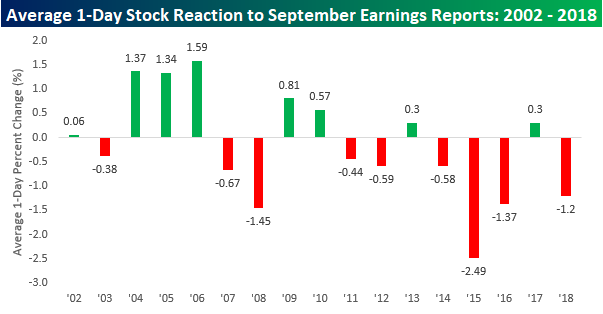

Most people are probably familiar with the Green Day song, “Wake Me When September Ends,” but in this case a more appropriate term may be “Wake Me When Earnings Season Ends.” While this past September was positive for the S&P 500, companies reporting earnings faced pretty brutal initial reactions. Of the 109 companies reporting earnings in September, the average one-day reaction to their earnings reports was a decline of 1.2%, and in the second half of the month, things were even worse. Of the 43 companies that reported in the second half of September, the average one-day reaction to earnings was a decline of 3.5% with only eight having positive initial reactions. While October has only just begun, things don’t look to be coming in much better as stocks like Stitch Fix (SFIX), Acuity Brands (AYI), and Cal-Maine (CALM) have all declined more than 5% in reaction to earnings, while only two stocks traded up (LW and PAYX).

Using our Earnings Report Screener, which is available to all Institutional clients, we ran a screen of how stocks reporting earnings in September have historically reacted to earnings going back to 2002. This is just one of the many useful screens clients can run using this invaluable tool.

As shown in the chart, the average one-day decline of 1.2% for companies reporting earnings in September wasn’t the worst of any year in our database, but it was the fourth weakest. The only other Septembers where stocks saw weaker one-day reactions to earnings were in 2015 (-2.49%), 2008 (-1.45%), and 2016 (-1.37%). The key question now is whether the weakness we have seen in reaction to earnings so far is a preview of what’s to come during the actual earnings season that runs from 10/10 through mid-November.

In a just-published B.I.G. Tips report, we did an extensive analysis of this topic which highlighted actionable trends. To see it, sign up for a monthly Bespoke Premium membership now!