Bespoke’s Morning Lineup – 2/17/22 – Snap Out of It!

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you have more than 120 or 130 IQ points, you can afford to give the rest away. You don’t need extraordinary intelligence to succeed as an investor.” – Warren Buffett

Futures are in the red again this morning but just modestly, and while they’re off their lows of the overnight session, they’ve just recently started heading lower again. Russia continues to take up a lot of the headlines, but unfortunately, there’s little in the way of resolution on the horizon. Just released headlines quoting US officials suggest that Russia is moving towards an imminent invasion, and US Secretary of State Anthony Blinken will head to the UN today to address the Security Council. No one besides Putin really knows when and how the situation will resolve itself.

Earnings season came to an ‘unoffical’ close today with Walmart’s (WMT) better than expected report, and given the multiple tape bombs that were dropped throughout the reporting period, investors will be happy to see this earnings season wind down. It was a busy morning for economic data as well, and while most of this week’s data has been better than expected, this morning’s results were mixed. To hear out instant take on all of the reports listen to it here.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

We’ll discuss it in more detail later today, but after seeing the latest investor sentiment readings from the American Association of Individual Investors (AAII), we couldn’t not mention them. As of the latest survey, bullish sentiment dropped from an already low reading below 25% to less than 20% this week. As shown in the chart below, the only other times that bullish sentiment was as low as it is now were in January and May 2016. Just about every survey of sentiment these days, whether it covers the economy or financial markets, shows elevated levels of pessimism. We realize there’s no shortage of concerns out there and you can take your pick as to which one is the biggest problem, but one has to ask whether these levels of pessimism are starting to get a bit extreme.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 2/16/22

Bespoke Baskets Update — February 2022

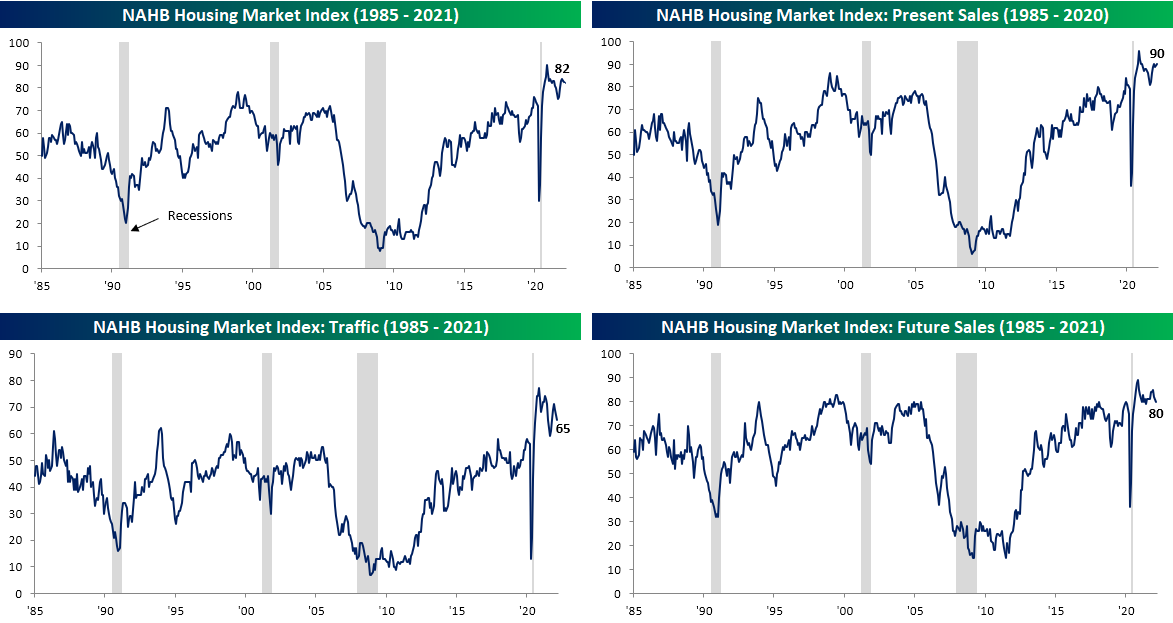

Homebuilder Sentiment and Stocks Rangebound

It was a busy morning of economic data, and included on the list was homebuilder sentiment from the NAHB monthly survey. After surging in the first year of the pandemic, the past year has seen homebuilder sentiment moderate until last summer when it made a short-term low at 75 (still a historically elevated reading), and for most of the time since then sentiment has rebounded. The first two months of 2022 have seen further moderation though with the February reading of 82 marking the second month in a row with a one-point decline. While sentiment is no longer improving, though, it remains well above any pre-pandemic reading.

