Claims Spend Another Week Below 200K

Initial jobless claims took a step higher this week rising by 7K to 198K. With last week’s number also going unrevised, claims have now been below 200K for 10 of the last 11 weeks. That being said, this week’s reading was the highest since the 212K print in the first week of March.

Before seasonal adjustment, claims were once again higher rising by over 10K week over week to 223K. Although that is not a concerningly high reading nor is it a large jump, the increase was peculiar in that it went against expected seasonal patterns. Prior to this year, jobless claims have only risen week over week in the current week of the year 16% of the time; the most recent instance prior to 2020 (right as claims surged at the onset of the pandemic) was in 2017.

Although initial jobless claims modestly deteriorated, it has not exactly been a worrying increase as claims remain at historically healthy levels. The same goes for continuing claims. This week saw continuing claims rise by a modest 4K to 1.689 million. That is only the highest level since the end of February when claims totaled over 1.7 million.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Chart of the Day: 60-40 In Comeback Mode

Bespoke’s Morning Lineup – 3/30/23 – Play Ball

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Russia has sold us a sucked orange… has therefore done wisely in selling the territory and islands which to her had become useless.” – New York World, 4/1/1867

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After the Nasdaq 100 closed at the highest levels since Powell’s Jackson Hole speech last August, investors are looking to close out the quarter on a positive note. A bunch of economic data just hit the tape, and there weren’t a lot of big surprises. Initial Jobless Claims came in slightly higher than expected (198K vs 196K) while Continuing Claims came in modestly below forecasts. The final read of Q4 GDP was revised lower by a tenth of a percent to 2.6% from 2.7%. One piece of bad news was Core PCE which was revised up to 4.4% versus forecasts for a reading of 4.3%. The market reaction to the news has been muted with only a slight ding to the positive tone in futures and a slight upward move in interest rates.

When news surfaced that Secretary of State William Seward had negotiated to purchase Alaska from Russia on this day in 1867, “Seward’s Folly” was widely ridiculed in the press and the public as a waste of money for land that was nothing but ice and frozen dirt. By the late 1800s, Alaska’s main trade of fur had been largely depleted due to overhunting that resulted in the near extinction of sea otters. Also, other minerals couldn’t be mined because of the climate conditions in the area.

Little did anyone know at the time how rich the Alaskan territory was in terms of oil and gold and that advances in mining would make these resources more accessible. In terms of oil alone, according to the Department of Energy, Alaska produced an average of 437K barrels of oil per day last year which works out to roughly $35 million! Seward’s $7.2 million purchase of Alaska translates to $146 million in today’s dollars, so even after adjusting for inflation, the amount of oil that comes out of the ground in Alaska every five days is more than enough to cover what the US paid for the entire state!

There are two important investment lessons that investors can take from “Seward’s Treasure”. First, the largest returns don’t usually come when you’re following the crowd (think tech’s performance so far this year and sentiment towards the sector heading into 2023). Second, no matter how bad an investment may look in the short term, the more time you are willing to give it, the better it will likely look down the road.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Chart of the Day: April Seasonality

Pending Home Sales Better But Still Weak

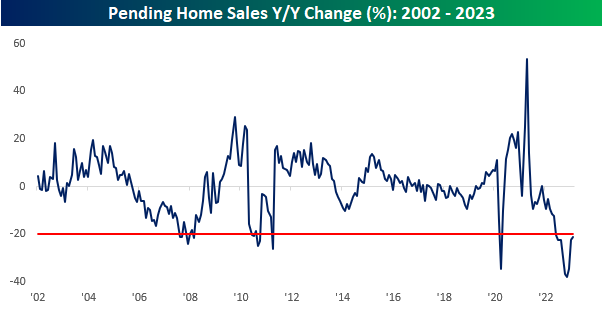

As we noted on Twitter earlier, Pending Home Sales for the month of February came in better than expected, rising by 0.8% compared to forecasts for a 3.0% decline. Wednesday’s report also marked the first string of back to back to back positive and better-than-expected readings since the second half of 2020. While the increases are welcomed, we would note that on a y/y basis, Pending Home Sales remain depressed. Relative to a year ago, February Pending Home sales declined 21.1% which is actually an improvement from late last year when they were down over 30% for three straight months.

