Best Stock Market Returns for a US President Since…Obama

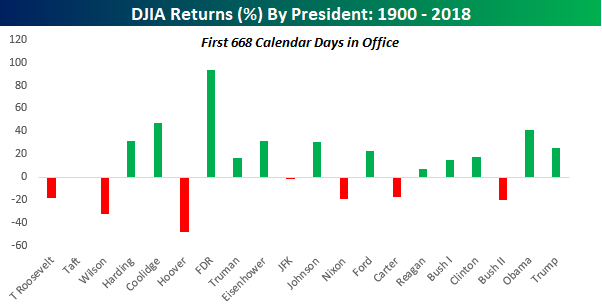

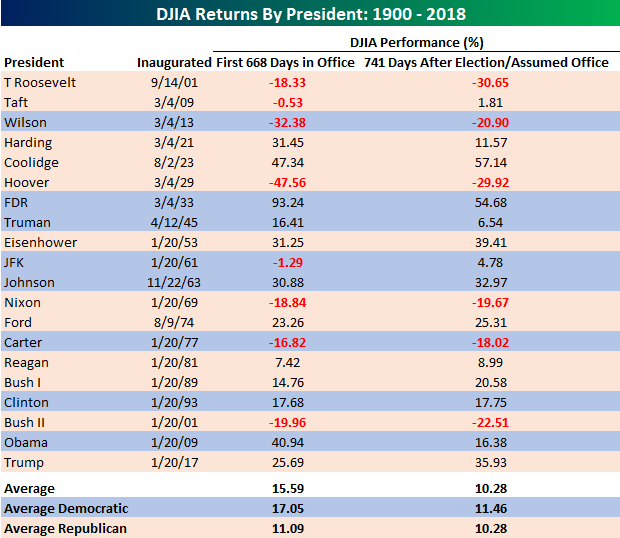

It may sound hard to believe, but for all the talk about how well the stock market has done under President Trump, the Dow Jones Industrial Average (DJIA) is actually up less (25.69%) since he took office than it was under President Obama (40.94%) at the same point in his Presidency! The chart below shows the DJIA’s historical returns during each US President’s first 668 calendar days in office going back to 1900. With a gain of 25.7%, the DJIA’s performance during President Trump’s first 668 calendar days in office is still well above the historical average for all US Presidents (15.59% – see table below) and even better when you compare it to just Republican Presidents (11.09%).

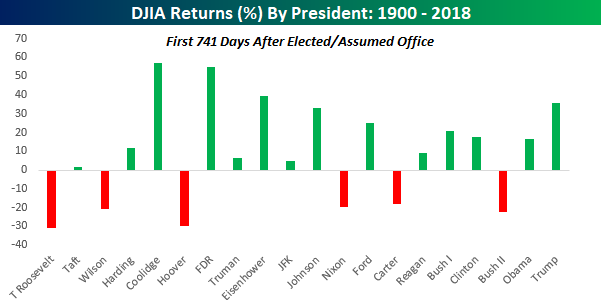

Looking at just the market’s performance since each President took office, however, may be considered a bit misleading given the fact that the market also tends to react swiftly once a President is elected. Based on this measure, even after the recent pullback in stock prices, the DJIA’s returns since President Trump was elected until now (741 days) are still the best since Eisenhower and more than twice the returns of Obama at the same point following his election in 2008.

In the table below, we have listed the DJIA’s returns for each US President since 1900 in both their first 668 days in office as well as the first 741 days after they were elected or assumed office. In the case of Presidents who weren’t elected, we used the date they first assumed office as the starting point for each period. Obviously, no method of measuring stock market returns is perfect and a lot of the rankings often are impacted by the political bias of the person reporting them. In terms of the charts above, Republicans will likely dismiss the first and focus on the second, while Democrats will do the opposite. As an investor, you should pay little attention. The basic takeaway here is that big moves over a short period of time can have a big impact on how the stock market supposedly views a President.

