Bespoke’s Morning Lineup – 3/2/22 – “Crisis Mode”

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The lesson of history is that you do not get a sustained economic recovery as long as the financial system is in crisis.” – Ben Bernanke

Futures are looking to bounce back from yesterday’s weakness, but it’s still early and there are a lot of events on the horizon for today. St. Louis Fed President James Bullard will be speaking right at the open and then a half-hour later, Fed Chair Powell will be testifying in front of a House Panel. Then at 2 PM, we’ll get the release of the Fed’s Beige Book. The only economic indicator of note today was the ADP Private Payrolls report which came in higher than expected. More noteworthy, though, was the 800K positive revision to last month’s report.

News on the Russia-Ukraine front has been relatively quiet. Nothing much new to speak of, but the Russian shelling of Ukrainian targets has continued.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday, we highlighted the fact that the Nasdaq 100 has traded in an intraday range of over 1% every day this year. Yesterday, another shorter but pretty incredible streak also came to an end as it was the first time since 2/18 that QQQ was not up and down at least 0.5% in the same trading session. Swings from intraday gains of at least 0.5% to intraday losses of 0.5% (or in the opposite order) on an intraday basis indicate a volatile session, and five trading days in a row indicates extreme volatility and uncertainty.

The chart below shows historical streaks where QQQ saw intraday gains and losses of 0.5% in the same trading session. At five trading days, the streak that just ended is tied for the longest since February 2008 (six trading days), but it was well off the record of 18 trading days back in October 2000 – a period where there were multiple streaks with 0.5% intraday swings between gains and losses.

Looking at all the dates shown, though, the thing that stands out is that these types of streaks aren’t common, and they have only been seen during periods where the market was in a period of varying degrees of crisis.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 3/1/22

Bespoke Market Calendar — March 2022

Please click the image below to view our March 2022 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Start a two-week free trial to one of Bespoke’s three research levels.

Bespoke Stock Scores — 3/1/22

Chart of the Day: Decile Analysis

Bespoke’s Morning Lineup – 3/1/22 – Volatility: It’s All Relative

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“One doesn’t recognize the really important moments in one’s life until it’s too late.” – Agatha Christie

It was a pretty quiet night in markets, but things have taken a turn for the worse since Europe opened for trading. What was looking like a flat open for the markets about four hours ago is now looking more like a decline of close to 1%. In yesterday’s post, we noted that despite the big moves following the weekend’s events neither crude oil nor gold managed to take out their prior highs from last week. Well, this morning both are rallying again, and while gold has yet to take out its recent intraday high, WTI is trading above $100 per barrel and at new multi-year highs. Bottom line is that no one knows where this is all going, so it’s probably best to avoid making a big stand in one way or the other but use extreme market moves (in either direction) to your advantage.

In economic news today, investors will be watching Markit Manufacturing at 9:45 and then Construction Spending and the ISM Manufacturing report at 10 AM.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

Yesterday was the 39th trading day of the year, and it was also the 39th straight day where the intraday range of the Nasdaq 100 ETF (QQQ) was more than 1%. Seems like a lot, right? Looking back over the last ten years, 39 straight trading days of 1% ranges on an intraday basis ranks as one of the longer streaks we have seen. The longest streak during this period was 46 trading days coinciding with the COVID crash, and besides that, the only one that was longer was the 41 trading days ending 1/10/19.

While the current streak ranks as one of the longest of the last ten years, it is nowhere near the longest on record. In the chart below, we show streaks of 1% intraday ranges in QQQ going back to its inception in early 1999. Notice anything in the chart? From early 1999 through October 2003 – a period encompassing more than four and a half years – QQQ traded in an intraday range of more than 1% every single day! How’s that for volatile? The current streak of 39 trading days also pales in comparison to streaks of more than 100 trading days that QQQ experienced during the financial crisis, but in the chart, those streaks barely even register to the 1999 to 2003 period. As volatile and hectic as the last eight weeks have been for markets, it’s still nothing compared to the ‘old days’.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The State of the Union

