Chart of the Day: Early Bird Not Getting The Worm

Homebuilder Sentiment Tanks… Again

As mortgage rates remain elevated relative to 2021 levels but housing supply remains thin, NAHB’s Housing Market Index fell again this month, reaching the lowest level since May of 2020. Last month, the index posted its second largest month over month decline, and following this report, the index has fallen by 18 points over the last two months, the third largest two month decline on record, falling just short of April and May of 2020. Click here to start a two-week trial to Bespoke Premium and receive our paid content in real-time.

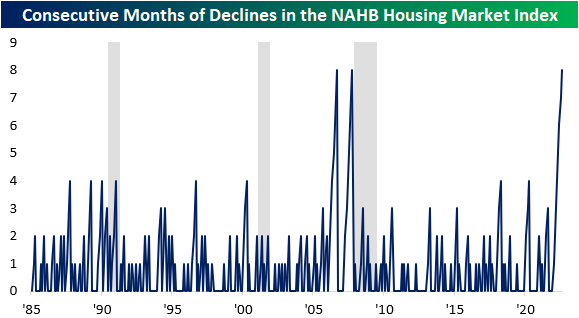

The NAHB Housing Market Index has now declined for eight consecutive months, which is tied for the longest monthly losing streak since the index’s inception in 1985. The only two other periods with an equal number of monthly declines were the eight months ending in October 2007 and before that September 2006. As most Americans remember, these periods were followed by precipitous declines in home values. Interestingly, the NY Post reported that Google searches for “sell my home fast” spiked by 2,750%.

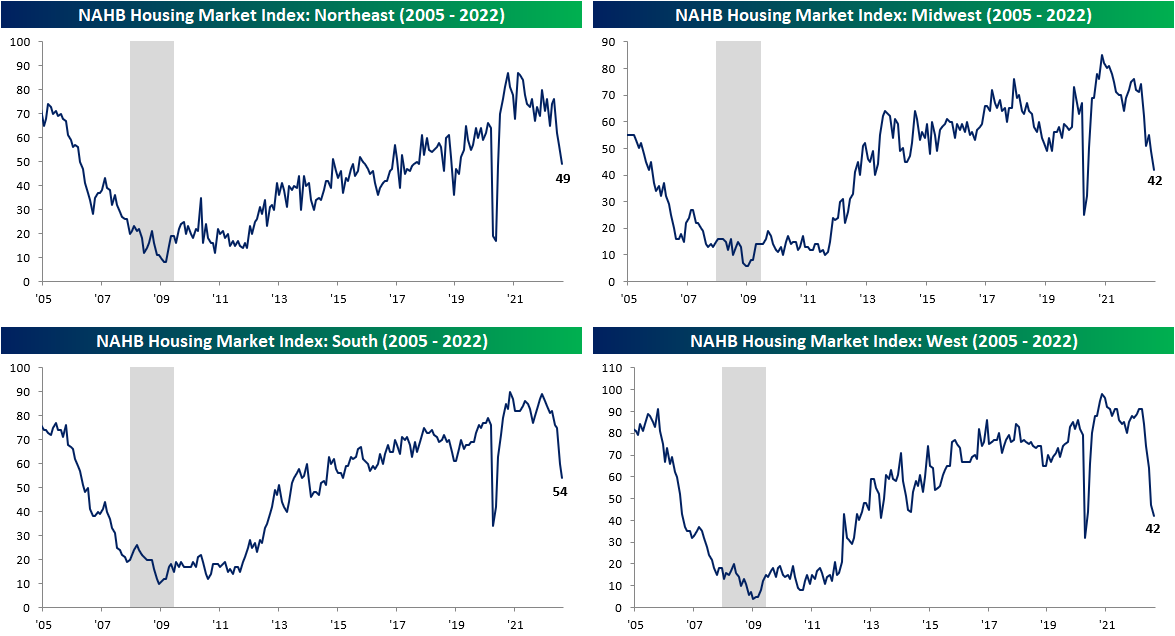

All of the sub-indices within the report fell as well, indicating broad weakness. Apart from Future Sales and sentiment in the Western region, all of the other sub-indices experienced declines that were in the bottom 5th percentile of all periods. However, the current readings are not nearly as negative. Future sales and traffic are in the 18th and 23rd percentile, but the Northeast is still in the 63rd percentile. Although the current readings aren’t as low as the readings leading up to previous recessions, it is difficult to be positive given the current trends.

