Bigger Has Been Less Bad

The average stock in the S&P 1500 (a combination of large-caps, mid-caps, and small-caps) is down 2.71% already in October. The chart below shows that the smaller the stock, the worse performance has been.

We broke the S&P 1500 into deciles based on market cap at the start of the month — decile 1 contains the 150 largest stocks in the index, decile 2 contains the next 150 largest, and so on and so forth. We then calculated the average performance of the stocks in each decile so far in October.

With the exception of deciles 6 and 7, the average performance gets worse and worse as you move from the deciles of largest stocks down to the deciles of smallest stocks.

The 150 largest stocks in the S&P 1500 are only down an average of 0.45% so far in October, while the 150 smallest stocks are down an average of 4.25%!

Bespoke Brunch Reads: 10/7/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Monetary Policy

I Created ‘The Bernank’ on YouTube. And I Was Mostly Wrong. by Omid Malekan (NYT)

One of the most unintentionally hilarious videos about monetary policy ever made was intended as a satire of actual policies, fueling popular misconception along the way. The creator is now mostly recanting. [Link; soft paywall]

The Fed’s No Longer Guided by Concept of Neutral Rates by Tim Duy (Bloomberg)

Over the past week two major proponents of the neutral rate framework for thinking about the path of Fed policy have either recanted or walked back significantly. [Link; soft paywall]

Tax Policy

Issue #2: New York City Taxes More Valuable Property at Lower Rates than Less Valuable Properties (Tax Equity Now)

Some staggering charts communicating the remarkably regressive nature of New York City property tax rates; for a place with a progressive reputation, New York applies much higher tax rates to lower-value properties. [Link]

I.R.S. Tax Fraud Cases Plummet After Budget Cuts by Jesse Eisinger and Paul Kiel (NYT)

Forget political debates over what the correct level of taxation is: what happens when the law can’t be enforced and the dollars Congress has decided to levy in tax aren’t being collected? [Link; soft paywall]

Auction Antics

Banksy auction prank leaves art world in shreds by Chris Johnston (The Guardian)

After a painting by street artist Banksy was sold for just over 1mm GBP, it started to feed into a shredder installed at the bottom of the frame. [Link]

Rare bottle of Scotch whisky fetches record price (Yahoo!/AFP)

A 60 year old bottle of scotch (Macallan) has fetched a staggering $1.1mm price at auction, coming in slightly above a bottle from the same cask sold back in May. [Link]

Dystopia

How I ended up as a modern-day slave in the middle of NYC by Gabreille Fonrouge (NYP)

The story of a young girl who was brought to the US to serve as indentured, un-payed labor in New York households; her experience as a slave is as gut-wrenching as her effort to move forward with her life after has been. [Link]

Suicides Get Taxi Drivers Talking: ‘I’m Going to Be One of Them’ by Emma G. Fitzsimmons (NYT)

With the rise of ride-sharing apps, taxi drivers who financed access to the New York City market with debt to purchase medallions are struggling to stave off depression and suicide. [Link; soft paywall]

New Research

The Long and Short of It: Do Public and Private Firms Invest Differently? by Naomi Feldman, Laura Kawano, Elena Patel, Nirupama Rao, Michael Stevens, and Jesse Edgerton (Fed Working Papers)

Using a like-for-like comparison of public and private firms sourced from US tax returns, Fed and private sector economists find that contrary to the popular perception of “short-termism” among public companies, they actually invest more (especially in R&D) than privately held companies. [Link; 50 page PDF]

The Liking Gap in Conversations: Do People Like Us More Than We Think? by Erica J. Boothby, Gus Cooney, Gillian M. Sandstrom, Margaret S. Clark (Psychological Science)

A new paper argues that people under-estimate how much the people they meet and talk with like them, creating a gap between perception and reality. [Link]

Food

Human History: Brought to You by Wine, Cheese and Bread by Faye Flam (Bloomberg)

The use of basic food processing technology (making bread, wine, and cheese) are among the oldest human achievements. [Link; soft paywall]

