Chart of the Day: Take the Long View After Short-Term Swings

Bespoke’s Morning Lineup – 10/5/22 – Giving Back

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When nobody wants something, that creates an opportunity.” – Carl Icahn

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Equity futures are giving back much of yesterday afternoon’s gains and treasury yields are higher as markets reverse some, but certainly not all, of the moves from the last two trading days. ADP Private Payrolls increased 208K in September which was slightly above the consensus forecast of 200K. Oil is down marginally today ahead of an expected production cut announcement today, but crude rallied over 8% to start the week in anticipation of today’s decision. Overnight and this morning, we’ve seen the release of Services PMIs for a number of countries, and the general trend was of sequential declines suggesting that economic momentum continues to wane.

The S&P 500 rallied 5.7% in the first two trading days of the week, and while large, moves of this magnitude haven’t been unprecedented, and looking back over the last 50 years, there have been more than 30 other two-day rallies of 5%+. This week’s move was the largest since April 2020 and we saw a number of similar moves in the weeks coming off the COVID lows. Between those occurrences and the Financial Crisis, there was one occurrence in late 2018 and another in August 2015.

The red dots in the chart below indicate every prior day where the two-day trailing return of the S&P 500 was 5% or more. In recent years, a number of these occurrences came right or near market lows, but over the longer term, they have sprung up in all sorts of market environments like near market tops, early in a downturn, near market lows, or in the early stages of new bull markets. In other words, their level of significance is debatable.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day: Back to Back +2% Gains

Daily Sector Snapshot — 10/4/22

Bespoke Stock Scores — 10/4/22

A Five Times in a Lifetime Moment

File this under “You Don’t See This Very Often.” Equities surged over 2% yesterday reversing a recent trend of relentless declines since late August. It wasn’t just equities that rallied though. Everything did. Crude oil gushed more than 4.5% and even Treasuries caught a bid as prices at the long end of the curve jumped 1.5%. Taken by themselves, yesterday’s moves in all three asset classes were large but hardly out of the norm. It was the 29th time this year that the S&P 500 rallied 1.5% or more in a single day, the 66th time that crude oil advanced at least 1.5%, and the long-bond future has now rallied more than 1.5% six different times this year. Again, nothing to raise eyebrows at.

What was unique about yesterday, or at least used to be considered unique, was the fact that all three asset classes rallied 1.5%+ on the same day. All three asset classes tend to rally for different reasons, so what’s good for one isn’t always good for the others. Therefore, it’s very uncommon to see them all rally like that on the same day. It’s so uncommon, in fact, that since the late 1970s, it has only happened four other times, and one of them was last week on 9/28! The three other occurrences were on 10/7/88, 9/16/97, and 11/4/08.

Below we have included charts of the S&P 500 in the six months before and one year after each of the three prior occurrences. Again, these are the three times prior to last week that the S&P 500, the long bond, and crude oil all rallied more than 1.5% on the same day.

Back in October 1988, markets were concerned about Fed rate hikes and a weaker than expected non-farm payrolls report along with a downward revision to readings from prior months. These were the catalysts for the move as economic growth was still strong but at a pace that was not as strong as anticipated, which raised hopes that the FOMC would not have to be as aggressive in hiking rates. While the S&P 500 experienced a pullback of about 7% shortly after the one-day rally, the longer-term uptrend remained intact, and the S&P 500 was up more than 25% over the course of the next 12 months.

The move in September 1997 came right before the downturn from the Asia Financial Crisis and was spurred on by a weaker-than-expected CPI report. The S&P 500 was in the middle of a sideways range at the time of the simultaneous rallies and it remained there for the next three months. Over the next 12 months, the S&P 500 was up over 10% after rallying as much as 25%.

The third prior occurrence in early November 2008 capped off a six-trading day 19% rally in the S&P 500, and the index was back at new lows by the end of the month. The move came on Election Day, but polls had already shown a clear path to victory for Obama, so it wasn’t anything election specific that caused the move. More likely, the rally followed what had essentially been a waterfall decline where everything declined and declined sharply. From that close to the ultimate trough in March 2009, the S&P 500 lost a third of its value before finally bottoming, but one year later, the S&P still managed to gain just over 4% in total.

