Mega-Caps Down $5 Trillion in Market Cap, AMZN Now Down $1+ Trillion

As we approach the end of 2022, below is an updated look at the drawdown in market cap that we’ve seen in the US equity space since major indices peaked on the first trading day of the year. Using the Russell 3,000 as a proxy, the US stock market has seen an $11.7 trillion drawdown from the peak on 1/3/22. The max drawdown was $13.6 trillion at the low on 9/30, so we’ve seen market cap increase by just under $2 trillion since then. In dollar terms, this drawdown has been more extreme than anything investors have ever experienced. That’s pretty deflationary if you ask us!

Of the $11.7 trillion drawdown in US equity market cap, just over $5 trillion of the drop has come from six companies! Below is a look at the six current and former “trillion dollar market cap” club members that have now collectively lost about $5.07 trillion in market cap from their peaks. As shown, Apple (AAPL), Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), Meta (META), and Tesla (TSLA) have all lost at least $750 billion in market cap from their highs. And Amazon (AMZN) is the first to lose more than $1 trillion in market cap! Just a few years ago, no company had a market cap of more than a trillion dollars, and now we have a company that has lost more than a trillion dollars in market cap.

For all six of these companies, their current drawdowns are easily their biggest on record. Apple (AAPL) has lost $880 billion, Alphabet (GOOGL) is down $846 billion, Meta (META) and Tesla (TSLA) are both down more than $760 billion, and Microsoft (MSFT) is down $784 billion even though it was down close to a trillion at its lows in November. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 12/20/22 – Japanese Jolt

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“To lose is to win” – Japanese Proverb

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

If the above statement is true, 2022 should end up as one of the best years ever. Right? Futures are mixed this morning, but there was still some big news overnight in central bank moves as the Bank of Japan raised the upper bound of its cap on the 10-year JGB yield by 0.25 percentage points to 0.50%. While the move wasn’t entirely a surprise, the timing was. Just yesterday, in our Morning Lineup, we discussed how this type of action would likely be taken in April when Kuroda retires from the BoJ.

While equity futures have seen little impact from the BoJ news, interest rates in the US are higher across the board this morning with the 10-year yield up to 3.66%. In economic news, the only data on the calendar today is Building Permits and Housing Starts at 8:30. Building Permits missed by a mile while Housing Starts actually posted a slight beat.

The Bank of Japan’s jolt to financial markets overnight had one of the most direct impacts on the value of the yen which surged 3% relative to the dollar. Besides just the last 24 hours, it has been a very strong two months for the yen. After the dollar peaked at 150 yen two months ago today, it has experienced a sharp move lower falling more than 10% versus the yen and looking at the chart in recent weeks, there have been a number of sharp single-day moves lower.

The USD/JPY cross is now significantly below its 200-DMA after closing below that level earlier this month for the first time since early 2021 – nearly two years earlier! Going back to 1972, that streak of 462 trading days was the longest streak of closes above the 200-DMA on record and just the fourth streak that lasted more than a year.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

B.I.G. Tips – Disney (DIS) Falls to COVID Crash Lows

Weaker than expected ticket sales for its new Avatar movie were part of the reason Disney (DIS) shares fell another 4.77% yesterday. As shown below, the stock has now round-tripped its entire post-COVID bull market run-up from $85.76 to a high of $201.91 seen on March 8th, 2021. At $85.78, DIS is now just two cents above its COVID Crash closing low.

Start a two-week trial to Bespoke Premium to read more about Disney’s current drawdown and how it compares to prior big moves lower.

The Closer – Markets Red In To Christmas – 12/19/22

Log-in here if you’re a member with access to the Closer.

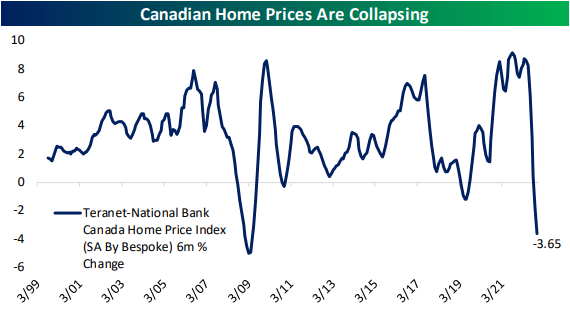

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out tonight by checking in on where the past several days of declines leaves the S&P 500 from a technical perspective and what forward returns may look like given similar past declines (page 1). We then check in on economic and policy uncertainty indices (page 2) and Canadian home prices (page 3). We then preview this week’s Treasury auctions (page 4) before finishing with a speculator positioning update (pages 5 – 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!