Chart of the Day: Fedspeak Shifts Into Dovish Territory

B.I.G. Tips – Housing Sentiment: Brutal

Trend Analyzer – 11/19/18 – Flat

This morning, our Trend Analyzer is more or less unchanged from this time last week. With the exception of the Nasdaq (QQQ), every major US Index ETF is in the same section of its trading range as five days ago. Along with QQQ, the Micro-cap ETF (IWC) is currently oversold while all others are unchanged at neutral. The Dow (DIA) has seen the largest downward movement within its trading range recently. It had been the only name above its 50-DMA, but with losses for a solid portion of last week, it has fallen closer to oversold. Despite this, unlike its peers, the ETF has still held onto its uptrend.

Morning Lineup – Quiet Start to a Quiet Week

It’s been a quiet start to what has historically been a quiet week, and the way things have been lately if this trend keeps up for the remainder for the day, that would be a win for the bulls. Pre-market equity futures are pretty much unchanged versus fair value on what has historically been the weakest day of the Thanksgiving week.

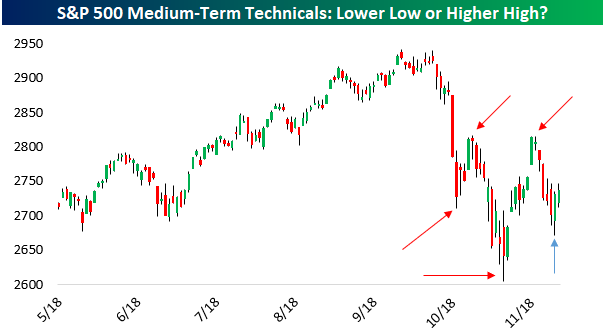

The most important question for technicians this week is whether the S&P 500 is poised to make a higher high or a lower low. As shown in the chart at left, the last two highs have been lower than the prior high (the most recent high was virtually the same, but slightly below, the prior one) while recent lows have been of the lower variety. Another lower low, in addition to a huge decline in percentage terms, would start to look pretty convincingly look like part of a new downtrend rather than a pullback in the broader bull market. A higher high, on the other hand, would be a signal that this drawdown was a sideways trend rather than a downward one and would do wonders for bulls’ confidence.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke Brunch Reads: 11/18/18

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, try a two-week free trial to Bespoke’s premium stock market research! You’ll be able to read our important “Equity Market Pros and Cons” report that was just published.

Here are our week 11 NFL picks vs. the spread. We’re 77-55 (58.33%) so far this season through 10 weeks.

Social Media

Facebook Morale Takes a Tumble Along With Stock Price by Deepa Seetharaman (WSJ)

As Facebook continues to digest swirling drama around content moderation, lobbying, and other scandals, the stock price continues to lose ground and that’s having a brutal impact on employee morale. [Link; paywall]

Burned to death because of a rumour on WhatsApp by Marcos Martínez (BBC)

The horrifying story of small town rumor mills turbo-charged by instant messages which resulted in the assault and murder of two entirely innocent men in Mexico. [Link]

Sports

NBA Stars Make It Easier for You to Watch Them Play Esports by Christopher Palmeri (Bloomberg)

Fans are starting to watch NBA players play their favorite video games, and a variety of different services are lining up to help facilitate more fan-player interaction. [Link; soft paywall]

No One Has Ever Crossed Antarctica Unsupported. Two Men Are Trying Right Now. by Adam Skolnick (NYT)

Two years ago, a man lost his life trying to cross the entire continent of Antarctica on foot, but that isn’t deterring two men from attempting the near-impossible. [Link; soft paywall]

Health

The Effects of Cognitive Behavioral Therapy as an Anti-Depressive Treatment is Falling: A Meta-Analysis by Tom J. Johnsen and Oddgeir Friborg (Psychological Bulletin)

Using data from 70 different studies between 1977 and 2014, the authors reach the conclusion that cognitive behavioral therapy (talk therapy) is becoming much less effective (or perhaps wasn’t that effective to begin with). [Link; 23 page PDF]

The Flu Shot Needs Fewer Stats And More Stories by Maryn McKenna (Wired)