As shown above, no geographic region has been safe from the plunge in sentiment, but the Northeast has held up better than the others. Over the last eight months, the West, South, and Midwest regions have seen their largest eight-month declines in the index on record, while the decline in the Northeast is the third worst on record. Click here to start a two-week trial to Bespoke Premium and receive our paid content in real-time.

The stocks most affected by these trends – homebuilders – struggled during the sustained sell-off between the end of 2021 and mid-June, but have recovered by over 28% relative to the lows. However, the ETF is still down over 22% relative to the highs. The recovery might be due to the fact that much of the negativity has been priced in, historically low valuation multiples, and a pullback in interest rates. The chart below shows the performance of the SPDR S&P Homebuilders ETF (XBH). As you can see, XBH has broken its downtrend and has been moving consistently higher carving out what might be a new uptrend.

Empire Collapses

The first regional Fed manufacturing reading for the month of August which came from the NY Fed showed a massive slowdown in general business conditions. The headline number was expected to fall but remain positive at 5. Instead, the index plummeted all the way down to a contractionary reading of -31.3. That is the fourth lowest reading on record, the lowest reading since May 2020, and the largest one-month decline since April 2020. In other words, New York area manufacturers reported rapid deterioration in business conditions in the first half of August.

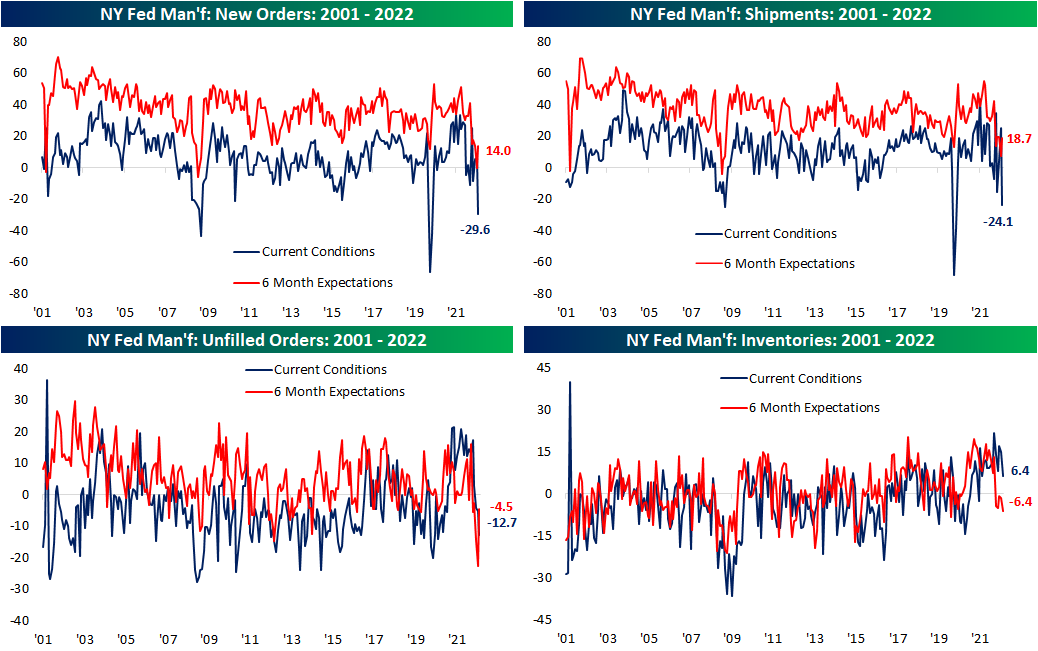

Breadth was equally horrendous. The sole index that managed to move higher month over month was Prices Received while declines in all of the others resulted in all but four categories falling into contraction territory. Future expectations are only slightly more positive than current conditions, albeit these too are seeing readings in the bottom few percentiles of their historical ranges even after significant moves to the upside month over month.