Again, the current period is unique relative to the prior three since we’ve seen it happen twice within the same week! Like the period in 2008, yesterday’s move followed a period in the market where everything was declining. Unlike the 2008 occurrence, though, both moves came the day after the S&P 500 closed at a 52-week low rather than just late in a near 20% rally in the S&P 500. Like the first two occurrences in 1988 and 1997, although the market isn’t in an uptrend this time around, the move was spurred on by weaker economic data, raising hopes that the FOMC would take a less hawkish approach to monetary policy.

While there isn’t a clear common link between the current period and the prior three, moves like yesterday where stocks, bonds, and crude oil all rallied sharply (1.5%+) have been extremely uncommon over the last 45 years.

Brazilian Equities (EWZ) Ripping

Of a number of country ETFs, Brazil (EWZ) has far outpaced the rest of the world as we noted last week. With some well-received news on the election front over the weekend, that outperformance has been amplified even as other global equity markets similarly have posted large gains. Whereas the average country ETF is down 20.73% year to date, Brazil is up over 17%. So far this week and in the month of October, EWZ has also left the rest of the world in the dust rallying nearly 11%; more than twice the average for other emerging markets.

As shown above and in the chart below, the past couple of days’ surge in price in the wake of the country’s election going to a runoff has sent the ETF smashing through its 50-DMA as well as its 200-DMA. Not only is that coming off of a lower low, but additionally it has now moved above the high end of the range since early August. That being said, the move has resulted in the ETF approaching extremely overbought levels.

As for just how large the move has been, below we show the daily moves in EWZ since its inception in July 2000. With a gain of 9.85% yesterday, there have only been a baker’s dozen other times with a daily move that was even larger. The most recent of these was March 24, 2020 (+12.06%); one day after the pandemic low for many equity markets around the world. However, earlier that month there were equally if not even more impressive daily moves of 10.1% on March 10th, 13.1% on March 17th, and 17.62% on March 13th. Prior to that, only 2008 and 2002 single-day moves of as large an amount.

As previously mentioned, the rally in Brazilian equities has been impressive, but so too has been the bounce here in the US as well as the rest of the world. As a result of the corresponding moves, the ratio of EWZ to SPY has moved up to the highest level since August 2021. In spite of the recent outperformance in 2022, from a longer-term perspective (the past five years), the ratio has been in a downtrend and essentially moved sideways during the post-pandemic rally. In other words, the past few days have been impressive for Brazilian equities, but one day does not necessarily make a trend. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 10/4/22 – Captain Macro Still at the Helm

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“So the last shall be first, and the first last: for many be called, but few chosen.” – Matthew 20:16

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The market is finally getting some positive follow-through for a change. After yesterday’s 2.5% rally, the S&P 500 is poised to gap up over 1.5% while the Nasdaq is looking at an even larger gain of 2.0%, and this comes despite no let-up in geo-political concerns as North Korea fired a ballistic missile near Japan. Traders have instead chosen to focus on central bank policy and a lower-than-expected rate increase from the Reserve Bank of Australia (25 bps vs 50 bps expected). The hope is that Australia’s easing off the gas pedal is a sign of things to come from other central banks around the world.

In addition to the spike in equity futures, treasury yields are lower again with the 10-year yield down below 3.6% and the 2-year now just a couple of basis points above 4%. Crude oil is up another 1% and getting closer to $85 per barrel. The earnings calendar remains quiet for the next few days, and the only economic reports on the calendar are Factory Orders and JOLTS (both reports for August).

Usually, when you get a rally following a steep market decline, the dogs of the downturn lead the subsequent rally. It’s called the dash for trash. The logic behind the trend makes perfect sense. The stocks that drop the most during a market decline are the ones that investors expect to be the most negatively impacted by the market catalyst, whether it be rising rates, economic weakness, geo-political concerns like a war in Europe, or weather events like a hurricane hitting a major population center. Once investors perceive that weight to lift, these stocks start to levitate.

Take the war in Europe. Surging energy prices from the near or complete shut-off of energy supplies to Europe from Russia have taken a higher share of the disposable income of consumers in that region and forced some European industrials to halt production since it’s become too expensive to keep the lights on. If the Ukraine war were to end, though, energy prices for the region would likely come back in, and these consumers and companies that have been hurt the most would have the most to gain.

In yesterday’s rally, though, the dash for trash was not evident. The chart below shows the performance of Russell 1000 stocks yesterday broken out by deciles based on their YTD performance through last Friday’s close. While the worst-performing stocks YTD (deciles 7 through 10) slightly outperformed yesterday, so too did the best-performing stocks YTD (decile 1), and the other five deciles barely underperformed. In other words, traders were not just buying the ‘losers’.

