Dec 22, 2022

The misery of 2022 has continued when it comes to investor sentiment. In the latest weekly AAII poll, bullish sentiment declined from 24.3% down to 20.3%. That’s the lowest reading since the end of September and less than five points above the YTD low of 15.8% from mid-April.

As shown in the chart above, there hasn’t been a single week this year where bullish sentiment has been above its historical average of 37.6%, and the only week where sentiment was even close to its historical average was at the start of the year. With just one week left in the year, barring a historic one-week surge, 2022 will go down as the first year in the history of the AAII survey where there wasn’t a single week that bullish sentiment was above average. Talk about malaise. Click here to learn more about Bespoke’s premium stock market research service.

Aug 6, 2020

As mentioned in a prior post, in the past week the S&P 500 has moved within 2% of its 2/19 high, but at the same time, less than a quarter of AAII respondents are optimistic for the future of stocks over the next six months. That begs the question- if there have been past times that sentiment and price action have been so detached from one another. Since the start of the AAII survey in 1987, there have been 10 periods (including the current one) in which the S&P 500 was within 2% of an all-time high but bullish sentiment was less than 25% without another occurrence in the prior three months. The most recent prior occurrence was not even a full year ago. Back in October, sentiment was only slightly higher as the S&P 500 was 1.84% from its all-time high. Prior to that, there were some scattered instances throughout 2013, 2015, and 2016 but before that, you would have to go back to 1993 to find another similar period. The one occurrence in 2013 stands out as it was both the lowest sentiment reading of these prior occurrences and the only one that occurred with the S&P 500 right at an all-time high.

As for where things stand after such instances, sentiment has tended to reverse higher in the following six months as the S&P 500 has tended to move higher. The S&P 500 has actually tended towards better than average returns over the next three months, although performance six months out has been modestly worse than average, even as it has been higher more often than not. Additionally, as shown in the second chart below, of the more recent occurrences of the past decade, they haven’t marked any major top or bottom for the S&P 500 with occurrences clustered both coming off of lows and in the middle of longer-term uptrends. Click here to view Bespoke’s premium membership options for our best research available.

Dec 19, 2019

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Apr 18, 2019

Last week, bullish sentiment as indicated by the AAII’s weekly survey of individual investors came in at the second highest level of the year at 40.29%. Declines this week seemed to have weighed on bulls as the percentage of investors reporting as bullish fell to 37.56%. That is back below the historical average of 38.2%, though, it is also not far away from where bullish sentiment has stayed for much of the year. This week’s level deviates slightly from the Investors Intelligence survey which saw bearish sentiment unchanged while optimism rose to the highest levels since October.

Start a two-week free trial to Bespoke Institutional to access our Closer which includes our Market Timing Model which uses these sentiment indicators to forecast the market.

The bearish camp seems to have borrowed from the bulls as 21.83% of investors reported bearish sentiment versus 20.38% last week. This is a fairly small movement relative to what could be observed in the past couple of months. For example, last week and in the final week of March, bearish sentiment fell by over 7%. In other words, bearish sentiment seems stable around the lower end of the range from the past few years, now several percentage points below the historical average of 30.31%.

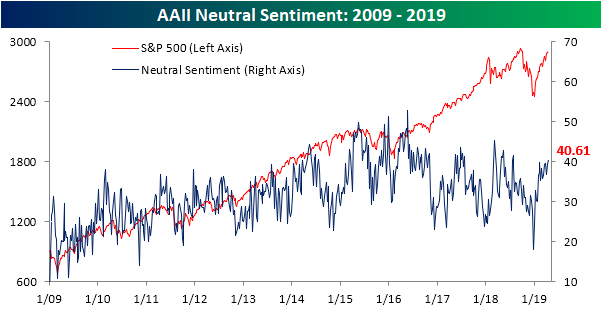

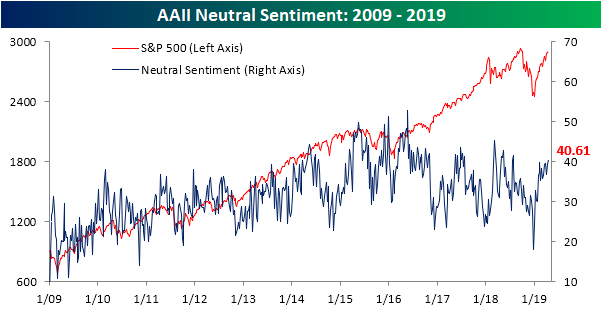

While bullish and bearish sentiment remains high and low, respectively, neutral sentiment is also very elevated. At 40.61%, the percentage of investors reporting neutral sentiment is now slightly over one standard deviation above the historical average. The last time this happened was in late July of last year.