The most pronounced drop of any category was New Orders and Shipments with month-over-month declines of 35.8 points and 49.4 points, respectively. For both, that was the largest month-over-month drop on record with both indices now in the bottom 1% of all readings as a result. Unfilled Orders fell deeper into contraction with a less dramatic 7.5 point decline month over month.

Expectations were the inverse of that story. New Orders, Shipments, and Unfilled Orders all saw upper decile monthly increases with Unfilled Orders’ 18.1 point rise the second largest on record behind May 2010.

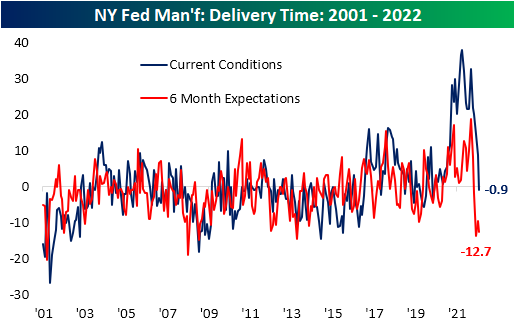

The past couple of months have seen plenty of evidence that supply chain stress has begun to ease, and this month’s report from the NY Fed added yet another data point of evidence. For the first time since May 2020, the Delivery Times index fell into contraction meaning responding firms reported a decline in how long it took for products to reach their destinations. That trend is also expected to continue as six-month expectations continue to hover around the low end of the historical range.

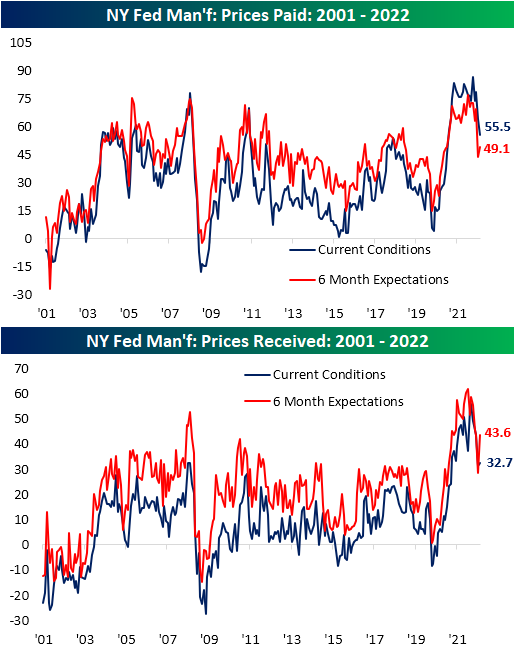

Alongside supply chain pressures, inflation pressures have likewise shown signs of easing. The Prices Paid and Prices Received index have both peaked and come in well off of prior highs of the past year indicating fewer firms are paying suppliers more or raising their prices.

Across manufacturing reports of late, employment metrics have been somewhat of a bright spot as they have managed to hold up in spite of signs of slowing demand. In August, employment did not stand out as strongly. On net, firms continue to increase their number of employees but at the slowest rate since October 2020. Meanwhile, the Average Workweek contracted to an extent not seen since the first few months of the pandemic, late 2015, during the Financial Crisis, or in the aftermath of 9/11. Meanwhile, companies are beginning to pull back on capital spending at a rapid rate as indices tracking plans for Technology Spending and Capital Expenditure have fallen sharply. For the latter, the two-month decline is now the fifth worst of any period on record. Click here to learn more about Bespoke’s premium stock market research service.

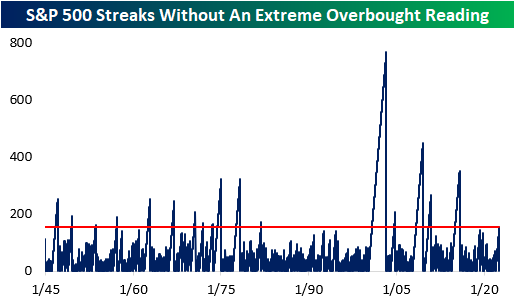

S&P 500 Reaches Extreme Overbought Levels

On Friday, the S&P 500 rallied 1.7% to round off the fourth straight week of gains. Relative to the mid-June lows, the index has rallied 16.7%, a notable move as YTD weakness subsides (at least for now). With Friday’s move, the S&P 500 also closed more than two standard deviations above its 50-day moving average for the first time since 12/29/21, marking the end of a 155-day trading day streak in which the index did not close at ‘extreme’ overbought levels.

