May 30, 2025

Our Matrix of Economic Indicators provides a concise summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke-Summary-of-Economic-Indicators-123024-tpy9756

Bespoke-Summary-of-Economic-Indicators-123024-tpy9756

May 30, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you don’t occasionally make a mistake, you’re not doing your job.” – Jim Sinegal

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

There wasn’t a lot of action going on in the markets this morning. That was up until just a few minutes ago when the President started “truthing” about China, and said “No more Mr. Nice Guy!” Futures on both the S&P 500 and Nasdaq quickly went from unchanged to down about 0.5%. European stocks were higher but have given up some of their gains, while Asian stocks fell on the on/off/now back on Trump tariffs. Like the equity market, treasuries are little changed. Crude oil is one of the bigger movers this morning with a gain of just over 1% while gold, the dollar, and crypto are all in the red.

It may be Friday, but there’s a busy batch of economic data on the calendar with Personal Income and Spending, PCE, Chicago PMI, and Michigan Sentiment.

One of the more high-profile earnings reports since yesterday’s close was Costco (COST), which reported better than expected EPS on inline sales and an 8% increase in comp sales. COST is trading marginally lower in response to the report, with the stock on pace to gap down about 0.5% at the open. What’s notable about this morning’s weakness is that it continues a trend that has been in place for the stock since the start of 2022. As shown in the table below, not including this morning, shares of COST have gapped down in reaction to 11 of its last 13 earnings reports. Another negative open today would make it 12 out of the last 14!

May 29, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No technology has ever had the opportunity to address a larger part of the world’s GDP than AI.” – Jensen Huang

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To see yesterday’s CBNC interview, click on the image below.

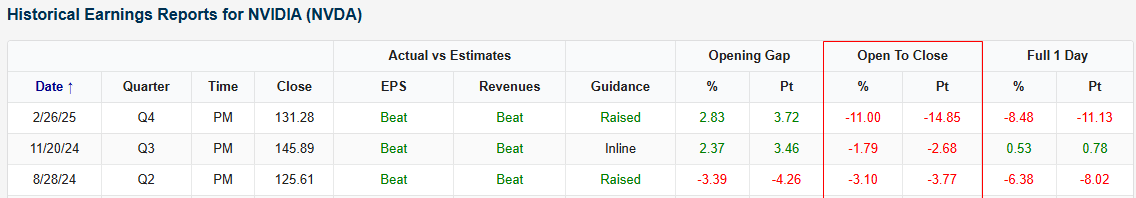

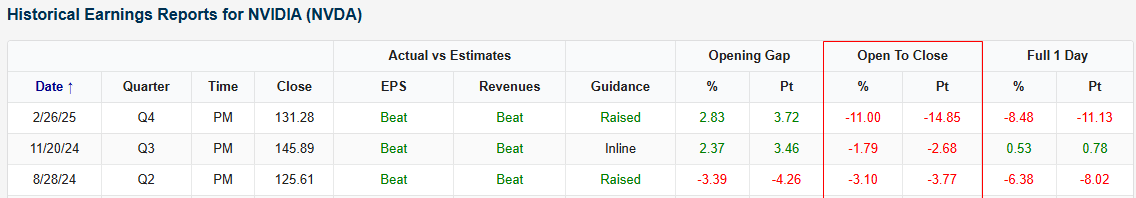

The biggest report of the earnings season has come and gone, but as Nvidia CEO Jensen Huang said on last night’s call, “This is just the beginning.” At least that’s what NVDA bulls are hoping. Based on pre-market levels, shares of NVDA are looking at an upside gap of over 5%. That would be the stock’s biggest upside gap in reaction to earnings since last May, and as we highlighted in Tuesday’s Chart of the Day, would extend its streak of positive reactions to May reports to four.

NVDA’s current pre-market levels are at the high end of the range the stock has traded in since the DeepSeek news first hit markets in late January. If NVDA can build on these gains during the trading day, it would be notable for two reasons. First, it would indicate a breakout from the post-DeepSeek range (shaded area in the chart below). More importantly, it would help to reverse a trend where the stock has repeatedly capped rallies with intraday negative reversals (see arrows in the chart below).

This trend has also been evident on the stock’s recent earnings reaction days. Following the last three earnings reports, the stock has sold off from the open to close, including in February when it sank 11% after initially gapping up nearly 3%.

May 28, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Most ways of making big money take a long time. By the time one has made the money one is too old to enjoy it.” – Ian Fleming

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Today’s the day. The second most valuable company in the world, and the most important company when it comes to AI, reports after the close, and there will be a lot of attention on what Nvidia (NVDA) has to say when the company reports. Ahead of this afternoon’s report, it’s so quiet in the futures market, you can hear a pin drop as markets digest Tuesday’s big gains to kick off the week. The only economic report on the calendar this morning is the Richmond Fed Manufacturing report at 10 AM, while the Minutes of the last FOMC meeting will hit the wires at 2 PM Eastern. While NVDA is this afternoon’s main earnings event, we’ll also get reports from HP (HPQ) and Salesforce (CRM).

Heading into this afternoon’s report from NVDA, the stock has had a wild ride. Although it’s trading right at levels it was at a year ago, the stock has been all over the place, trading from above $140 late last spring to just above $90 early last August. From there, it rallied back to new highs and above $150, but less than two months ago, it was back below $90 amid the chaos of the Liberation Day tariffs. Then, yesterday, it closed back up near $140. For a large-cap stock to see back-and-forth fluctuations of declines over 35% followed by gains of over 60% is wild enough, but when swings like this occur in what is one of the most valuable companies in the world from a market cap perspective, it’s nuts.