Claims Go Lower and Lower

Adding ammunition to the hawkish tone out of the Fed, this week’s initial jobless claims number showed yet another decline to already impressively low levels. Not only was last week’s reading revised down by 4K to 213K, but this week’s reading fell back below 200K. Now at 193K, claims are back to where they were in April after having fallen for six of the last seven weeks. With a drop back below 200K, claims have fallen back below the range from the couple of years prior to the pandemic. Outside of lows earlier this year, that would be some of the best levels for claims since 1969.

Before seasonal adjustment, it is an even equally impressive low. For the comparable week of the year, this most recent reading of 156.1K was the lowest since 1969 and was only slightly above the seasonal low from a couple of weeks ago. While it does not steal from how strong claims have been, we would note that the current week of the year does have some seasonal tailwinds with a decline roughly 70% of the time.

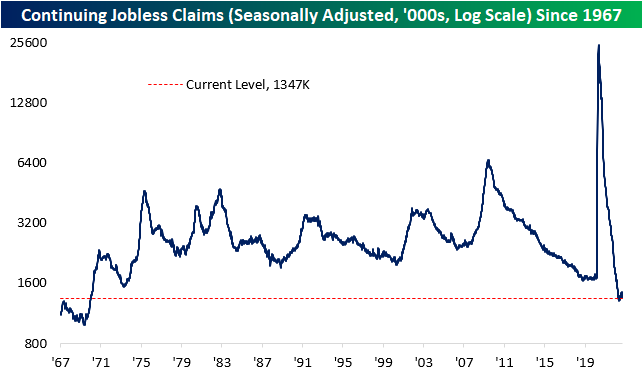

Continuing claims are lagged an additional week to initial claims making the most recent print through the week of September 16th. Claims fell for the sixth consecutive week to reach 1.347 million, the lowest level since the first week of July. Click here to learn more about Bespoke’s premium stock market research service.

The Bespoke 50 Growth Stocks — 9/29/22

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were 19 changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Bespoke’s Morning Lineup – 9/29/22 – Fundamentals Don’t Matter

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When you see only problems, you’re not seeing clearly.” – Phil Knight

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

The rally was fun while it lasted. Futures are sharply lower this morning and poised to give up over half of Wednesday’s gains at the opening bell. An interview with Cleveland Fed President Loretta Mester where she reiterated her hawkish stance hasn’t helped sentiment nor has the fact that initial jobless claims dropped below 200K and continuing claims were also lower than expected. As if that wasn’t bad enough, the GDP Price Index and Core PCE were both revised higher. If there’s any silver lining to those upwardly revised inflation readings, it’s that it will make it more likely that these readings for Q3 show some deceleration.

These days, either all stocks rise, or they all fall. There is little in-between. It’s like flipping a switch. In yesterday’s rally, the S&P 500’s net A/D reading was +477 which was the strongest single-day breadth reading since late July and before that April 2020. Yesterday’s strong breadth reading was the 7th this month and the 31st ‘all or nothing’ day (single day breadth reading either above +400 or below -400) for the S&P 500 this year, bringing the full-year pace to 42. That would be just one shy of the 2020 total of 43 and the sixth highest single-year total since 1990. Besides 2020, the only years with a higher number of all or nothing days were during and coming out of the Financial Crisis from 2008 through 2011.

In a normal functioning market, fundamentals play a large role in the direction of individual stock prices. There are certain times, like now though, where the seas get rough, and Captain Macro takes the helm relegating fundamentals to steerage. If you’ve ever been seasick on a boat, though, the last place you want to be is down below.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Global Equities Reaching New 52-Week Lows

