May 19, 2022

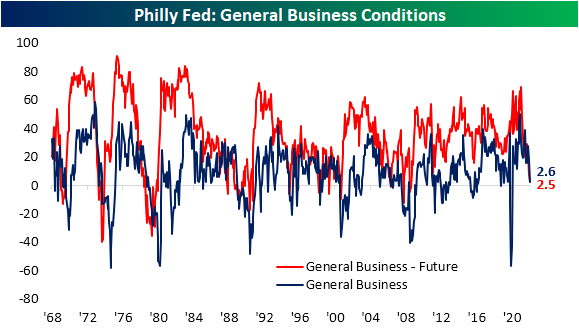

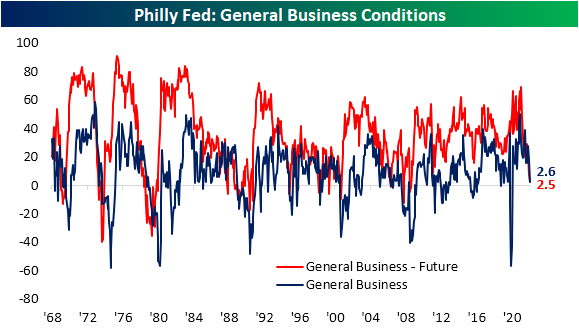

On the backs of a disappointing Empire Fed earlier this week, the neighboring Philadelphia Federal Reserve Bank’s own reading on its region’s manufacturing economy also came in well below expectations at the headline level. The index for General Business Conditions was anticipated to decline from a healthy reading of 17 to a more modest 15. Instead, it plummeted to a barely positive reading of 2.6. That would point to a significant moderation in activity in the month of May.

While the headline index fell sharply, the rest of the report was perhaps more mixed. Breadth was certainly weak with only three categories rising month over month (New Orders, Shipments, and Unfilled Orders). As for the indices that declined, on the one hand, some could be perceived as welcome drops with pullbacks in elevated readings of prices and delivery times. On the other hand, the moderation in Number of Employees or CapEx expectations could be taken as a less positive sign for the broader economy.

As shown in the table above, overall most current conditions indices remain historically elevated even after recent declines. Expectations indices meanwhile are generally more depressed with some readings even near record lows. As such, the average normalized distance between the current conditions and expectations categories throughout the report have broken out to the highest level since February 1988 and mid-1975 before that. Put differently, there have rarely been times in which the region’s manufacturers have reported such a dramatic difference between healthy current conditions while also holding a pessimistic outlook.

Taking a closer look at individual categories, New Orders remain well off-peak but ticked higher in May rising 4.3 points to 22.1. There was an even larger jump in expectations, although the level of that index is not nearly as elevated. The modest increase in demand was met with a huge jump in Shipments and Unfilled Orders. With a 16.2 point jump month over month, Shipments are reported to be growing at the fastest rate since the fall of 2020. Given the region’s firms are getting orders out the door at a faster clip, inventories are growing only modestly with that index falling to a barely expansionary 3.2. Additionally, that evidence of improved fulfillment also resulted in a huge drop in expectations for Unfilled Orders. In fact, that index dropped to the lowest level since March 1995. That means the region’s firms expect to work off unfilled orders at a historic rate in the coming months.

The likely reason as to why companies are anticipating such a huge improvement in fulfillment is massive expected declines in lead times. Delivery Times remain elevated but have moderated significantly in the past couple of months. Six-month expectations meanwhile have fallen all the way down to -29.1 which, like unfilled orders expectations, is the lowest level since March 1995.

Another expectations reading that has fallen precipitously in May is CapEx expectations. The reading fell to the worst reading since September 2016 indicating huge moderation in planned investment. Likewise, hiring is expected to slow as has already been observed by the current conditions index. We would note that these readings remain positive, meaning firms are still expecting to take on more hiring and spending on net, but at a more modest rate. Click here to learn more about Bespoke’s premium stock market research service.

