Mar 28, 2019

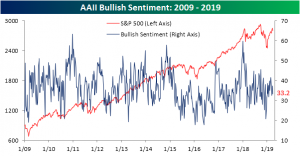

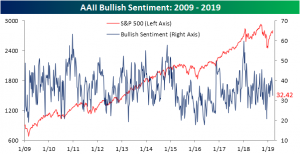

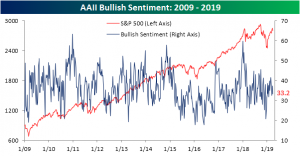

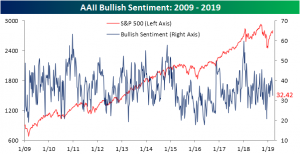

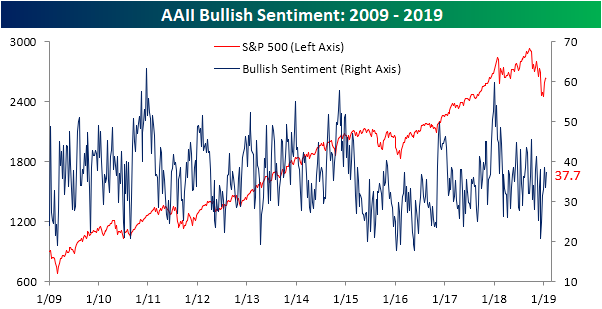

Bullish sentiment is back down this week to 33.2% as the percentage of individual investors reporting as bulls fell just over 4% from last week’s 37.3%. Optimism has now declined 8.4 percentage points from the recent high in late February. While still not at any sort of extreme levels, this most recent reading does sit on the lower end of the range from the past few weeks.

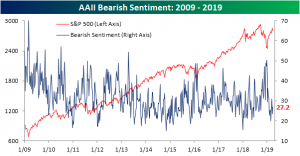

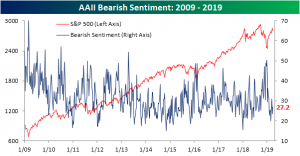

All of the declines in bullish sentiment seem to have predominately gone to the negative camp as bearish sentiment rose this week to 27.2% from 23.4% last week. Similar to bullish sentiment, bearish sentiment has yet to reach any sort of extreme readings.

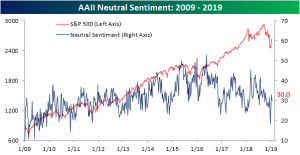

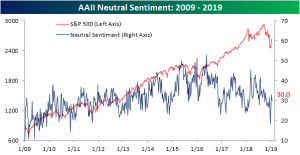

The same cannot necessarily be said for neutral sentiment. As price action has somewhat plateaued around current levels, an increasing amount of investors predict the market to remain here for the coming months. At 39.6% this week and just off of the recent high of 39.82% from last month, neutral sentiment has remained the most popular opinion among investors for three weeks in a row now. These levels are approaching an extreme too as they sit just under 1 standard deviation above the historical average.

Mar 14, 2019

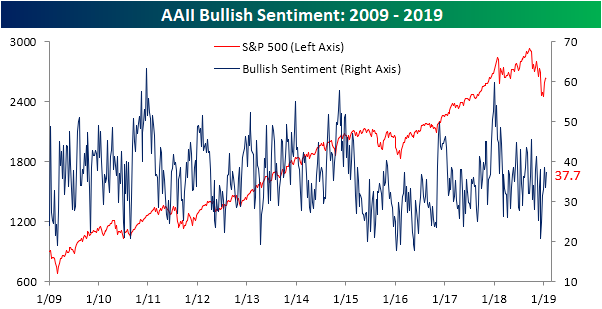

Bullish sentiment as seen through AAII’s weekly survey of individual investors released this morning showed another drop in bullish sentiment. This comes following the first weekly decline that equities have seen so far in 2019. The percentage of investors expressing optimism dropped to 32.42% from 37.39% last week. The week prior to that was a recent high, and the highest since early November, at 41.63%. Given this week’s strong rally so far, it would not be surprising if bullish sentiment picks back up again in next week’s survey.

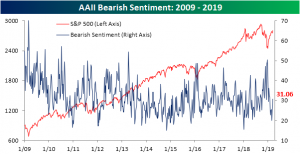

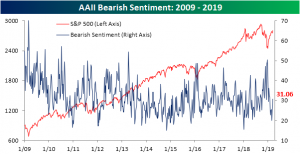

Conversely, bearish sentiment rose to its highest level since the final days of January coming in at 31.06% versus 26.75% last week. Bearish sentiment has come well off of its lows of 20% only a couple of weeks ago. Where it currently sits is much more in line with its historic average of 30.5%.

