Morning Lineup – It’s Almost Over

The week that is. As for the market decline, it’s another story as to when that will end, but no matter how you slice it, stocks are trading at extremely oversold levels similar to short-term declines we saw in early 2016, August 2015, August 2011, and before that 2008. Today, equity futures are slightly higher, but is anyone going to put any trust in them at this point? We just had a big release of economic data and for the most part, the reports came in roughly in line to below expectations, but nothing was that far off the mark. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/21/18

We have two quick charts to highlight this morning. The first is the rolling 5-day change in the S&P 500 over the last ten years. As of yesterday’s close, the S&P 500 was down 6.9% over the prior five trading days. How does that stack up to the past? You may be surprised to see that back in February we actually had a sharper drop over five days. Overall, there have only been six other periods in the last ten years where the S&P 500 fell this much or more over such a short period. What’s unique about the most recent period relative to earlier this year is that the period of selling was much quicker back then. The current period has seen a lot more consistency in terms of selling, similar to 2011.

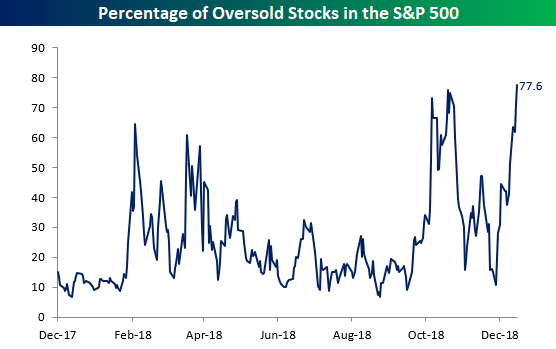

The next chart shows the percentage of oversold stocks in the S&P 500 (trading more than one standard deviation below their 50-day moving average). The current level of 77.6% is now the highest level in well over a year. In fact, you have to go back to January of 2016 to find a higher reading.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

2019 Outlook — The Year In Headlines

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Year In Headlines” section of the 2019 Bespoke Report, which recaps the market year with a sampling of headlines from Bloomberg and the Wall Street Journal.

To view this section immediately and all other sections as they’re published between now and December 21st, sign up for our 2019 Annual Outlook Special!

Bespoke CNBC Appearance (12/20)

Bespoke co-founder Paul Hickey appeared on CNBC’s Squawk Box on Thursday morning to discuss the markets and their reaction to Wednesday’s FOMC meeting. To view the segment, click on the image below.

2019 Outlook — Analyst Ratings

Our 2019 Bespoke Report market outlook is the most important piece of research that Bespoke publishes each year. We’ve been publishing our annual outlook piece since the formation of Bespoke in 2007, and it gets better and better each year! In this year’s edition, we’ll be covering every important topic you can think of dealing with financial markets as we enter 2019.

The 2019 Bespoke Report contains sections like Washington and Markets, Economic Cycles, Market Cycles, The Fed, Sector Technicals and Weightings, Stock Market Sentiment, Stock Market Seasonality, Housing, Commodities, and more. We’ll also be publishing a list of our favorite stocks and asset classes for 2019 and beyond.

We’ll be releasing individual sections of the report to subscribers until the full publication is completed by year-end. Today we have published the “Analyst Ratings” section of the 2019 Bespoke Report, which looks at the percentage of buy, sell, and hold ratings from Wall Street analysts and how they have changed over the last year. We also provide lists of the most and least loved stocks by analysts, and which stocks analysts have gotten the most bullish or bearish on this year.

To view this section immediately and all other sections as they’re published between now and December 21st, sign up for our 2019 Annual Outlook Special!

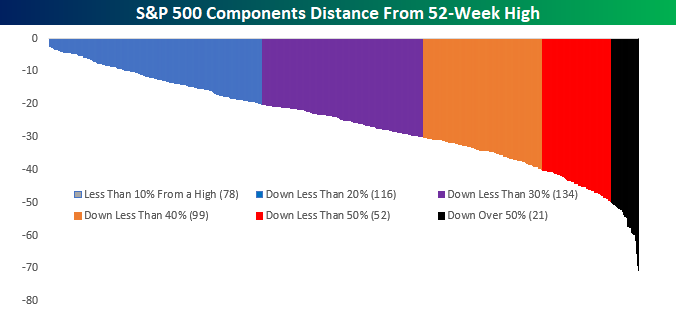

Average S&P 500 Stock Decline Exceeds 25%

The S&P 500 may not have reached bear market territory as an index yet, but of the 500 individual stocks in the index, more than 60% are down at least 20% from their 52-week highs. Overall, the average decline from a 52-week high is a staggering 25.7%! The chart below shows the distance each of the individual components is trading from their 52-week highs grouped by 10 percentage point ranges. As of Thursday afternoon, just 72 stocks in the S&P 500 are even trading within 10% of their 52-week highs. Meanwhile, 82 stocks in the index are down 40% or more with 24 of those 82 stocks down by more than half! Have their been uglier periods for the stock market? You bet. But not in a long time.

