It’s been a quiet start to what has historically been a quiet week, and the way things have been lately if this trend keeps up for the remainder for the day, that would be a win for the bulls. Pre-market equity futures are pretty much unchanged versus fair value on what has historically been the weakest day of the Thanksgiving week.

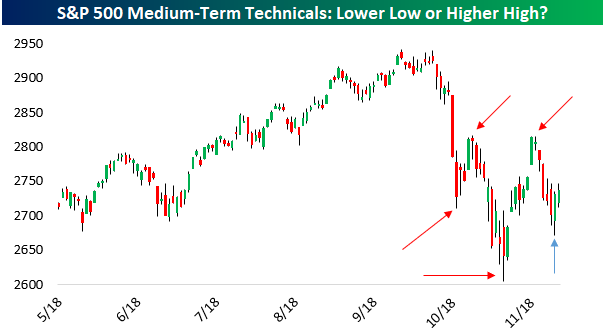

The most important question for technicians this week is whether the S&P 500 is poised to make a higher high or a lower low. As shown in the chart at left, the last two highs have been lower than the prior high (the most recent high was virtually the same, but slightly below, the prior one) while recent lows have been of the lower variety. Another lower low, in addition to a huge decline in percentage terms, would start to look pretty convincingly look like part of a new downtrend rather than a pullback in the broader bull market. A higher high, on the other hand, would be a signal that this drawdown was a sideways trend rather than a downward one and would do wonders for bulls’ confidence.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.