Dow Jones Thousand Point Thresholds

Get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

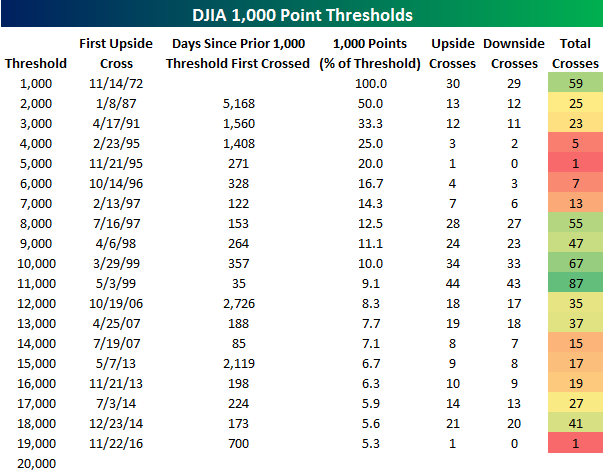

With the Dow Jones Industrial Average (Dow) getting ever so close to 20,000 after only first crossing 19,000 to the upside 21 days ago, we wanted to provide a look at prior 1,000 point thresholds in the DJIA and how many times the index has crossed above (and below) each one of them. The table below lists each 1,000 point threshold for the DJIA from 1,000 to 20,000. For each level we have included the date the DJIA first crossed each 1,000-point threshold to the upside, the number of days that elapsed between the first cross of that 1,000-point threshold and the prior one, what percentage 1,000 points represents of each threshold, and then finally how many upside, downside, and total crosses each threshold has seen.

Looking at the table, a couple of trends are worth highlighting. The first is that with each 1,000-point threshold the DJIA crosses, the percentage that 1,000 points represents declines. For example, when people were focused on Dow 10,000 in 1999, 1,000 points represented 10% of the index. At 20,000, though, 1,000 points only represents 5%. That’s just basic math but is important to remember. A second notable aspect of the table worth pointing out is that even though equities remain in one of their longest bull markets on record, the road from 18,000 to 19,000 was a relatively long one. Even though it represented a gain of just over 5%, it took the DJIA nearly two years to get to 19,000 after first crossing 18,000. Of the 18 other 1,000 point thresholds shown, the time that elapsed between 18K and 19K was the sixth longest. In other instances, long gaps between thousand point thresholds were due to either a bear market or the fact that 1,000 points represented a large percentage of the index. From 18K to 19K, though, neither of those factors played a role. Instead, the market just did nothing for over a year.

After taking 700 days to get from 18K to 19K, the DJIA is moving a lot quicker in trying to get to 20K, and if it gets to 20K between now and Christmas, it will be the shortest amount of time between 1,000 point thresholds in the index’s history. 19K is also one of only two 1,000-point thresholds the DJIA has never closed below after first crossing it to the upside. Obviously, it has only been three weeks, so that could change, but at this point, 19K and 5K are the only two 1,000-point thresholds that have never experienced a downside cross.

B.I.G. Tips – Market Performance Following Rate Hikes

B.I.G. Tips – Ominous S&P 500 Election Pattern

Chart of the Day: S&P 500 New Closing All-Time Highs By Year

The Bespoke Report — 2017 — “Seasonality”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Over the next few weeks until the full publication is sent to paid members on December 29th, we’ll be releasing individual sections as we complete them. Today we have published the “Seasonality” section of the 2017 Bespoke Report, which highlights the seasonal tendencies of large, mid, and small cap stocks, as well as individual sectors and additional asset classes.

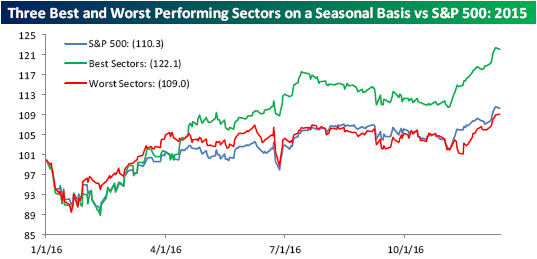

While we never recommend investing based solely on seasonal factors, we do think it should be a part of the investing equation. Take the chart below, for example, which shows the cumulative performance in 2016 of how an investor would have performed by investing in the three sectors that have historically performed the best and worst in each month of the calendar year. Beginning at the close on 12/31 and through 12/12, an investor who purchased an equal share of the three sectors that historically do best during the upcoming month and then repeated the process at the end of each month would have a gain of 22.1% in 2016 compared to a gain of 9.0% for a strategy of buying the three sectors that have historically performed the worst in each month. Over that same time period, the S&P 500 is up 10.3%. So even in a year where we saw some wild swings driven by outside forces, a strategy of buying the seasonal winners more than doubled the return of going long the seasonal losers.