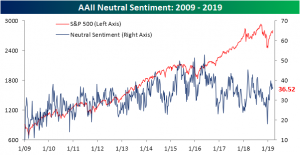

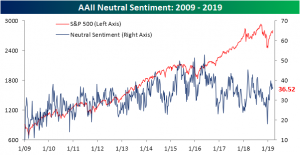

Meanwhile, neutral sentiment (investors not predicting any change in the stock market) moved slightly higher to 36.52% after dropping to 35.87% last week. Unlike bullish and bearish sentiment which have seen a degree of mean reversion, neutral sentiment has remained fairly elevated for most of the new year. Seems to make sense that investors largely report neutral sentiment as Q4 highs continue to be stiff resistance.

Mar 7, 2019

As the S&P 500 has stalled out near late 2018 highs, sentiment readings have moved pretty much in line with what could be expected. Bullish sentiment has fallen off of its multi-month high of 41.63% reached last week. This week, bullish sentiment as seen through the AAII individual investor survey came in at 37.39%. This drop is nothing too dramatic as it brings the percentage of optimistic investors just below the historical average of the survey of 38.5%. It is also still near the upper end of the range it has been in for the past year.

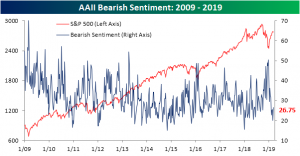

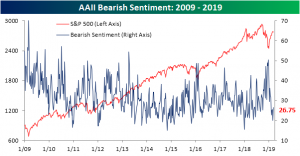

Bears have taken all of the gains from declines in neutral and bullish sentiment. Bearish sentiment rose this week to 26.75% off of 52-week lows of 20% from last week. Like bullish sentiment, while this is a solid increase it does not necessarily leave the sentiment level at any sort of extreme. At its current levels, it is under 4% away from its historical average. With that said, it remains low relative to where it had been for the latter half of 2018.

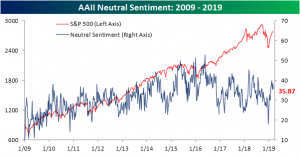

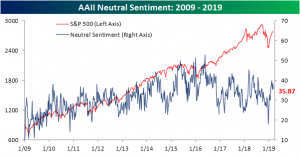

As previously mentioned, neutral sentiment fell this week by 2.5% down to 35.87%. Neutral sentiment has worked its way up since the market put in its bottom. Despite this week’s decline, it is still at fairly elevated levels. Given these readings, individual investors seem to be showing some signs of hesitation as the market reaches resistance, but at the same time, are not expressing outright bearishness at these levels.

Feb 14, 2019

Sentiment pulled back slightly this week but has maintained a fairly optimistic attitude as seen through the weekly AAII survey data. Bullish sentiment fell to 35.1% from a recent high of 39.87% last week. While that is below the historical average, it is well off of the lows of the past few months as markets sold off and is now sitting right in the middle of the range from 2018.

Bearish sentiment, on the other hand, remains at multi-month lows but picked up slightly this week. Pessimistic views rose to 25.07% from 22.78% last week. While these readings could seem concerningly low when looking at the past six months or so—meaning from a contrarian perspective it is due for a reversal—it is not necessarily a concern as it is only at a lower range than the indicator has been at for the better portion of the past few years.

Meanwhile, neutral sentiment has picked up significantly in the past few weeks. This week’s reading of 39.82% is the highest since late July of last year. It is also the fourth consecutive week of an uptick in this sentiment reading. Since the market bottomed on Christmas Eve, neutral sentiment has increasingly become the majority sentiment reading from investors. In other words, as the market has rallied, investors have been less polarized between bulls and bears as they had been during the late 2018 volatility. Rather, investors seem to be a tad more cautious of the markets and have low expectations of bigger movements in either direction. Depending on whether or not a contrarian stance to the indicator is taken, the survey’s recent results have indicated more investors are expecting markets to rally or maintain these levels than continue the sell-off from late 2018.

Jan 24, 2019

Bullish sentiment ticked back up this week to 37.7% after falling to 33.5% last week. This comes as the S&P 500 has traded above its 50-DMA for a week now. The weekly investor sentiment survey conducted by AAII has come off of extremely low levels from the late 2018 sell-off and has maintained above 30% readings for all of 2019 so far. This jump in bullish sentiment is still slightly lower than the historical average and where we were only a couple weeks ago (38.5%).

Bearish sentiment fell 4% this week down to 32.3%. Bearish sentiment has fallen off of extremely elevated levels following the Christmas Eve sell-off. While it has fallen, bearish sentiment remains above the historical average of 30.5%, though not by much.

Neutral sentiment has remained essentially unchanged at 30% this week. Given this, the gain in the bullish camp seems to have entirely come from those with formerly pessimistic outlooks.