Bespoke’s Morning Lineup – 10/19/22 – Worse Than 1987

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“It’s the nearest thing to a meltdown that I ever want to see.” – John Phelan, NYSE Chairman (1987)

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

35 years ago today, US stocks experienced their largest single-day decline in history as the Dow dropped 22.6%. Back then, before most Americans had 401Ks, the stock market wasn’t nearly as enmeshed in the lives of Americans as it is today, but the plunge still was THE story of the day prompting questions over whether it was a repeat of 1929 and the depression that followed. With the benefit of time and hindsight, the market and economy quickly moved on from the 1987 crash, and it barely even registers as a blip on long-term stock charts. Since the close on 10/19/87, the S&P 500 has had an annualized total return of 10.71%. Even more notable, though, is that had you invested in the S&P 500 on the Friday before the crash, you’re annualized total return over that span would have still been just short of 10% (9.99%). Not bad for the worst-timed trade of all time.

Moving to the present day, 2022 has actually been worse than 1987. After the crash in 1987, the S&P 500 was down less than 8% YTD. Today, even after a gain of nearly 4% over the last week, the S&P 500 is down more than 20% YTD or twice the decline of the S&P 500 at this point in 1987.

This morning, futures are in the red after trading higher overnight as yields surge with the 10-year nearing 4.10%. Building Permits and Housing Starts were just released and came in mixed relative to expectations with starts missing forecasts while starts came in a bit higher than forecast. Mortgage applications continue to decline, though, suggesting that the sector will continue to face pressure.

It’s now been a week since the S&P 500’s closing low on 10/12 (the intraday low was on 10/13), so we wanted to take a bird’s eye look at where things stand at the index and sector level. Of the Russell 2000 (IWM), Nasdaq 100 (QQQ), and S&P 500 (SPY), IWM probably looks best from a technical perspective. Of the three indices shown, it is the only one that didn’t violate the June lows on a closing basis and is also the only one that made a higher high even if it was just on an intraday basis. For both QQQ and SPY, the charts look very similar as last week’s lows represented lower lows, and the rally over the last few days has yet to make a higher high.

At the sector level, Financials have been leading the charge, rallying more than 6% over the last week. Of the remaining ten sectors, the only one not up more than 2.5% is Utilities. Despite the gains from the last week, though, the only sector that has managed to retake its 50-day moving average is Energy, and four sectors (Technology, Real Estate, Consumer Discretionary, and Utilities) still remain at oversold levels.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 10/18/22

Bespoke Stock Scores — 10/18/22

Not All New Lows for Homebuilders

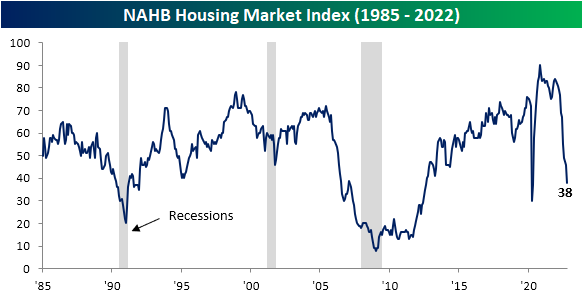

With mortgage rates running higher unabated and mortgage demand decimated, homebuilder sentiment has continued to tank. The latest reading on homebuilder sentiment from the NAHB hit a new post-pandemic low in October dropping from 46 down to 38. Outside of the weaker readings in May and April of 2020, August 2012 was the last time the index was as low as it is now.

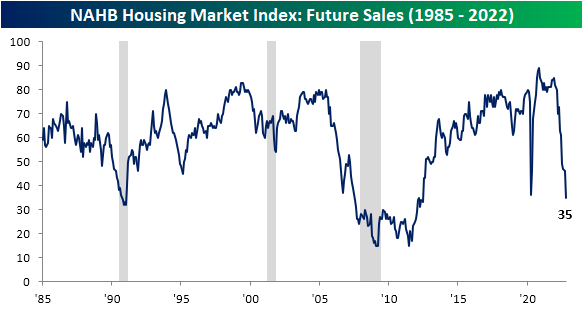

Not only is the index at a new cycle low, but the 8-point month-over-month drop also ranks in the bottom 1% of all monthly moves. The declines in the present and future sales indices rank by similar magnitudes.

Although the headline index as well as sub-indices like present sales and traffic have not yet taken out 2020 lows, the index for future sales dropped to its lowest level since June 2012. As shown above, it has the lowest reading within its respective range historically of each of the sub-indices.

The only other index in the report that is below 2020 levels is the sentiment in the West region. While the Midwest and South have also fallen precipitously, the Northeast actually experienced a modest rebound in sentiment. Relative to other indices in the report, homebuilder sentiment in the Northeast is remarkably stronger with the index in the 62nd percentile relative to historical readings.

As for the technical picture of homebuilder stocks, recent declines have been a bit healthier than the broader market. Whereas major indices set new 52-week lows as recently as last week, the lows for the S&P 1500 Homebuilders Group at the end of September and the end of last week were between 7% and 8% above the June lows. While the line is somewhat choppy, relative strength versus the broader market has also been generally trending upward since the spring. In last Monday’s Closer, we further highlighted the disconnect between housing stocks and macro data.

