Bespoke Stock Scores — 6/21/22

Chart of the Day: Prices Collapse Versus Price Targets

And Then It Was Energy’s Turn

The Energy sector has bounced along with the overall market today, but last week it was that sector’s turn to get taken to the woodshed. Throughout the year, Energy was the only sector that worked, and less than two weeks ago it traded at 52-week highs. From the high on June 8th through Friday’s close, though, the S&P 500 Energy sector fell over 20%. The only other times since at least 1990 that the Energy sector fell more than 20% in an eight trading day span were in October 2008 and March 2020. While the sector’s 50-day moving average didn’t hold in last week’s plunge, the sector was able to hold support at its late April lows.

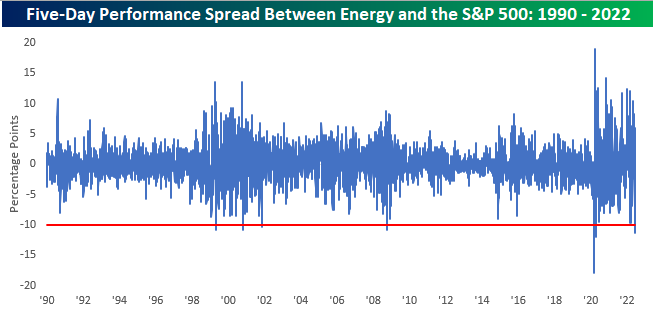

In addition to falling over 20% in an eight-day span, the Energy sector’s 17.2% decline last week (5-days) was also one that was surpassed by only a handful of other periods (October 2008, August 2011, and March 2020) since 1990. While declines of last week’s magnitude have been very uncommon, Energy is a volatile sector, and as illustrated in the chart below, there have been a number of periods in the last thirty years when the sector fell 10% or more (red line) in a five-day span.

Of the periods mentioned above where the Energy sector dropped as much as it did in the five days ending last Friday, they were also periods of overall market weakness. To help adjust for broader market moves, the chart below shows the rolling five-day performance spread between the S&P 500 Energy sector and the S&P 500 going back to 1990. Last week marked just the sixth period in the last 30+ years that the Energy sector underperformed the S&P 500 by more than ten percentage points in a five-trading day span. The other periods were April 1999, October 2000, November 2001, October 2008, and March and April 2020. On a side note, one aspect of the chart below that really stands out is how untethered the Energy sector has become relative to the S&P 500. Since 2020, the range of out/underperformance for the sector relative to the S&P 500 has widened out to an unprecedented range.

Separately, given the fact that Energy’s decline occurred as oil prices were only down a bit over 10% from their 52-week high (-11.4%), we were curious to see how far WTI was from 52-week highs following prior five-day periods where the Energy sector experienced massive underperformance. Of the six prior periods, there was only one where crude oil was down less relative to its 52-week high than it was as of last Friday (April 1999). Additionally, the only other time it was down by a similar amount was in October 2000. In the remaining four periods, crude oil prices had already declined significantly relative to their 52-week highs with declines of at least 48% and up to 70%. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 6/21/22

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“A ship is safe in harbor, but that’s not what ships are for.“ – William Shedd

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

It took a day longer than normal, but at least equity markets are kicking off the week on a positive note. Obviously, where we end up today is an entirely different story. It doesn’t take much to erase a market rally these days, but at least there won’t be much in the way of economic data to derail things. The only two reports on the calendar are the Chicago Fed National Activity Index which was barely positive at +0.01 and was the lowest level since last September and Existing Home Sales which will be released at 10 AM Eastern. On the speaker front, Fed Presidents Mester and Barkin will be speaking this afternoon.

In today’s Morning Lineup, there’s a lot covered as we discuss overnight moves in Asian and European markets, the wild weekend in crypto, political trends in Latin America, and economic reports out of Asia and Europe.

Based on where the tracking ETF (SPY) is currently trading in the pre-market, the S&P 500 is poised to gap up 1.7% to kick off the new trading week. As shown in the chart below, if these gains hold through the opening bell it would be the largest upside gap to kick off a new trading week since “Pfizer Monday” on 11/9/20. While this week’s upside gap is the strongest since November 2020, it follows last week’s downside gap of 2.6% which was the largest downside gap to kick off a week in two years.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

B.I.G. Tips – Moving on From Back to Back 5% Weekly Declines

Bespoke Brunch Reads: 6/19/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Recession Watch

Housing Market Update: Share of Homes with Price Drops Reaches New High as Mortgage Rates Top 2008 Levels by Tim Ellis (Redfin)

Demand is cratering across the housing market per Redfin data measuring everything from buyer traffic to price cuts to pending sales indicating that surging mortgage rates have buried the housing market. [Link]

It’s hip to be bear: Business leaders join chorus of economic doomsayers by Jason Kirby (The Globe And Mail)

Prognosticators, pundits, strategists, fund managers, and all manner of other market participants are leaning heavily into a negative outlook for stock markets reeling amidst massive global monetary policy tightening and soaring interest rates. [Link; soft paywall]