Last flu season, almost 80,000 people died at the hands of the flu after only 37% of adults got the flu vaccine, despite efficacy and safety that could prevent thousands of deaths. [Link; soft paywall]

Food

I Found the Best Burger Place in America. And Then I Killed It. by Kevin Alexander (Thrillist)

The darker side of those lists you read – and decide where to eat based on – which had the horrible side effect of ruining the restaurant. A cautionary tale about which kinds of customers a business should focus on. [Link]

Welcome to the Golden Age of Grocery Shopping by Clint Rainey (Grub Street)

While the grocery business has been challenged in terms of margins, the benefits have been huge for consumers in terms of choices and prices. [Link]

Weird News

Face off: Realistic masks made in Japan find demand from tech, car companies by Kwiyeon Ha (Reuters)

One small Japanese company is cashing in on the market for highly realistic face masks, which have a surprising number of uses! [Link]

Raccoons drunk on crab apples cause false rabies scare in West Virginia by Cleve R. Woodson Jr. (BHMG News/WaPo)

The denizens of Milton, West Virginia were concerned that they were being terrorized by raccoons “behaving weirdly”; thankfully, rotting crab apples were the true source of the odd behavior. [Link]

History

The Economics of the Great War: A Centennial Perspective by Stephen Broadberry and Mark Harrison (VOXEU)

A sweeping overview of the historical causes, conduct, and consequences of the First World War; this week marked the 100th anniversary of Armistice Day. [Link]

Work Life

Cornering Your Boss, Snapping Pictures at Your Desk: It’s Take Your Parents to Work Day by Te-Ping Chen (WSJ)

In an aging society it shouldn’t really surprise us that office visits from parents rather than children are becoming a thing, but that doesn’t make it any less weird. [Link; paywall]

Mitch McConnell Guarantees Industrial Hemp Legalization by Kyle Jaeger (Marijuana Moment)

While federal decriminalization of marijuana probably isn’t happening soon, industrial hemp legalization is another story as the Senate Majority Leader has cleared the way for approval in the next farm bill. [Link]

Convenience, Consternation

The War Inside 7-Eleven by Lauren Etter and Michael Smith (Bloomberg)

Combining corporate power, federal law enforcement, and immigration law, this story is an incredible insight into the stand-off between 7-Eleven and its franchisees with significant collateral damage. [Link; soft paywall]

Hollywood

At Netflix, Who Wins When It’s Hollywood vs. the Algorithm? by Shalini Ramachandran and Joe Flint

In the race for viewer engagement, Netflix is often torn between what data tells it and the expertise it has hired to manage talent and produce content the old fashioned way. [Link; paywall]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

2018 Week 11

Week 10 Results: 9-3, Overall: 77-55 (58.33%)

Outside of financial markets, we’re also sports fans here at Bespoke. With new legal sports betting avenues now available across the US, we figured we’d have some fun and pick each NFL game versus the spread this season (as of Saturday evening). Let’s see how we do…on to Week 11. (Lines as of 10:05 PM ET on 11/17/18.)

We were 9-3 in week 10, bringing our overall record through 10 weeks to 77-55 (58.33%).

2018 NFL Week 11 Bespoke Picks:

Carolina (-4.5) at Detroit: Detroit +4.5

Dallas at Atlanta (-3): Dallas +3

Cincinnati at Baltimore (-5.5): Cincinnati +5.5

Minnesota at Chicago (-2.5): Minnesota +2.5

Philadelphia at New Orleans (-7.5): Philadelphia +7.5

Tennessee at Indianapolis (-1.5): Indianapolis -1.5

Houston (-3) at Washington: Washington +3

Tampa Bay at NY Giants (-2.5): NY Giants -2.5

Denver at LA Chargers (-7): LA Chargers -7

Oakland at Arizona (-5.5): Oakland +5.5

Pittsburgh (-5.5) at Jacksonville: Pittsburgh -5.5

Kansas City at LA Rams (-3.5): Kansas City +3.5

2018 NFL Week 10 Bespoke Results:

Buffalo at NY Jets (-7): Buffalo +7 (Win)

