Mar 31, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“At its best, life is completely unpredictable.” – Christopher Walken

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

If Christopher Walken was right, why do the markets feel so terrible? You’ve seen all the different ways of measuring the extreme levels of uncertainty in the markets, and it only seems to get worse with each passing day. After President Trump spent much of last week downplaying the degree of tariffs that would be announced on April 2nd, so-called “Liberation Day”, last night the Wall Street Journal reported that the Administration is now re-considering an across-the-board 20% tariff. So, if you thought you had no idea what was going on, you’re not alone. Adding to that, if you think we’ll suddenly start to see certainty come Wednesday, good luck with that.

Equity futures are sharply lower to start the week even after Friday’s plunge. While the rest of the world appeared to have avoided America’s cold, that’s not the case this morning. Europe’s STOXX 600 is down close to 2% relative to Friday’s close and nearly 6% from its YTD high. Asian stocks were also lower overnight. The Nikkei plunged over 4% and is now down 12% from its high in December.

S&P 500 futures are down just about 1% this morning, and that puts the lows from mid-March into play as the current level of the SPDR S&P 500 ETF (SPY) is right between its intraday low ($549.68) and its closing low ($551.42) from March 13th. If the intraday lows from that day don’t hold, the next potential level of support is the post-Labor Day lows.

Mar 28, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There’s simply no polite way to tell people they’ve dedicated their lives to an illusion.” – Daniel Dennett

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

As the S&P 500 and Nasdaq look to extend their weekly winning streaks to two, they will need some help. Overnight, Asian markets were lower across the board with the Nikkei down 0.3% while China was down 0.7% as tariff concerns continue to weigh on sentiment. In Europe, things aren’t much better as the fallout from this week’s tariff announcements and others planned for next week on April 2nd, shake investor confidence. The STOXX 600 is down about 0.5% which would put it down by about 1% for the week.

US futures are down across the board with the S&P 500 trading nearly 0.2% lower while the Nasdaq faces a decline of 0.31%. Treasury yields had been rising in recent days even as stocks struggled, but this morning, the 10-year yield is 4 basis points lower to 4.33%. Oil prices are basically unchanged at just under $70 per barrel, while gold and silver are both up about 1%. After hitting a record high two days ago and selling off by over 4% since then, copper prices are marginally lower again this morning.

This morning’s economic calendar is busy with Personal Income and Spending at 8:30, as well as the Michigan Sentiment report at 10 AM. The key report of the day, however, will be the PCE report at 8:30. How this report comes in relative to expectations will likely determine whether the week finishes with a plus sign or minus sign next to it.

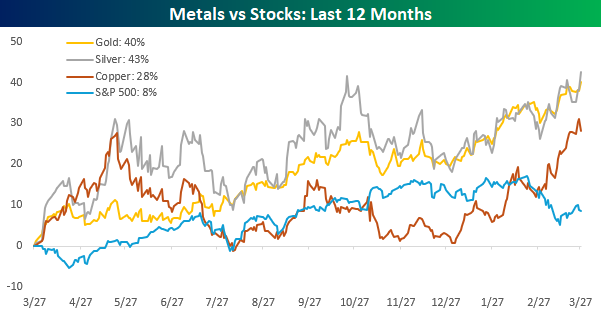

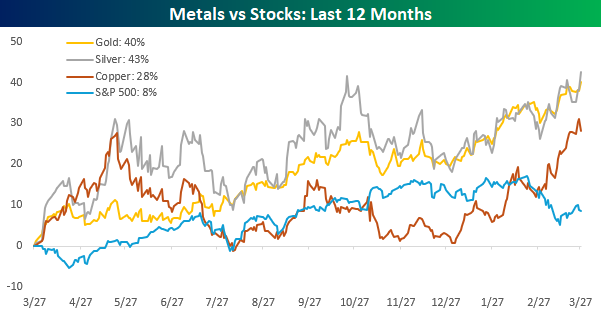

Stocks have had difficulties seeing gains lately, but hard assets like gold, silver, and copper have been ripping higher. Over the last year, gold and silver have rallied 40% or more while copper prices have risen 28%. The S&P 500 is also up on a y/y basis, but it’s up by less than a third of copper’s gain and less than a quarter of gold and silver. While gold and silver have been outperforming the S&P 500, up until just recently copper had been underperforming. Since the S&P 500’s peak in mid-February, though, all three commodities have seen their rallies pick up steam, and this week they all traded at 52-week and/or all-time highs.

This week’s move in copper was particularly interesting. After trading at an all-time high on Wednesday, copper finished the day down more than 2% from its intraday high and fell another 2%+ in Thursday’s session. As you can see in the chart, the commodity had a similar move higher and subsequent reversal early last May when it hit record highs after an even more impressive rally. While it’s tempting to look at the rally in copper as a sign of economic strength, it’s worth pointing out that the price in New York has rallied more than the price in London, and that’s because traders have been stockpiling inventories ahead of anticipated tariffs from the Trump administration.

Mar 27, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I like the dreams of the future better than the history of the past.” – Thomas Jefferson

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

After selling off throughout the session yesterday in anticipation of the President’s tariffs on the auto industry, the negative tone has flowed into this morning’s session. Equities are indicated to open modestly lower, and the potentially inflationary impact of these tariffs has yields moving higher with the 10-year yield approaching 4.4%. That could change in the hours ahead as investors digest several economic reports, including revised GDP, Personal Consumption, and Core PCE. We’ll also get jobless claims at 8:30, Pending Home Sales at 10, and then the KC Fed Manufacturing report at 11.

