Sentiment Staying Low

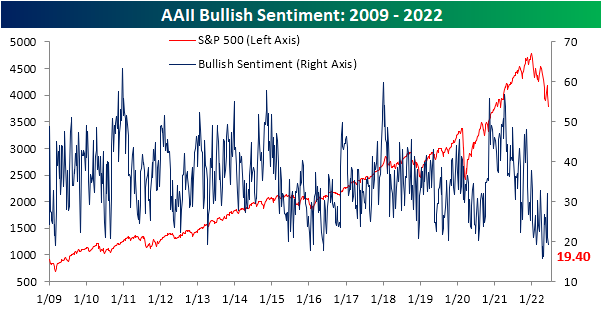

More hawkish monetary policy and the S&P 500 hitting the bear market threshold have given sentiment plenty of reason to turn lower, and that’s exactly what has happened. After reaching a short-term high of 32% only two weeks ago, the percentage of respondents to the AAII survey considering themselves bullish has fallen back below 20% this week. That may not be as extreme of reading as those in the mid-teens from back in April, but, it is still a historically low reading and in the bottom 2% of all weeks going back to the start of the survey in 1987.

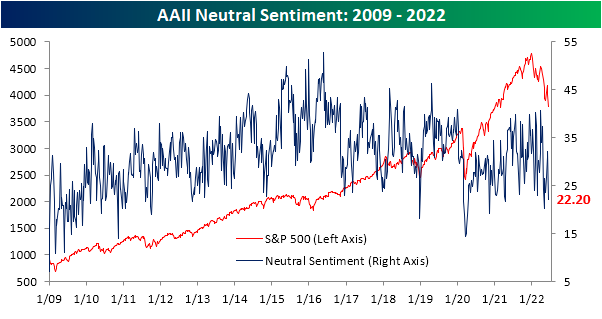

While bullish sentiment has declined, this week’s 1.6 percentage point decline was actually much smaller than the 11 percentage point drop last week. An even bigger decline occurred for those reporting neutral sentiment. That reading fell 9.9 percentage points from a recent high of 32.1%. Now at 22.2%, the percentage of neutral respondents is back down to the lowest level since the start of May.

With both bullish and neutral sentiment falling, the bearish camp picked up the difference. Heading into this week, bearish sentiment was already elevated at 46.9%. The 11.4 percentage point bump this week means that well over half of respondents are now bearish with the current reading just 1.1 percentage points shy of the 59.4% high from the end of April. That ranks as the eleventh highest reading of all weeks on record.

That also means the percentage of bears outweighs bulls by an astounding 38.9 percentage points and is the lowest reading since the last week of April.

Not only do bears outweigh bulls by a large margin, but it has also been a historically long length of time that this has been the case. Smoothing out the reading by taking a four-week moving average of the bull-bear spread, the average has been below -10 (in other words on average over a four-week span bearish sentiment has been at least 10 percentage points higher than bullish sentiment) for 21 straight weeks. That surpassed another long 18-week streak in 2020 and is now only five weeks short of the record stretch of 26 weeks in the early 1990s.

Not only has the AAII survey showed souring sentiment, but so too have the weekly NAAIM Exposure Index and the Investors Intelligence surveys. This week, the NAAIM index showed investment managers only have 32.2% long equity exposure. Meanwhile, the Investors Intelligence survey saw the most negative bull-bear spread in a month. Normalizing each of these three sentiment indicators, the average reading is now 1.28 standard deviations from the historical norm. That is not as bad as last month, but it remains a historically pessimistic reading on sentiment. Click here to learn more about Bespoke’s premium stock market research service.

B.I.G. Tips – Recession: In 2023 or Now?

Jobless Claims Moderate

Jobless claims have been trending higher off of multi-decade lows, indicating a moderating labor market. This week, initial claims would have gone unchanged week over week at 229K if it were not for a modest upward revision to 232K to last week’s number. In other words, claims were little changed this week as they continue to gradually head higher. At these levels, claims remain at the high end of the range from the few years prior to the pandemic.

