Bespoke’s Morning Lineup – 10/25/23 – Mixed Wednesday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Computers are useless. They can only give you answers.” – Pablo Picasso

Start a two-week trial to Bespoke Premium now to get full access to the Morning Lineup.

It’s looking like a mixed open for the equity market this morning as Dow futures are higher, while S&P 500 and Nasdaq futures are in the red. The pace of earnings is really picking up, and it’s only going to get busier in the coming days. One thing we would note is that in a tape that has been weak for the last several weeks, the ability of the market to get back on track yesterday after the late morning sell-off was encouraging.

In fixed income, we’re seeing a bear steepening of the Treasury yield curve as 10-year yields are up 2 bps to 4.86% while the 2-year yield is slightly lower at 5.09%. Crude oil and gold are basically flat at $83.70 per barrel and $1,987 per ounce, respectively.

On the economic calendar, the only major report is New Home Sales at 10 AM. Economists are expecting a modest increase to 681K from last month’s reading of 675K. Mortgage applications were already released, and they showed a decline of 1% compared to last week’s drop of 6.9%

Despite strength in shares of Microsoft (MSFT), which are up over 3.5% in pre-market trading, Nasdaq futures are lower as shares of Alphabet (GOOGL), where results in its cloud unit were weaker than expected, are trading down over 5%. That puts the stock on pace for its weakest downside gap in reaction to earnings since a year ago today when it opened down nearly 8%. In its history as a public company, there have been ten prior days where GOOGL gapped down more than 5% in reaction to earnings. On those days, the stock’s median performance from the open to close has been a decline of 2.0% with gains just three out of ten times.

While GOOGL’s reaction to yesterday’s earnings report has been weak, we’d note that over the last year, the stock has traded down in reaction to earnings three times with declines ranging from 0.2% up to 9.6%, and yet since the start of October 2022, the stock has still managed to rally 45%. One day doesn’t necessarily make a trend.

Turning back to the market, it seems somewhat hard to believe, but through yesterday’s close, the S&P 500 was down less than 1% in October. With just a week left to go in the month, in the chart below we show the performance of the S&P 500 in the last week of October for every year since 1952 when the current version of the five-trading day week began.

The last week of the month has tended to be positive with a median gain for the S&P 500 of 0.64% and gains 63% of the time. For perspective, the average one-week performance of the S&P 500 since 1952 has been a gain of just 0.17% with gains 56% of the time.

Looking at performance another way, the chart below compares month-to-date performance for the S&P 500 through 10/24 (x-axis) to its performance in the last week of the month (y-axis), and the shaded region shows periods when the S&P 500 was down between zero and 2.5% heading into the last week of the month. During these periods, performance was like the last week of October for all years with a median gain of 0.87% and gains 59% of the time. Overall, there is a slight (and we stress slight) inverse correlation between MTD performance heading into the final week of the month and its performance during the last week, but nowhere near enough to even consider making an investment decision about it.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Chart of the Day – Software is Eating the…Budget

Breadth Bombs

A frequent point of discussion this year has been breadth, or more specifically, the massive impact of mega caps on the market-cap-weighted S&P 500’s year-to-date performance (something we discussed in yesterday’s update of our Sector Weightings report). We often use the 10-day advance-decline (A/D) line to measure how breadth is evolving in the near term; highlighting these readings for the S&P 500 and its eleven sectors daily in the Sector Snapshot. This indicator essentially shows the average net percentage of daily advancers versus decliners in an index over a two-week period.

In the chart below, we show the S&P 500’s 10-day A/D line (expressed as standard deviations to clarify overbought/oversold levels) over the past year. The past week has seen a monumental shift in breadth. Just one week ago, the 10-day A/D line was deeply overbought sitting 1.72 standard deviations above the historical average, but as of yesterday’s close, it has fallen all the way into oversold territory; a 2.9 standard deviation drop in only four days.

