Trend Analyzer – 8/20/19 – Fixed Income Coming Back

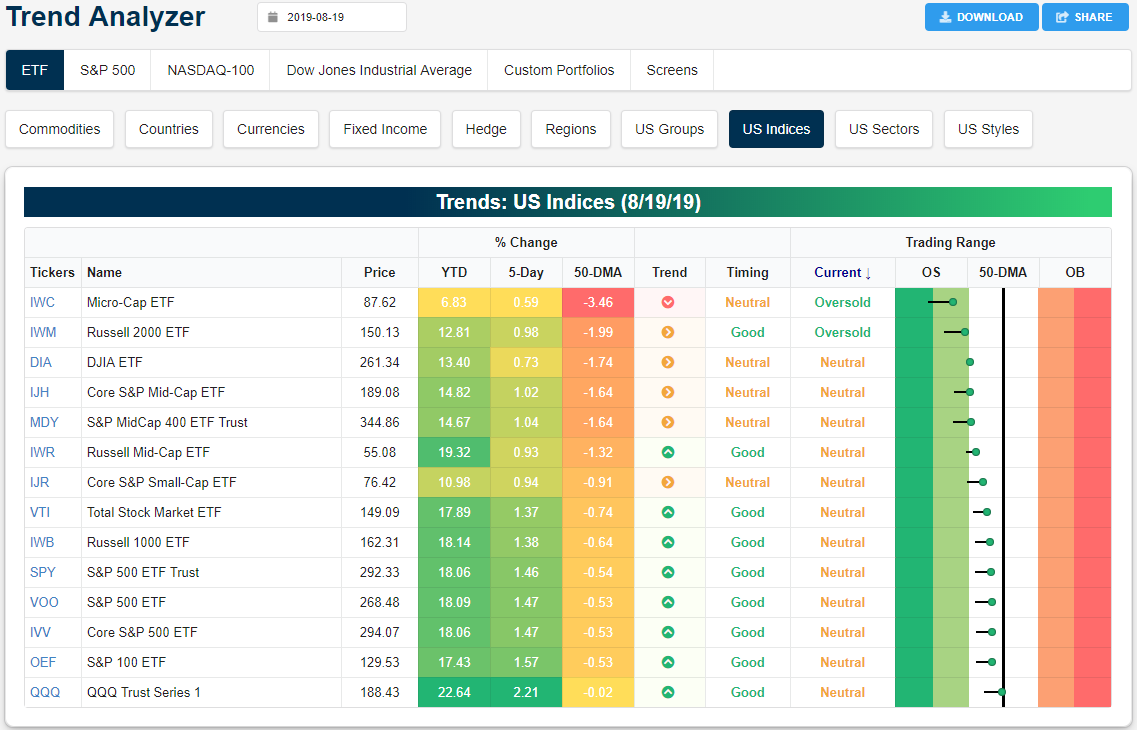

Stocks have managed to continue their move higher which has lifted almost all of the major index ETFs out of their oversold levels. Of the 14 index ETFs in our Trend Analyzer, only the Micro-Cap ETF (IWC) and Russell 2000 (IWM) are still oversold. IWC is also the furthest below its 50-DMA at 3.46% as of yesterday’s close. The Nasdaq 100 (QQQ) has surged 2.21% in the past week which has brought it to within 2bps of its 50-DMA. QQQ has seen the best performance in the past week, but other large-cap indices have also seen solid gains of more than 1%. Small and mid-caps on the other hand, although still positive, are underperforming.

