The Bespoke Report – 4/1/22 – Just a Mirage?

This week’s Bespoke Report newsletter is now available for members.

After a bounce in the second half of March that surprised just about everyone watching, the last two trading days of Q1 and the first trading day of Q2 have called into question whether or not the rally was the real thing. On the positive side, the gains that stalled out earlier this week pushed the S&P 500 back above its 50 and 200-day moving averages as well as the highs from early February forming a higher high in the process. On the negative side, the highs from February didn’t hold for long as Thursday’s waterfall decline to close out the quarter took the S&P 500 back below those levels.

Friday started off with some gains, but sellers quickly took control as equities weakened throughout the day before some stabilization into the close. While the February highs are overhead resistance again, bulls will be closely watching the major moving averages for signs of support. This week’s declines haven’t been enough yet to cause bulls to lose hope, but it won’t be a worry-free weekend either.

With the beginning of a new quarter, markets are in a bit of a limbo period as investors await what is likely to be a volatile earnings season, but there was still a lot to cover this week. There’s not enough time (or computer memory) to cover everything that transpired this week, but we tried to cover some of the most pressing macro issues. Make sure to check it all out in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Bespoke Market Calendar — April 2022

Please click the image below to view our April 2022 market calendar. This calendar includes the S&P 500’s average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Crypto Report – 4/1/22

Bespoke’s Crypto Report contains numerous technical, momentum, and sentiment charts for bitcoin, ethereum, and other key cryptos. Page 1 of the report includes our weekly commentary on the space and attempts to identify any new trends that are emerging. The remaining pages include important overbought/oversold levels to watch, charts on historical drawdowns and rallies, seasonality trends, futures positioning data, Google search trend shifts, and more. Our weekly Crypto Report is produced so that followers of the space can more easily stay on top of price action, technicals, seasonality, and sentiment.

Sign up for a monthly or annual subscription to Bespoke Crypto to receive our weekly Crypto Report and anything else we publish related to cryptos. Note: If you’re currently a Bespoke Premium, Bespoke Newsletter, or Bespoke Institutional subscriber, you’ll need to subscribe to Bespoke Crypto as an add-on to receive access. The weekly Crypto Report and any additional crypto analysis is not included with our Premium, Newsletter, or Institutional memberships. You can sign up for Bespoke Crypto and receive our Crypto Report in your inbox weekly using the monthly or annual checkout links below. If you sign up for the annual plan, the first year of access is 50% off!

Bespoke Crypto Access — Monthly Payment Plan ($49/mth)

Bespoke Crypto Access — Annual Payment Plan ($247.50 for the first 12 months, then $495/year in year 2 and beyond)

Bespoke Investment Group, LLC believes all information contained in this service to be accurate, but we do not guarantee its accuracy. None of the information in this service or any opinions expressed constitutes a solicitation of the purchase or sale of any securities, commodities, or cryptocurrencies. This service contains no buy or sell recommendations. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

Bespoke’s Consumer Pulse Report — April 2022

Bespoke’s Morning Lineup – 4/1/22 – Clean Slate

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The strength of the team is each individual member. The strength of each member is the team.” – Phil Jackson

It’s a new quarter today, but markets will get right into it today with a good deal of economic data. For starters, we get the March employment report at 8:30 eastern, and then at 10 AM, we’ll get Construction Spending and the ISM Manufacturing report. While payrolls are expected to show a modest decline, ISM Manufacturing is expected to see a modest bounce. With the employment report, though, the devil will be in the details.

In Europe, equities are trading higher following what has generally been weak manufacturing PMI data in the region. Interest rates are moving higher on the day while crude oil has dropped below $100 per barrel.

After a plunge into the close yesterday, futures are looking to claw back those losses in early trading, but even at current levels, we’re only basically back to where we were a half-hour before yesterday’s close.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

April may bring showers in terms of the weather, but historically it has been one of the greener months of the year. Over the last 100 years, the Dow’s average gain of 1.46% with positive returns 62% of the time ranks as the third-best of any month behind July (1.65%) and December (1.52%). In the last 50 years, the 68% frequency of positive returns hasn’t been the most consistent, but the 2.21% average gain is easily the highest of any month. Likewise, the average gain of 2.21% in the last 20 years has also been the strongest of any month. Not only that, but with just three down Aprils over the last 20 years, no other month during this period has been more consistent to the upside.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

The Bespoke 50 Growth Stocks – 3/31/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Chart of the Day: Same Old Story As Stocks Move Off Their Highs

Bears Go Back Into Hibernation

The last couple weeks of the first quarter have seen equities reverse a sizable portion of this year’s losses and sentiment has rebounded in sync, though, bullish sentiment turned slightly lower this week in spite of the S&P 500’s move higher. From the weekly AAII sentiment survey, bullish sentiment shed 0.9 percentage points coming in at 31.9%. Even after that decline, the current level of reported optimism remains above all others (outside of last week) since early January, but bullish sentiment still would need to rise another 6 percentage points to move back up to its historical average.

While more investors are not reporting much optimism, fewer are outright bearish. Bearish sentiment fell for a second week in a row falling another 7.9 percentage points to 27.5%. With a little over a quarter of respondents reporting as bearish, this sentiment reading is at the lowest level since November. That is also now the biggest two-week decline in bearish sentiment (22.3 percentage points) since November 2009 when it had fallen 23.74 percentage points in a two-week span.

