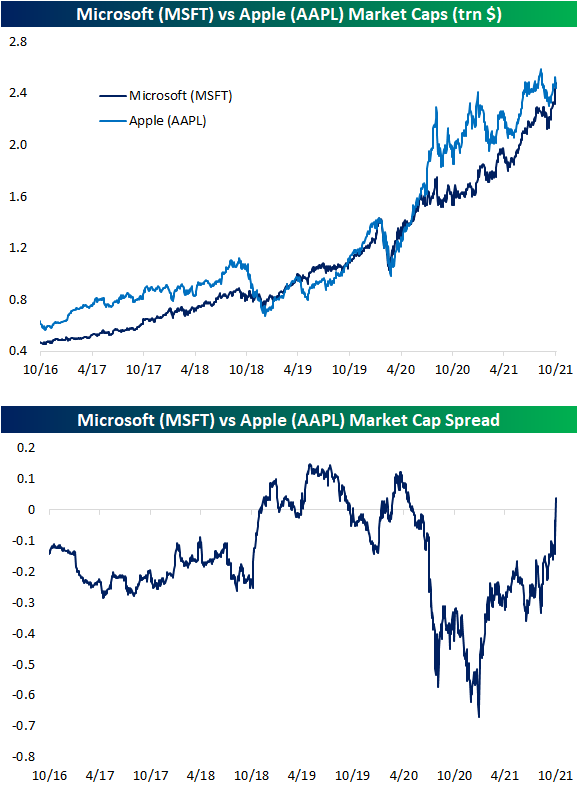

Only two days ago as the stock was seeing a strong reaction to earnings, we noted how Microsoft (MSFT) was gaining ground on Apple (AAPL) for the title of world’s largest stock by market cap. After reporting inline EPS and lower than expected revenues last night, AAPL is lower on earnings for the fifth quarter in a row. Meanwhile, MSFT has risen 6.5% since reporting top and bottom-line beats. In terms of market cap, MSFT has tacked on $149 billion over the past few days while AAPL has lost $82 billion today alone. Those inverse moves have lifted the market cap of Microsoft above that of Apple for the first time since June 2020. As shown in the second chart below, over the past few years MSFT and AAPL have battled back and forth for the largest stock spot. From last summer until recently, AAPL held significant ground on MSFT, but that is obviously no longer the case. Click here to view Bespoke’s premium membership options.

B.I.G. Tips – Guidance Normalization

Heard on Conference Calls

Below are some of the most interesting things we heard on quarterly conference calls from Corporate America this week:

Supply Chain

In terms of days of supply, Ford has historically averaged 75 but ended Q3 with about 20. CFO John Lawler commented, “we are not going back there.”

![]()

In terms of the chip shortage, Ford’s Lawler added, “we’re doing everything we can to get our hands on as many chips as we can. But we do see that running through 2022. It could extend into 2023, although we do anticipate the scope and severity of that to reduce as we move through ’22 into ’23.”

In terms of plane production rates, Boeing CEO David Calhoun added, “Raw materials, logistics, and labor availability will also be key watch items for future rate increases.”

According to 3M CEO Mike Roman, “ocean freight costs have more than doubled over the last year, and the number of containers on the water is up 70% because of port congestion.”

Apple CEO Tim Cook stated, “We estimate these constraints had around a $6 billion revenue dollar impact, driven primarily by industrywide silicon shortages and COVID-related manufacturing disruptions.”

Amazon CEO Andy Jassy revealed, “In the fourth quarter, we expect to incur several billion dollars of additional costs in our consumer business as we manage through labor supply shortages, increased wage costs, global supply chain issues, and increased freight and shipping costs.”

Labor

Automatic Data Processing CEO Carlos Rodriguez stated, “Our clients are eager to hire, and we are seeing workers return to the labor force, even if it’s gradual.”

According to McDonald’s CEO Chris Kempczinski, “Our US franchisees have never been better positioned to weather the labor and inflation pressures while still investing in growth.”

Microsoft CEO Satya Nedalla stated, “as more people change jobs than ever before, we saw record engagement as they increasingly turn to LinkedIn to connect, learn, grow and get hired.”

![]()

COVID related

In Q3, the airline industry saw “global departures increase slightly to an average of 67% of 2019 levels, up from 59% the previous quarter,” according to Calhoun.