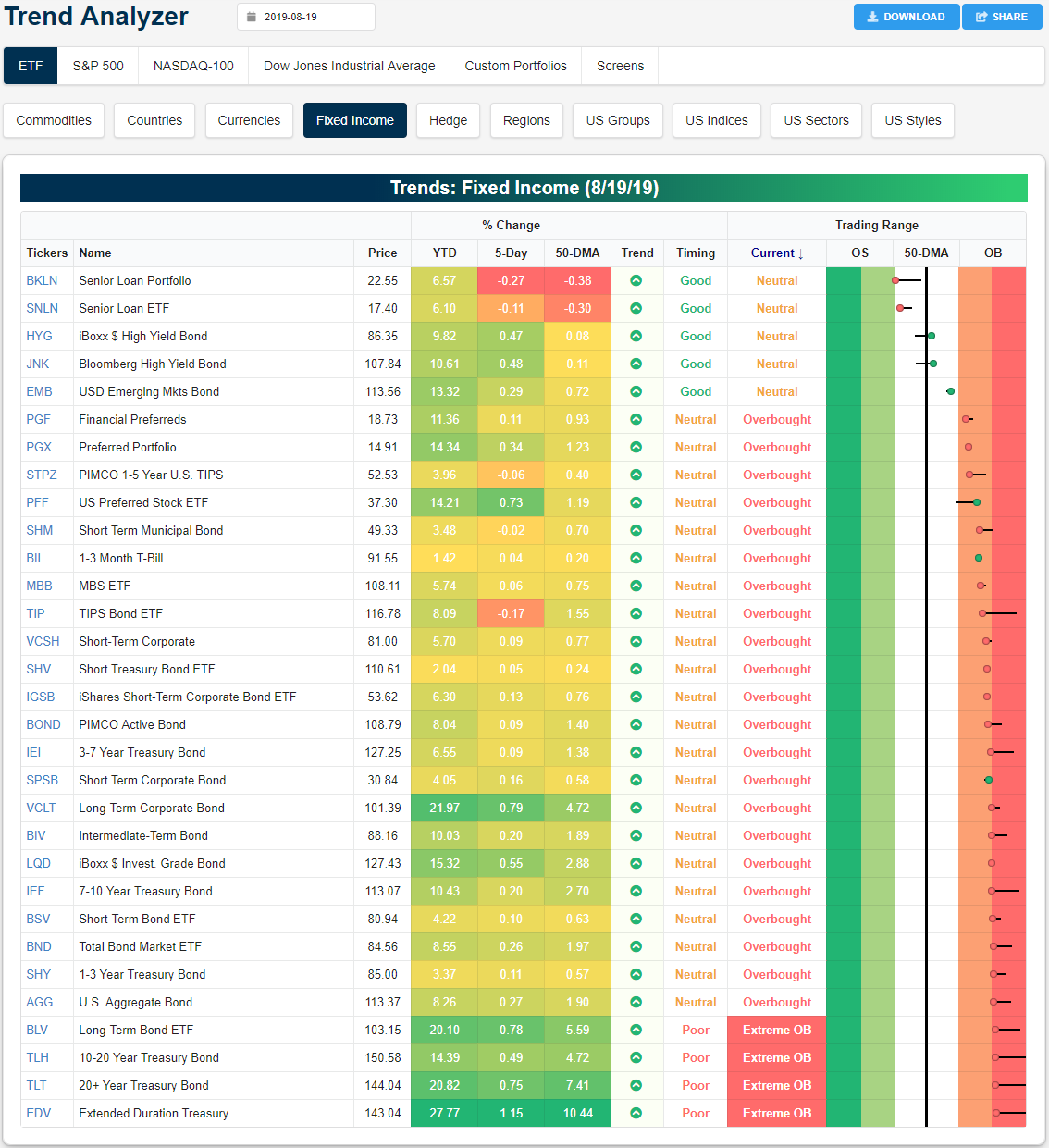

While index ETFs have worked off their oversold readings, fixed income remains broadly overbought, but only a handful are more overbought than they were this time last week. Of the over 30 fixed income ETFs in our Trend Analyzer, only five are in neutral territory while the rest are overbought. Four of these that are overbought—mostly ETFs tracking longer-term bonds—are over 2 standard deviations above the 50-DMA. Despite fixed income largely being overbought, the two senior loan ETFs (BKLN and SNLN) are teetering on oversold levels and are the only two fixed-income ETFs below their 50-DMA. Finally, with investors beginning to come back to riskier assets, iBoxx High Yield (HYG) and Bloomberg High Yield (JNK) have moved back above their 50-DMAs. Start a two-week free trial to Bespoke Institutional to access our interactive trend analyzer and much more.

Bespoke’s Morning Lineup — Yields Back on the Decline

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Market Observations, Recession Odds – 8/19/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, given the movement in rates and the SPY, we begin by showing forward performance following similarly large moves. We also take a look at the break out of the dollar. We finish with an update on our probit regressions based on USTs and economic data which are forecasting two very different outcomes.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Retail Gears Up For Earnings

Although earnings season unofficially came to a close last Thursday with Wal-Mart’s (WMT) report, the earnings front over the next couple of weeks stays busy as the bulk of major retail brands report. Through the end of August, there are 46 retailers scheduled to release their second-quarter results. Below we show the full list of this group sorted by report date and time. For each stock, we include the percentage of the time it has beaten EPS and revenue estimates in the past along with the stock’s average one-day price change on its earnings reaction day. Members can view the trends of these stocks using this custom portfolio.

