Daily Sector Snapshot — 11/3/21

Love For The Taper

In today’s Chart of the Day, we provided a rundown of the S&P 500’s historical intraday pattern on Fed days. Now that the trading day has come and gone, we have added today’s price action into the mix as well.

Below is a look at the average path that the S&P 500 has taken on Fed days since 1994 when the Fed first began announcing its policy decisions on the same day as its meeting.

For the entire data set of Fed days since 1994 (dark blue line), the S&P has historically trended higher throughout the day with only a small dip in the immediate aftermath of the 2 PM ET announcement.

Since Powell became Fed chair in early 2018, the intraday action has been quite a bit different (red line). Especially early on in Powell’s tenure, the S&P had a pattern of posting solid intraday gains prior to the 2 PM announcement but then trading sharply lower during the Fed press conference into the 4 PM ET close.

The opposite pattern emerged today. Instead of trading higher heading into the 2 PM announcement, the S&P was in the red all day leading up to the Fed release. At 2 PM when the Fed statement came out (including the official announcement of tapering asset purchases), the S&P got an initial jolt and traded into positive territory. Then when Powell’s presser began, the S&P saw another intraday jump and then it continued to rally into the close. Had Powell known that the taper would cause this type of reaction, maybe he would have done it sooner! Click here to view Bespoke’s premium membership options.

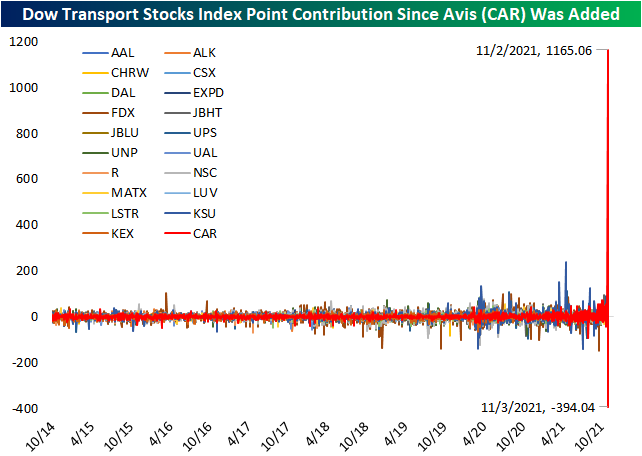

Avis (CAR) Takes The Wheel Of The Transports

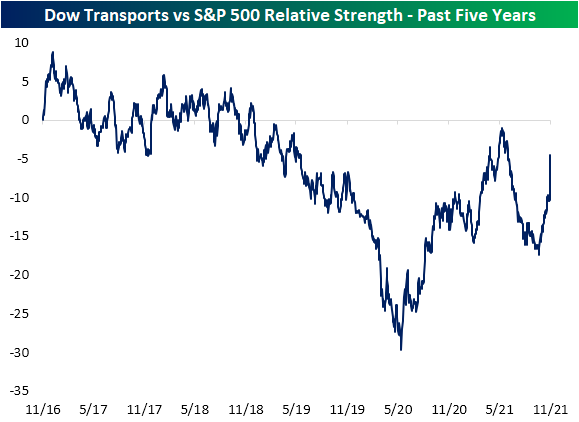

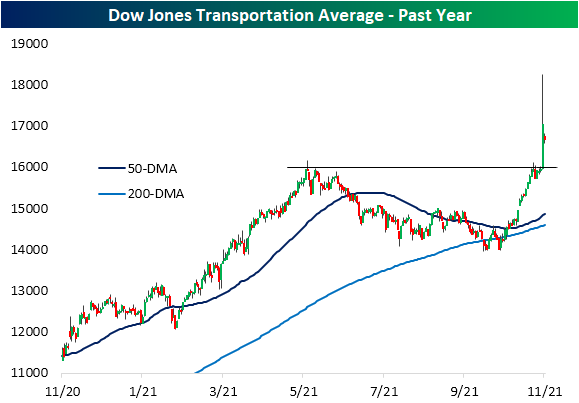

In an earlier post, we highlighted the relative performance of one of the key industries used to gauge broader economy/market health: the semis. As for another—perhaps more old school—cohort of stocks considered to be a leading group acting as a barometer for the broader economy, the Dow Transports have seen some interesting moves this week. In the chart below, we show the relative strength line of the Dow Transports versus the S&P 500 over the past five years. On a relative basis, the group has generally underperformed over the past few years, but more recently the relative strength line has been headed higher. Yesterday alone, though, it received a massive boost.