May 19, 2022

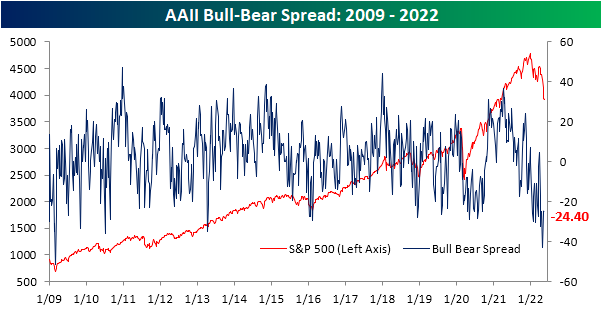

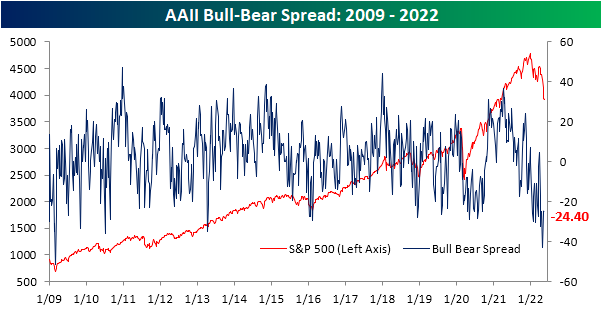

Depending on when a respondent reported their answers to the weekly AAII sentiment survey, they could have been justified in giving either bullish or bearish. From last Thursday’s close to Tuesday, the S&P 500 rallied a little more than 4% but anyone reporting yesterday would have reflected the index giving back all of those gains in a single session. Given that back and forth of equities, sentiment remains little changed. Around a quarter of respondents remain in the bullish camp as has now been the case for three weeks in a row. Albeit a historically low reading, it is a major improvement from readings in the mid-teens only one month ago.

Bearish sentiment meanwhile ticked higher and back above 50% this week. As with bullish sentiment, that is an overwhelmingly pessimistic reading even if it is less extreme than last month when it closed in on a 60% reading.

The bull-bear spread in turn was marginally improved rising from -24.7 to -24.4 indicating sentiment stays heavily slated toward pessimism.

With both bearish and bullish sentiment gaining share this week, the percentage of respondents reporting neutral sentiment fell back below 25% to 23.6%. Click here to learn more about Bespoke’s premium stock market research service.

May 18, 2022

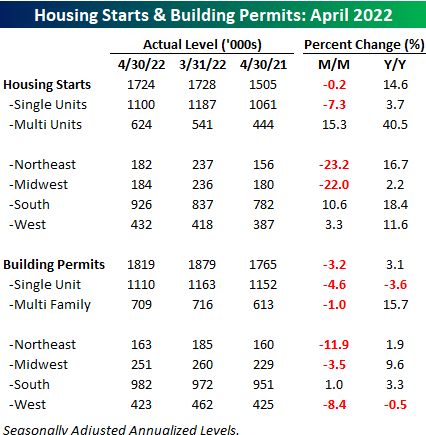

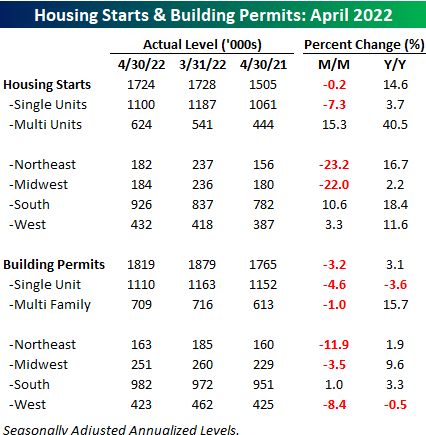

On the same day that mortgage applications plunged 12% and one day after homebuilder sentiment for the month of May showed a large decline, the latest updates on Housing Starts and Building Permits showed a mixed picture. While economists were expecting both reports to decline, the drop in Housing Starts was more than expected while the decline in Building Permits was slightly less than forecast.

The table below breaks down this month’s report by type of unit and region and shows both the m/m and y/y changes. For Housing Starts, the 0.2% m/m decline was driven entirely by single-family units (-7.3%) while multi-family units surged 15.3%. With respect to Building Permits, we saw a similar breakdown although the disparity wasn’t nearly as large as single-family units dropped 4.6% while multi-family units declined just 1%. On a regional basis, the Northeast and Midwest experienced 20%+ declines on a m/m basis while every region except the South experienced declines in Building Permits.