Taking a closer look at the components of the survey, traffic and future sales have been the more pessimistic readings having continually ground lower in the past year. Present sales, however, have held up relatively well. This month even saw that index rise to 90 which tied the December reading for the strongest level since last Febraury.

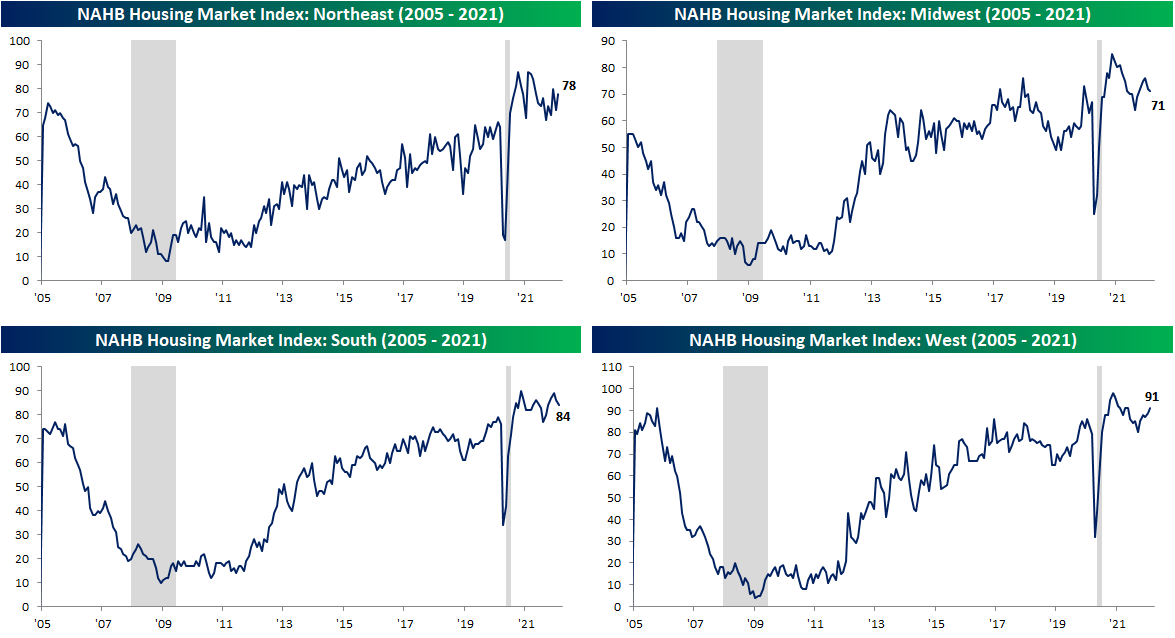

As for a geographic breakdown, pretty much each region has fallen back into the middle of the range of post-pandemic readings. In February, the Northeast saw the most substantial improvement rising 7 points to 78. That is an upper decile reading in terms of both its level and month-over-month change. The West was the only other region to improve in February, and that is in the context of what has now been several months of consistent improvements.

Like sentiment, homebuilder stocks have come off their highs. The iShares Home Construction ETF (ITB) made a double top in December, which was followed by a break below its 50-DMA and 200-DMA in the new year. For the past few weeks, ITB has been consolidating between overhead resistance at the 200-DMA and support at the lows from this past July and October. If those lows don’t hold, though, there isn’t much more support further below. Click here to view Bespoke’s premium membership options.

Chart of the Day – Economic Indicator Diffusion Index On the Rebound

Bespoke’s Morning Lineup – 2/16/22 – Retail Sales Lead a Busy Day

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Swim upstream. Go the other way. Ignore the conventional wisdom.” – Sam Walton

Retail Sales were just released and came in much stronger than expected at the headline level (3.8% vs 2.0%). Backing out Autos and Gas, the numbers were even stronger relative to expectations. Last month’s report was revised lower than originally reported but not by enough to offset this month’s strength. Other data released this morning includes Import and Export Prices, and both of those were also stronger than expected. Still on the calendar today, we have Industrial Production (9:15), Capacity Utilization (9:15), Business Inventories (10:00), and Homebuilder Sentiment (10:00). Then at 2 PM we’ll see a release of the Minutes from the January meeting.

