Jul 14, 2022

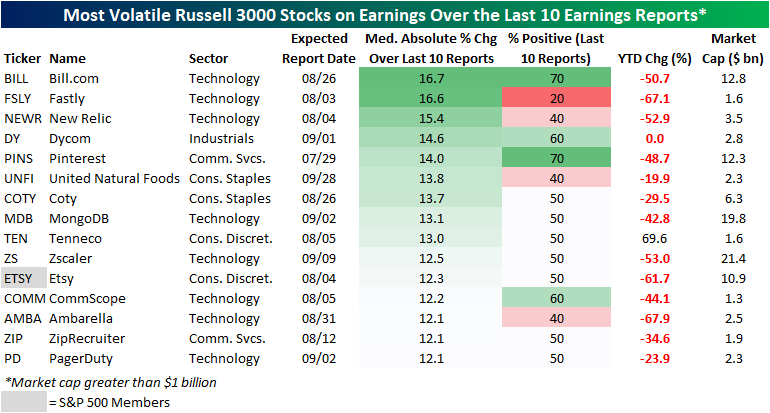

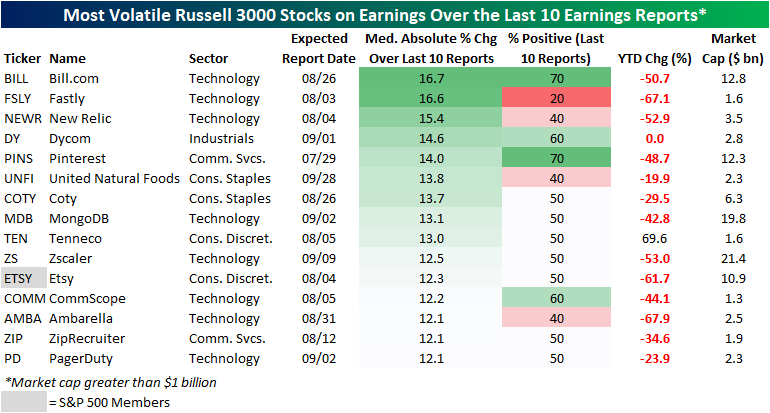

With earnings season kicking off, we wanted to highlight Russell 3000 stocks that in recent history have been the most volatile in reaction to earnings (over the last ten quarters). In order to be included in this list, a stock must have reported at least ten quarters since going public and must also have a market cap over $1 billion. The list includes tech companies, e-commerce players, food producers, and more. On average, these stocks are down 35.1% on a YTD basis (median: -44.1%), which is notably worse than the overall market. We measured volatility by the median absolute percent change on earnings reaction days over the last ten quarters, and these names averaged a move of 13.6% in either direction on their earnings reaction days. The most volatile name has been Bill.com (BILL), followed by companies like Fastly (FSLY), New Relic (NEWR), Dycom (DY), and Pinterest (PINS). Only one of the stocks outlined below is in the S&P 500 (Etsy), and none have a market cap of more than $21.4 billion.

Of course, volatility does not imply direction. Of the 15 stocks outlined below, two – BILL and PINS – have seen seven of their last ten reports result in gains on their earnings reaction day. On the other end of the spectrum, four stocks have seen positivity rates of 40% or less over the last ten reports: Fastly (FSLY), New Relic (NEWR), United Natural Foods (UNFI), and Ambarella (AMBA). If you own any of these names, be prepared for a potentially sharp reaction to earnings (in either direction) when they report this earnings season. Click here to learn more about Bespoke’s premium stock market research service.

Just to show you what we mean, the graphic below shows BILL’s (the most volatile name on the above list) earnings reactions over the last 10 quarters. As you can see, eight of its last ten reports have been followed by a one-day reaction of 10%+, including four moves of more than 20%! Click here to learn more about Bespoke’s premium stock market research service.

Jun 1, 2022

Bespoke’s Conference Call Recaps provide helpful summaries of corporate conference calls throughout earnings season. We go through the conference calls of some of the most important companies in the market and summarize key topics covered by management. These recaps include information regarding each company’s financial results, growth by segment, as well as some aspects of the business that management expects to impact future results. We also identify trends emerging for the broader economy in these recaps.

Bespoke’s Conference Call Recaps are available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call recaps. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Below is a list of the Conference Call Recaps published during the Q1 2022 and Q4 2021 earnings reporting period.