Atlanta (-6) at Cleveland: Cleveland +6 (Win)

New Orleans (-5.5) at Cincinnati: Cincinnati +5.5 (Loss)

Washington at Tampa Bay (-3): Washington +3 (Win)

New England (-6.5) at Tennessee: New England -6.5 (Loss)

Miami at Green Bay (-10): Green Bay -10 (Win)

Jacksonville at Indianapolis (-3): Jacksonville +3 (Push)

Detroit at Chicago (-7): Detroit +7 (Loss)

Arizona at Kansas City (-16): Arizona +16 (Win)

LA Chargers (-10) at Oakland: LA Chargers -10 (Win)

Seattle at LA Rams (-9.5): Seattle +9.5 (Win)

Dallas at Philadelphia (-7): Dallas +7 (Win)

NY Giants at San Francisco (-3): NY Giants +3 (Win)

The Bespoke Report: Equity Market Pros and Cons

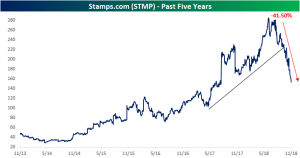

Stamps.com (STMP) Gets Stamped Out

Since reaching an all-time high back on June 18th of this year, Stamps.com (STMP) has broken its uptrend and moved straight down. As it currently stands, the stock is down 41.5% from its high. STMP is another name that has seen fantastic growth the past few years, but after hitting highs earlier this year, it has given up all of its momentum. The company has consistently reported strong quarters over the years with the last revenue or EPS miss happening back in Q2 of 2014.

So why has it gotten crushed despite seemingly solid earnings? Traders seem to be focused more on a slowdown in margins and political risks that come with the company. Over the past several quarters, despite strong headline numbers, gross margins have steadily slowed from higher cost of revenues. So the headline earnings reports essentially are being taken with a grain of salt.

Being so closely connected with the United States Postal Service, the company announced contract re-negotiations back in August that stoked investor concerns. Essentially, large parts of the business rely on USPS approval, and the results of negotiations determine some of the fixed costs and pricing of the company. For 2019, the USPS has proposed price increases around 10%. According to the company, these may not necessarily harm the company, but investors seem to disagree. In addition, on the political front, the United States’s potential withdrawal from the Universal Postal Union, which is an agreement that coordinates postal policies internationally, would further complicate the business, although again, in its most recent earnings report the company does not see withdrawal as a headwind seeing as most of the company’s customers interact within the United States. At the end of the day, STMP has seen tremendous growth over the past few years, but the innards of their earnings reports and political concerns have become a major headwind, not so much within the company, but in the market, and the market determines the price.

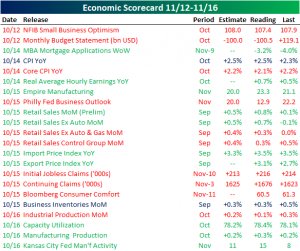

Economic Indicators This Week and Next — 11/16/18

This week was mixed for economic data with about half of indicators coming in positive and the other half negative. The major release early in the week was CPI data. The headline number came in line with expectations while Core CPI came in slightly lower YoY. Hourly earnings continued to accelerate; more confirmation of a tight labor market. Thursday was the busiest day of the week. Retail sales came in with a healthy beat. Also on Thursday, the first two of our five Fed manufacturing indices came in with Empire beating and Philly missing, but the internals were stronger. Today, we got one more of the five with Kansas City Fed’s manufacturing index beating estimates. Along with higher manufacturing production, we should expect a slight uptick in the ISM PMI for October, as we mentioned in Thursday’s Closer.

Next week will be a quiet one for economic data due to the Thanksgiving holiday. The first half of the week is all housing with the only release on Monday being the NAHB’s Housing Market Index, but more housing data follows Tuesday and Wednesday with housing starts, permits, and mortgage applications. Manufacturing data also releases Wednesday with transportation expected to drag down durable goods. Nothing will release on Thursday on account of Thanksgiving, but we cap off Friday with preliminary manufacturing and services PMIs.

As always you can check in on our Economic Monitor to get updated on the day’s economic releases.