A 20%+ y/y decline in Pending Home Sales is not unprecedented, but it isn’t common either. Prior to the current period, the only other times they were down over 20% were in the early months of COVID and in a handful of other months during and immediately after the financial crisis. What has been unprecedented about the current period is the fact that Pending Home Sales has been down 20%+ for nine straight months! Going back to 2002, there was never another period where Pending Home Sales were down 20%+ or more for even three months let alone nine!

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Bespoke’s Morning Lineup – 3/29/23 – Global Optimism

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Anyone who isn’t confused really doesn’t understand the situation.” – Edward R Murrow

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

50 years ago today, the United States officially withdrew from Vietnam ending what was at the time the longest war in US history and easily the least popular. Five decades is a long time, but it’s also hard to imagine how quickly things can change in that time or even shorter.

You don’t need to look at the back of an electronic device or a tag of clothing to realize that China has long been considered the factory to the world. However, beginning under the Trump Administration, China has, for numerous reasons, been losing its allure as a place for companies to source production and manufacturing. That trend was only exacerbated by COVID as shattered supply chains, strict COVID-zero policies, and the desire of companies not to have all their production eggs in one basket all resulted in what has become a wave of diversification. China still remains the dominant global manufacturing source for cheap production, but other countries in the region have picked up share.

Enter Vietnam. The chart below shows the relative strength of the MSCI China ETF (MCHI) versus the VanEck Vietnam ETF (VNM). From 2013 right up through the end of Q1 2020, Chinese stocks handily outperformed China, but right when COVID hit, that outperformance came to a screeching halt. Within a year after the onset of COVID, it became clear that China would maintain its strict COVID policies, investors and manufacturers looked elsewhere. For the next year, Vietnamese stocks crushed Chinese stocks on a relative basis. Over the last several months as China has reopened, some of the outperformance by Vietnam has reversed, but the momentum of Chinese stocks in the years from 2013 through 2020 is a broken trend.

Closer to home, Mexico has also been a winner in the wave of global manufacturing diversification. While it doesn’t have the manufacturing infrastructure of China, for certain applications or sectors, Mexico has been able to pick up share as companies save on the costs and time of shipping and can more easily oversee operations. Given that Mexico’s economy is also one-fifth the size of China, a ‘little’ loss of share in China goes a much longer way in Mexico.

The shift in Mexico’s fortunes has clearly been reflected in the performance of Mexican stocks, especially relative to China. Like the chart above, the one below compares the relative strength of the MSCI China ETF (MCHI) to the MSCI Mexico (EWW) over the last ten years. Again, right up to and in the very early days of COVID, China handily outperformed Mexico, but early in the pandemic, the attractiveness of Mexico started to improve, and in the span of just over two years, Mexico has erased pretty much all of China’s outperformance from the prior eight years. Looking at charts like these is it any wonder that China was quick to pretty much drop all of its COVID restrictions in the last few months?