Crypto

Yale Invests in Crypto Fund That Raised $400 Million by Alastair Marsh and Lily Katz (Bloomberg)

Yale’s huge endowment is dipping its toes into crypto, with $400mm dedicated to a new fund. While that seems like a huge number, it’s a drop in the bucket for the $30bn fund. [Link, soft paywall, auto-playing video]

Espionage

The Big Hack: How China Used a Tiny Chip to Infiltrate U.S. Companies by Jordan Roberson and Michael Riley (Bloomberg)

The astounding story of a chip placed on circuit board exports from China which may have allowed cover access to vast swathes of the US technology infrastructure. [Link; soft paywall]

Teller Tales

The $500 Million Central Bank Heist—and How It Was Foiled by Margot Patrick, Gabriele Steinhauser and Patricia Kowsmann (WSJ)

An alert teller at an HSBC branch in London found a request to transfer $2mm of a $500mm balance account to an account in Japan odd; the result was the uncovering of a massive fraud. [Link; paywall]

Nicotine

FDA Barges In on Vape Maker Juul, Seizes ‘Thousands’ of Documents by Andrew Couts (Gizmodo)

In an effort to uncover potentially illegal marketing towards teenagers, vape company Juul was raided by the FDA this week. [Link]

Athletic Bargaining Power

Earl Thomas and Le’Veon Bell are leading the way in how NFL players fight for their salaries by Natalie Weiner (SB Nation)

The anti-trust immune NFL has massive leverage over its employees (athletes) and those employees are starting to take a more aggressive approach in protecting their livelihoods. [Link]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

2018 Week 5

Week 4 Results: 6-7, Overall: 32-24 (57.1%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). Let’s see how we do…on to Week 5.

We were 6-7 in week 4, bringing our overall record through 4 weeks to 32-24 (57.1%).

2018 NFL Week 5 Bespoke Picks:

Tennessee (-5.5) at Buffalo: Tennessee -5.5

Miami at Cincinnati (-6): Cincinnati -6

Baltimore (-3) at Cleveland: Baltimore -3

Green Bay at Detroit Even: Green Bay Even

Jacksonville at Kansas City (-3): Kansas City -3

Denver (-1) at NY Jets: NY Jets +1

Atlanta at Pittsburgh (-3): Atlanta +3

NY Giants at Carolina (-6): NY Giants +6

Oakland at LA Chargers (-5.5): Oakland +5.5

Minnesota at Philadelphia (-3): Minnesota +3

Arizona at San Francisco (-3): San Francisco -3

LA Rams (-7.5) at Seattle: LA Rams -7.5

Dallas at Houston (-3): Dallas +3

Washington at New Orleans (-7): Washington +7

2018 NFL Week 4 Bespoke Results:

Cincinnati at Atlanta (-4): Cincinnati +4 (Win)

Tampa Bay at Chicago (-3): Tampa Bay +3 (Loss)

Detroit at Dallas (-2.5): Dallas -2.5 (Loss)

Buffalo at Green Bay (-10): Green Bay -10 (Win)

Philadelphia (-3) at Tennessee: Philadelphia -3 (Loss)

Houston at Indianapolis (Even): Indianapolis Even (Loss)

Miami at New England (-7): New England -7 (Win)

NY Jets at Jacksonville (-9): Jacksonville -9 (Win)

Cleveland at Oakland (-2.5): Oakland -2.5 (Win)

Seattle (-3) at Arizona: Seattle -3 (Push)

New Orleans (-3) at NY Giants: NY Giants +3 (Loss)

San Francisco at LA Chargers (-11.5): LA Chargers -11.5 (Loss)

Baltimore at Pittsburgh (-3): Baltimore +3 (Win)

Kansas City (-4.5) at Denver: Kansas City -4.5 (Loss)