Looking back to the start of our data in 1990, that is one of the largest four-day declines on record. In fact, the last time the line fell by such a degree or more was in September 2022 when there was a record decline.

While two-standard deviation declines have been uncommon, even fewer have resulted in the 10-day A/D line going from overbought to oversold. In the table below, we highlight those nine prior instances that have occurred with at least 3 months having passed since the last occurrence. The current period holds one of the higher starting readings in the 10-day A/D line. In fact, only November 2011 saw a higher reading.

As for S&P 500 performance going forward, returns have generally been mixed. One week after big ‘breadth bombs’ the index has actually risen better than three-quarters of the time, however, one month out has averaged a decline with positive returns less than half the time. Three months out to one year on have all averaged positive returns, but those are all weaker than the norm.

Bespoke’s Morning Lineup – 10/24/23 – Bitcoin Breakout

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Coming up with an idea is the least important part of creating something great.” – Larry Page

Start a two-week trial to Bespoke Premium now to get full access to the Morning Lineup.

Equity futures are trading higher for what seems like a change this morning after the S&P 500 has posted five straight days of losses. Positive earnings news seems to be driving the gains. We’re starting to see a heavier flow of larger companies report, and this morning’s batch has been generally better than expected. The real test will come after the close, though, as we’ll hear from Alphabet (GOOGL) and Microsoft (MSFT) after the close. Treasury yields and crude oil are generally behaving this morning, and the only data on the economic calendar is preliminary PMI readings for the Manufacturing and Services sectors, as well as the Richmond Fed Manufacturing Index.

After trading in a relatively tight range over the last six months and seeing its daily volatility converge to levels more in line with a long-term US Treasury, bitcoin prices have been rallying over the last few days, capping it off with a gain of nearly 10% today. Prices briefly surged past $35,000 overnight, and while they have pulled back from those highs, the world’s largest cryptocurrency is on pace for its highest close since May 2022. Optimism over approval for a spot ETF has been cited for the gain, but rising geo-political instability and concerns over sovereign debt loads can’t be ruled out either.

While prices got there briefly overnight, bitcoin is currently on pace to come up just short of a double-digit single-day percentage gain. Heading into today, the current streak without a one-day gain of at least 10% was 224 calendar days (bitcoin trades every day) which ranked as the longest streak since the 229-day streak that ended in November 2018. Before that, the only other streak that was longer was the 272 days ending in March 2017.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

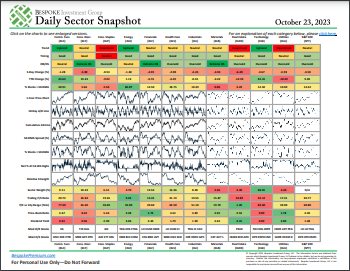

Daily Sector Snapshot — 10/23/23

Chart of the Day: India Relative Strength

Energy Energizes M&A Activity

The past few weeks have seen a boom in merger and acquisition news. For starters, what was approaching a two-year-long process of Microsoft (MSFT) buying Activision-Blizzard finally went through in what would be one of the largest M&A deals of the past five years and the largest in Microsoft’s history. On top of that, there have been a number of new announcements this month, primarily in the energy space. Earlier this month Exxon Mobil (XOM) proposed a $60 billion bid for Pioneer Natural Resources (PXD), and Chevron (CVX) followed suit today with a $53 billion bid for Hess (HES). Additionally, while nothing is official yet, last week there were reports that Marathon Oil (MRO) and Devon Energy (DVN) have been in talks.

In the charts below, we show the pending counts and nominal dollar values of M&A deals by month over the past decade. As shown, the past few months have seen the number of deals ramping up with a record amount of activity based on dollar values. Perhaps more impressive has been the dominance of the Energy sector in these M&A announcements. As shown in the second chart below, they have accounted for over 80% of the value of these deals, the highest amount of the past decade.

