25% Off At Amazon.com

It’s hard to believe but less than two months ago, Amazon.com (AMZN) was trading over $2,000 a share and briefly enjoyed a market cap of over $1,000,000,000,000.00. That’s right — a trillion dollars! Those days seem long gone now, though, as today AMZN is trading under $1,500 and down more than 25% from its recent highs. He may still be the richest person in the world, but Jeff Bezos now also owns the record for losing more wealth in the course of two days ($19.2 billion) than any other person.

While pretty uncommon in recent years, 25% drawdowns in the stock of AMZN have been relatively frequent. The last drawdown from a record closing high was back in February 2016 when AMZN was briefly down 30% from its previous high, and going back to the lows of the Financial Crisis in 2009, there have been a total of five prior drawdowns of more than 25% (red line). Also, while it is a little bit of a misleading statistic, AMZN has actually spent nearly half of its existence as a public company down at least 25% from its prior all-time closing high. The seven year stretch from 2000 to 2007 accounts for a big chunk of that percentage, but it does serve as a reminder that stocks don’t always trade right near all-time highs.

B.I.G. Tips – Consumers Still Confident

Despite turmoil in the stock market this month, US consumers remain optimistic. In the Conference Board’s read of consumer sentiment for the month of October, the headline index came in higher than expected, rising from 135.3 (revised from initial reading of 138.4) to 137.9 compared to expectations for a reading of 135.9. As shown in the chart below, October’s level is the highest since September 2000. As is usually the case, this month’s report highlights a number of important trends regarding the economy and financial markets that investors should be aware of.

In a just-published B.I.G. Tips report, we went through the details of this month’s Consumer Confidence report and highlighted some of the key trends investors should be aware of. To unlock immediate access to this report, sign up for a monthly Bespoke Premium membership now!

Trillions in Losses

Since the US stock market peaked on a closing basis back on September 20th, Russell 3,000 stocks have collectively lost roughly $3.5 trillion in market cap. Breaking the losses down by market cap, the 50 largest stocks in the US have lost roughly $1.25 trillion in market cap, while the 2,000 smallest have lost $350 billion.

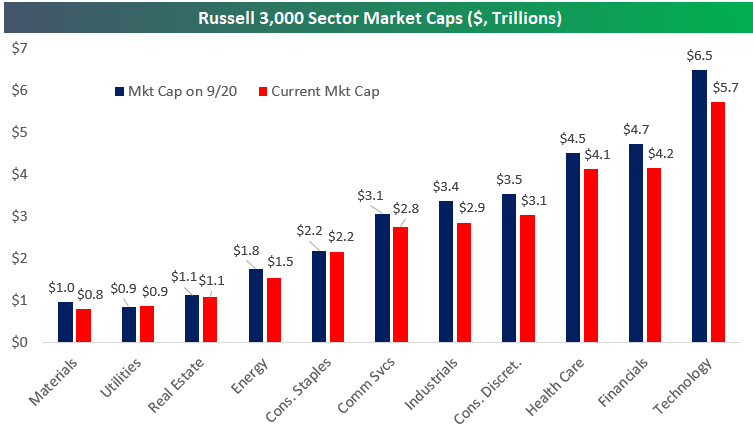

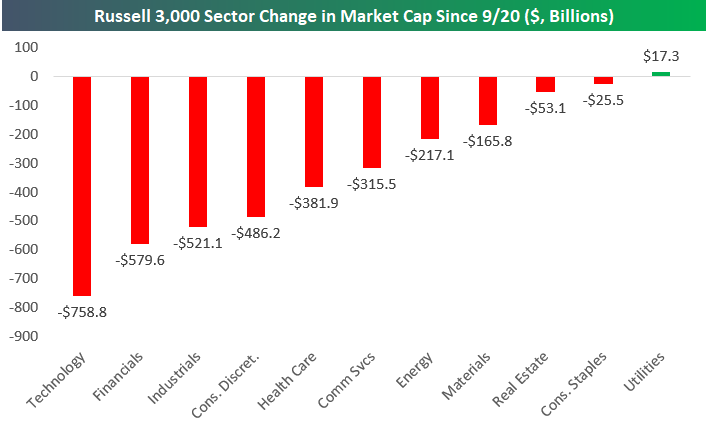

Below we show Russell 3,000 sector market caps as they stood on 9/20 and as they stand now, while in the second chart we show the change in market caps since 9/20.