Alphabet CFO Ruth Porat commented, “people increasingly are embracing a hybrid work model.” Porat added that the consumer shift to digital is “real and will continue.”

Alphabet CEO Sundar Pichai explained, “as consumers, businesses and schools continue their shift towards hybrid work… customers are turning to Google workspace and our cyber security platform.”

Broader Economy

Evercore CEO John Weinberg stated, “momentum in capital raising for financial sponsors continues and secondary market activity remains high.”

In terms of secular changes, Evercore management believes, “there is clearly a great deal of liquidity in the system that it’s not going to go away soon… we see real opportunity on corporate balance sheets as there is a lot of leverage available.”

According to Baker Hughes CEO Lorenzo Simonelli, “the oil field services market is in the early stages of a broad-based multi-year recovery.”

Johnson & Johnson CFO Joe Wolk stated, “Cost of products sold improved by 200 basis points, driven by recovery from prior year COVID-19 related impacts and favorable enterprise mix [in pharmaceuticals.]”

![]()

Wolk added, “in the United States, they are ramping up again and resuming elective procedures.” However, the CFO referenced, “the growing impact from reduced medical staffing on constraining procedure volumes” as a possible headwind.

United Rentals CEO Michael Flannery commented “virtually all key indicators point to a sustained recovery,” adding, “We’re also seeing work build across the entire easy supply chain. Plant maintenance is another big driver for us. We’re seeing that work start up again after being paused for COVID.”

![]()

In summary, although the broader economy has largely recovered from the COVID recession, we are still dealing with multiple repercussions, including the global chip and labor shortage. COVID and resulting policies have significantly altered the way in which people work and engage in commerce.

The quotes above are from our detailed Conference Calls publications. Throughout earnings season, we publish Conference Call summaries for select companies. These summaries include information regarding each company’s financial results, growth by segment, as well as some aspects of the business that management expects to impact future results. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our Conference Calls reports are available to Bespoke Institutional subscribers only. If you’re not currently a Bespoke Institutional subscriber, click here to sign-up for or upgrade to Bespoke Institutional now.

Conference Calls Reports So Far This Earnings Season:

Apple (AAPL)

Amazon (AMZN)

Merck (MRK)

United Rentals (URI)

Ford (F)

Automatic Data Processing (ADP)

Boeing (BA)

Evercore (EVR)

McDonald’s (MCD)

Alphabet (GOOGL)

Microsoft (MSFT)

Digital Realty (DLR)

3M (MMM)

Facebook (FB)

Olin (OLN)

Tesla (TSLA)

Equifax (EFX)

Baker Hughes (BKR)

Netflix (NFLX)

Intuitive Surgical (ISRG)

Johnson & Johnson (JNJ)

NextEra Energy (NEE)

B.I.G. Tips – Consumer Discretionary Booming Without Breadth

Bespoke’s Morning Lineup – 10/29/21 – Apple (AAPL) Falls From the Tree

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Nature is pleased with simplicity. And nature is no dummy” – Isaac Newton

Futures are indicating a negative end to the week and the month, but it probably could have been worse. With Apple (AAPL) and Amazon.com (AMZN) both down close to 4%, they are accounting for just about all of the weakness in equities at the open. Even with the losses, though, October is on pace to be the best month for the S&P 500 since last November and the best October since 2015.

In the latest dump of economic data, the only outliers relative to expectations were the Employment Cost Index (ECI) which came in higher than expected, and Personal Income which declined more than expected. The only remaining reports scheduled are Chicago PMI and Michigan Confidence shortly after the opening bell.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

It may seem like the law of gravity sometimes gets suspended, but it usually makes its presence felt at some point. In the case of Apple’s (AAPL), that was last night as the company traded down in reaction to weaker than expected earnings and lowered guidance citing the impact of supply chain issues. With the stock indicated to gap down close to 4% at the open, it is on pace for its worst earnings reaction day in exactly a year.