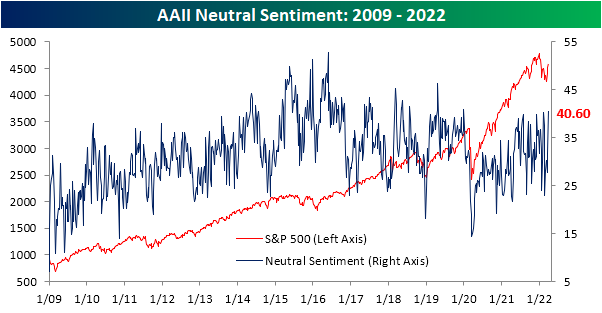

Finally, we would note that given bearish sentiment has plummeted at a historic rate without much of an increase in bullish sentiment, neutral sentiment has picked up the difference. That reading clipped above 40% this week for the highest level since January 2020.

Other sentiment surveys like the Investors Intelligence one and NAAIM’s Exposure Index have also pivoted more bullish this week. As a result, our sentiment composite is close to zero meaning across these three indicators, sentiment is now only just slightly below the historical average. Click here to view Bespoke’s premium membership options.

Continuing Claims At The Lowest Level Since 1969

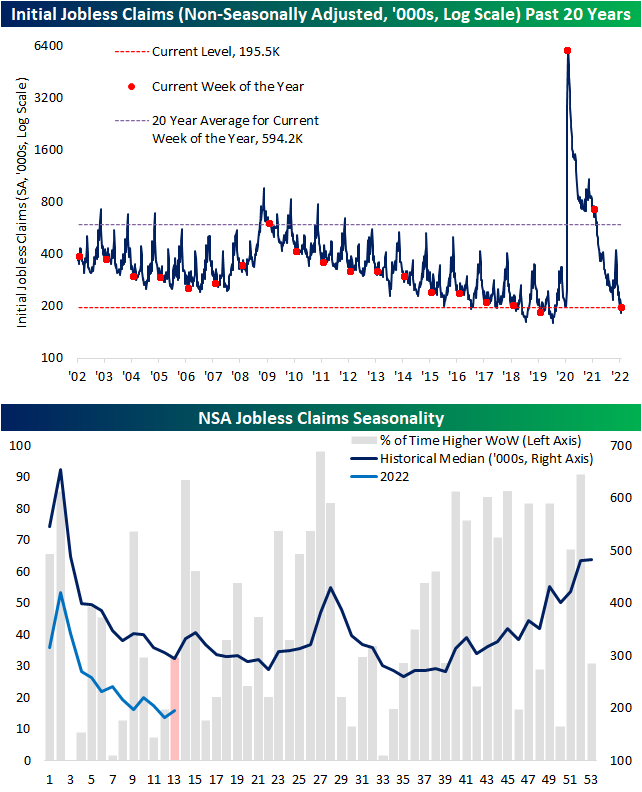

Whereas last week’s release of initial jobless claims set a new multi-decade low, this week that number was revised up by 1K. That means last week’s revised reading of 188K matched the December low. Turning to this week, claims came off that low rising 14K. Albeit higher, at 202K initial claims remain at historically strong levels.

On a non-seasonally adjusted basis, claims had another sub-200K showing after rising 13.2K week over week. In terms of seasonality, the current week of the year has historically seen unadjusted claims fall sequentially more often than not, and the following couple of weeks have tended to see a seasonal uptick in claims. In other words, we’re likely to see claims rise on account of seasonal factors in the coming weeks.

Delayed one week to initial claims, the continuing claims number was the most impressive part of the most recent release. Coming in just above 1.3 million, seasonally adjusted claims hit the lowest level since the final week of 1969. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 3/31/22 – Au Revoir

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I ought to be jealous of the tower. She is more famous than I am.” – Gustave Eiffel

133 years ago today, the Eiffel Tower, one of the most iconic landmarks in the world today opened for business. It may sound hard to believe, but when the tower first opened a number of critics thought it would be an eyesore on the Paris landscape, and twenty years after it opened the Eiffel Tower was almost demolished when the lease on the land it stood on expired. The main reason it was spared was because of its utility as a radio antenna! More than 100 years later, the mere thought of Paris without the Eiffel tower would be considered a sacrilege. Just like in the stock market and everything else in life, one person’s (or generation’s) trash is another one’s treasure.

In markets this morning, investors want nothing to do with oil as WTI is trading down more than 5% on reports of a massive stockpile release from the US Strategic Petroleum Reserve (SPR). For more on this and how the SPR works, make sure to check out our explanation in today’s Morning Lineup. The weakness in futures has equity futures up modestly, but it’s the last day of the quarter, so expect to see a decent amount of volatility throughout the trading day.

In economic news, we just got a slug of economic data this morning, and there weren’t that many major outliers. Perhaps the biggest outlier was Personal Spending which rose 0.2% versus forecasts for an increase of 0.5%.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

There’s still a day left in the quarter, and despite the strong rally in the last couple of weeks, for the majority of stocks and sectors, it has been a quarter to forget. On a year-to-date basis, Energy is the clear leader with a gain of more than 40%, but over the last week, both Utilities and Financials have moved into positive territory for the year. At the other end of the spectrum, Communications Services, Consumer Discretionary, Technology, and Real Estate are all still looking at losses of more than 5%. Not great, but it could have been a lot worse were it not for the 3.5%+ gains in the last week.

While the vast majority of sectors are looking at YTD declines to close out Q1, they’re also trading at short-term overbought levels. All eleven sectors are currently above their 50-DMAs, and all but Financials and Communication Services are also ‘overbought’ (at least one standard deviation above their 50-DMA.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.