As shown, Technology has lost by far the most market cap since the peak at -$758.8 billion, which isn’t surprising given that it’s the largest sector of the market. Financials have lost the second most at -$579.6 billion, followed by Industrials at -$521.1 billion and Consumer Discretionary at -$486.2 billion.

One sector — Utilities — has actually seen an increase in market cap since 9/20 as investors have rotated out of cyclicals and into defensives.

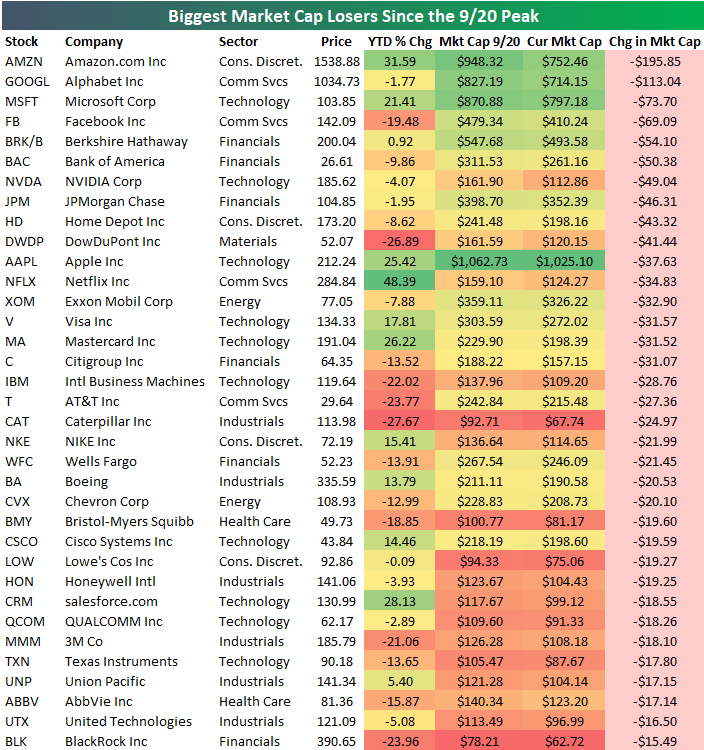

Below is a list of the individual stocks that have lost the most market cap since the 9/20 peak. Amazon.com (AMZN) has lost the most at -$195.85 billion, while Alphabet (GOOGL) ranks second worst at -$113 billion. Microsoft (MSFT), Facebook (FB), and Berkshire Hathaway (BRK/B) round out the top five with losses of more than $50 billion each.

Bespoke Stock Scores — 10/30/18

Trend Analyzer – 10/30/2018 – Seeing Red

As lower closes have become more or less the norm lately, the major US Index ETFs from our Trend Analyzer continue to look worse and worse. Every one of the members of this group is still deeply oversold. More concerning is that half of these are now in downtrends after declining all of October. Once again those fairing the worst are predominantly comprised of small to mid-caps. Up until this point, the other members of this group had held up relatively well. Even though they have been declining this month, they had not gone under levels from the start of the year. This does not hold as true anymore. An increasing number have either gone negative on the year or are close to it. The Nasdaq (QQQ) is the only one up more than 1% YTD. Furthermore, QQQ is a far cry from where it had been just one week ago. This time last week it had seen YTD gains of 12.28%, but since that time, QQQ has fallen 6.14%, cutting these gains by more than half to 5.38% YTD.