Q1 2022 Recaps:

Salesforce — Q1 2023

NVIDIA — Q1 2023

Best Buy — Q1 2023

Zoom — Q1 2023

Deere — Q2 2022

Palo Alto Networks — Q3 2022

Target — Q1 2022

Q1 Previously Published Recaps

Home Depot Q1 Conference Call — 5/17/22

Walmart Q1 Conference Call — 5/17/22

Disney Q2 Conference Call — 5/11/22

Roblox Q1 Conference Call — 5/11/22

Simon Property Q1 Conference Call — 5/9/22

Tyson Foods Q2 Conference Call — 5/9/22

Block Q1 Conference Call — 5/5/22

Albemarle Q1 Conference Call — 5/5/22

Cheniere Energy Q1 Conference Call — 5/4/22

Uber Q1 Conference Call — 5/4/22

Starbucks Q1 Conference Call — 5/3/22

Advanced Micro Devices Q1 Conference Call — 5/3/22

Hilton Hotels Q1 Conference Call — 5/3/22

Amazon Q1 Conference Call — 4/28/22

Apple Q2 Conference Call — 4/28/22

United Rentals Q1 Conference Call — 4/28/22

McDonald’s Q1 Conference Call — 4/28/22

Meta Platforms Q1 Conference Call — 4/27/22

Automatic Data Processing Q3 Conference Call — 4/27/22

Chipotle Q1 Conference Call — 4/26/22

Microsoft Q3 Conference Call — 4/26/22

Alphabet Q1 Conference Call — 4/26/22

United Parcel Service Q1 Conference Call — 4/26/22

Whirlpool Q1 Conference Call — 4/25/22

Coca-Cola Q1 Conference Call — 4/25/22

American Express Q1 Conference Call — 04/22/22

Snap Q1 Conference Call — 04/21/22

Pool Corp Q1 Conference Call — 04/21/22

Alcoa Q1 Conference Call — 04/20/22

Tesla Q1 Conference Call — 04/20/22

IBM Q1 Conference Call — 04/19/22

Johnson & Johnson Q1 Conference Call — 04/19/22

JB Hunt Conference Call — 04/18/22

Citigroup Q1 Conference Call — 04/14/22

UnitedHealth Group Q1 Conference Call — 04/14/22

Taiwan Semiconductor Q1 Conference Call — 04/14/22

BlackRock Q1 Conference Call — 04/13/22

Delta Q1 Conference Call — 04/13/22

JP Morgan Q1 Conference Call — 04/13/22

CarMax Q4 Conference Call — 04/12/22

Constellation Brands Q4 Conference Call — 4/7/22

Walgreens Q2 Conference Call — 3/31/22

Micron Q2 Conference Call — 3/29/22

Lululemon Q4 Conference Call — 3/29/22

KB Home Q1 Conference Call — 3/23/22

Adobe Q1 Conference Call — 3/22/22

Nike Q3 Conference Call — 3/21/22

Recaps published during Q4 2021 are available with a Bespoke Institutional subscription:

Salesforce Q4 Conference Call — 3/1/22

Target Q4 Conference Call — 3/1/22

Zoom Q4 Conference Call — 2/28/22

Moderna Q4 Conference Call — 2/24/22

Home Depot Q4 Conference Call — 2/22/22

Deere Q1 Conference Call — 2/18/22

Walmart Q4 Conference Call — 2/17/22

NVIDIA Q4 Conference Call — 2/16/22

Airbnb Q4 Conference Call — 2/15/22

Marriott Q4 Conference Call — 2/15/22

Advance Auto Parts Q4 Conference Call — 2/14/22

Uber Q4 Conference Call — 2/9/22

Disney Q1 Conference Call — 2/9/22

Chipotle Q4 Conference Call — 2/8/22

Simon Property Q1 Conference Call — 2/7/22

Tyson Foods Q1 Conference Call — 2/7/22

Snap Q4 Conference Call — 2/3/22

Amazon Q4 Conference Call — 2/3/22

Estée Lauder Q2 Conference Call — 2/3/22

Meta Q4 Conference Call — 2/2/22

Ferrari Q4 Conference Call — 2/2/22

Match Group Q4 Conference Call — 2/2/22

Advanced Micro Devices Q4 Conference Call — 2/1/22

PayPal Q4 Conference Call — 2/1/22

Starbucks Q1 Conference Call — 2/1/22

Alphabet Q4 Conference Call — 2/1/22

United Parcel Service Q4 Conference Call — 2/1/22

Visa Q1 Conference Call — 1/27/22

Apple Q1 Conference Call — 1/27/22

McDonald’s Q4 Conference Call — 1/27/22

Intel Q4 Conference Call — 1/26/22

Tesla Q4 Conference Call — 1/26/22

Boeing Q4 Conference Call — 1/26/22

Automatic Data Process Q4 Conference Call — 1/26/22

Microsoft Q2 Conference Call — 1/26/22

Johnson & Johnson Q4 Conference Call — 1/25/22

3M Q4 Conference Call — 1/25/22

Lockheed Martin Q4 Conference Call — 1/25/22

American Express Q4 Conference Call — 1/25/22

Netflix Q4 Conference Call — 1/20/22

Intuitive Surgical Q4 Conference Call — 1/20/22

Union Pacific Q4 Conference Call — 1/20/22

Baker Hughes Q4 Conference Call — 1/20/22

UnitedHealth Q4 Conference Call — 1/19/21

Fastenal Q4 Conference Call — 1/19/22

Procter & Gamble Q2 Conference Call — 1/19/22

Silvergate Capital Q4 Conference Call — 1/18/22

Charles Schwab Q4 Conference Call — 1/18/22

BlackRock Q4 Conference Call — 1/14/22

JP Morgan Q4 Conference Call — 1/14/22

KB Home Q4 Conference Call — 1/12/22

Delta Airlines Q4 Conference Call — 1/13/22

Constellation Brands Q3 Conference Call — 1/6/22

Nike Q2 Conference Call — 12/20/21

May 18, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Inflation is a form of tax, a tax that we all collectively must pay.” – Henry Hazlitt