While both Housing Starts and Building Permits declined on a m/m basis, the longer-term trend for both still remains intact. At 1.759 million, the 12-month average of Building Permits came in at the highest level since January 2007 while the 1.659 million average level of Building Permits was the highest since February 2007. Higher interest rates have caused a slowdown in housing at the margin, but longer-term trends have yet to show signs of rolling over. Click here to learn more about Bespoke’s premium stock market research service.

May 18, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Inflation is a form of tax, a tax that we all collectively must pay.” – Henry Hazlitt

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

This week the tax of inflation is being felt most by retailers as two of the nation’s largest retailers have gotten absolutely destroyed in the last two days. Futures are indicated lower this morning, but one could make the case, given the plunge in Target (TGT) shares this morning, that it could even be worse. Oil prices are also trading up close to 2%, the ten-year yield is back up to 3%, and the dollar is trading lower.

On the economic front, we’re about to get the latest updates on Housing Starts and Building Permits for April, but if mortgage data is any indication, the data isn’t likely to be very strong.

In today’s Morning Lineup, we recap the continued developments in retail earnings (pg 4), market action in Asia and Europe (pg 4), economic data in Asia and Europe (pg 5), and a lot more.

If you thought yesterday’s 11% pounding of Walmart (WMT) was bad, meet Target (TGT). After reporting significantly weaker than expected earnings on better than expected revenues, shares are trading down more than 20% in the pre-market. The company blamed ‘unexpectedly high costs’ that it faced throughout the quarter for the earnings miss, and didn’t provide much additional detail in its release. Investors aren’t waiting for further clarity, though. With margins falling more than 400 basis points (bps), the stock is trading down more than 20% in the pre-market and is easily on pace for not only its worst earnings reaction day in at least 20 years, but also its worst one-day drop since the 1987 crash.

Yesterday, WMT had its largest one-day decline since the 1987 crash and now TGT is on pace to do the same! The experiences of both companies further reinforce the point that we are operating in one of the most complicated macro environments that any company or investor has had to deal with. Few companies are so entwined into so many aspects of the US economy as WMT and TGT, and their logistics and supply chain operations rival or exceed those of most other companies. If they’re having these types of issues keeping up with the rapidly changing environment, who isn’t?