Morning Lineup – Another Gap Higher

The S&P 500 is looking to open higher again this morning following some crazy late-day trading yesterday. It may sound hard to believe, but today’s positive open will be the 11th time in 22 trading days this month that equities opened the day higher. Even though this has been one of the worst Octobers on record and the worst month in years, stocks have had positive opens on half of the trading days this month. The problem, as we all know by now, is what happens once that opening bell rings; there have only been six trading days where stocks have finished the day higher than they open.

For the full recap of all the major overnight developments around the globe, check out the full Morning Lineup.

When it comes to financial markets, the last few weeks provide a great example of how quickly gains can vanish. The chart below is from page two of our Morning Lineup, and it shows the relative strength of the S&P 500 vs the US Treasury Long Bond Future over the last year. When the line is rising it indicates outperformance from equities and vice versa.

It was only a month ago that the performance of equities was leaving treasuries in the dust, but in the span of less than one month, equities have given up more than half of their outperformance relative to Treasuries. Less than a month!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — EEM New Lows, Sector Dispersion, PCE, Manufacturing, Capex — 10/29/18

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we dive into how Tech is dragging down the market, or maybe more accurately how it isn’t holding the market up like it used to. We also take a look at some very bearish stats related to breadth today, the decline in EEM, and economic analysis in the form of personal income and spending, the last piece of data for our Five Fed Manufacturing index in October, and the outlook for capex spending.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

B.I.G. Tips – Last Two Days of BAD Months

Wire to Wire Selling

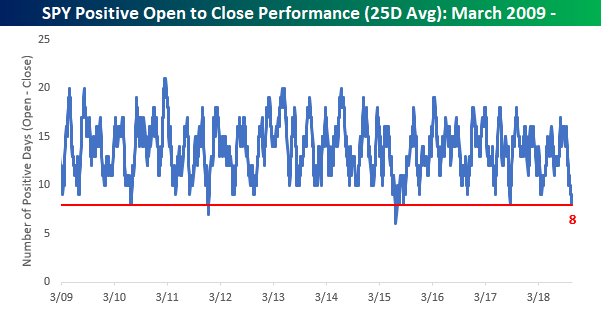

We’ve highlighted this trend a number of times and most recently this morning as well as in last Friday’s Bespoke Report, but the hours from 9:30 AM to 4:00 PM Eastern just haven’t been friendly to the bulls. Over the last 25 trading days, the S&P 500 tracking ETF (SPY) has closed higher than its opening price on just 8 trading days. The chart below shows the historical rolling 25-day total of days where SPY finished a trading day higher than its opening price going back to 2009. During that span, there have only been a handful of periods where we saw similar amounts of selling pressure over a five-week period and only two periods where there was even more relentless selling.

The two periods where the rolling 25-day total fell even lower were in December 2011 and July 2015, while the only two other periods of similar selling pressure were in July 2010 and August 2017. In three of these four prior periods, the S&P 500 was quick to regain its upward trend, but in July 2011, it was another six months before equities finally bottomed and started to rally again.

Clicks to Bricks?