A streak of this length had not been reached since 2015, and the longest streak since WWII ended in 2003 (768 trading days). All in all, there have now been 27 streaks since WWII where the S&P 500 went at least six months without registering a close in ‘extreme’ overbought territory. Click here to start a two-week trial to Bespoke Premium and receive our paid content in real-time.

For investors who are long equities, it’s hard not to like the way stocks have performed in recent weeks. However, with the market reaching overbought levels after a sharp rally, fears of a pullback increase as moves of this magnitude may be unsustainable. Historically speaking, median returns following the end of prior streaks without an ‘extreme’ overbought reading that lasted at least six months have, in aggregate, been followed by decent returns. For every time period we looked at (next day, next week, one month, three months, and six months), median returns were positive and better than the historical average for all comparable time periods since WWII. Over the next three months, for example, the S&P 500’s median performance was a gain of 4.4% which is 1.8 percentage points better than the historical average for all six-month periods. From a historical perspective at least, when equities reach ‘extreme’ overbought levels after a prolonged period without a similar reading, fears of an imminent reversal were typically unwarranted.

Positivity rates tend to be superior as well, apart from one month forward. Over the next week (which would be through the end of the week in this case), the S&P 500 has performed positively 77% of the time, which is 20 percentage points higher than that of all periods. Over the next three and six months, the positivity rate has been 73%, which is also quite positive. Click here to start a two-week trial to Bespoke Premium and receive our paid content in real-time.

To paint the full picture, the maximum drawdown following these occurrences was in November of 1981, when the S&P 500 fell by 10.8% over the next three months and 11.6% over the following six months. On the flip side, the best performance occurred following the January of 1975 occurrence, when the index went on to gain 14.4% and 17.7% over the next three and six months, respectively. Over the following month, the data has a range of -7.1% to +6.6%. Click here to start a two-week trial to Bespoke Premium and receive our paid content in real time.

Bespoke’s Morning Lineup – 8/15/22 – The Best of Times and the Worst of Times

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“A day wasted on others is not wasted on one’s self.” – Charles Dickens

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Coming out of a four-week winning streak, bad news out of China has put pressure on stocks to kick off the week. S&P 500 futures have been trading down over half of one percent this morning, but that weakness comes after a four-week rally of over 10% which took the S&P 500 to ‘extreme’ overbought levels (more than two standard deviations above 50-DMA) to close out last week.

The week kicks off on the economic calendar with the Empire Manufacturing report at 8:30 Eastern and then Homebuilder Sentiment at 10 AM. Both of these numbers will be for the month of August, so bulls will want to see improvement in both readings to allay any concerns over the health of the economy.

Today’s Morning Lineup discusses earnings and market news from Europe and the Americas, overnight economic data, including the weaker than expected data out of China which prompted a surprise rate cut, and much more.

A lot of people go on vacation in the second half of August, so things often tend to quiet down. In a perfect world, the slowdown would be accompanied by a period where not much occurs in the markets. Every so often, though, less liquidity at this time of year can exacerbate the impact of news and cause an exaggerated move in markets. Usually, the direction is lower. From a seasonal perspective, the upcoming one-week period has historically been one of the weakest of the year. Over the last ten years, the S&P 500’s median decline from the close on 8/15 through 8/22 has been a decline of 0.26% which ranks in just the 22nd percentile of all one-week periods throughout the year. As bad as the upcoming week has tended to be for stocks, the next three months have historically been one of the better periods as the S&P 500’s median gain has been 4.56% which ranks in the 86th percentile of all three-month periods throughout the year.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 8/14/22

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day free trial!