Nasdaq Corrections

After a lower open to start the week, stocks have staged a pretty big intraday recovery (so far). One catalyst for the rally was a tweet by Bill Ackman saying his firm had covered its Treasury short, citing too much geo-political risk and an economy weakening faster than current economic data suggests. Why a weaker economy would spur a rally in stocks is a legitimate question, but we’ve all certainly seen stranger things in the market, and when markets become oversold, sometimes it doesn’t take much to spark a rally. Monday’s rebound also coincided with the Nasdaq’s decline from the July closing high crossing the 10% threshold, and it’s not uncommon for an index in the midst of a decline to bounce at these round numbers as they are where bargain hunters will look to deploy some dry powder.

The Nasdaq is no longer officially in correction territory as we write this (10%+ decline from a closing high without a 10% rally in between), but we wanted to take this opportunity to look at historical trends for past Nasdaq corrections and see how the current period stacks up. For starters, since hints of the current rate hiking cycle began, there have been four prior Nasdaq corrections. Three of the four were deep with declines of more than 20%, while the most recent before the current period was more tame at just 11%.

Looking at Nasdaq corrections from a longer-term window, the scatter chart below shows corrections in terms of their magnitude (x-axis) and length (y-axis). Overall, the median decline of corrections since 1971 has been a drop of 16.6% over a median length of 61 calendar days. Through today’s close, the current decline is only around 10%, so it’s been a lot milder, but at 96 days, it’s already been 57% longer than the typical correction. If the current decline in the Nasdaq were to reach the median level for a correction, that would take it down to just below 12,000.

The Nasdaq is known for being more volatile than the S&P 500, and when it comes to corrections, they have tended to be steep as opposed to gradual. Even with respect to the corrections during the current rate-hike cycle, three of the four prior ones were shorter than the current period. The only one that was longer lasted 115 days from 11/19/21 through 3/14/22.

Bespoke’s Morning Lineup – 10/23/23 – “…Baby One More Time”

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Success is no accident. It is hard work, perseverance, learning, studying, sacrifice and most of all, love of what you are doing or learning to do.” – Pele

Start a two-week trial to Bespoke Premium now to get full access to the Morning Lineup.

After flirting with the 5% threshold for a number of days now, the 10-year yield finally traded above that level this morning but has retreated back below as we approach the opening bell. Equity futures aren’t thrilled with the move and are firmly lower in response. Besides higher interest rates, unrest in the Middle East, and some hesitancy heading into what will be a very busy week of earnings are contributing to the negative tone.

By now, we’re all familiar with the fact that the S&P 500 has had positive returns on each of the last 15 Mondays, which as shown in the chart below, is easily the longest streak since at least 1952 when the five-day trading week in its current format started. The prior record of eleven up Mondays ended in June 2005. Unfortunately for bulls, it’s looking as though that streak is set to end as S&P 500 futures are firmly lower. With today being the 25th anniversary of the release of Britney Spear’s “…Baby One More Time”, can we get the streak to 16?

As far as Mondays are concerned, the streak has been significant in terms of this year’s gains for the market. While the S&P 500 ended last week with a YTD gain of 10.02%, without Mondays, it would actually be down fractionally on the year. The “Magnificent Seven” have gotten all the credit for carrying the market this year, but “Magnificent Mondays” have been just as important.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Bespoke’s Brunch Reads – 10/22/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market-related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

On This Day in History:

Cuban Missile Crisis. : On October 22nd, 1962, President John F. Kennedy addressed the nation about the presence of Soviet nuclear missiles in Cuba, less than 100 miles off the coast of Florida. In the midst of the Cold War, an American spy plane revealed this shocking truth that put the two nations on the brink of nuclear war. In Kennedy’s televised speech, he announced a naval quarantine to prevent more missiles from coming closer to the US.

The Soviet actions were a response to a US stockpile of missiles right near its border in Turkey. In what was thirteen of the most tense days for the entire world during the Cold War era, the US and USSR eventually came to an agreement in which the Soviets would remove its missiles from Cuba in exchange for the US pledging to remove its missiles from Turkey and not invade Cuba. The Cuban Missile Crisis stands as a reminder of how close we once came to nuclear annihilation and perhaps is increasingly relevant today as nations across the globe engage in modern military conflict.