The Bespoke Report – Growth Stocks Spooked

The Closer: End of Week Charts — 10/5/18

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

Below is a snapshot from today’s Closer highlighting intraday price moves in equities and interest rates this week. If you’d like to see more, start a free trial below.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

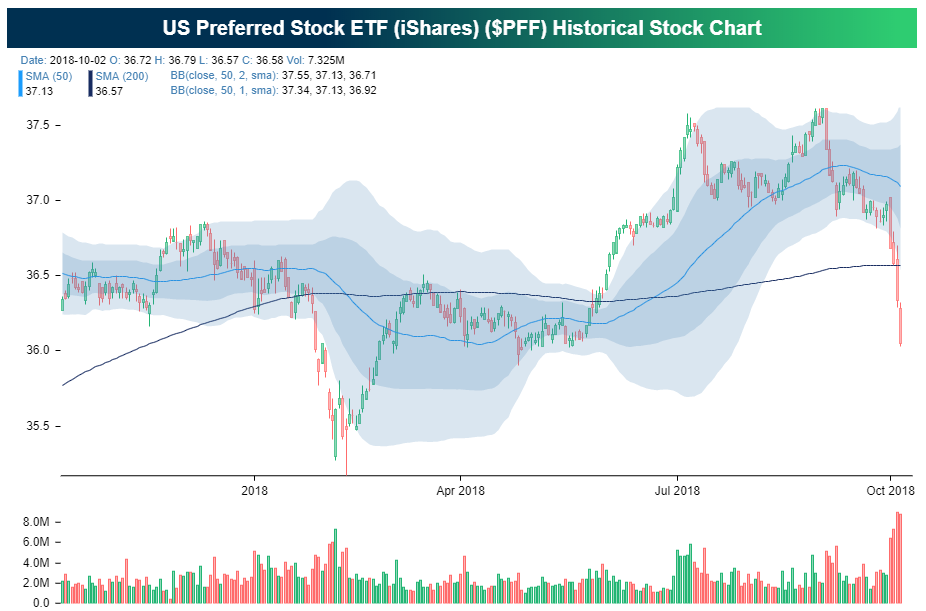

Preferred Shares Pummeled

One area of fixed income that’s gotten hit especially hard in recent days has been preferred shares. Preferred shares are hybrid securities that are similar to equity (with no obligation to return capital) with fixed income characteristics (a steady stream of coupon payments). They are also generally callable, giving issuers the option to buy them back. Their various features give them a return profile that gives them low volatility in most situations but can drive big declines when rates spike or credit spreads widen sharply. In recent days, it’s been the former. As shown, PFF (a preferred stock ETF) closed down more than 3.5 standard deviations below its 50-DMA, an extreme oversold reading if there ever was one.

To illustrate the relationship between PFF and credit/rates risk, in the chart below we show how PFF tends to track the price of LQD, an ETF comprised of US investment grade corporate bonds. While PFF and LQD don’t trade in lockstep, their general exposures are similar at different magnitudes.

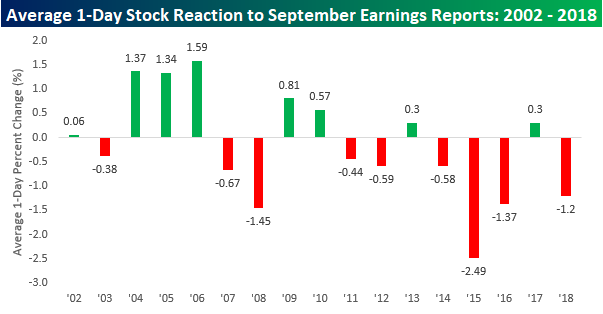

Weak Earnings Reactions

Most people are probably familiar with the Green Day song, “Wake Me When September Ends,” but in this case a more appropriate term may be “Wake Me When Earnings Season Ends.” While this past September was positive for the S&P 500, companies reporting earnings faced pretty brutal initial reactions. Of the 109 companies reporting earnings in September, the average one-day reaction to their earnings reports was a decline of 1.2%, and in the second half of the month, things were even worse. Of the 43 companies that reported in the second half of September, the average one-day reaction to earnings was a decline of 3.5% with only eight having positive initial reactions. While October has only just begun, things don’t look to be coming in much better as stocks like Stitch Fix (SFIX), Acuity Brands (AYI), and Cal-Maine (CALM) have all declined more than 5% in reaction to earnings, while only two stocks traded up (LW and PAYX).

