Bespoke Brunch Reads: 9/30/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Social Media

Twitter says bug may have exposed some direct messages to third-party developers by Zack Whittaker (TechCrunch)

A bug in Twitter’s back end may have let third-party developers read and store private direct messages between users. [Link]

Facebook Security Breach Exposes Accounts of 50 Million Users by Mike Isaac and Sheera Frankel (NYT)

In another huge breach of security for a social media network, Facebook announced a breach this week that had exposed full account control of more than 50 million users; what’s worse, that access could have spread across other connected applications as well. [Link; soft paywall]

New Studies

How universal free preschool in DC helped bring moms back to work by Bryce Covert (Vox)

By offering a guaranteed placement for all children in preschool, without costs to parents, Washington, DC was able to generate an extremely substantial increase in labor force participation. [Link]

World War II and African American Socioeconomic Progress by Andreas Ferrara (University of Warwick Working Paper Series)

The last period of significant socioeconomic progress and upward mobility for black Americans was during the middle of the last century. This paper argues that progress was a function of tight labor markets and labor shortages, rather than some sort of shift in the moral fiber of the nation as it marched towards desegregation. [Link; 96 page PDF]

A Hedge Fund Manager Who Drives a Ferrari Will Probably Underperform by Amy Whyte (Institutional Investor)

Using public vehicle records, the authors match hedge fund managers to their wheels and find that sports car drivers tend to underperform peers who make more staid vehicular choices. [Link]

Country-level social cost of carbon by Katharine Ricke, Laurent Drouet, Ken Caldeira and Massimo Tavoni (Nature)

While carbon emissions have a global impact and therefore a general level of social cost for the whole world, this paper gets a bit more detailed and argues the distribution of those costs are not equal across countries. [Link]

Dark Money

How Dirty Money Disappears Into the Black Hole of Cryptocurrency by Justin Scheck and Shane Shifflet (WSJ)

An in-depth investigation of how cryptocurrencies help launder proceeds from credit card fraud and Ponzi schemes around the world. [Link; paywall]

2 Investigators: Fans Scammed Out Of Millions Of Dollars By Fake Celebrity Accounts by Pam Sekman (CBS Chicago)

A local news network in Chicago reveals the story of people convinced to send thousands of dollars to Dubai or other strange locales, duped by fake accounts purporting to be real-life celebrities. [Link]

Drugs

Instagram has a drug problem. Its algorithms make it worse. by Elizabeth Dwoskin (WaPo)

While Instagram is better known for its totally legal influencer culture (across fitness, travel, food, interior design, and a litany of other topics), it’s also a booming advertising venue for illegal drugs. [Link; soft paywall]

On Ecstasy, Octopuses Reached Out for a Hug by JoAnna Klein (NYT)

We’re curious what the proposal to feed an octopus MDMA looked like, but that aside a recent study used doses of the drug to show how similar the strange animals are to humans. [Link; soft paywall]

Autonomous Vehicles

Baidu just made its 100th autonomous bus ahead of commercial launch in China by Kirsten Korosec (TechCrunch)

While this story is somewhat out of date, it does help illustrate progress being made by tech companies in China; in this case, on level 4 (capable of taking over driving in certain conditions) mini-buses. [Link]

The Amazin’s

Gary Keith and Ron, the Magi of Mets Nation by Devin Gordon (NYT Mag)

The antics of Mets broadcasters is helping keep interest in the once-again lowly Mets alive late in a season that saw the squad knocked out of playoff contention months ago. [Link; soft paywall]

Liberalism

The Economist at 175 (The Economist)

10,000+ words on the classic liberal perspective (note: “liberal” in this case is not synonymous with “left wing” as is often the common use in the United States) of The Economist, 175 years after the magazine was launched and in the midst of a global discussion about the fruits of an approach which elevates freedom over pre-modern approaches to political organization. [Link; soft paywall]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

2018 Week 4

Week 3 Results: 9-6, Overall: 26-17 (60.5%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). Let’s see how we do…on to Week 4.

We were 9-6 in week 3, bringing our overall record through 3 weeks to 26-17 (60.5%).