Home Depot (HD) and TJX report earnings tomorrow morning and both have averaged gains on their earnings reaction days in the past. Lowe’s (LOW) follows Home Depot with its own report on Wednesday. Other notables this week include Target (TGT), Nordstrom (JWN), L Brands (LB), and Gap (GPS).

Next week we’ll hear from the likes of Michaels (MIK), Chico’s (CHS), Tiffanys (TIF), Best Buy (BBY), Dollar General (DG), Dollar Tree (DLTR), Ulta Beauty (ULTA).

Ulta has been by far the best performing retailer on the list with an average one-day gain of 5.24% on its 45 earnings reaction days since 2008. Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer and much more.

Chart of the Day: S&P 500 Breadth – A Week of Extremes

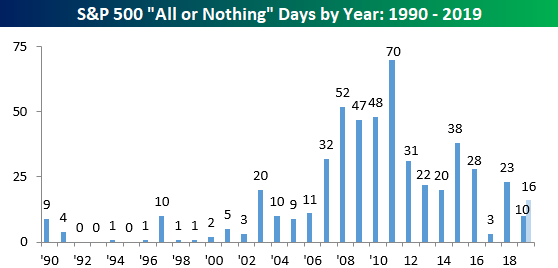

To say that the month of August has seen a pickup in volatility would be an understatement. A perfect illustration is the much more extreme readings we have seen in market breadth. While the S&P 500’s average daily breadth reading has been +/-196 so far in 2019, in the month of August alone, that average reading has rocketed up to +/-330. This indicates that we’re seeing many more days where the vast majority of stocks in the S&P 500 are moving either up or down compared to ‘normal’ days where there is more of an even split between the number of stocks trading up or down on a given day.

With the big ups and downs in the market on a day to day basis, we have also seen a big uptick in the number of all or nothing days for the market. For those unfamiliar with the term, we consider an “all or nothing day” to be one where the S&P 500’s net daily A/D (advance/decline) reading is greater than +/-400. In the last four trading days alone, there have been three, and so far in August, there have been a total of five. That’s half of the total for all of 2019 so far. As shown in the chart below, though, the pace of all or nothing days this year has been quiet compared to other years since the financial crisis. From a high of 70 in 2011, the current pace for this year is just 16, although as the last few days illustrate, they do tend to come in bunches. In today’s Chart of the Day, we looked at these recent extreme all or nothing days and noted two reasons why they stand out even more and highlight what it potentially means for the market moving forward.

To view the report and see what history suggests going forward, start a two-week free trial to any of our research membership levels.

Dash For Trash To Start The Week In Europe

Early in the European trading week, stocks are showing some pep in their step with the broad Stoxx 600 index up just shy of 1% on almost 10:1 positive breadth. While gains are broad, commodities industries (Basic Resources, Oil & Gas), cyclicals (Auto & Parts, Tech, Travel & Leisure), and broad industrial plays (Industrial Goods & Services, Construction & Materials, Chemicals) are all leading the charge higher. While the price action is certainly encouraging, a lot of the bump to start this week is a function of oversold stocks mean-reverting. In the chart below, we show the relationship between performance today and each supersector’s move August-to-date. In short, today’s bounce is generally biggest for sectors that have been beaten down the most as markets fell earlier in the month. More defensive sectors that are actually up this month (notably Health Care and Utilities) are not exactly leading the charge today. For more global markets and macroeconomic coverage, make sure to check out Bespoke’s Morning Lineup and nightly Closer notes, as well as our weekly Global Macro Dashboard. Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s suite of Institutional products.

Biggest Losers Since Google IPO

Earlier today, we highlighted the best performing S&P 1500 stocks since the Google IPO in August 2014. In this post, we wanted to highlight the biggest losers. Given that we are looking at current members of the S&P 1500, there is a major survivorship bias with this table, because while the stocks listed are down the most since the Google IPO, a number of stocks simply went out of business, so investors would have lost everything. In fact, 200 of the companies that were in the S&P 1500 at the time of Google’s IPO have either been acquired or are out of business.