Lawmaking

Congress Just Passed a Big Climate Bill. No, Not That One. by Robinson Meyer (The Atlantic)

In addition to the passage of the Inflation Reduction Act this week, Congress passed the CHIPS Act earlier this summer, with as much as one quarter of its $280bn in outlays aimed at accelerating zero-carbon and climate-relevant industries. [Link; soft paywall]

The Sinema-Manchin split that shaped Dems’ deal by Burgess Everett and Marianne Levine (Politico)

A tick-tock recap of the furious dealmaking which allowed Democrats to move their climate and taxation bill through the Senate and in to law with no margin for error. [Link]

Energy

Oil is back on the menu as energy majors return to exploration by Robin Millls (The National News)

While the oil industry capex response to higher prices has been at best tepid so far, there are signs of rising interest in new large-scale projects, including deep offshore exploration. [Link]

The Place With the Most Lithium Is Blowing the Electric-Car Revolution by Ryan Dube (WSJ)

Left wing politics, a history of environmental exploitation, vocal indigenous communities, and booming demand for lithium make the process of extracting it in South America fraught at best as electric vehicle production explodes. [Link; paywall]

China

China Graft Probes Stem From Anger Over Failed Chip Plans (Bloomberg)

An effort to build domestic capacity in semiconductors manufacturing and development has been relatively unsuccessful in China, which has so far failed to keep up with American intellectual property that underpins global chip use. [Link; soft paywall, auto-playing video]

China’s Current Account: A Very Nerdy Investigative Thread by Adam Wolfe (Thread Reader/Twitter)

A detailed dive into why the huge increase in the Chinese goods trade surplus hasn’t led to a similar increase in the country’s current account surplus. [Link]

Investing

RIP Big Bull Market (1982-2022) by Andy Kessler (WSJ)

A history of the massive trend towards capital appreciation dating from the early 1980s which may finally be coming to a close with the end of ever-lower interest rates. [Link; paywall]

Hedge Funds Face SEC Demand To Share More About Their Strategies by Lydia Beyoud (FA Mag)

A new SEC proposal would see a requirement that hedge funds provide regulators with more details about their strategies, which would allow the SEC to better understand risks in the financial system. [Link]

Inflation

The Snowballing US Rental Crisis Is Sparing Nowhere and No One by Maria Paula Mijares Torres and Jonnelle Marte (Bloomberg)

Across the country, rents are soaring far above incomes thanks to low vacancy rates and a dearth of new buildings as well as pandemic-era high demand for housing that hasn’t faded much yet. [Link; soft paywall]

Richer people are eating more at Applebee’s and IHOP by Danielle Winer-Bronner (CNN)

Down-market but still full-service restaurants are seeing improving foot traffic and consumer spend as higher-income consumers trade the steakhouse for a more humble meal. [Link]

Labor Markets

Business Is Booming for Layoff Specialists: ‘Never Seen Anything Like This’ by Maxwell Strachan (Vice)

Tech companies used to ramping up hiring rather than reducing headcount are scrambling for expertise as they look to fire staff that were added as part of over-optimistic expansion plans pre-dating the recent collapse in valuations. [Link]

Iranian charged in alleged plot to kill ex-Trump adviser John Bolton by Ellen Nakashima and Perry Stein (WaPo)

A Justice Department investigation uncovered an Iranian IRGC member attempted to book a $300k hit on Bolton; the suspect is presumed to have fled back to Iran. [Link; soft paywall]

Social Media

Teens, Social Media and Technology 2022 by Emily A. Vogels, Risa Gelles-Watnick, and Navid Massarat (Pew)

Use of Facebook among teens has plunged, with Twitter also down. Instagram and Snapchat are more popular while TikTok is second-place to YouTube; 95% of teens say they’ve used Google’s video site. [Link]

Vaccination

A vaccine for Lyme disease is in its final clinical trial by Bill Chappell (NPR)

As Lyme disease spreads across a greater territory of the US, a vaccine designed to prevent it has entered Phase 3 trials and could be available as soon as 2025. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 8/12/22 – Inflation Superfecta

This week’s Bespoke Report newsletter is now available for members.