Heading into last night’s earnings report, AAPL still held the title of the company with the largest market capitalization in the world at $2.46 trillion, but its lead over Microsoft (MSFT) was slim at ‘just’ $20 billion. When the opening bell rings today, though, MSFT will move into the top spot by virtue of not falling as much as AAPL. Looking at the performance of each stock over the last year, there has been a growing divergence between the two stocks. Up until late February of this year, both were performing relatively in line with each other, but ever since March, MSFT has been widening the gap over AAPL. Based on where each stock is trading in the pre-market, MSFT’s gain of 59.69% over the last year is just over double the gain of AAPL.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke’s Weekly Sector Snapshot — 10/28/21

The Bespoke 50 Growth Stocks – 10/28/21

The “Bespoke 50” is a basket of some of our favorite growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There was one change this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Click here for a full history of the Bespoke 50. Prices listed in the full-history file are the prices of each ticker at the time of publication and not the next day’s opening price used for performance tracking.

Tenth District Manufacturing Flying

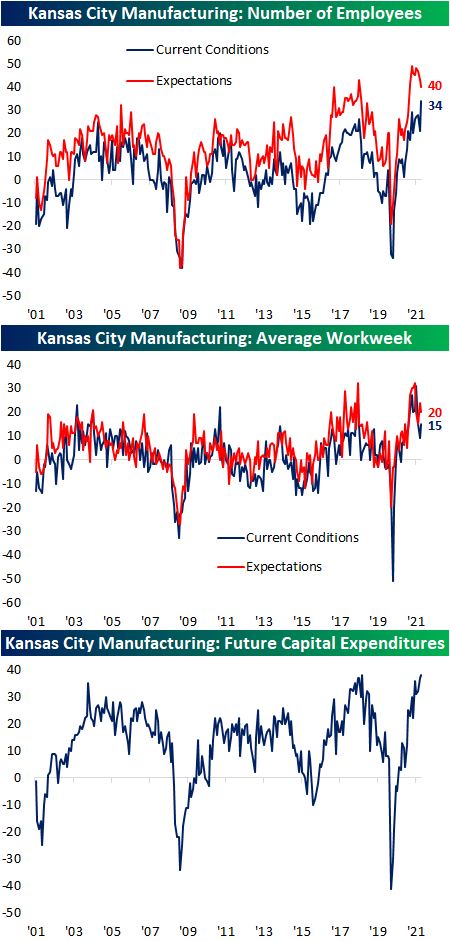

The fifth and final regional Fed manufacturing survey results came in this morning from the tenth district, and like the Richmond and Dallas Fed results, the region’s manufacturing activity saw a significant acceleration in October. The Kansas City Fed’s Composite Index tied the April record high at 31 after rising 9 points month over month. That was the largest one-month uptick since August 2020. While expectations were slightly lower, the past several months’ readings have been less volatile hovering around record highs.

Feeding into the very strong composite index were historically high readings across almost every other category. All but two indices came in the 90th percentile or better and there were three indices—Number of Employees, Prices Paid, and Supplier Delivery Times—that hit record highs. For some of those categories, this month’s upper decile readings also mark a significant improvement from the prior month. For example, Production, Shipments, and New Orders were coming from readings in the 40th percentile range. Additionally, breadth was very strong this month with only two indices falling month over month: Backlog of Orders and Material Inventories. Expectations on the other hand saw weaker breadth in terms of month over month moves and less elevated readings relative to their historical ranges.

As previously mentioned, the most improved area of the report was concerning demand. New Orders, Production, and Shipments all surged MoM with each one seeing double-digit gains. Whereas last month these three indices were somewhere in the 40th percentile range, this month there were in the upper decile of their historical range. Each of those indices experienced big declines last month, so the huge gains in October bring them back to levels last seen in July or August. While those are positives, expectations for Production and Shipments saw large declines ranking in the bottom 3.3% and 1.2% of month-over-month moves. Given current conditions for production and shipments moved significantly higher, firms were able to work off backlogs as that index fell 7 points to 23 which is the lowest reading since January.

That is not to say supply chains improved though. Delivery times surged yet again to set another record high for both current conditions and expectations. The MoM increase in expectations we would also note was the largest to date.

Additionally, Prices Paid continued to rise also hitting records for both current and future indices. While Prices Received were also higher, the indices for that category are off their peak from earlier this year.

The other record high reached this month was for Number of Employees. The index rose 13 points to 34, but potentially because positions are being met, expectations for hiring were weaker. That index continued to roll over falling to 40 in October. While lower, the current reading is still at historically strong levels. Although expectations for increasing hiring have been pulling back, Capital Expenditure expectations have continued to rise with that index tying the record high of 38 set back in September 2018. Click here to view Bespoke’s premium membership options.