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

May 17, 2022

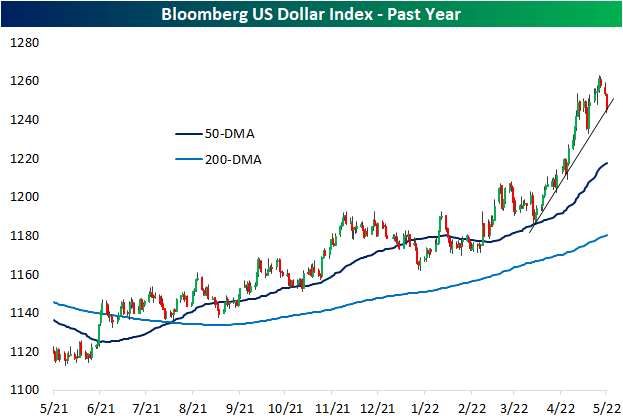

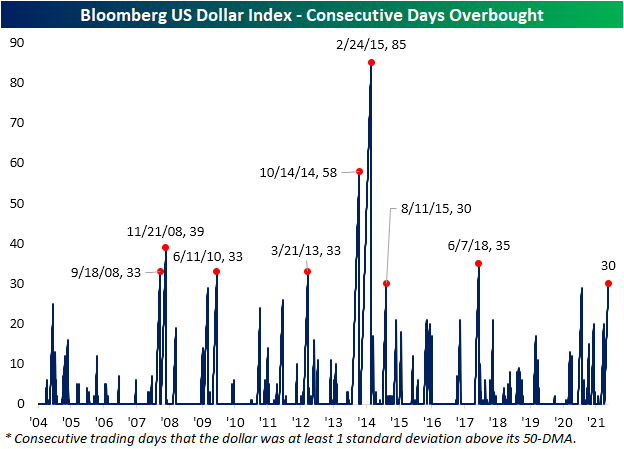

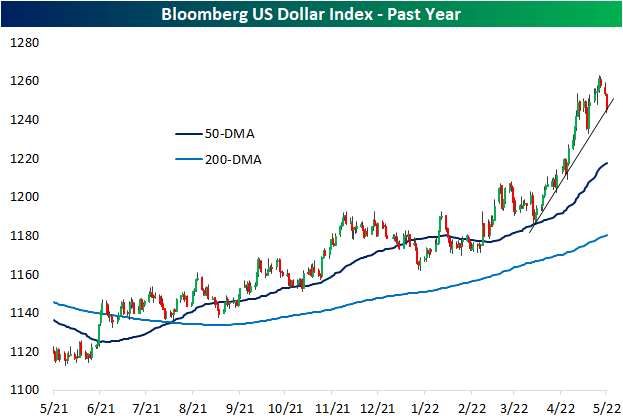

The US dollar has surged amidst the weakness in risk assets in 2022. While also part of a longer-term and more gradual uptrend over the past year, in the past couple of months the Bloomberg Dollar Index has seen its uptrend steepen significantly. Since the last retest of its 50-DMA at the end of March, the dollar was up over 6% through the closing high last Thursday. To round out last week and start this week, the dollar has pulled back sharply with a 1.25% decline. While that may not sound like much, it ranks in the third percentile of all 3-day moves going back to the start of the index in 2005.

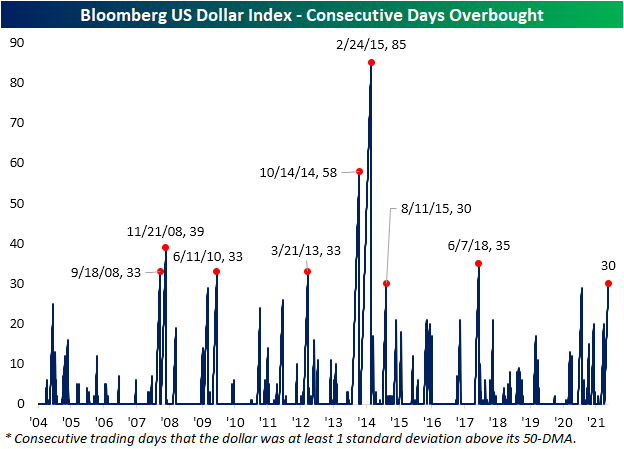

At the moment, the dollar is testing the aforementioned steep uptrend off the late March low. Assuming that the uptrend or any recent lows do not provide support, the dollar has much further to go until it would test its 50-DMA. In fact, the dollar would currently need to fall another 2.28% to reach its 50-DMA as it has consistently traded well above that moving average for multiple weeks in a row. As shown in the second chart below, the dollar recently hit some of the most overbought levels of the past five years, and the long stretch of days with overbought (1+ standard deviation above its 50-DMA) readings has continued.

While recent declines have put the streak on the ropes, today marks the 30th consecutive trading day that the dollar has been at least one standard deviation above its 50-DMA. Going back through the history of the index, there have only been 8 other streaks that have also gone on for at least 30 trading days. The most extended of these ended in February 2015 at 85 days long. The next longest only occurred shortly before that in October 2014.

Additionally, given the dollar has been pulling back, it could be reasoned that stocks with heavy domestic exposure would underperform relative to those with more international exposure. Since last Thursday, that has largely been the case. In the chart below, we have broken down the Russell 1,000 into deciles based on their share of revenues generated from abroad. The first decile is composed entirely of stocks with 100% of revenues generated within the US while the tenth decile is the stocks with the most international exposure. That tenth decile has seen notable outperformance with an average gain of nearly 6% versus an average of 4.2% for all other deciles. The eighth and ninth deciles have also averaged stronger returns than most other groups while the worst performance comes from the first decile, the 100% domestic stocks. Click here to learn more about Bespoke’s premium stock market research service.