So, what happened? We’ve been highlighting the extreme daily breadth readings in the S&P 500 for weeks now, and this ‘all or nothing tone’ of the markets -more ‘nothing’ than ‘all’ lately – is reflective of a market driven by macro forces. Instead of specific sector/company fundamentals acting as the primary driver of performance, factors like central bank actions or the latest comments from a Fed official have taken precedence Captain Macro is still steering the ship.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 10/3/22

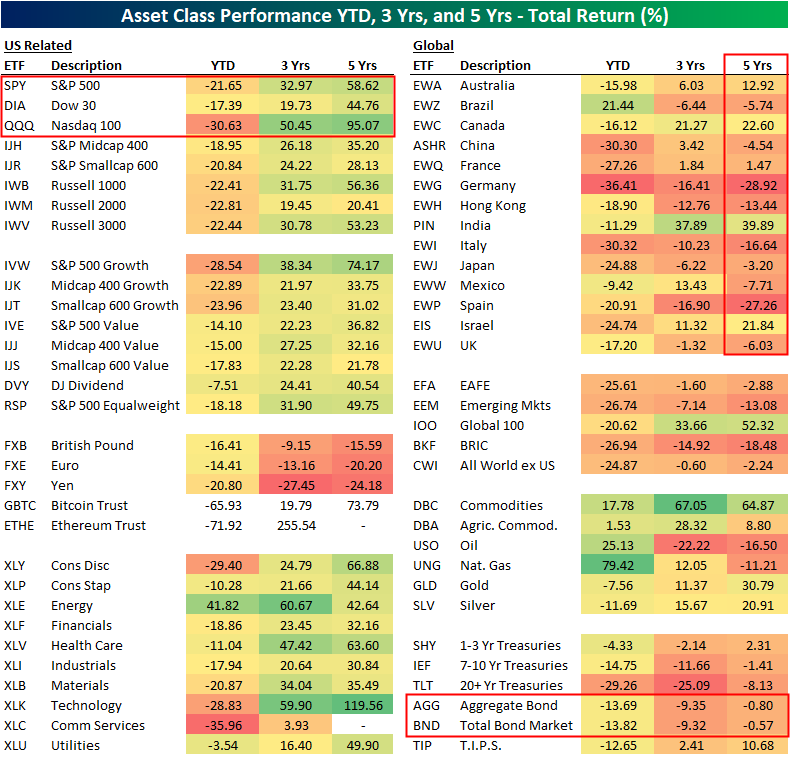

ETF Total Returns Across Asset Classes

Below is a look at our key ETF matrix highlighting total returns over the last five years, three years, and year-to-date. What’s most remarkable to us is how bad five-year performance has gotten for quite a few asset classes. Significant drops in price this year have erased years of built-up gains, and now a lot of areas of global financial markets are actually looking at double-digit percentage declines going back to the late 2010s.

The major US index ETFs are sitting on 20%+ declines in 2022, but they’re still up nicely over the last three and five years. The Nasdaq 100 (QQQ) is down 30% YTD but still up 95% over the last five years. Only the Technology sector ETF (XLK) has done better on a five-year total return basis out of all the ETFs listed in the matrix.

On the flip side, an unrelenting rise in interest rates this year has caused the bond market to suffer its worst drawdown in decades. This has left the aggregate US bond market ETFs (AGG, BND) now lower on a total return basis over the last five years. The long-duration 20+ Year Treasury ETF (TLT) is down 25% over the last three years and 8% over the last five years.

Outside of the US, every major country ETF in our matrix has underperformed SPY over the last five years. India (PIN) is up the most (+39.9%) and the closest to SPY’s 58.6% five-year gain. Canada (EWC) and Israel (EIS) are both up just over 20% over the last five years, while Australia (EWA) and France (EWQ) are the only others in the green. Spain (EWP) and Germany (EWG) are down the most with five-year declines of more than 25%! Click here to learn more about Bespoke’s premium stock market research service.

Looking more closely at stocks vs. bonds, below is the five-year total return of the S&P 500 (SPY) vs. the US aggregate bond market (AGG). Historically there has been an expectation that bonds would cushion the blow when stocks fall, but 2022 has been uniquely painful for both asset classes. While SPY has fallen more than 20% this year, it has still posted a total return of nearly 60% on a five-year basis. The bond market, on the other hand, is now negative over the last five years. Click here to learn more about Bespoke’s premium stock market research service.