May 20, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Every man who says frankly and fully what he thinks is so far doing a public service.” – John Stuart Mill

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Is it summer already? Summer doesn’t officially start for another month, and the unofficial start isn’t until this weekend, but we’re in the doldrums regarding futures. Depending on the index, futures are slightly higher or lower, but they’re all off the overnight lows. There’s no economic data on the calendar this morning, but several Fed speakers are scheduled to speak throughout the day.

The only major earnings report of the day is Home Depot (HD). The company reported weaker-than-expected EPS and broke a streak of 19 straight quarters of EPS beats. Revenues were higher than expected, though, and the company reiterated full-year guidance and said they do not plan to raise prices due to tariffs. In response, the stock is up about 2%.

Like the S&P 500, the Nasdaq 100 also comes into today riding a six-day winning streak. After yesterday’s gain, the index is currently within 4% of its all-time high, meaning that all it would take is a rally almost as strong as the last six days to get us there. Given the magnitude of the gain over the last six days, though, it’s unlikely we’ll see a move like that in the next several days, not only because we’re now sitting at overbought levels in the short term but also because the index is bumping up against potential resistance.

May 19, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs.” – Moody’s, 5/16/25

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

After being the lone holdout with a AAA credit rating on the sovereign debt of the US, on Friday evening, Moody’s joined Standard and Poor’s and Fitch in downgrading US debt. As you might expect, equity futures are lower and interest rates are higher in response to the news. As Moody’s noted in its statement, the downgrade is the result of ‘successive US administrations’, and the buildup of debt in the US has been a long-running issue. The news, therefore, is surprising to no one, but it still reinforces the problem and brings it to the forefront.

The chart below shows the 10-year US Treasury yield dating back to 2010, with each AAA downgrade notated on the chart. In the case of both the S&P and Fitch downgrades, the actions did little to change the trend in interest rates. When S&P downgraded US debt in 2011, yields were already falling and continued to decline, whereas the Fitch downgrade in 2023 came in the middle of a period when rates were rising. So, while each action garnered headlines, the ratings agencies didn’t tell us anything the market didn’t already know.

May 16, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The most important decision you make is to be in a good mood.” – Voltaire

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

The biggest individual stock story of the week and probably of the last year is UnitedHealth Group (UNH). The stock is down 28% this week alone and has been more than cut in half in just a month! It’s hard to remember what was once considered a blue-chip stock falling out of favor so fast.

UNH is also a member (for now) of the Dow Jones Industrial Average (DJIA), and because that index is price-weighted, the stock used to be one of the index’s largest components. That has made its fall from grace even that much more impactful on the index. The chart below shows the Dow’s performance over the last six months, and we have also created a theoretical index price that doesn’t include UNH (green line).

While the DJIA is still 6% below its recent high, without UNH, it would be just 2% from its high, and the spread between the current Dow and the Dow Ex UNH is 4.6% percentage points! From a technical perspective, the Dow would look much better without UNH. Through yesterday’s close, the Dow was still below potential resistance at its late-March/pre-Liberation Day high, but backing out UNH, it cleared those levels earlier this week. Taking out the index’s weakest component involves cherry-picking, but we think it provides some good perspective.

May 15, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“How you begin life is not nearly as important as how you end up.” – Emmitt Smith

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To view last night’s segment on CNN’s OutFront with Erin Burnett, click on the image below.

After some positive days of market performance, the euphoria surrounding the US-China trade talks has faded a bit as investors focus again on rising rates, with the 10-year treasury yield back above 4.5%. Walmart (WMT) marked the unofficial end to earnings season with better-than-expected earnings on inline revenues, and the stock is up fractionally. The morning is much worse for UnitedHealth (UNH) as that company’s terrible year continues with reports that the company is under criminal investigation related to billing practices in its Medicare Advantage plans. Based on where the stock is trading in the pre-market, shares have lost more than half of their value since April 11th!

While the pace of earnings reports is slowing down, today is one of the busier days in recent memory for economic data with Empire and Philly Fed Manufacturing reports for May, Retail Sales for April, PPI for April, jobless claims, Industrial Production, Capacity Utilization, and Business Inventories. As if that’s not enough, Powell will also be speaking at 8:40 eastern.