The tariff news yesterday has foreign stocks trading mostly lower. Japan was down 0.60%, and the STOXX 600, while off its lows, is still down 0.6% as Auto stocks in Japan and Europe weigh on performance.

With stocks getting a respite from the selling last week and into early this week, we expected some subsiding of the extremely high levels of bearish sentiment in the weekly survey from the American Association of Individual Investors (AAII). Bearish sentiment did manage to decline from 59.1% to 52.2%, but this week’s reading was still above 50% and higher than 96.8% of all prior weekly readings since 1987.

Mar 26, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You make no friends in the pits and you take no prisoners. One minute you’re up half a million in soybeans and the next, boom, your kids don’t go to college and they’ve repossessed your Bentley.” – Louis Winthorpe III, Trading Places

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To view yesterday’s CNBC segment, please click on the image below, and you can read today’s Morning Lineup PDF at the link below:

After weeks of heightened volatility, markets are relatively quiet for the second straight day this morning. Enjoy the peace while it lasts! Futures were indicated lower overnight but are now slightly, and we stress the word slightly, positive. One place we aren’t seeing gains this morning is in Europe as the STOXX 600 is trading lower for the fourth time in five trading days.

Today’s economic calendar is light. The only report on the calendar is Durable Goods at 8:30. Economists expect the headline reading to fall 1% m/m after a 3.2% in January. Excluding Transports, the report is expected to show an increase of 0.2% after no change in January. Besides those two reports, we’ll also hear from two Fed speakers with Goolsbee speaking at 10:00 AM while Musalem’s comments will hit the tape just after 1:00 PM Eastern.

After trading above its 200-DMA for the first time in over two weeks Monday, the S&P 500 traded above that level for the entire session yesterday notching its third straight day of gains for the first time since early February. The S&P 500 closed above the 200-DMA, but with a cushion of just 0.4%, it has hardly been a convincing move. Given the narrow spread between the price and 200-DMA, there’s been a relatively even split between the number of sectors trading above their respective 200-DMAs. As of Tuesday’s close, six finished the day above that level while five finished below, and six finished the day within 2% of their 200-DMAs (three above and three below), so it wouldn’t surprise us to see sectors flip-flopping between trading above and below that long-term trend line.

Two sectors that flip-flopped positions in yesterday’s session were Consumer Discretionary and Consumer Staples. Starting with the Discretionary sector, Monday’s rally took the sector within spitting distance of the 200-DMA, but a late-day rally on Tuesday helped to push the sector marginally above it.

While the more cyclical Consumer Discretionary sector managed to reclaim its 200-DMA, the more defensive-oriented Consumer Staples sector traded down modestly below that level yesterday. It’s good from a market perspective to see Consumer Discretionary rallying while the defensive-oriented Staples sector lags, but at this point, rather than breaking down, the sector has simply been trendless. In each of the last six trading days, the sector closed within 1% of its 200-DMA; three of those closes were above and three were below. In other words, the only ones making money in the sector recently have been Duke & Duke.

Mar 25, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I’d rather be optimistic and wrong than pessimistic and right.” – Elon Musk

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Futures have been drifting higher all morning and have just recently moved modestly into positive territory building on the optimism from yesterday’s session. When the day started yesterday, all the major index ETFs we track in our Trend Analyzer were at oversold levels, but after yesterday’s rally, we’ve seen a continuation of the uniformity where they have all moved out of oversold and into neutral territory.

While optimism that the planned tariffs from the trump Administration won’t be as draconian as feared helped boost the market yesterday, not much has changed. There’s still tons of uncertainty regarding what the planned policies will be, but lower prices do make those high levels of uncertainty more palatable. Today, we’ll get reports on New Home Sales and Consumer Sentiment, and investors will probably be most focused on how consumer sentiment has continued to evolve given all the uncertainty surrounding geopolitics, the economy, and trade/tariff policies. Also just released was the Philly Fed Non-Manufacturing report for March. That index collapsed from -13.1 to -32.5, the fifth negative reading in a row and the lowest since Spring 2020. When it comes to soft data, data remains very weak.

With a decline of over 31% year to date, it’s been a hangover of a year for shares of Tesla (TSLA). Elon Musk has become a lightning rod in American politics, and everyone reading this probably has strong opinions of him (in both directions). Sales of Tesla vehicles have slowed due to protests, rising competition, and slower overall sales in general. Incredibly, the stock is down over 40% from its high just over three months ago in mid-December, but it’s still 11% higher than it was on Election Day last year. That means it has outperformed more than 80% of stocks in the S&P 500 during that time!

Mar 24, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“What the eyes see and the ears hear, the mind believes.” – Harry Houdini

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

US equity futures are getting a boost this morning after news broke over the weekend that the Trump administration is planning on narrowing the scope of its planned tariff implementation on April 2nd. As of 8 AM ET, the S&P 500 ETF (SPY) was trading up 1.24% in the pre-market. If the gains hold, today will be the first time we’ve had a 1%+ opening gap higher on a Monday morning since October 17th, 2022!

Over the last ten years, there have been exactly twenty Monday morning gaps up of at least 1%. (Today would be the 21st.) On average, SPY has continued higher by another 0.17% from the open to the close on these strong Monday opens, and we’ve seen open to close gains 70% of the time. Only once (10/29/18) have we seen SPY finish the day in the red after starting the week with a 1%+ gap up.