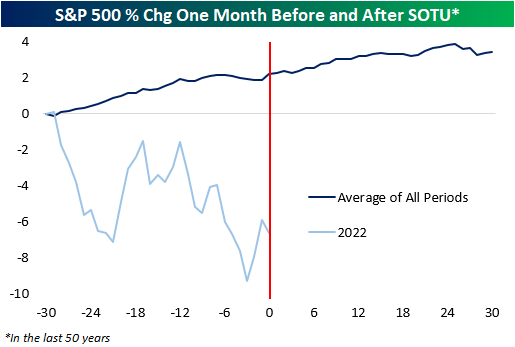

Tonight, President Biden will present to Congress and the nation his first official State of the Union address (SOTU). In terms of timing, this will be the latest into a new year that a SOTU has been held in at least 50 years. Therefore, when looking at market performance leading up to and after the address, we’ll be dealing with different than normal seasonal factors for this SOTU. Still, the S&P 500’s performance in the month leading up to the current SOTU address ranks as the fourth worst since 1945, outperforming only 2016, 2008, and 1982. Whereas the average performance in the month prior to the SOTU is a gain of 2.2%, this year, the S&P 500 is down by about 6.6% in the month leading up to Biden’s first SOTU address (chart below).

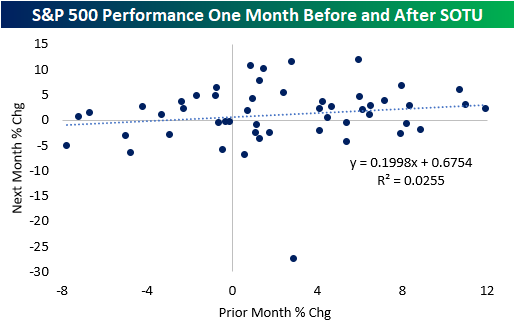

In the last 50 years, there have only been four other years where the S&P 500 traded down 5%+ in the month leading up to a SOTU address. In those four other years, the S&P 500’s performance in the month after the SOTU was a loss of 1.5%, but the median was a gain of 0.7%, indicating that results varied widely. For perspective, the average one-month return for all periods in the last 50 years is a gain of 1.1% (median: 1.8%). Regarding treasuries, in the four years where the S&P 500 was down 5%+ leading up to the SOTU, the 10-year yield’s performance was all over the map both before and after the address.

Below is a table that summarizes the performance of the S&P 500 and the 10-year yield in the month before and after the SOTU address. For the S&P 500, performance in the week after the SOTU has generally been positive, but one major exception was 2020 when the S&P 500 declined more than 27% as COVID crashed the markets and economy. Regarding the 10-year, it’s performance is relatively trendless, although its yield tends to rise modestly the day after the address as investors ponder how all the ‘goodies’ that the President mentions in the speech will be paid for.

Although the past month’s performance has been weak relative to the other periods, there is little correlation between performance the month before and after the SOTU address. Although there is a slight positive relationship, only 3% of the variance in the y-variable is explained by movements in the x-variable. Essentially, this is not a tradeable event.

Ukraine and the pandemic will likely be the main focusses of tonight’s address, and investors will eye the President’s comments about each situation for a read on the President’s view on each situation. Positive comments about these situations may not necessarily be positive for the market, as easing in these areas would imply an increased probability of more aggressive Fed rate hikes. In any event, though, investors should not be making trading decisions based on previous market movements leading up to and after the SOTU, as every year bears unique political circumstances. Click here to view Bespoke’s premium membership options.

Daily Sector Snapshot — 2/28/22

Bespoke’s Matrix of Economic Indicators – 2/28/22

Our Matrix of Economic Indicators provides a concise summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Wage Expectations Surge in Dallas

The receding of COVID case counts and higher oil prices had a beneficial impact on manufacturers in the eleventh district in February. The Dallas Fed’s Manufacturing Outlook Survey was forecast to see Business Activity rise only slightly from 2 in January to 2.8 after three straight months of declines. Instead, the index surged 12 points to 14 which is the biggest one-month gain since June 2020 and the highest reading since October.