Hedge Funds

JPMorgan Packed Its Wealthy Clients Into Tiger Global Fund for Private Bets by Sridhar Natarajan, Hema Parmar and Miles Weiss (The Wealth Advisor/Bloomberg)

The most recent fund offered by collapsing hedge fund complex Tiger Global was stuffed full of investments from JPMorgan customers; total investments in Tiger and another similar fund a few months earlier neared $5bn just before the funds cratered. [Link]

Hedge Fund Selling Was Never More Furious Than in Last Two Days by Lu Wang and Melissa Karsh (Yahoo!/Bloomberg)

Goldman Sachs prime brokerage clients in the equity hedge fund space liquidated more equity exposure over two days in the past week than at any point since 2008. The good news, we suppose, is that this kind of liquidation event is often the sort of even that tags market lows rather than the other way around. [Link]

Prices

Why Gas Prices Are So High by Ella Koeze and Clifford Krauss (NYT)

High crude prices and insufficient new production are the most important driver of the surge in prices at the pump that consumers are suffering through this summer. [Link; soft paywall]

Cruise-Line Pricing Is Lost at Sea by Laura Forman (WSJ)

Eye-watering hotel prices are making seaborne trips a lot more attractive, with room rates roughly 10% below what’s on offer from mid-scale hotels. The industry’s rebound might be dependent on consumers biting at the bargain. [Link; paywall]

Plague & Pestilence

Ancient DNA solves mystery over origin of medieval Black Death by Willy Dunham (Reuters)

The discovery of bubonic plague victims who died in 1338 or 1339 are the earliest ever documented from the Black Death pandemic, all but confirming the plague originated in Central Asia and spread to Europe and the rest of Asia via trade routes. [Link]

New Tools Can Make Our Covid Immunity Even Stronger by Deepta Bhattacharya (NYT)

A recap of the new technologies which have boosted COVID immunity, and a proposal for maximizing population immunity long-term, including deploying vaccines through the mouth or nose instead of via a shot. [Link; paywall]

Single beaver caused mass internet, cell service outages in Northern B.C. by Kaitlyn Bailey (CTV)

One pesky beaver got a little bit too interested in the wrong aspen tree and ended up cutting a large swathe of British Columbia off from the internet in the process. [Link]

Crypto

What were all those 6,200 Coinbasers doing anyway? by Alexandra Scaggs (FTAV)

An investigation into the downright perplexing personnel decisions of one of the world’s largest crypto exchanges. [Link; registration required]

Crypto Hedge Fund Three Arrows Capital Considers Asset Sales, Bailout by Serena Ng (WSJ)

One of the largest pools of crypto investment capital has seen positions blown up a scramble for liquidity amidst brutal market conditions across the blockchain. [Link; paywall]

Marriage

Marry Your Like: Assortative Mating and Income Inequality by Jeremy Greenwood, Nezih Guner, Georgi Kocharkov, and Cezar Santos (NBER)

An estimate that assortative mating (that is, marriages that pair people with similar incomes and socioeconomic backgrounds) was responsible for much of the increase in US income inequality over the past half century. [Link; 26 page PDF]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report — 6/17/22

Daily Sector Snapshot — 6/17/22

Bespoke’s Morning Lineup – 6/17/22 – Trying To Go Out On A Positive Note

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We can offer sunshine that glows bright in the afterthought, and scatters the darkness of the tenement for the price of a nickel or a dime.” — L.A. Thompson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

138 years ago yesterday, the first roller coaster in the United States opened at Coney Island. Called the Switchback Railway, it was invented by LaMarcus Thompson, and in the years since the roller coaster has become a staple of American leisure activities. The one area where we like to avoid them as much as possible is in the financial markets. Unfortunately, investors haven’t been able to dodge them this year. Making matters worse, the last several days have been more like the ride Free Fall than anything else. After all, in order to have a roller coaster, there have to be ups and downs.

Futures are higher heading into the last trading session of the week, and whether they hold into the close is probably a bet many investors wouldn’t take at this point given the tendency to give up gains intraday. We’ll also get some important reports on Industrial Production (9:15), Capacity Utilization (9:15), and Leading Indicators (10:00).

In today’s Morning Lineup, there’s a lot covered as we discuss the latest moves from the BoJ, and overnight economic and market data in Asia and Europe.

We’ve been calling it the one step forward and two steps backward market for some time now, and yesterday and today provides another illustration of that pattern. After rallying over 1% following yesterday’s Fed meeting, the S&P 500 is indicated to open down about 2.0% this morning, more than erasing all of Wednesday’s gains. Keep in mind too, that even after Wednesday’s rally, the trailing five-day performance of the S&P 500 was a decline of just under 8%.

For the second week in a row, the S&P 500 is closing out trading with a decline in nine of the last ten weeks. In the post-WWII period, there have only been three other periods where this has occurred. Besides the fact that all three were lousy market environments, another theme they all have in common is that they all occurred in the middle of recessions. In 1970, the economy was six months from bottoming out, while in March 1982, the economy was more than a half year into a recession and eight months from its trough. Lastly, the period ending in early April 2001 was just one month into a recession that had another seven months left to go.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke 50 Growth Stocks — 6/16/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.