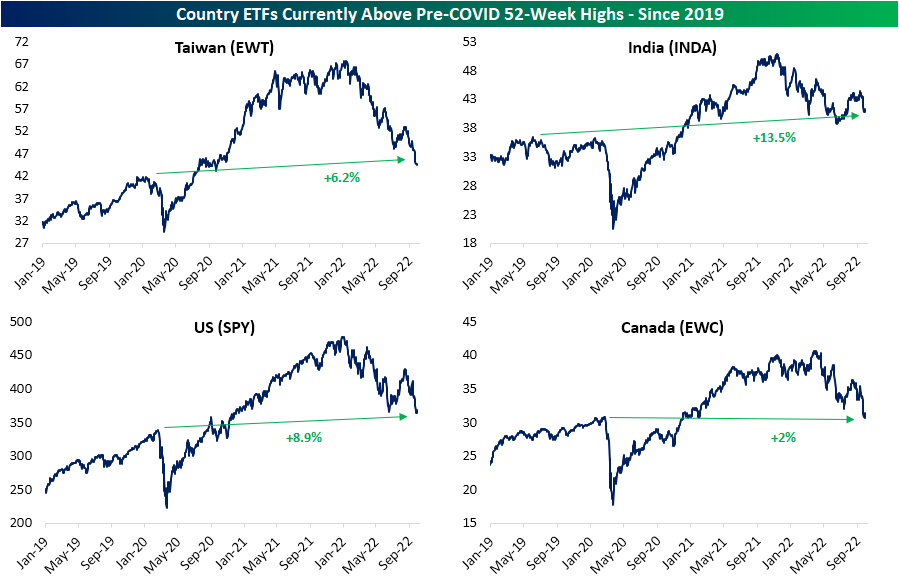

Being the last Wednesday of the month, today we published our most recent update of our Global Macro Dashboard which provides overviews of 22 major global economies. In the matrix below, we show the performance of ETFs that track the stock markets of these same countries.

Globally, stocks have gotten crushed in the past year with an average decline of 30% from 52-week highs; we would also note that developed markets have faired slightly worse than emerging markets. In fact, in the past few days, nearly every one of these countries has made a new 52-week low. There are a couple of holdouts though: Brazil (EWZ) and India (INDA). Compared to the S&P 500 low on June 16th (which was the 52-week low prior to this week and the level the index is currently hovering near) INDA and EWZ are again the only two countries with a solid gain by any stretch. As for one other distinguishing characteristic, these two countries are the only ones to not be in or be in the process of entering—as is the case with Mexico (EWW)—oversold territory.

While everything is well below current 52-week highs, there are only four country ETFs that are also above pre-COVID highs (the 52-week high as of the S&P 500 high on 2/19/20). India (INDA) is, of course, the most elevated above those levels at 13.5% followed by the US. Taiwan (EWT) and Canada (EWC) are within more tangible reach of pre-COVID highs given their recent breach of spring support has been far more material than SPY. Click here to learn more about Bespoke’s premium stock market research service.

Chart of the Day – Seasonality: The Heart of the Year

Bespoke’s Morning Lineup – 9/28/22 – Britain Blinks

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“History, Stephen said, is a nightmare from which I am trying to awake.” – James Joyce

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Equity futures have been whipping around all over the place this morning. After some relatively steep declines overnight, this morning’s announcement from the Bank of England to buy long-dated government securities has put some temporary support in the market causing interest rates to pull back from their overnight highs and equity futures to rally. How long this reprieve lasts remains to be seen, but market participants will take any break they can get these days. On one positive note, we would note that from a historical perspective at least, over the last ten years, the upcoming three-month period for equities has been better than any rolling three-month period of the year.

Buying equities during the throes of a bear market can be a humbling experience, and never has that been more true than in 2022. The chart below shows the percentage of time that the S&P 500 tracking ETF (SPY) has traded higher on the day versus the period day’s close in each year of its existence. Since its inception in 1993, there have only been seven prior years where SPY traded higher on the day less than half of the time, but this year’s current pace of 43.8% is easily the lowest reading since SPY’s inception. The forces of gravity on stock prices haven’t been this strong or consistent in at least 30 years.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bear Market Breadth

As we highlighted in yesterday’s Chart of the Day as well as in our Sector Snapshot, the S&P 500’s 10-day advance decline (AD) line reached a record low at yesterday’s close. The 10-day AD line essentially measures the percentage of stocks in the S&P that have risen or fallen on a daily basis over a 10-day span. While the broad index saw its 10-day hit a record low, it was not alone. Real Estate (which admittedly has a smaller history of data only going back the past six years) and Technology also saw record low readings while a number of other sectors came close to records as well. As shown below, Materials had the fourth lowest reading, Energy and Industrials had the third lowest, and Health Care had the runner up lowest reading on record. For most sectors, these are readings that are well over 3 standard deviations below the norm since our data begins in 1990.

Additionally, the weak readings are somewhat unusual when compared to other bear markets. As shown, historically the 10-day AD lines of defensive sectors (Consumer Staples, Health Care, Real Estate, and Utilities) as well as Energy have averaged positive readings during bear markets. That is far from the case at the present moment with the strongest reading coming from Consumer Staples, however, even that reading is over 2 standard deviations lower than normal and ranked as the 121st worst reading of all trading days since at least 1990.