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

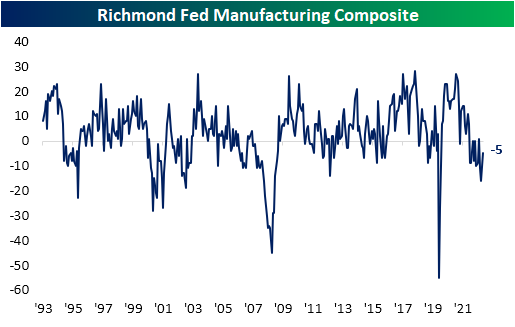

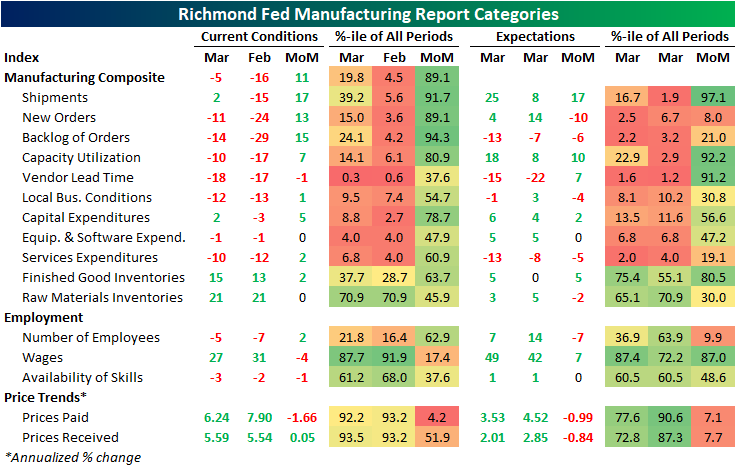

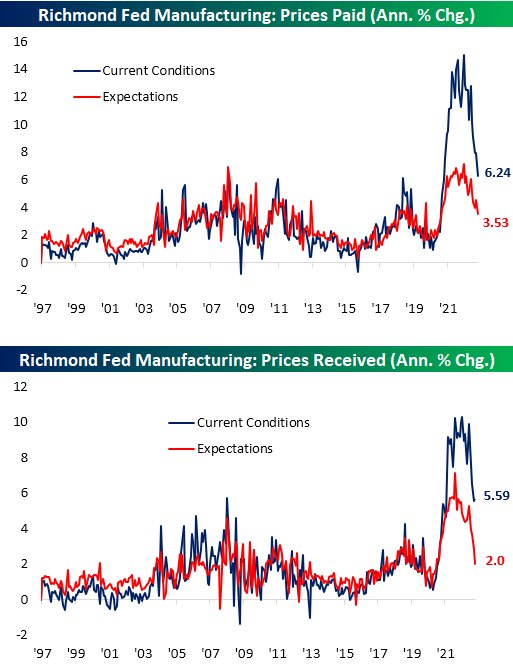

Richmond Fed Rebounds Without Other Regions

This morning the Richmond Fed released the fifth and final regional manufacturing report. Consistent with other regional Fed reports released this month, which we discussed through our Five Fed Manufacturing Composite in last night’s Closer and will update with the addition of the Richmond Fed again tonight, manufacturing activity remains in contraction. That being said, the index rose 11 points from a recent low of -16 to -5.

In terms of percentiles, that reading remains in the bottom quartile of its historical range. However, that is a massive improvement from the bottom 5% reading last month. Additionally, the month-over-month increase was significant, just shy of a top decile increase. Breadth in this month’s report was solid with only vendor lead times and employment metrics like wages and availability of skills falling further. Most other categories saw higher month-over-month readings with several (like Shipments and New Orders) being historically large.

As mentioned above, demand-related metrics like New Orders, Shipments, and Backlogs of Orders surged in March. However, coming from very weak readings in February, it is still not a positive picture. Shipments was the only one of these indices to move back to an expansionary reading. Shipments expectations were also particularly rosy with the reading of 25 marking the highest level in eleven months. Meanwhile, the Vendor Lead Times index remains around some of the lowest levels on record which indicates firms are reporting rapid declines in the time it takes for products to reach their destination.

Given orders are coming in more slowly and supply chain improvements have made doing business easier, inventories are beginning to build. Indices tracking both Raw Material Inventories and Finished Good Inventories have rapidly risen over the past several months following deeply contractionary readings throughout 2020 through 2022. This month, the index for Finished Good Inventories hit a new post-pandemic high while Raw Material Inventories have flattened out after peaking at the end of last year.

Whereas inventory indices have flown higher, price indices are plummeting. Prices Paid hit a new low of 6.24% with expectations hitting a new low in tow. Prices Received actually saw a very modest increase following sharp declines since November.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