2018 NFL Week 4 Bespoke Picks:

Cincinnati at Atlanta (-4): Cincinnati +4

Tampa Bay at Chicago (-3): Tampa Bay +3

Detroit at Dallas (-2.5): Dallas -2.5

Buffalo at Green Bay (-10): Green Bay -10

Philadelphia (-3) at Tennessee: Philadelphia -3

Houston at Indianapolis (Even): Indianapolis Even

Miami at New England (-7): New England -7

NY Jets at Jacksonville (-9): Jacksonville -9

Cleveland at Oakland (-2.5): Oakland -2.5

Seattle (-3) at Arizona: Seattle -3

New Orleans (-3) at NY Giants: NY Giants +3

San Francisco at LA Chargers (-11.5): LA Chargers -11.5

Baltimore at Pittsburgh (-3): Baltimore +3

Kansas City (-4.5) at Denver: Kansas City -4.5

Week 4 Picks: 9 Favorites, 5 Dogs; 8 Home, 6 Away

2018 NFL Week 3 Bespoke Results:

New Orleans at Atlanta (-1.5): New Orleans +1.5 (Win)

San Francisco at Kansas City (-6.5): Kansas City -6.5 (Win)

Oakland at Miami (-3): Miami -3 (Win)

Buffalo at Minnesota (-16.5): Minnesota -16.5 (Loss)

Indianapolis at Philadelphia (-7): Indianapolis +7 (Win)

Green Bay (-2.5) at Washington: Green Bay -2.5 (Loss)

Cincinnati at Carolina (-3): Cincinnati +3 (Loss)

Tennessee at Jacksonville (-9.5): Tennessee +9.5 (Win)

Denver at Baltimore (-5.5): Denver +5.5 (Loss)

NY Giants at Houston (-6): NY Giants +6 (Win)

LA Chargers at LA Rams (-7): LA Rams -7 (Win)

Chicago (-4.5) at Arizona: Chicago -4.5 (Loss)

Dallas at Seattle (-1.5): Seattle -1.5 (Win)

New England (-7) at Detroit: New England -7 (Loss)

Pittsburgh (-1) at Tampa Bay: Pittsburgh -1 (Win)

The Bespoke Report — Stumbling And Bumbling

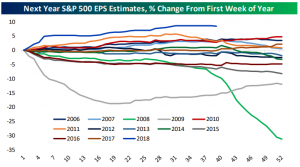

While the economy is on good footing and the overall backdrop is reasonably positive for stocks, there’s reason to be a bit cautious. EPS estimates have been rising sharply this year relative to history, and that process may be completing. While it’s not certain that the bar being set by analysts is too high, stocks have gotten a tailwind from stronger earnings estimates all year; if that process goes into reverse, equity market gains would require higher valuation. While possible, this late in the economic cycle and given higher interest rates, it would be prudent to not rush to expectations of the same climb in valuations that we saw earlier in this bull market.

We’ve just published our latest weekly Bespoke Report newsletter, which is available to subscribers across all three of our membership levels. Sign up here to read the report.

To get up to speed on our thoughts regarding the market’s direction going forward, choose any membership option and access this week’s full Bespoke Report newsletter after signing up! You won’t be disappointed. Some of the topics discussed in this week’s report include:

- Why chaos in the headlines doesn’t mean chaos for stocks

- US economy update

- Check in Europe: Italian chaos, slow inflation, but firm credit growth

- Recent global trade and industrial production volumes

- Breakouts in APAC equity indices and some improvements in EM

- Weak earnings reactions since the end of the last earnings season

- Chinese economic data recap

- Review of the Fed rate hike this week and current FOMC thinking

- Improving credit spreads despite high debt-to-GDP levels

- Focus on homebuilders: versus housing data and valuations

- Model Growth Portfolio update

The Closer: End of Week Charts — 9/28/18

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

Below is a snapshot from today’s Closer highlighting the current positioning of speculators in US interest rate markets. If you’d like to see more, start a free trial below.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Stocks Tanking on Earnings Heading Into Q3 Reporting Period