As we have seen with other regional Fed manufacturing surveys this month, breadth across components has been somewhat mixed in spite of the move in the headline index. While there are a handful of categories in the upper end of their historical ranges, others like Company Outlook and Inventories have been more middling. Additionally, six categories decelerated month over month.

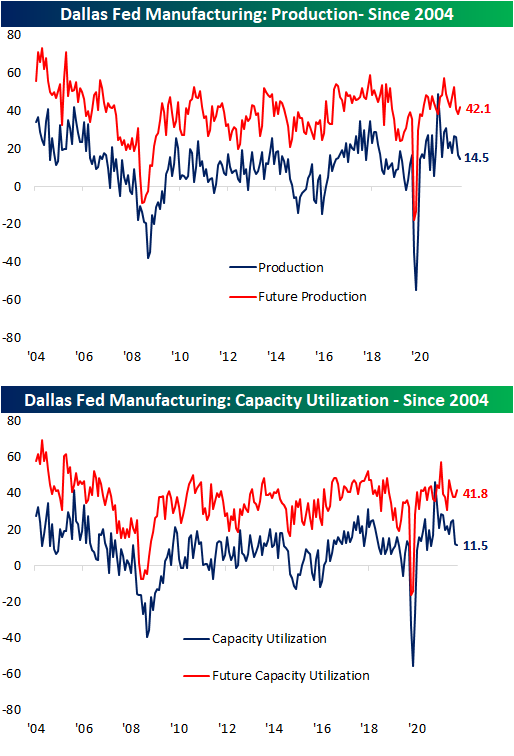

One area that experienced a decline was in regards to output. Production and Capacity Utilization both fell in February. For the former, that was the third decline in a row leaving it at the lowest level since January of last year. Capacity Utilization is also at the lowest level in a year and a month, but this month’s decline was far smaller than the prior month’s 9.4 point drop.