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

This week the tax of inflation is being felt most by retailers as two of the nation’s largest retailers have gotten absolutely destroyed in the last two days. Futures are indicated lower this morning, but one could make the case, given the plunge in Target (TGT) shares this morning, that it could even be worse. Oil prices are also trading up close to 2%, the ten-year yield is back up to 3%, and the dollar is trading lower.

On the economic front, we’re about to get the latest updates on Housing Starts and Building Permits for April, but if mortgage data is any indication, the data isn’t likely to be very strong.

In today’s Morning Lineup, we recap the continued developments in retail earnings (pg 4), market action in Asia and Europe (pg 4), economic data in Asia and Europe (pg 5), and a lot more.

If you thought yesterday’s 11% pounding of Walmart (WMT) was bad, meet Target (TGT). After reporting significantly weaker than expected earnings on better than expected revenues, shares are trading down more than 20% in the pre-market. The company blamed ‘unexpectedly high costs’ that it faced throughout the quarter for the earnings miss, and didn’t provide much additional detail in its release. Investors aren’t waiting for further clarity, though. With margins falling more than 400 basis points (bps), the stock is trading down more than 20% in the pre-market and is easily on pace for not only its worst earnings reaction day in at least 20 years, but also its worst one-day drop since the 1987 crash.

Yesterday, WMT had its largest one-day decline since the 1987 crash and now TGT is on pace to do the same! The experiences of both companies further reinforce the point that we are operating in one of the most complicated macro environments that any company or investor has had to deal with. Few companies are so entwined into so many aspects of the US economy as WMT and TGT, and their logistics and supply chain operations rival or exceed those of most other companies. If they’re having these types of issues keeping up with the rapidly changing environment, who isn’t?

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

May 16, 2022

Today we published our newest Top Triple Plays report. This season we identified 11 earnings triple plays that may be worth taking a closer look at.

What is a triple play? When a stock reports quarterly earnings, it registers a “triple play” when it beats analyst EPS estimates, beats analyst revenue estimates, and raises forward guidance. We coined the term back in the mid-2000s, and you can read more about it at Investopedia.com. We consider triple plays to be the cream of the crop of earnings season, and we’re constantly finding new long-term opportunities from this basket of names each quarter. You can track the newest earnings triple plays on a daily basis at our Triple Plays page if you’re a Bespoke Premium or Bespoke Institutional member. To read our newest report and see the triple plays that we think look the best right now, start a two-week trial to Bespoke Premium!

May 12, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Money does not buy you happiness, but lack of money certainly buys you misery.” – Daniel Kahneman

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Today, the futures aren’t even attempting to sucker traders in with a rally, so maybe today, we’ll actually get a bounce. Treasuries are continuing to rally again this morning, while crude oil trades modestly lower and crypto plunges. Overnight, China pledged further support to its economy. On the geopolitical front, Finland has said it is preparing to apply for membership in NATO, and Russia has responded by threatening retaliatory steps of both military and ‘other’ measures.

We just got a chunk of economic data in the form of PPI and jobless claims. In terms of PPI. headline CPI was in line with forecasts at a m/m gain of 0.5%. Core PPI rose much less than expected at 0.4% vs 0.7%, but data for March was revised higher. In terms of jobless claims, initial claims came in 10K higher than expected 203K vs 193K while continuing claims showed another drop falling to 1.343 million versus forecasts for 1.372 million. Equity futures have seen little in the way of a reaction to the news while treasury yields remain lower.

In today’s Morning Lineup, we recap the recent developments in the crypto space (pg 4), overnight earnings (pg 5), economic data out of Europe (pg 6), and a lot more.

The year is barely more than a third over, but already the Nasdaq has had 24 different over the course of just 90 trading days. That works out to more than once a week! Again, we still have nearly two-thirds of the year left ahead of us, but already, the number of 2%+ daily declines this year ranks as the 8th highest in the Nasdaq’s history. The only years that were higher were 1999, 2000, 2001, 2002, 2008, 2009, and 2020. If, and this is a big if, the current pace of 2% declines continues, 2022 wouldn’t quite catch 2000 for the record number of 2% declines in a single year, but it would be a close second.

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.