Using our Earnings Report Screener, which is available to all Institutional clients, we ran a screen of how stocks reporting earnings in September have historically reacted to earnings going back to 2002. This is just one of the many useful screens clients can run using this invaluable tool.

As shown in the chart, the average one-day decline of 1.2% for companies reporting earnings in September wasn’t the worst of any year in our database, but it was the fourth weakest. The only other Septembers where stocks saw weaker one-day reactions to earnings were in 2015 (-2.49%), 2008 (-1.45%), and 2016 (-1.37%). The key question now is whether the weakness we have seen in reaction to earnings so far is a preview of what’s to come during the actual earnings season that runs from 10/10 through mid-November.

In a just-published B.I.G. Tips report, we did an extensive analysis of this topic which highlighted actionable trends. To see it, sign up for a monthly Bespoke Premium membership now!

Trend Analyzer – 10/5/18 – Dow Stands Firm

Yesterday’s widespread declines have eliminated gains from the week for all but one of the major US Index ETFs tracked in our Trend Analyzer tool. The Dow (DIA) is the only one to have edged out gains over the past five days, up 0.76%. It is also the only index ETF to hold firm in overbought territory; of the others, there are 6 oversold and 7 neutral. As you can see from the long tails in in the trading ranges, most ETFs have actually seen fairly large movements back towards or further below the 50-DMA. As we have made note of in the past, small-cap ETFs are falling the most. Core S&P Small-Cap (IJR), Micro-Cap (IWC), and the Russell 2000 (IWM) have moved deeply into oversold territory. IWC is down the most at 2.93%.

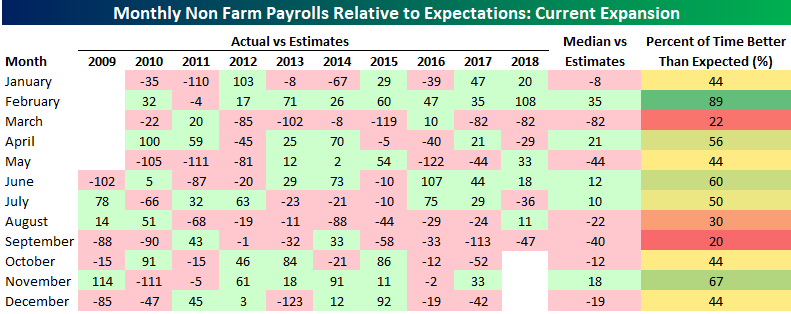

Morning Lineup – September Jobs Report Weaker Again

This morning’s release of the September Non-Farm Payrolls (NFP) report came in considerably weaker than expected at a level of 134K vs estimates for a gain of 181K. This weaker reading was especially surprising given the fact that most secondary indicators of employment for the month were positive. In this case, though, it must have all come down to seasonality. As we highlighted in yesterday’s preview report, “Seasonality is one factor not working in favor of a strong report tomorrow. Along with March, no other month has seen a weaker than expected initial release of the NFP more often than September.”

As shown in the table below, with today’s NFP report coming in weaker than expected again, September is now in the lead all by itself in terms of the greatest frequency of weaker than expected reports. In September reports over the last ten years, the initial release has only exceeded forecasts twice.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Vol Spike, China Drama, Factory Orders — 10/4/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we focus on the volatility spike today and cross asset signals from FX and commodities. Financials got a huge lift from the bear-steepening of the yield curve, doing something we haven’t seen since the first day of the current bull market. In economic data today, factory orders continue to come in strong. Finally, discuss the Vice President’s speech on the subject of China today.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!