Futures have seen a bit of a bounce in reaction to news but are still indicated to open modestly in the red.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday was just the third time in 2022 that the S&P 500 tracking ETF (SPY) traded in positive territory from the opening to the closing bell, and over the last 50 trading days, there have been just eight times where the S&P 500 traded higher all day. As recently as 2/1, though, the trailing number of times over the last 50 trading days that the SPY traded higher all day was at just six which was the lowest reading since March 2018. What’s even more notable is that back in early December, just as Powell was retiring the term transitory, the 50-day reading of the number of trading days that SPY traded in positive territory for the entire trading day reached a record high of 20. In other words, there’s been quite a reversal in the last three months where the market has frequently opened higher and stayed there to more a of choppy environment where the market has jumped between gains and losses throughout the trading day.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 2/15/22

Bespoke Stock Scores — 2/15/22

Empire Fed Back In Expansion

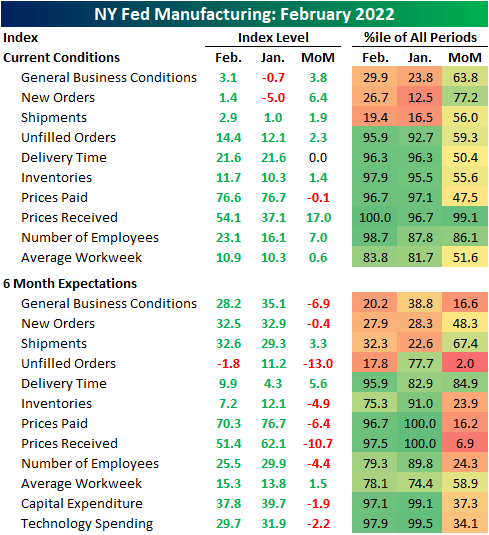

The New York Fed released the February results of the Empire Fed Manufacturing survey this morning. Last month saw the index fall into negative territory for the first time since June 2020. This month, the headline number is back into expansionary territory rising to 3.1.

As the region’s activity is once again expanding, most areas of the report showed improvement. New Orders are once again growing alongside shipments, although each of those indices are at the lower end of their historical ranges. Other areas are much more elevated with Prices Received even setting a new record high. Six-month expectations saw weaker breadth in February and are generally at lower levels with respect to their ranges.

Similar to the headline number, New Orders went from a negative reading to a positive one in the past month after rising 6.4 points. Unfilled Orders picked up in tune with a 2.3 point increase to 14.4 which was the highest reading since October. Expectations, however, experienced a dramatic 13-point decline ranking in the bottom 2% of all monthly moves. That marked the largest one-month drop for the index since June 2016.

The index of Delivery Times went unchanged at 21.6. Without any change, the index remains historically elevated but significantly improved versus the record highs in the fall. In other words, supply chains continue to show historic strain, but it appears to have alleviated to a degree.

Although the decline was small at just 0.1 points, Prices Paid fell for the third month in a row. In spite of having peaked, the index remains very high. Contrary to the move in Prices Paid, Prices Received surged from 37.1 in January to 54.1 this month. That wasn’t only a record high for the index, but it also marked the largest one-month gain in a decade.

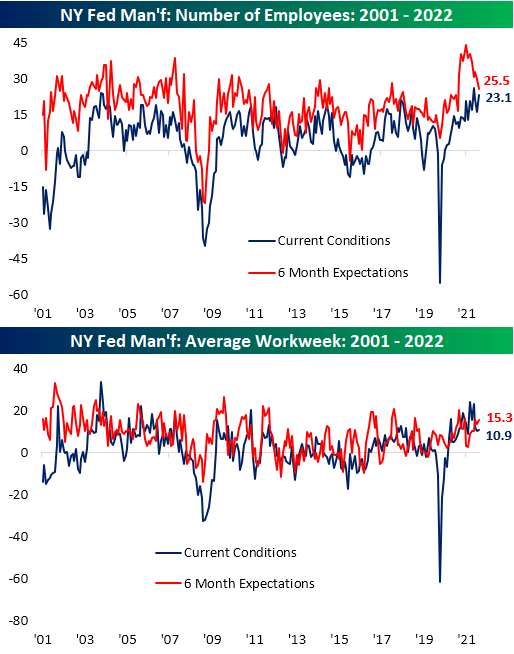

The employment situation also improved with the index for Number of Employees edging higher indicating the region’s firms took on more workers at an accelerated rate. Average Workweek meanwhile saw a small move only rising 0.6 points. Click here to learn about Bespoke’s stock market research services.