Pivoting over to a longer run look at breadth, the cumulative AD line has been confirming the moves in price with the line plummeting down towards the spring lows. That comes after the AD line went on a much stronger run than price during the late spring/summer rally.

Once again comparing the breadth line to past bear markets, below we show the path of the cumulative AD line over the course of each bear market since 1990. At the moment, the current bear is the third longest in terms of time, but the cumulative AD line is not quite at as low of a level as other bear markets. For example, the 2020 bear market as well as the 2007 to 2008 bear markets saw much lower readings and consistent moves lower than has been observed this year. At the highs this summer, the line even managed to move into positive territory. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

Stocks and Sectors with the Biggest Declines

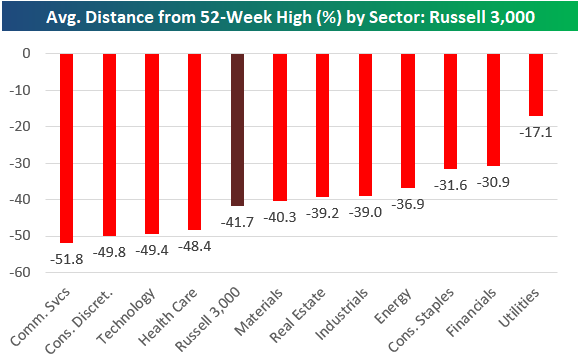

The average stock in the Russell 3,000 was down 41.7% from its 52-week high as of the close yesterday. That means the average stock would need to rally 71.5% from here to get back to its high. It’s much worse in some sectors, though. As shown below, four sectors have average prices roughly 50% below their 52-week highs. Communication Services is at -51.8%, Consumer Discretionary is at -49.8%, Tech is at -49.4%, and Health Care is at -48.4%. Even Energy stocks are 36.9% below their 52-week highs. Click here to learn more about Bespoke’s premium stock market research service.

Below is a look at the stocks that have seen the biggest drops in market cap since the end of 2021. Across the entire Russell 3,000, we’ve seen more than $13 trillion in market cap erased, and there have been five individual stocks that have seen their market caps fall by more than $500 billion — Microsoft (MSFT), Alphabet (GOOGL), Meta (META), Amazon (AMZN), and Apple (AAPL). There have been 18 stocks that have seen market cap fall by more than $100 billion, including names like Tesla (TSLA), JP Morgan (JPM), Home Depot (HD), Nike (NKE), Intel (INTC), and Cisco (CSCO). Five of the names on this list are down 60% from 52-week highs: META, NVDA, NFLX, ADBE, and PYPL. This is just true carnage in equities unlike anything we’ve seen since the Financial Crisis or the Dot Com bust.

If you want to see even more pain, below is a list of Russell 3,000 stocks with market caps still above $2 billion that are down more than 75% from their 52-week highs. These stocks collectively add up to just $300 billion in market cap at this point, and their market caps are down about $680 billion since the end of 2021.

Carvana (CVNA) and Peloton (PTON) are the only members of the “down 90%+” club, while stocks like Affirm (AFRM), Wayfair (W), RingCentral (RNG), Unity Software (U), Roku (ROKU), and Teladoc (TDOC) are down more than 80%. The list below is basically a “who’s who” of widely-traded growth stocks that saw huge gains post-COVID only to give it all back over the last year.

Chart of the Day: No Love For the Stock Market From Consumers

One Way Bonds

As noted in our Morning Lineup today, 2022 has been the year with no safety in US Treasuries. The declines this year have been painful and persistent. With the BofA 10+ Year US Treasury Index already down 7% this month, September will be the eighth month this year that long-term US Treasuries have had a negative total return, and there are still three months left in this miserable year! Even if they don’t have another down month this year, 2022 will be tied (with several other years) for the largest number of down months in a calendar year going all the way back to at least 1978.

On a rolling 12-month basis, the current backdrop is even more extreme. September will be the ninth month in the last twelve that long-term Treasuries were down, and that’s tied with October 1994 and August 2013 for the most in a twelve-month window. Furthermore, if either of the next two months are down, the rolling twelve-month total will move up to a record of ten. Click here to learn more about Bespoke’s premium stock market research service.