To view our full “Seasonality” section immediately and also receive the full 2017 Bespoke Report when it’s published on December 29th, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

The Bespoke Report — 2017 — “Thematic Performance”

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

Our 2017 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2017. And to say that 2017 should be an interesting year for asset classes would be an understatement given the huge rotation we’ve already seen in just a few weeks since the Presidential Election was held back on November 8th.

The 2017 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. In this year’s edition, we’ll also be featuring our new “Trump Index” of stocks that we expect to perform best in 2017 based on the new administration.

Over the next few weeks until the full publication is sent to paid members on December 29th, we’ll be releasing individual sections as we complete them. Today we have published the “Thematic Performance” section of the 2017 Bespoke Report, which highlights the various market themes like large caps versus small caps, value versus growth, and stocks versus bonds that are currently outperforming and underperforming as we get set to enter the new year.

To view this section immediately and also receive the full 2017 Bespoke Report when it’s published on December 29th, simply sign up for a 30-day free trial to Bespoke Premium. It’s that easy!

Bespoke Stock Scores: 12/13/16

ETF Trends: International – 12/13/16

Three emerging markets are the best performing ETFs we track in the last five days, with Russia, Mexico, and South Africa each gaining over 4%. FX-hedged ETFs for Japan and Europe have also surged, while oil, tech, home builders, and consumer staples have performed well too. Underperformance came from biotech, gold miners, natural gas, metals, bonds, and gold.

Bespoke provides Bespoke Premium and Bespoke Institutional members with a daily ETF Trends report that highlights proprietary trend and timing scores for more than 200 widely followed ETFs across all asset classes. If you’re an ETF investor, this daily report is perfect. Sign up below to access today’s ETF Trends report.

See Bespoke’s full daily ETF Trends report by starting a no-obligation free trial to our premium research. Click here to sign up with just your name and email address.

Amazon’s Amazing Numbers

Each month, Bespoke runs a survey of 1,500 US consumers balanced to census. In the survey, we cover everything you can think of regarding the economy, personal finances, and consumer spending habits. We’ve now been running the monthly survey for more than two years, so we have historical trend data that is extremely valuable, and it only gets more valuable as time passes. All of this data gets packaged into our monthly Bespoke Consumer Pulse Report, which is included as part of our Pulse subscription package that is available for either $39/month or $365/year. We highly recommend trying out the service, as it includes access to model portfolios and additional consumer reports as well. If you’re not yet a Pulse member, click here to start a 30-day free trial now!

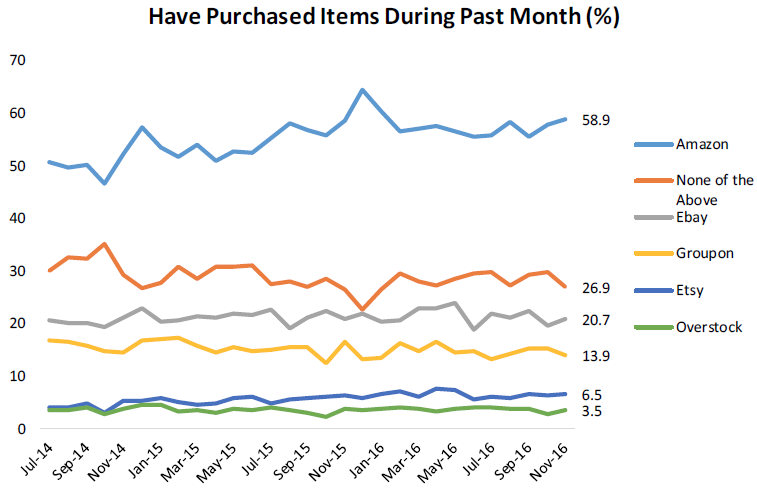

Below are the results of a question we ask consumers regarding online retailer purchases during the past month. Overall, the competition in the space has remained consistent throughout our survey series as Amazon (AMZN) keeps the top spot followed by eBay (EBAY) and Groupon (GRPN). Interestingly, while the percentage of consumers making purchases at many of the retailers we survey has stayed constant throughout this series, only Amazon and Etsy (ETSY) have seen growth when it comes to this metric. Also, this month we saw the beginnings of the seasonal uptick for purchased items as all retailers saw increases except for Groupon (GRPN), which fell slightly.

The most amazing part about this data series is that a whopping 58.9% of survey participants said they purchased an item on Amazon.com over the past month. For a survey that’s balanced to US census population figures, this shows just how big the Amazon presence is when it comes to shopping in 2016. More than half the country is now using Amazon to buy goods on a regular basis!

Our full November Pulse report has additional research on online retailers, and it also has data on groups like consumer electronics (AAPL, MSFT, etc.), social media (FB, TWTR, LNKD), streaming media (NFLX, AMZN), and much more. If you’re not yet a Pulse member and want to see the full report, click here to start a 30-day free trial now!