After a strong jobs report last Friday reignited fears of an overheating economy, markets were edgy heading into a busy week for inflation data. It doesn’t happen that often, but bulls hit the inflation superfecta. It started with Monday’s release of the July Survey of Consumer Expectations which showed a continued decline in inflation expectations. On Wednesday, the big bad CPI report for July was released and that came in lower than expected for a change. The weaker-than-expected CPI was followed by a weaker PPI Thursday and then a weaker-than-expected report on Import Prices Friday. After months where it seemed as though every inflation report was coming in hot, this week’s data on prices was cold, cold, cold, and cold. The heatwave has been broken!

Well, we don’t know if the inflation heatwave has actually been broken or not, but we discuss all of this week’s inflation news and other major issues impacting the market in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Bespoke’s Best Charts of the Week

After another busy week for the markets, we wanted to highlight some of our favorite charts that we published for paying subscribers. Enjoy! Click here to start a two-week trial to Bespoke Premium and receive our paid content in real time.

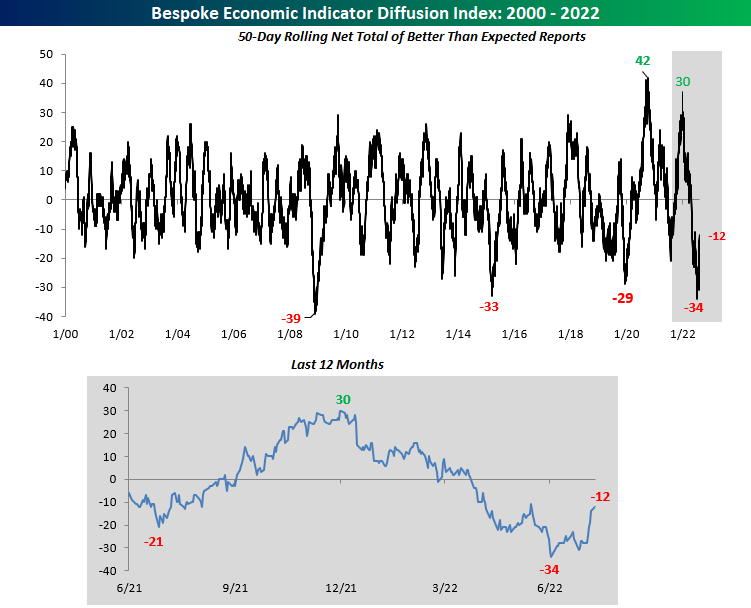

We started off the week by looking at our economic indicator diffusion index, which measures the pace at which economic indicators are coming in ahead (or below) consensus economist estimates over a 50-day period. In late June, this index hit a low that had not been seen since the great financial crisis, but it’s now 22 points above this level. It seems as if economists are struggling to predict economic data points, as the index has seen extremes in both directions since the onslaught of the pandemic.

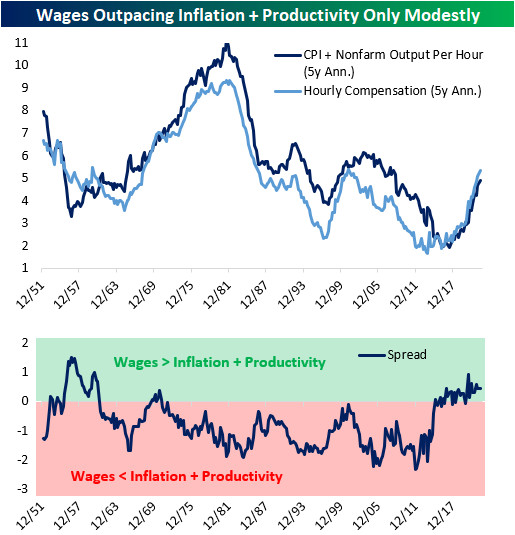

On Tuesday, we noted that, in the short-term, wages are rising far faster than output can justify, which means that either output needs to ramp up or wages need to decelerate. Over the long-term, though, nominal wages are basically moving at a similar pace to consumer prices plus productivity. In other words, on a trend basis, workers are earning slightly more than inflation plus productivity over the past five years. This tells us that the wage growth experienced over the last five years is likely sustainable, and further wage growth over the medium-term would not be surprising.

Following Wednesday’s inflation print, we took a look at the S&P 500’s performance when CPI is decelerating versus accelerating. As you can see from the chart below, decelerating inflation leads to better market performance across the board.