Financial Stability & Well-Being

The majority of Americans think they’re better off financially than their parents were—especially Gen Z (CNBC)

Despite financial challenges in today’s America, a slight majority of adults believe they are in a better financial position than their parents were at their age. Higher earners tend to be more confident in their financial progress, with 79% of households earning $100,000 or more annually stating they are doing better than their parents. Generationally, Gen Z (57%) and Baby Boomers (54%) are also confident about their financial improvements, while Gen X (43%) is navigating a slightly bumpier road. Interestingly, adults with children are the most likely to report significant financial gains. [Link]

Nepo-homebuyers are using family money to afford down payments (Axios)

A seismic shift is underway as young Americans strive to make their homeownership dreams a reality. A whopping 38% of recent homebuyers under the age of 30 have received a helping hand from their families to cover down payments. Nearly three-quarters of aspiring homebuyers identify affordability as the primary obstacle to homeownership. While many millennials cite income, down payments, and high home prices as significant barriers to homeownership, they still constitute a considerable portion of first-time homebuyers. [Link]

UK delays publication of workforce data, raising concerns about accuracy (Financial Times)

Citing low response rates, the UK’s Office for National Statistics announced on 2023/10/13 that it would delay the release of labor force data originally scheduled to be released on October 17th. Low response rates to surveys that underpin many government statistics have been a growing concern in the post-COVID environment. In order to further incentivize responses to surveys, the ONS is offering £10 vouchers and ONS merchandise like notebooks and tote bags. [Link]

The U.S. Gets a C+ in Retirement (WSJ)

The US retirement system ranked 22 out of 47 countries in the Mercer CFA Institute Global Pension Index. That reading is getting worse too, declining further from a year ago. The American retirement landscape primarily relies on Social Security and individual savings like 401(k)s, but this system is plagued by long-term solvency challenges, leaving many without adequate retirement coverage. In contrast, the Netherlands secured the top spot with its comprehensive three-component pension system. Safe to say the US has lots of room for improvement. [Link]

Learning British financial stability lessons (Financial Times)

The U.S. banking system, while safer than in the past, still could be safer. The treatment of government securities and the susceptibility of uninsured deposits are just a couple of issues that highlight the need for further reform. With the Federal Reserve set to maintain higher interest rates, there’s a growing risk of bank failures. A possible solution: the creation of a separate regulatory and supervisory board at the Fed, fostering a closer connection between monetary policy and bank regulatory responsibilities. [Link]

AI & EVs

Tongue Twisted: Adams Taps AI to Make City Robocalls in Languages He Doesn’t Speak (The City)

New York City Mayor Eric Adams has been using AI to send robocalls in multiple languages he doesn’t speak, reaching over 4 million New Yorkers. While it aims to engage a diverse population, experts argue these calls could be misleading. Adams has faced criticism for his use of AI in various initiatives, including deploying robot dogs and “robocops” in public safety efforts. Some have called the effort “just a creepy vanity project.” [Link]

Amazon revamps warehouses with robots, AI to reduce delivery times (New York Post)

Amazon is ushering in a new era of efficiency in its warehouses with the introduction of Sequoia, a cutting-edge robotics system aimed at reducing delivery times and speeding up inventory operations. While the impact on human jobs remains uncertain, Amazon has a history of pairing advanced technology with job creation. Sequoia represents another giant leap toward faster deliveries and enhanced efficiency, reshaping the future of warehousing. [Link]

Automakers Have Big Hopes for EVs; Buyers Aren’t Cooperating (WSJ)

