May 23, 2022

Bespoke’s Little Known Stocks (LIKS) report highlights a company that may not be on the traditional radar of most investors. In this report, we provide an in-depth analysis of the little known stock, including industry insights, growth lever analysis, insights to the competitive landscape, equity performance, relative valuation, operational efficiency, pros & cons, and more. This week’s report is about a discount retailer that has the ability to benefit as household discretionary budgets compress.

As always, this report is for informational purposes only and is not a recommendation to buy or sell any specific securities. Investors should do their own research and/or work with a professional when making investment decisions. Highlighting a stock doesn’t mean we are bullish or bearish on it. Our goal is simply to provide readers with facts to help them make informed decisions rather than just opinions.

Bespoke’s LIKS reports are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our LIKS reports. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan[/MM_Access_Decision]

May 10, 2022

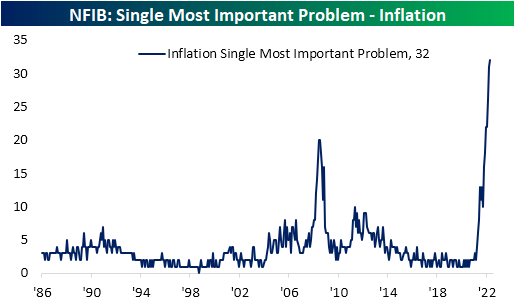

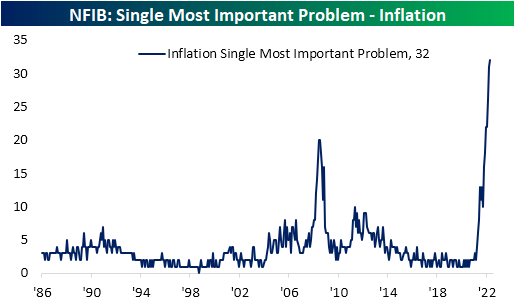

As we noted in an earlier post, inflation appears to be a major driver as to why small businesses are reporting historic pessimism for the US economy. Looking across the most important problems reported by small businesses in the NFIB’s monthly survey, inflation takes the cake as the biggest concern. Nearly a third of responding firms reported higher prices as their biggest problem; the highest level on record in data going back to 1986. That has now surpassed the prior series high of 20% in mid-2008.

Given inflation has stolen such a large share of small business worries, several other problems are now at or near record lows. For example, no firms reported competition from big businesses as the biggest issue. Government requirements and red tape are similarly at a record low after a one percentage point decline month over month. Taxes, poor sales, and financial and interest rates are also not a huge concern according to the survey.

With both government-related concerns dropping yet again, the combined reading between the percentage of respondents reporting taxes and government red tape as their biggest issues hit a new record low of 22%. The past few Presidential administrations have seen this reading more elevated and rising with Democrat presidents while Republican Presidents have coincided with lower readings. The current administration is now an exception with big declines as inflation concerns have come front and center.

The rise of inflation concerns have also resulted in a pullback in the share of respondents reporting cost or quality of labor as the biggest issue. While the combined reading rose one point in April thanks to the quality of labor, the combined reading is well off the peak of 40% from last September. Additionally, for the second month in a row and for the first time in roughly a decade, inflation continues to be the bigger concern. Click here to learn more about Bespoke’s premium stock market research service.

Apr 12, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“In spite of the cost of living, it’s still popular.” – Kathleen Norris

The CPI report that everyone was waiting for has finally arrived and as is usually the case when everyone expects the worst, the results weren’t as bad as feared (although they’re far from good). On a headline basis, CPI rose 1.2% m/m which was right in line with forecasts. Core CPI, however, rose ‘just 0.3%’ compared to forecasts for a gain of 0.5%. Given the weaker than expected core reading, futures have shot higher with the Nasdaq up nearly 1%. As equities have rallied, Treasury yields are falling but still high even relative to where they were last week!

Make no mistake, these readings are still very high relative to recent history. For example, backing out the period since 2020, the 0.3% increase in m/m Core CPI would have been the highest since March 2006. Compared to recent trends and what people were expecting, though, this morning’s report was a positive surprise.

Read today’s Morning Lineup for a recap of all the major market news and events from around the world, including the latest US and international COVID trends.

We all know that recent inflation data has been high, but the consistency of upward pressure has been incredible. It’s a popular narrative that the Fed is behind the curve, but they’re not the only ones. Economists have simply not been able to catch up and get ahead of the persistent trend of rising prices. The chart below shows the rolling 24-month total of the weaker than expected m/m headline CPI reports going back to 2000.

During this span there have only been three months where headline CPI came in weaker than expected. Three!. Going back to 2000, there has never been a period where weaker than expected CPI reports were as scarce as they have been in the last two years.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Apr 6, 2022

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we review the possible implications of long-term trend breaks in US Treasury yields.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!