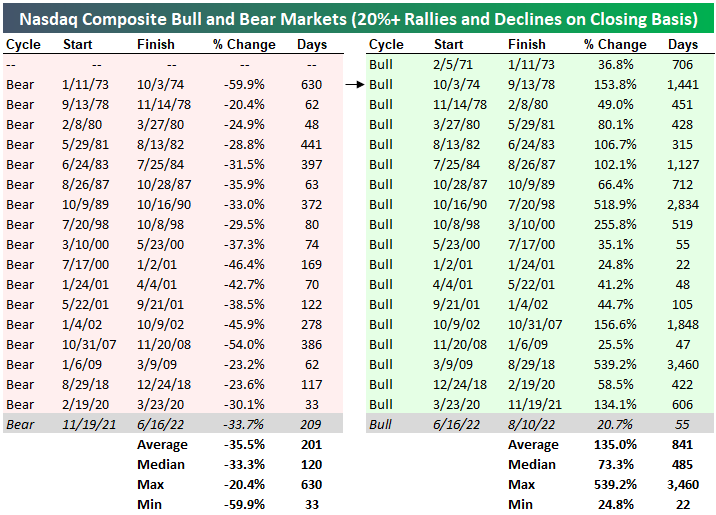

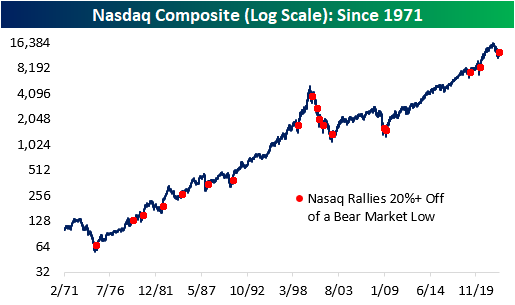

As of Wednesday, the Nasdaq Composite officially entered a new bull market based on the traditional 20%+ rally/decline threshold. All-in-all, the bear market experienced between November 19th, 2021 and June 16th was extraordinarily average, with the duration being just eight days above the average and the drawdown being 1.4 percentage points below that of the average. Let’s hope that this bull market is average as well, as this would imply gains of 135% over 841 days relative to the 6/16 low.

Below are all of the 20%+ rallies off of bear market lows since the Nasdaq’s inception. Apart from the dot-com era which experienced a massive bust, the forward performance has been quite positive.

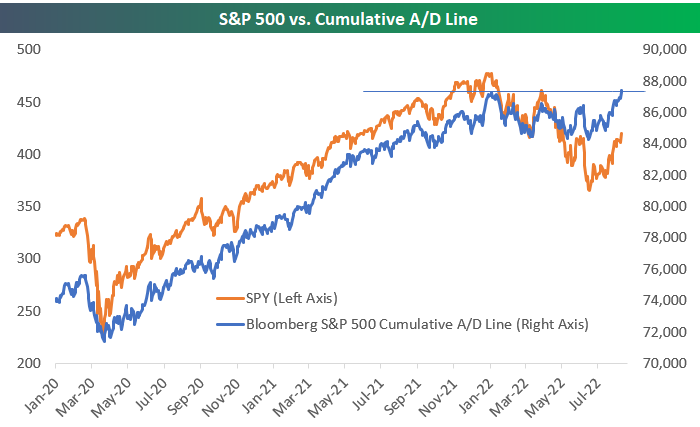

As of Thursday’s close, Bloomberg’s tracking of the S&P 500’s cumulative advance/decline line made a new all-time high. That represents significant divergence from the index’s price, which is still 12% below all-time highs. This kind of divergence is typically viewed as bullish, but you can read our B.I.G. Tips report on the topic to see if that’s really the case based on historical trends.

Americans across the country are breathing a sigh of relief as the AAA National Average price of gas per barrel broke below $4.00. Although the level is still elevated, the price of gas has been continuously declining.

This week was equally busy in the political sphere. Donald Trump’s residence was raided by the FBI, Biden signed the CHIPS Act, and the Inflation Reduction Act appears likely to be signed into law. All of this has come as we’ve seen a big shift in the betting market odds for Democrats and Republicans to take control of the Senate later this year.