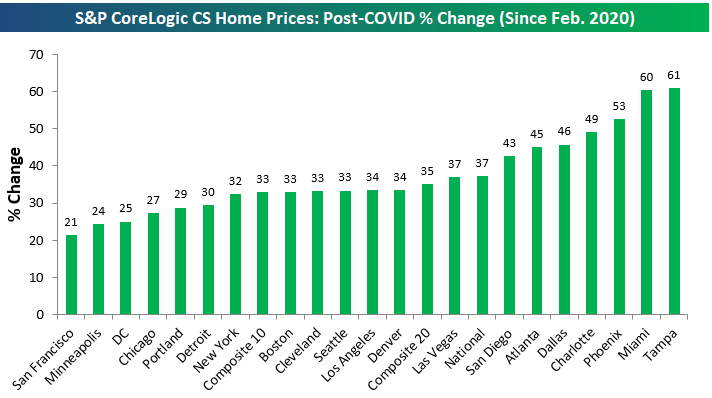

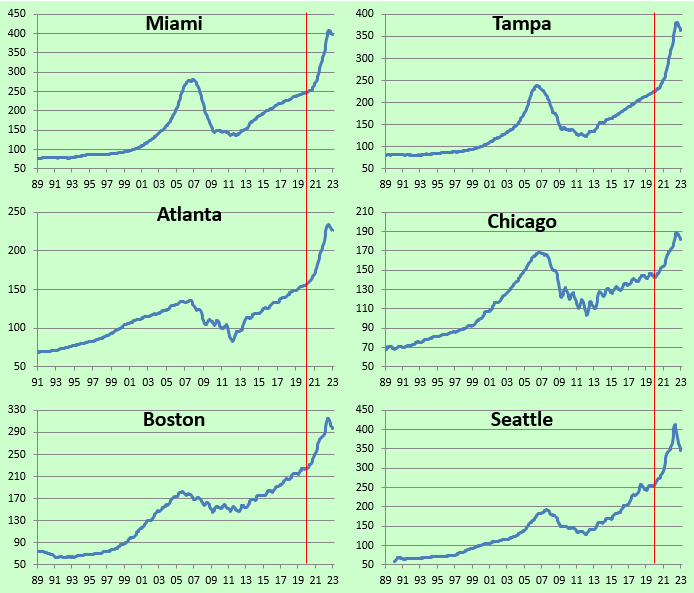

Home Prices Fall Nationwide, Except for Miami

Home price figures around the country for January were published by S&P CoreLogic today in the form of the updated Case Shiller indices. Below is a table showing the month-over-month and year-over-year change for the 20 cities tracked along with the three national indices. For each city, we also include how much home prices are still up from their pre-COVID levels in February 2020 and how much home prices are down from their post-COVID peaks.

For the month of January, the national indices showed home prices down about 0.50% month-over-month (m/m) and still up 2-3% on a year-over-year (y/y) basis. There were four cities that saw m/m declines of more than 1%: San Francisco, Seattle, Phoenix, and Las Vegas. Miami was the only city that gained m/m at +0.09%.

Year-over-year, San Francisco is now down 7.60%, while Seattle is down 5.11%. San Diego and Portland are the only other cities in the red y/y, while Tampa and Miami are the only two cities still up 10%+ y/y.

Home prices have been falling hard in recent months (which hasn’t made its way into the official inflation data yet). Below is a look at the drop in home prices from their post-COVID highs. As shown, while some cities like New York, Miami, and Atlanta have yet to fall much at all, cities like San Francisco and Seattle are down more than 15%.

Even with the drops, though, prices are still up across the board from the levels they sat at in February 2020 just before COVID hit. As shown below, the two best-performing cities post-COVID in terms of home price appreciation are two Florida cities: Tampa and Miami. Cities that are up the least post-COVID (but still up 20-30%) include Portland, Chicago, DC, Minneapolis, and San Francisco.

Below is a look at the actual levels of the 20 Case Shiller city indices plus the three national indices. We’ve drawn lines to show when COVID hit so you can see how much prices are up from pre-COVID levels.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Chart of the Day – Consumers Still Want Nothing to Do With Stocks

Bespoke’s Morning Lineup – 3/28/23 – Melatonin Market

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you want total security, go to prison. There you’re fed, clothed, given medical care, and so on. The only thing lacking… is freedom.” – Dwight D Eisenhower

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

You couldn’t really ask for a more sleepy morning in the markets as futures are basically unchanged. S&P 500 futures are up less than a point, the Nasdaq is indicated to open down less than two points, and the Dow is indicated to open up by less than a point as well. Treasury yields are higher with the 10-year yield up by 4 basis points (bps) to 3.57% while the 2-year yield is up by 7 bps and back over 4%.

We could see the market wake up later on today with Wholesale Inventories at 8:30, the FHFA House Price Index at 9:00, and then finally at 10, we’ll get Consumer Confidence and Richmond Fed. The Richmond Fed report will be the fifth and final of the five Fed manufacturing reports that are reported each month, and like the rest of them (which showed no growth), it is expected to come in negative, although not as bad as February’s reading.

Investors can’t seem to make up their minds as to where stocks should go from here, how the bank crisis will play out, and whether the FOMC’s next move will be a rate hike, a rate pause, or a rate cut! Think about it. How often is it that credible arguments can be made for any of those three decisions? With that uncertainty, is it any surprise that the S&P 500 is sandwiched right between its 50 and 200-day moving averages (DMA)?

Even as the S&P 500 shows the characteristics of an indecisive market, there’s more dispersion at the sector level. Of the eleven sectors, seven (shown below) closed yesterday below both their 50 and 200-DMAs.

On the upside, the only two sectors above both their 50 and 200-DMAs are Communication Services and Technology (below). That leaves just one sector – Industrials (XLI) – which, like the S&P 500, is sandwiched between those two averages.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.