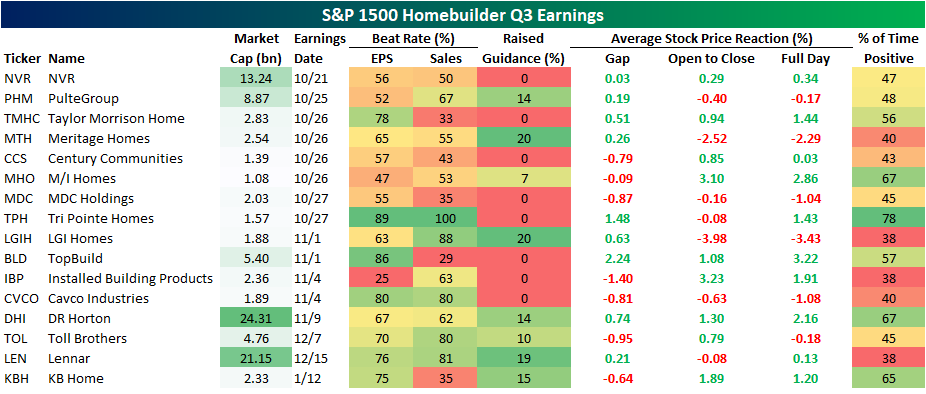

While homebuilder stocks have been holding up surprisingly well, earnings season is on the horizon which has the potential to change that picture; especially if said earnings start to mirror macro housing data. Using data from our Earnings Explorer database, below we show each of the S&P 1500 Homebuilder stocks as well as when they are expected to report earnings and what their historical Q3 earnings beat rates and stock price reactions have been.

Overall, Tri Pointe Homes (TPH) has been one of the strongest performers for Q3 with a positive reaction by the stock 78% of the time as it possesses the strongest beat rates as well. In fact, for TPH Q3 ranks as the best quarter of the year for stock price reactions. That is also the case for TopBuild (BLD) and KB Homes (KBH). Conversely, Q3 marks the weakest response to earnings for LGI Homes (LGIH), Cavco Industries (CVCO), Toll Brothers (TOL), and Lennar (LEN). Click here to learn more about Bespoke’s premium stock market research service.

B.I.G Tips – Anatomy of Major Market Lows

Chart of Day – All or Nothing Days Becoming the Norm

Bespoke’s Morning Lineup – 10/18/22 – Back to Back 500s

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Though I am often in the depths of misery, there is still calmness, pure harmony and music inside me.” – Vincent Van Gogh

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Stock futures are pointing sharply higher for the second day in a row this morning. While there are no specific catalysts, better-than-expected earnings against a backdrop of extremely oversold markets provide fuel for at least a short-term rally. Sentiment towards the market has been very negative as well. The latest example is the BofA Fund Manager Survey which showed the highest allocations to cash since 2001. Despite the rally in stocks, bonds are behaving as Treasury yields are modestly lower. In the commodities space, crude oil is little changed while gold is down modestly.

In the stock market lately, it’s either the end of the world or the beginning of a new bull market. In yesterday’s rally, the S&P 500’s net advance/decline (A/D) reading came in at +455 which followed a reading of negative -442 on Friday and +438 Thursday. With futures up nearly 2% this morning, it’s looking like another positive day of everything coming up roses (for now). We classify any day where the S&P 500’s net A/D reading is above positive 400 or below minus 400 as an all-or-nothing day. In the 1990s, all-or-nothing days were generally uncommon. There were seven years in the decade where there wasn’t more than one occurrence in an entire calendar year, and there were three with none.

As ETFs became more popular at the turn of the century allowing investors to buy or sell every stock in the index with one trade, the frequency of all-or-nothing days really picked up and peaked during the Financial Crisis when there were four straight years with more than 45. With all-or-nothing days occurring at a much more regular frequency in the last several weeks (and especially days), 2022 is giving some of those years from the Financial Crisis a run for their money. After three straight occurrences in a row (matching the total for all of 2017), the S&P 500 has now had 38 all-or-nothing days this year, putting 2022 on pace for 48. At that rate, this year would rank tied for third with 2010 trailing only 2011’s total of 70 and 2008’s total of 52.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Daily Sector Snapshot — 10/17/22

Flip Flopping Like a Politician

With Thursday’s 2%+ rally, followed by Friday’s 2%+ decline, and now today’s 2%+ rally, the S&P 500 tracking ETF (SPY) has now rallied or declined 2%+ for the third straight day. Since SPY’s inception in the early 1990s, the current streak is the 26th time that the ETF has been up or down 2%+ for three straight days (and the second this year). Of those 25 prior streaks, eleven extended to a fourth day, so while 2% moves aren’t especially common (less than 8% of all trading days), when SPY has 2%+ daily moves for three straight days, there has been a 2%+ move the following day 44% of the time. There’s a saying in markets that strength begets strength; a corollary to that phrase would be volatility breeds more volatility. Of the five streaks that lasted at least five trading days, one was in July 2002, three were in 2008 (September, October, and December), and the most recent, which ended up being the longest on record was in March 2020.

While we’ve experienced a short burst of volatility in the last few days, SPY’s average daily move recently hasn’t been particularly extreme. Over the last 50 trading days, SPY has averaged a daily move of +/-1.25%, which while well off its lows from early September, is still well below the levels seen back in June. For all the talk about why the VIX hasn’t seen a major spike, one big reason is that we have yet to see a meaningful uptick in day-to-day volatility. Click here to learn more about Bespoke’s premium stock market research service.