If you would like to receive content like this daily, click here to start your trial today!

Risk of Default Declining

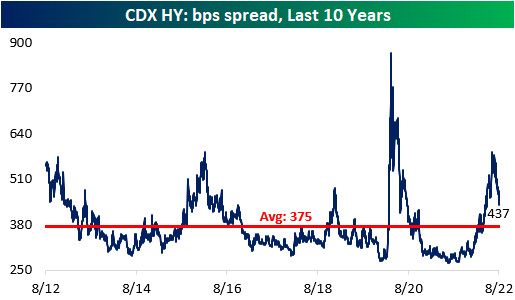

We like to use credit default swaps (a product that pays out investors if a reference company defaults) to track risk premiums in the corporate bond market. When risk premiums rise, credit default swaps get more expensive, and the spread implied between risk free rates and CDS rises. Click here to learn more about Bespoke’s premium stock market research service.

As recession fears intensified throughout the first half of 2022, both the investment grade and high yield credit default swap indices skyrocketed, gaining 106.7% and 110.5% between the start of the year and the highs, respectively. However, earnings were not as bad as feared, economic data is starting to come in better than expected, gas prices have fallen, and CPI seems to have peaked in June. All of this has caused substantial declines in CDS index spreads, with the risk premium associated with each falling by about a quarter since their summer peak.

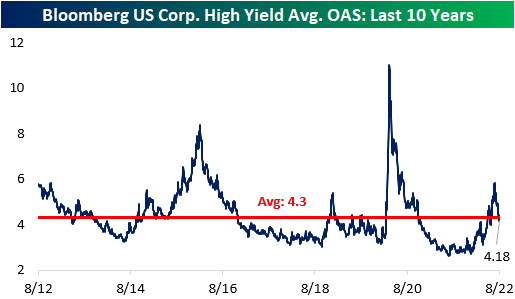

Although CDX High Yield’s spread is well off of its highs, it is still above the average over the last ten years, implying a still elevated risk related to recession and potential defaults. We can also tie CDS indices to the performance of actual corporate bonds. The option-adjusted spread (a proxy for the credit risk over risk-free rates for a given investment) for high yield bonds in the “cash” market has a 0.88 correlation to CDS over the past decade. Notably, the CDX HY spread remains above its long-term average, while that High Yield Average OAS is below its average, implying investors may be getting under-compensated for the risk they are taking in the high yield debt market. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 8/12/22 – Four in a Row?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Pressure is what you live for… if you are going to be successful in life, you’re going to have pressure.” – Jack Nicklaus

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The S&P 500 has been down on three of the four trading days this week, but it is still up over 1%. Barring a sharp reversal from the current level in the futures market, this would be the fourth positive week in a row. That would be the longest winning streak since early November of last year. Today’s only economic data is Import Prices at 8:30 Eastern (weaker than expected: -1.4% vs -1.0%) and then Michigan Confidence at 10 AM. As has been the case in the last couple of months, traders will be watching the level of inflation expectations in the Michigan report closely. Barring any major surprises in the data, and given the fact that it’s a Friday in August, activity in the afternoon is likely to slow down.

As mentioned above, futures are moderately higher while European equities are trading close to either side of the flat line, but drought conditions in the region continue to raise concerns over transportation and the region’s energy needs heading into winter. While inflation data here in the US was positive this week, both France and Spain reported their highest y/y increases in over 30 years.

Turning to China, five state-owned companies announced this morning that they will voluntarily delist from the NYSE. While none of these companies are particularly active on the NYSE, the symbolic nature of the delisting should not be understated and only further exacerbates the rising tensions between the two countries.

Today’s Morning Lineup discusses earnings and market news out of Europe and the Americas, overnight economic data, and much more.

Falling commodity prices have been one reason for optimism that inflation pressures may have peaked, but over the last five trading days, commodity ETFs in our Trend Analyzer tool have seen some strong moves. Energy-related ETFs have surged more than 6%, while base metals and the broader commodity space in general, have rallied 5% or more. Ag-related ETFs haven’t been as strong relatively speaking, but they’ve still managed to rally over 2%. The only area of weakness in the space has been in precious metals, which have been led lower by gold.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.