On a non-seasonally adjusted basis, claims have begun to experience the typical upward swing for this point of the year and that is likely to continue over the next month and change. NSA claims topped 200K this week for the first time since the last week of April which is right in line with the readings from the comparable weeks of the year of 2018 and 2019.

Continuing claims are lagged an additional week to initial claims but this reading has also been making its way off the lows. Granted, the move off the lows for continuing claims has been much more modest than initial claims (only 6K for continuing claims versus 66K for initial). Seasonally adjusted continuing claims rose for the second week in a row this week to 1.312 million which is only the highest level in a month. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day: Second-Worst Period For 60/40 On Record

Weak May Housing Data

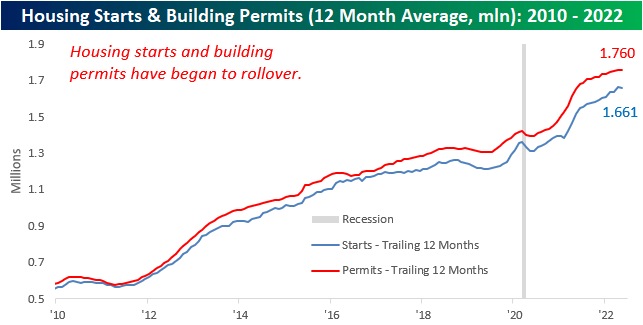

Earlier this week, we highlighted the fact that mortgage activity had fallen off a cliff due to a historic rise in rates. This is an important factor to keep in mind as the housing market tends to be a strong leading indicator for recessions, as every recession besides the COVID crash since the early 1960s has been preceded by a pronounced decline in Housing Starts. Although the NAHB index has already rolled over substantially, Housing Starts and Building Permits are yet to drop on a trailing twelve-month basis. However, the data has been showing signs of weakness, as we have now seen two consecutive months of declines in permits and a significant month-over-month fall in starts.

The table below breaks down this month’s report by type of unit and region and shows both the month-over-month and year-over-year changes. Contrary to what we saw last month, Housing Starts moved higher in the Northeast and Midwest on a m/m basis, while the South and West saw dramatic declines. On a y/y basis, only the Northeast (smallest of the four regions) saw starts move higher. In aggregate, Housing Starts fell by 14.4% month over month and 3.5% year over year. Although multi-units fell more than single units, the decline was substantial for both. In terms of permits, there was no positivity in sight, as every region saw m/m declines. This is not a positive sign for future starts data, as permits must be issued before starts can occur. In aggregate, Building Permits fell by 7.0% month over month, driven by a massive decline in the Northeast.

For the first time since February of 2021, the 12-month average of Housing Starts declined on a m/m basis. A rollover in this figure tends to be a strong recession indicator, which based on prior history would suggest that the economy is not yet in a recession. If this data continues to weaken, though. recession alarms will start ringing.

The charts below show the rolling 12-month average for Housing Starts and Building Permits since 2010 on both an overall basis (top chart) and for single-family units specifically (bottom chart). Overall, the 12-month average for headline starts and permits has experienced headwinds as of late with the rate of increase for both slowing down and starts actually showing a slight decline. The trend for single-family units, however, is much more divergent as permits have already started to roll over after peaking last summer while single-family starts have essentially leveled off during that same span. . Click here to become a Bespoke premium member today!

Bespoke’s Morning Lineup – 6/16/22 – All I Do Is Lose

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Everything is bearable.“ – Wendy Byrde, Ozark

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

We’re not quite sure Wendy Byrde would have had 2022’s financial market meltdown in mind when she uttered the three words above. The bad year has gotten even worse this morning as futures are already indicated to erase all of yesterday’s rally. Making matters worse, economic data this morning was very weak as Housing Starts, Building Permits, Philly Fed, Initial Jobless Claims, and Continuing Jobless Claims all came in weaker than economic forecasts. Housing Starts, for their part, were down over 14.4% m/m. This comes a day after the Fed lowered economic growth forecasts and raised its forecast for the unemployment rate in yesterday’s report of economic projections. Given all the weakness, it seems unbelievable that it has all come with the largest rate hike in nearly 30 years and promises of more to come in upcoming meetings. No one said coming out of COVID and all the stimulus programs would be easy, but they didn’t have 2022 in mind either.