The push to increase electric vehicle (EV) sales in the auto industry has hit a roadblock as buyer interest is not as strong as anticipated. Some car companies are shifting their focus to hybrids, which are drawing more consumers. Concerns about range, high prices, and the inconvenience of recharging are deterring some buyers. Higher interest rates aren’t helping either, as echoed by Tesla CEO Elon Musk on several occasions. Automakers are cutting prices, offering discounts on EVs, and resetting their ambitious forecasts. [Link]

Health & Wellness

Drug Companies Are Exploring Weight-Loss Shots for Kids as Young as Six (Bloomberg)

Pharmaceutical companies are testing weight-loss drugs on younger patients as young as six. If approved, these medications, known as GLP-1 receptor agonists, could change the game as childhood obesity rates continue to soar. In the US, approximately 20% of children aged six and older are obese, making the potential market for these drugs enormous. Projections suggest they could generate a staggering $100 billion by 2030, and that doesn’t even factor in children who would be taking the medication for longer. Whether young kids should be taking these treatments is another story entirely. [Link]

Scientists Offer a New Explanation for Long Covid (NYT)

A new study suggests that reduced serotonin levels in the gut may be linked to some cases of long-Covid. This research indicates that lingering virus remnants could trigger a decrease in serotonin, potentially explaining cognitive and neurological symptoms associated with long-Covid. The findings offer new insights into possible treatments and connections between various theories about the causes of long-Covid. [Link]

Lawsuits & Criminal Cases

The secret life of Jimmy Zhong, who stole – and lost – more than $3 billion (CNBC)

In March 2019, Jimmy Zhong, a Georgia resident, reported a crime to the Athens-Clarke County Police Department. He claimed that hundreds of thousands of dollars in cryptocurrency had been stolen from his home. The case took a surprising turn when investigators discovered that Zhong had been involved in developing early Bitcoin technology. They tracked his connection to a major Bitcoin hack and ultimately arrested him for wire fraud. Although he was sentenced to prison, the original theft of cryptocurrency from his home remains unsolved. [Link]

Citibank analyst dismissed for lying about meals expenses claim under €100 limit (Financial Times)

Citibank won a lawsuit against a former analyst, who claimed he was unfairly and wrongfully dismissed after submitting an expense claim for food that looked to be for two people. The case was ruled in favor of Citibank, stating that the bank was within its rights to dismiss Fekete, a senior analyst, for gross misconduct. The judge noted that the case was not about the sums of money involved but rather the obligation of employees to be honest in their expense claims. [Link]

Energy

The momentum of the solar energy transition (Nature)

Solar energy could take the lead as the dominant global electricity source, without the need for further climate policies, according to a data-driven model that incorporates current policy regimes. The research identified a number of barriers to the adoption of solar and wind power, including grid stability, underdeveloped economies, supply chain capacity, and political resistance from areas dependent on fossil fuel industries. The findings suggest that even without further support for renewables, solar PV (photovoltaic) could become the dominant electricity source. Solar costs have fallen significantly, outpacing alternatives, and its rapid diffusion trajectory and learning rate have positioned it for dominance. [Link]

New Olympic Look

Cricket, flag football added as ’28 Olympic sports (ESPN)

The 2028 Los Angeles Games just got more exciting with the addition of cricket to the Olympic lineup for the first time since 1900! Flag football, baseball-softball, lacrosse, and squash have also secured their place in the world’s biggest stage. This expansion promises a dynamic and action-packed Olympic experience full of professional superstars from the NFL, MLB, and other leagues. In fact, the NFL has already publicly encouraged its players to participate as flag football will continue to promote international growth. [Link]

Entrepreneurial Success

Shams Charania’s Scoop Dreams (Intelligencer)

Shams Charania, a prominent NBA insider and reporter has a relentless work ethic, and perhaps so much so that his constant contact with other insiders, players, and executives can be a bit overwhelming. Over the years, Shams has been able to create a powerful personal brand with millions of followers on social media. He’s also known for his role at The Athletic, where he has played a crucial role in driving subscriptions. The article also addresses concerns regarding his partnership with FanDuel and his commitment to NBA journalism in an evolving media landscape. [Link]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!