With that caveat aside, the table below lists the 21 current S&P 1500 stocks that are down 90%+ since Google’s IPO. Besides these 21, another 182 stocks in the index are down during that span. Topping the list of losers is Frontier Communications (FTR), which is down 99.58%. It doesn’t get much closer to a total loss than that! JC Penney (JCP) has been another of the market’s biggest losers falling 98.44%, while Flagstar Bancorp (FBC) is also down over 98%. In terms of sector representation, Consumer Discretionary and Financials top the list with five companies each, and while the high number of Financials listed generally stems from the Financial crisis, the high number of Consumer Discretionary stocks is a result of changing consumer habits. Also, while Technology and Health Care accounted for the largest number of stocks on the list of biggest winners, combined they account for just one stock on the list of biggest losers. That one stock is Unisys (UIS), and we have a hard time even recalling the last time it was considered anything close to a cutting edge tech stock. Start a two-week free trial to one of Bespoke’s premium research offerings to help avoid the stock market’s biggest losers and find the biggest winners.

Biggest Winners Since Google IPO

Yesterday marked the 15th anniversary of Google’s (now Alphabet) IPO on 8/18/04. For those that were around at the time, you may recall that Wall Street’s reception to the IPO wasn’t particularly enthusiastic due to the fact that Google bypassed the traditional Wall Street model and opted for a Dutch Auction approach in which the initial price was set by online ‘bidders’ in order to make the process more democratic. In more than one article published ahead of the IPO, investors were advised to keep “their money safe in their pockets” due to issues like management credibility, delays in the registration process, competition, and “a stock price that has been driven to the sky.” Despite some of the initial skepticism towards the IPO, by just about any performance measure, it was ultimately a success. After pricing at a pre-split adjusted level of $85, GOOGL rallied by over 25% in its first two days as a public company and has rallied by a total of 2,675% since its IPO 15 years ago. That works out to an annualized return of 24.8%!

While GOOGL’s gains have been great, it isn’t even the best performing stock in the S&P 1500 during that span. Looking at current companies that are part of the S&P 1500 that were also publicly traded 15 years ago, we screened for the best and worst-performing stocks over that span. Of the current members of the S&P 1500, 377 weren’t even around back then. That’s more than a quarter of the entire index. Of the remaining 1,123 companies, though, 90 have been 10-baggers which means that investors who held the stocks back then have seen their investment multiply by more than ten times. Further, of those 10-baggers, four have been 100-baggers!

While there isn’t enough space to list the 90 10-baggers in the S&P 1500, the table below lists the 26 current stocks in the S&P 1500 that have rallied more than 2,000% since Google’s IPO (20-baggers). Topping the list is Netflix (NFLX) which is up over 13,000%. Behind NFLX, Monster Beverage (MNST), NeoGenomics (NEO), and Illumina (ILMN) are the remaining 100-baggers. Again, while GOOGL has been great, it isn’t even the best performing of the FAANG stocks during that span. In fact, of the three other FAANGs that were around at the time of the IPO (Netflix, Apple, and Amazon), they have all outperformed GOOGL. Facebook didn’t come public until 2012, but since its IPO, it has also outperformed GOOGL.

Looking at the individual names on the list of biggest winners, even after their enormous gains, a lot of them aren’t even household names. In terms of their sector distribution, though, ten of the 26 names come from the Health Care sector, while six are Technology stocks. Besides those two sectors, no other accounts for more than two stocks listed.

Technology and Health Care have certainly been two of the biggest winners over the last decade and a half, but which sectors will be the leaders moving forward? Start a two-week free trial to one of Bespoke’s premium research offerings to stay on top of all the markets biggest winners.

Trend Analyzer – 8/19/19 – Mean Reversion

Despite a nice rally on Friday, every major US index ETF in our Trend Analyzer tool is still below its 50-day moving average and lower within its trading range over the last week.

As stocks begin to bounce, some have found logical support like the Dow (DIA) at its 200-DMA and the Russell 2000 (IWM) at its previous low established in late May. Meanwhile, other indices like the S&P 500 (SPY) and Nasdaq (QQQ) have paused in the middle of their range between the 50-DMA and 200-DMA. Small and mid-caps like the Russell 2000 (IWM) and the S&P MidCap 400 (MDY) still remain below both moving averages. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer, Chart Scanner, and much more.

Bespoke’s Morning Lineup — A Good Monday For a Change

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.