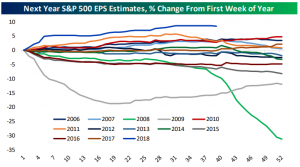

While the economy is on good footing and the overall backdrop is reasonably positive for stocks, there’s reason to be a bit cautious. EPS estimates have been rising sharply this year relative to history, and that process may be completing. While it’s not certain that the bar being set by analysts is too high, stocks have gotten a tailwind from stronger earnings estimates all year; if that process goes into reverse, equity market gains would require higher valuation. While possible, this late in the economic cycle and given higher interest rates, it would be prudent to not rush to expectations of the same climb in valuations that we saw earlier in this bull market.

We’ve just published our latest weekly Bespoke Report newsletter, which is available to subscribers across all three of our membership levels. Sign up here to read the report.

To get up to speed on our thoughts regarding the market’s direction going forward, choose any membership option and access this week’s full Bespoke Report newsletter after signing up! You won’t be disappointed. Some of the topics discussed in this week’s report include:

- Why chaos in the headlines doesn’t mean chaos for stocks

- US economy update

- Check in Europe: Italian chaos, slow inflation, but firm credit growth

- Recent global trade and industrial production volumes

- Breakouts in APAC equity indices and some improvements in EM

- Weak earnings reactions since the end of the last earnings season

- Chinese economic data recap

- Review of the Fed rate hike this week and current FOMC thinking

- Improving credit spreads despite high debt-to-GDP levels

- Focus on homebuilders: versus housing data and valuations

- Model Growth Portfolio update