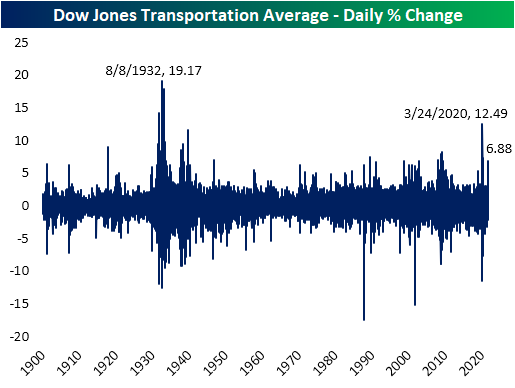

Heading into yesterday, the index was hovering right around resistance at the spring highs. It then surged 6.88% which not only smashed through that resistance but was the largest single-day gain since 5/18/20. The Dow Transports have a very long history going back to the late 1800s. As for just how impressive yesterday’s move was, since 1900 there have been less than 50 other days with as large of a single day gain. And at the intraday high, the Transports were up an even more impressive 14.5%.

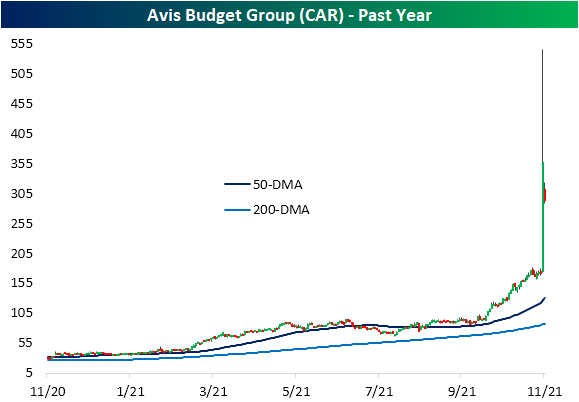

The index’s massive gains can be chalked up to a single name: Avis Budget (CAR). The car rental stock more than doubled yesterday on better than expected earnings, and potentially there were some short squeeze factors at play as the stock had 29% of shares sold short as of mid-October. As we noted last week when that data was released, that placed CAR as not only the most heavily shorted Transport stock but the most heavily shorted stock of the whole S&P 1500.

The Dow Transports is a price-weighted index, meaning that stocks with higher prices per share have larger impacts on the index. After doubling in a single day yesterday and even after falling well over 18% today, CAR is now the second highest-priced stock in the Dow Transports behind Kansas City Southern (KSU). Prior to earnings, CAR ranked as the eighth highest priced stock in the group. The massive move in the past few days has resulted in CAR contributing far more to the moves in the Dow Transports than what is normal. As for how large of an impact the past couple of sessions have had, below we show the daily point contribution of each member since October 2014 when CAR was added to the index—CAR is one of the most recent additions with the only newer members being United Airlines (UAL) in 2018 and American Airlines (AAL) in 2015. The extremely volatile moves of the stock paired with what is now a high price point relative to the rest of the index has resulted in the stock having major impacts on the day to day moves of the Dow Transportation index. Click here to view Bespoke’s premium membership options.