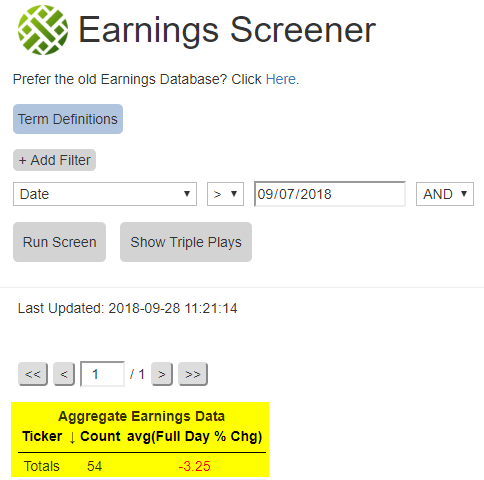

The third quarter earnings period starts up in early October, and if September is any guide, it’s going to be a long earnings season for investors. Over the last two weeks, 54 companies have reported earnings (the number of companies that report during the “off season” is much lower), and their stocks have averaged a one-day decline of 3.2% on their earnings reaction days. That’s an absolutely brutal reading, and while it’s a small sample size, it suggests that investors are not liking what they’re seeing from corporate America.

Below is a snapshot from our Earnings Screener, which allows users to pull up earnings stats like the one mentioned above. It’s available at the Bespoke Institutional level, which you can access with a two-week free trial.

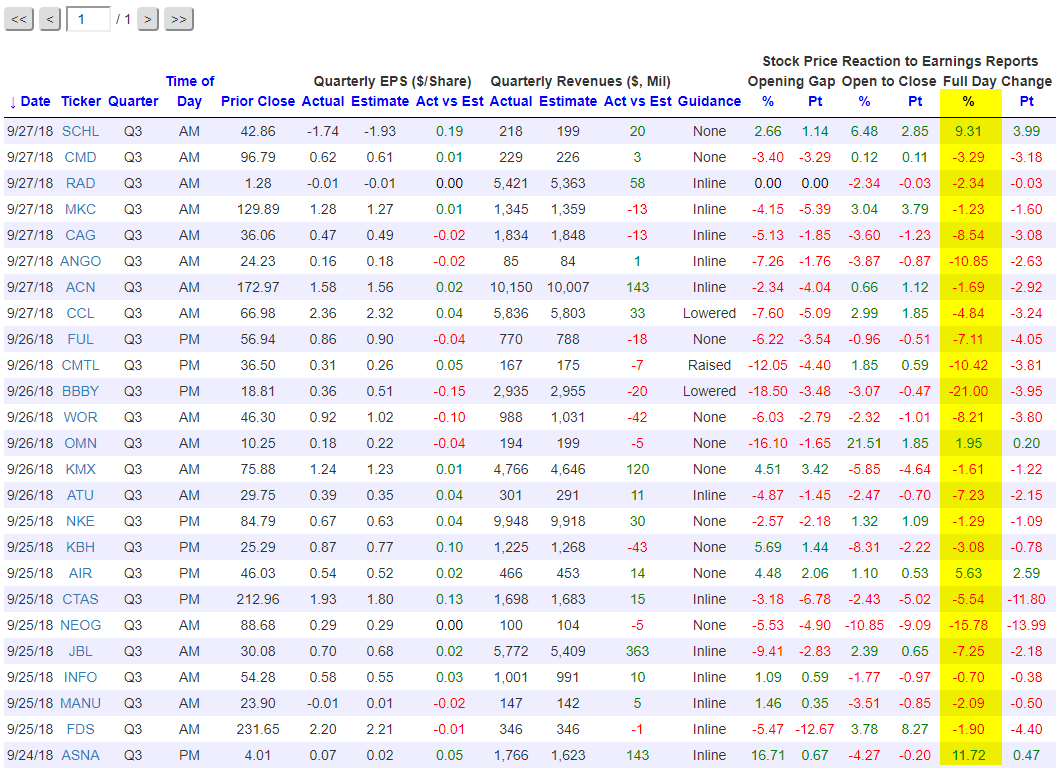

Below is a snapshot pulled from our Earnings Screener showing the stocks that reported earnings just this week. We’ve highlighted each stock’s one-day price change in reaction to the earnings news. As you can see, there’s a lot of red! In fact, the average one-day change for the stocks that reported this week was a decline of 3.6%, and only 4 of the 25 stocks that reported ended up gaining on their earnings reaction days.