“Rumors of my death have been greatly exaggerated.” — Mark Twain

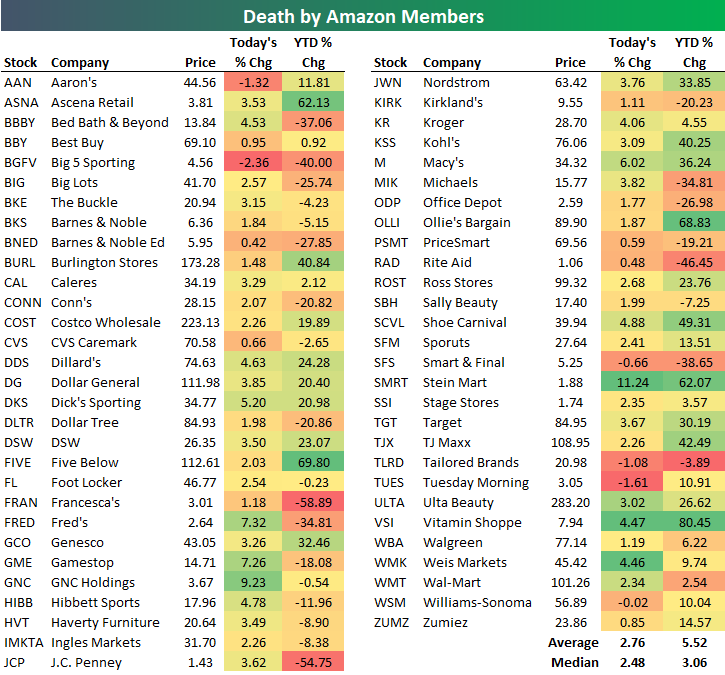

Traditional brick and mortar retailers are soaring today with the average stock in our Death by Amazon index up 2.76% on the day. As shown below, around half of these retailers are up 3-5% on the day with just a handful in the red.

As brick-and-mortar retailers see buying, Amazon.com (AMZN) has seen another wave of selling today with a drop of more than 4.5% as of mid-afternoon. This is on the heels of AMZN’s 7.82% drop on Friday after the company missed revenue estimates and lowered guidance for the second quarter in a row.

The chart for AMZN is really breaking down. After trading in a tight uptrend channel from October 2017 through August 2018, the stock is currently in free-fall in what appears to be a straight path towards $1,500/share. What’s remarkable is that even after the stock’s 23.6% decline from its highs, it’s still up 34% year-to-date!

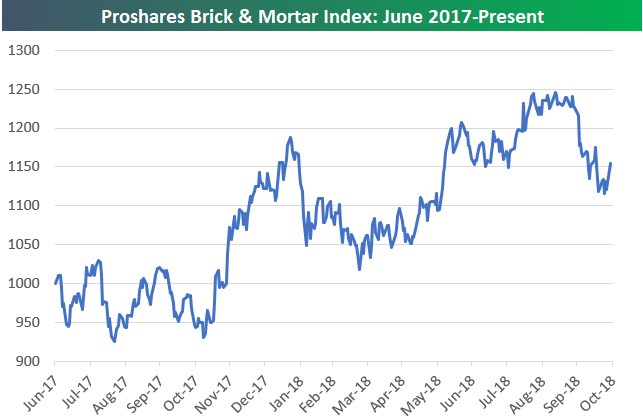

The chart for the Proshares Brick & Mortar index (which was created years after we formed the Death by Amazon index) has fallen a bit from its highs, but it still looks much more constructive than AMZN’s chart at this point, especially with today’s big bounce.

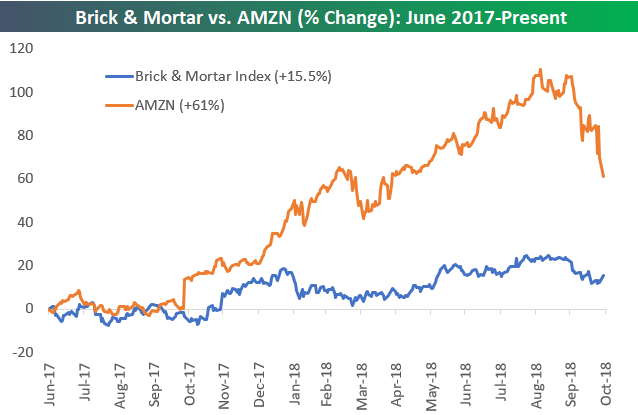

Since the Proshares Brick & Mortar index began back in June 2017, AMZN still holds a commanding lead on it. AMZN is up 61% versus a gain of 15.5% for Brick & Mortar. However, the fact that Brick & Mortar is in the green at all over the last 16 months is the real story. From mid-2015 through mid-2017, traditional retailers most at risk of online were slammed, but they’ve actually been performing quite well recently.