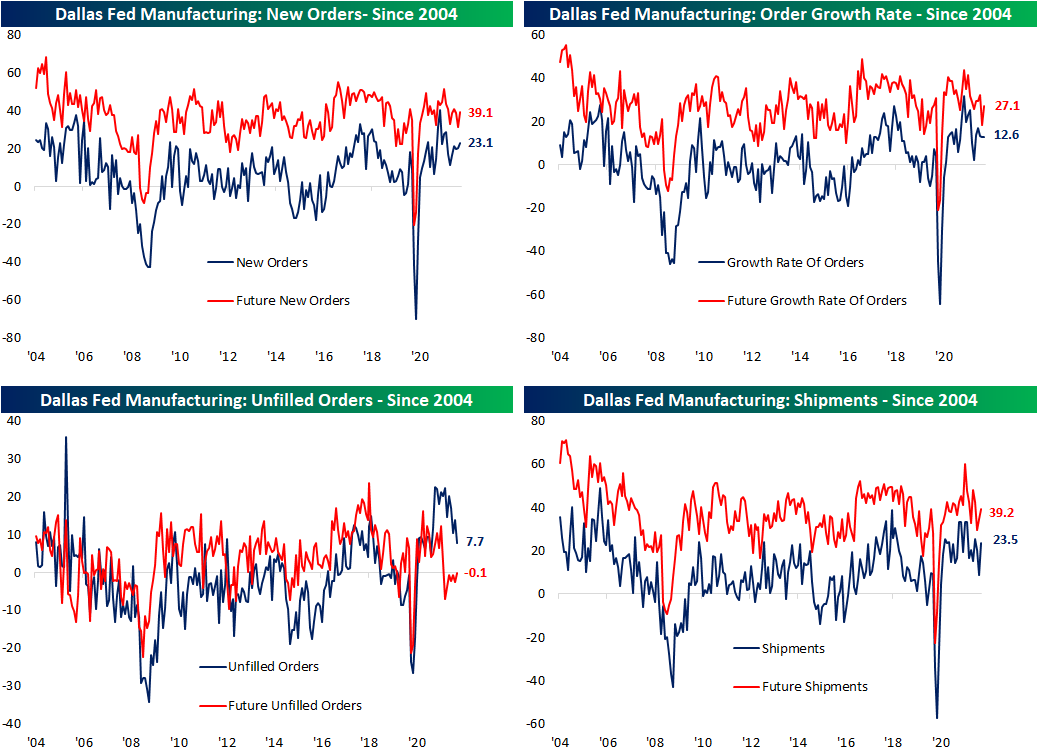

While production has pulled back, Order Growth Rate held firm as New Orders hit the highest level since July. Meanwhile, order backlogs continue to fall from historic levels with this month marking the lowest reading since last January as shipments recovered some of the declines from the past few months.

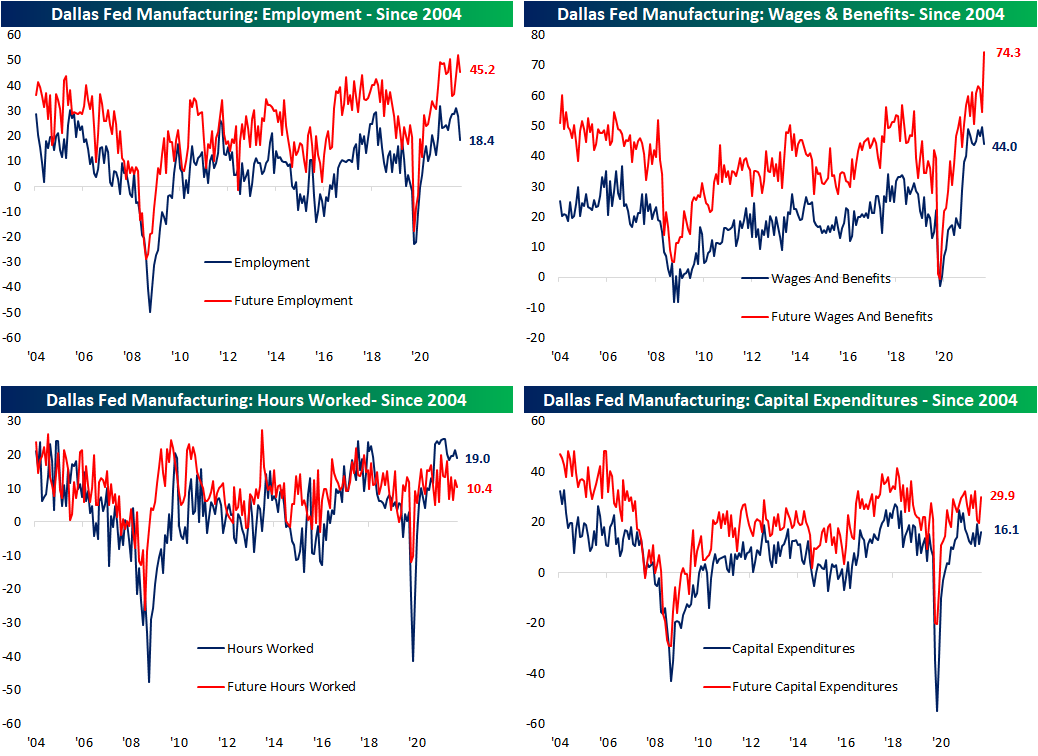

Employment was perhaps the most interesting area of the report. While the region’s firms continue to report net hiring, the Employment index plummeted 9.3 points for the largest single-month decline since March 2020. That deceleration in new employees happened alongside a deceleration in Hours Worked and Wages & Benefits as well. While current conditions for the Wages and Benefits index was lower, expectations have been blown out of the water. That index not only set a new record high, but it did so on the largest one-month gain to date. In other words, hiring slowed slightly in February, but there are widespread plans to increase wages in the future. While it is hard to pinpoint the exact reason for that increase, one potential explanation can be firms trying to raise wages to entice new workers. Click here to view Bespoke’s premium membership options.