Most Heavily Shorted Stocks Tank in September

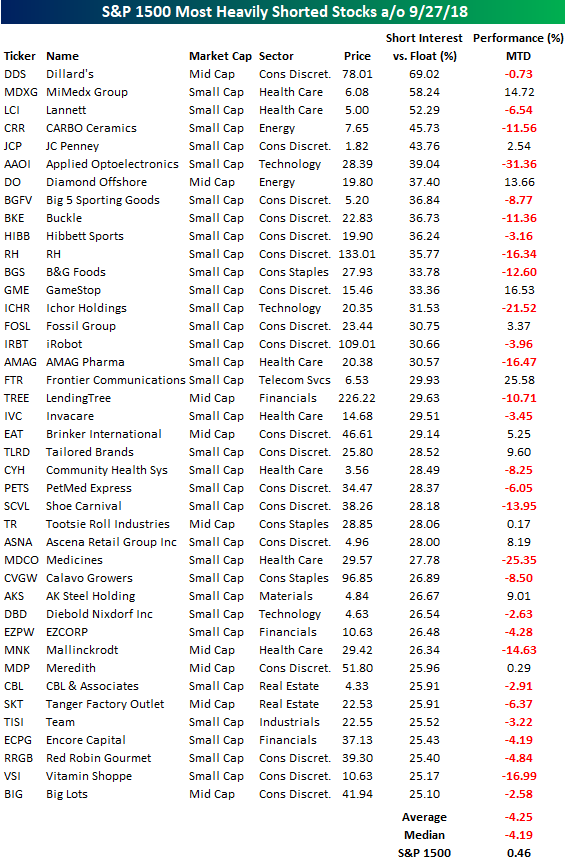

We published our regularly updated Short Interest Report earlier today in order to show clients which areas of the market are seeing the biggest increases and decreases in short interest levels. A supplement to the report is the table below highlighting the most heavily shorted stocks in the S&P 1500.

Notably, the most shorted stocks got crushed in September (through 9/27), falling 4.25% on average compared to a small gain for the S&P 1500. While the stock market was up in September, it wasn’t a great month for stocks that the shorts are bettign heavily against.

Dillard’s (DDS) is the most heavily shorted stock in the entire S&P 1500 with 69% of its float sold short. Two other stocks in the index have more than 50% of their shares sold short — MiMedx Group (MDXG) and Lannett (LCI). Some of the other stocks on the list below that got hit the hardest in September include Applied Opto (AAOI), Ichor Holdings (ICHR), and Medicines (MDCO), which all fell more than 20%.

Equities may have traded higher in September, but it looks like the shorts were still able to make plenty of money.

B.I.G. Tips – October 2018 Seasonality

Bespoke Short Interest Report: 9/28/18

Morning Lineup – Back to Markets

Investors are getting back to focusing on markets this morning yesterday’s spectacle in Washington has come and gone. With just one trading day left in the week though, we thought it would be a good idea to highlight where things stand on a sector by sector level.

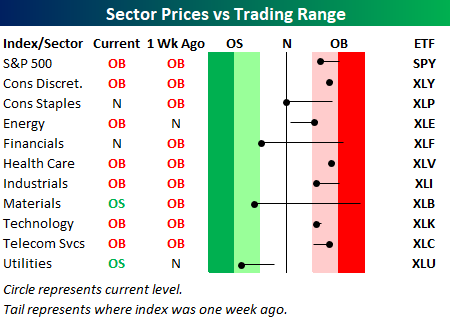

The chart below is from the second page of our Morning Lineup and shows where sectors are trading with respect to their trading ranges and how they’ve moved over the last week. The S&P 500 and most sectors continue to trade at overbought levels, although everyone with the exception of Energy and Communication Services has moved lower with respect to its trading range over the last week. The big movers, though, have been Materials and Financials, which have moved from overbought to either oversold or near oversold in the course of only a week. While it’s perfectly normal for sectors to ‘digest’ gains after a big move, those kinds of shifts aren’t particularly normal and suggest a good deal of uncertainty towards the sectors on the part of investors.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Hard Data Wave — 9/27/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we wade through an enormous wave of data released in the US today covering GDP, trade, manufacturers’ sales, new orders, and inventories, and inventories. We also discuss our now-complete Five Fed Index of regional manufacturing activity and some odds and ends from equity, credit, and FX markets.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!