So which stocks are down the most? There are actually a number of well-known names with stocks like General Electric (GE), Western Digital (WDC), Nvidia (NVDA), Halliburton (HAL), Wynn Resorts (WYNN), Micron (MU), and Applied Materials (AMAT) all having been more than cut in half.

Bespoke’s Sector Snapshot — 12/20/18

Chart of the Day: CDS Checkup

Bulls Come Back…For Now

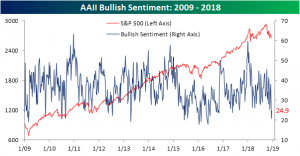

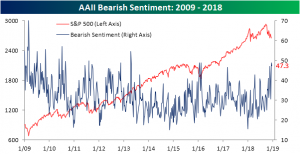

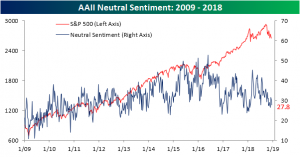

The survey of individual investor sentiment from AAII showed slightly more optimism this week with bullish sentiment coming in at just under 25%. That is a 4% jump from last week’s plunge to 20.9% taking equally from the bearish and neutral camp. Even with this increase, the results are not overly optimistic as bullish sentiment is still the minority opinion and at much lower than average levels. Last week’s reading was historically low, so it isn’t surprising that there was a small bounce. This week’s reading is also a divergence from price action in that time. On top of yesterday’s steep declines, markets have been broadly down since the last report alongside it being one of the worst Decembers to date, so an uptick—even a small one—is a bit of a surprise. If the current pace of market weakness continues, don’t expect the sentiment boost to last very long.

Additionally, yesterday’s declines in the wake of the FOMC meeting are also likely to drain optimism. A near majority of investors are still pessimistic on the market as bearish sentiment remains at extremely elevated levels. Ignoring the prior week, this week’s reading of 47.3% bearish sentiment is still right at multi-year highs. In addition, and we have been seeing this a lot of late, since the AAII survey closes on Wednesday nights, the full impact of Wednesday’s declines—especially late in the day like yesterday—can be reasoned to not fully come into play for the sample of surveyed investors. In other words, the damage done from Fed Chair Powell’s words likely weighed very lightly on this survey. Moving to next week, as scary of a thought as it may be, we could see yet another large rise in bearish sentiment to even more elevated levels if price action is similar to how it has been.

Meanwhile, neutral sentiment came in a few points lower at 27.8% from last week’s 30.23%. Neutral sentiment still outweighs bullish sentiment which expresses a decent degree of uncertainty among individual investors.

Jobless Claims Back Up

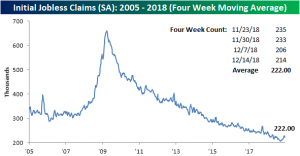

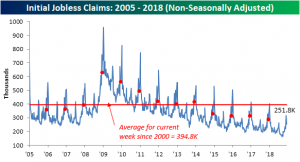

Following last week’s significant downtick to 206K for initial jobless claims, this week’s reading rose to 214K. This is slightly below the 215K rise that was expected, and while this week’s release is about 12K higher than last week, it is still at the lower end of the range we have seen in the past year. It is also well below the surprisingly elevated levels that we saw only a few weeks ago in late November.

As we have been highlighting, despite short-term upticks in claims, the indicator remains at very strong levels and has maintained some impressive streaks. This week marks the 63rd straight week with claims coming in at or below 250K. That’s the longest streak since the 89-week streak that ended in January 1970. Claims have also remained below 300K for a record 198 weeks.

The 4-week moving average saw a slight decline to 222K. This is only a little over 2K lower than last week’s 224.75K but well off of the short-term high of 228K from two weeks ago.

As we mentioned last week, the drop in claims was in line with seasonal patterns and likely bottomed out for the holiday season as this week’s uptick was to be expected. Claims still had their strongest week in the time since 2000 on a non-seasonally adjusted basis. It is also over 140K below the average for the current week since 2000.

Morning Lineup – The Day After

Equity futures are trading modestly lower this morning, and based on the market’s inability to hold on to any early gains anyway, maybe it’s a good thing that we’re starting out a little weaker. In case you missed it yesterday, the S&P 500’s negative reversal from an intraday gain of 1.5% to a decline of over 1.5% on the day was pretty monumental. The last time it happened was in February 2009! In economic news, Jobless Claims and the Philly Fed Manufacturing index both missed expectations with the Philly index hitting its lowest level since August 2016. Read today’s Bespoke Morning Lineup below for major macro and stock-specific news events, updated market internals, and detailed analysis and commentary:

Bespoke Morning Lineup – 12/20/18

Here’s a doozy for you and something not many would have expected back in January. Over the last 12 months, long-term Treasuries are now outperforming equities! The chart below is from the second page of today’s Morning Lineup, and it shows the relative strength of the S&P 500 versus long-term treasuries over the last year. When the line is rising, it indicates equities are outperforming and vice versa for a falling line. After outperforming Treasuries by a wide margin as recently as September, all of that outperformance has now been erased and equities are now underperforming!

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.