B.I.G. Tips – Charts We’re Watching

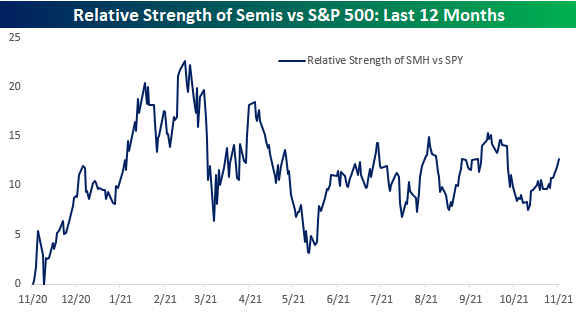

New High in Semis, But Not Relatively Speaking

Given their ubiquity in just about every aspect of our lives, the performance of semiconductor stocks provides a great barometer for the health of the economy. Therefore, yesterday’s new high in the VanEck Semiconductor ETF (SMH) was an encouraging sign for the broader economy.

While prices, on an absolute basis, are at new highs, semiconductors haven’t been nearly as strong relative to the performance of the broader market. The chart below shows the relative strength of SMH versus the S&P 500 ETF (SPY) over the last 12 months where a rising line indicates outperformance on the part of the semis and a falling line indicates underperformance. After closing out 2020 on a strong note and continuing that strength right up through the first two months of the year, semiconductors had a rough three months on a relative basis through May and have been moving pretty much in line with the S&P 500 ever since. One notable aspect of the sector’s relative strength has been that despite the new high in the broader market, the relative strength of semis is not only well off its high from earlier in the year, but still hasn’t even surpassed the recent peak levels from early August and early September. A move above those levels would be a positive development for the group.

The table below lists the holdings of SMH and shows each one’s performance YTD and over the last five trading days, as well as where they closed on Tuesday relative to their 50-day moving averages (DMA). On the right side of the table, we also show where each stock is currently trading relative to its trading range. Whether you look at the performance of individual stocks on a YTD basis or where they are trading relative to their trading ranges, there hasn’t been a strong degree of uniformity in the group. On a YTD basis, returns for stocks in the ETF range from a gain of 102% for NVIDIA (NVDA) to a decline of over 20% for Universal Display (OLED). Furthermore, just 12 of the 25 companies listed below have outperformed the S&P 500 YTD. On a more short-term basis, performance has been just as uneven with ten stocks up over 5%, 12 stocks up less than 5%, and three stocks that are down. Click here to view Bespoke’s premium membership options.

Chart of the Day: What to Expect on Fed Days

Bespoke’s Consumer Pulse Report – November 2021

Bespoke’s Morning Lineup – 11/3/21 – It’s Taper Time!

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s amazing what you can accomplish if you do not care who gets the credit.” – Harry S. Truman

It’s Taper Time. At least that’s what most investors are expecting to hear this afternoon when the FOMC releases its policy statement and chair Powell holds his press conference. The only questions now seem to be when it will start and how long it will take to completely wind down. A delay in the start to December would be considered dovish at the margin while any plan to wind asset purchases down in less than six months would be taken as a hawkish stance. In addition to asset purchases, investors will be looking for signs of when Powell and the FOMC is thinking the first rate hike will take place (the current assumption is for the end of 2022).

Outside of the FOMC, the October ADP Private Payrolls report came in better than expected, and ISM Services will be released at 10 AM. Besides the economic and earnings flow. throughout the day, market watchers will be trying to assess what impacts last night’s election results will have on policy coming out of Washington.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

With a number of major averages hitting record highs yesterday, one area of financial markets that has been taking a breather over the last week is commodities. Of the commodity-related ETFs in our Trend Analyzer, every single one of them with the exception of the DB Agriculture Fund (DBA) has traded down over the prior week ending Tuesday. The weakest of these commodity-related ETFs is the US Natural Gas Fund (UNG) which has declined more than 7% while another six are down more than 1%. Despite the recent weakness, though, it’s important to keep in mind just how well many of these ETFs have performed in 2021. UNG is still up more than 100% YTD while other energy-related ETFs are up more than 70%.

The laggards this year have been precious metals. Silver (SLV) is down by double-digit percentages YTD, the Precious Metals ETF is down over 8% and gold-related ETFs are all down between 6% and 8%.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.