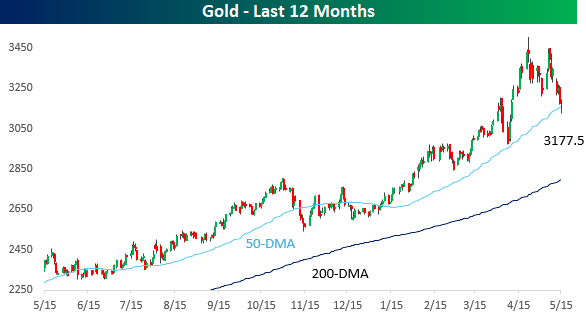

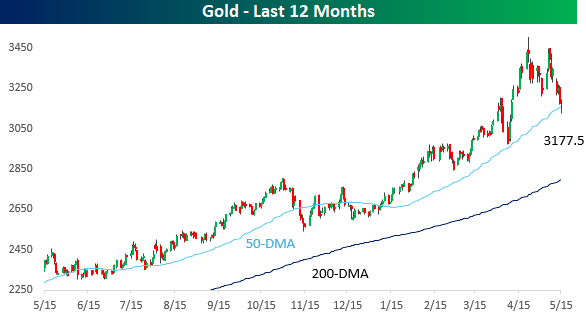

As tensions in global trade pushed economic uncertainty to levels rarely seen before, investors couldn’t get their hands on enough gold. At its high for the year on 4/22, front-month gold prices were up over 30% YTD, and Costco (COST) even had to place a one-ounce limit on the amount of gold that its customers could purchase as sales of the yellow metal on its website exceeded $200 million per month.

With the US and China dialing back on trade tensions, markets and investors have let out a giant exhale of relief, and while it has been good for risk assets, gold prices have taken a hit. Overnight, prices dropped as low $3,123 per ounce, representing a decline of 11% from the recent record high. While prices recovered a bit since the lows, gold briefly traded below its 50-day moving average for the first time since early January.

As gold corrects, its price has become increasingly volatile, and large daily moves have become increasingly common. While it traded more than 2% lower on an intraday basis yesterday, it finished the day down just 1.8%. Even though it didn’t have a daily move of 2%, 11 of the last 25 trading days have seen moves of more than 2%, and just recently, the rolling 25-day total was 12. As shown below, 2%+ daily moves haven’t been that clustered together since 2011, and before that, the Financial Crisis.

May 14, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The only strategy that is guaranteed to fail is not taking risks.” – Mark Zuckerberg

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Meta Platforms (META) founder Mark Zuckerberg turns 41 years old today, and love him or hate him, the man has certainly taken some risks in building META into what it is. That’s also why he has a net worth of over $200 billion, making him one of the richest people in the world!

This week, the market has taken a risk on persona, continuing into the pre-market futures. S&P 500 futures indicate a 27-bps point gain at the open while the Nasdaq is 0.40% higher. There’s not much in the way of earnings-related news to contend with today, the economic calendar is empty, and even the geo-political picture has experienced a bit of a lull. Just what you would expect as we all try to get through the middle of the week.

For the S&P 500, the first two trading days of the week have been notable for two big reasons. First, on Monday, the S&P 500 surged above its 200-DMA for the first time in over a month, as the S&P 500 rallied over 3%. The rally of 3.26% was the largest daily gain on a day when the S&P 500 crossed above its 200-DMA since March 2020. Second, it’s hard to see in the chart, but if you squint hard, you can see that yesterday was the first time in over two months that the S&P 500’s 50 and 200-DMA had an upward slope.

Yesterday’s upward shift in the slope of the 50 and 200-DMAs ended a streak of 56 trading days where both moving averages were sloping downwards. As shown in the chart, the length of that streak was far from extraordinary relative to history. During the 2022 bear market, we went nearly a year where at least one of the moving averages was sloping downwards, and during the financial crisis, the market had a stretch of over 19 months where at least one moving average was downward sloping. While the most recent period may not have been the longest streak with at least one moving average sloping downward, the fact that they are both now sloping upward is positive from a psychological standpoint.