In today’s Morning Lineup, there’s a lot covered as we discuss the latest moves of central banks, Asian and European markets, and overnight economic data.

We’ve been calling it the one step forward and two steps backward market for some time now, and yesterday and today provides another illustration of that pattern. After rallying over 1% following yesterday’s Fed meeting, the S&P 500 is indicated to open down about 2.0% this morning, more than erasing all of Wednesday’s gains. Keep in mind too, that even after Wednesday’s rally, the trailing five-day performance of the S&P 500 was a decline of just under 8%.

Assuming that today finishes in the red, the S&P 500 will have only traded up on 43.5% of all trading days this year. While that may not sound all that extreme, in the post-WWII period, there have only been seven other years where the percentage of up days in the first half of the year was lower, and the only two where the percentage was lower than 40% in the first half of the year were 1962 and 1970.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 6/15/22

Chart of the Day – Ten in Five

Bespoke Baskets Update — June 2022

Housing Data and Housing Stocks Erase Pandemic Gains

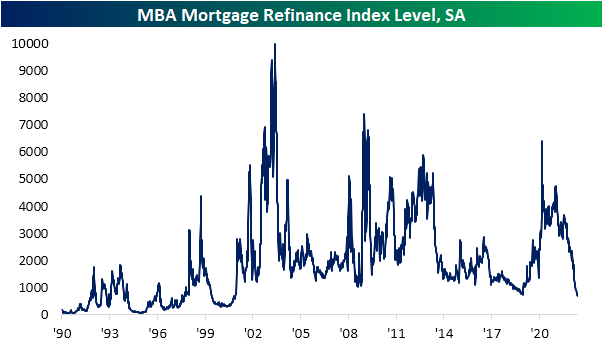

The past week has seen the national average for a 30 year fixed rate mortgage once again rocket higher. The average currently sits only a few basis points below 6%, the highest rate since the mid-2000s, as it has risen an astounding 42 basis points versus one week ago. As shown in the second chart below, that is one of only a handful of similar rapid upticks since at least 2000. The most recent of these is March 2020, and prior to that the December 2016 surge came close. Looking further back, only June 2013, the fall of 2008, and September 2003 have seen anywhere close to the same size short-term surges in mortgage rates.

Ironically, weekly data from the Mortgage Bankers Association actually got some relief this week. Seasonally adjusted purchases rose 8% week over week. That was the biggest one-week uptick since March but only brings the index back to levels last seen three weeks ago. Even though this week’s 3.66% increase ended a five-week losing streak, outside of last week, refinance applications are at the lowest level since 2000.

Also on the housing docket today was homebuilder sentiment from the NAHB. This report too shows a souring sentiment on the part of builders as higher prices (through both cost of a home and the cost to finance) dampen demand. Each category is dropping sharply and back in the middle of their ranges from the few years before the pandemic at best. The Future Sales index has gotten hit the hardest as it fell to 61 in June. Outside of the much more dramatic drop at the start of the pandemic in early 2020, such a low reading has not been observed since December 2018.

As quickly as homebuilder sentiment rose to historic heights and then erased its pandemic gains, the same applies to homebuilder stocks. The iShares US Home Construction ETF (ITB) had finally broken out of a sideways range at the end of last year but has consistently grinded lower in the months since then. In the past week alone it has fallen another 11% and failed at last month’s support in the process. That leaves two interesting next areas to watch. The first is only 2% away from current levels and traces back to the fall of 2020. A little further below that, and 5.25% away from current levels, is the pre-pandemic February 2020 peak. Click here to learn more about Bespoke’s premium stock market research service.