Bears Go Back Into Hibernation

The last couple weeks of the first quarter have seen equities reverse a sizable portion of this year’s losses and sentiment has rebounded in sync, though, bullish sentiment turned slightly lower this week in spite of the S&P 500’s move higher. From the weekly AAII sentiment survey, bullish sentiment shed 0.9 percentage points coming in at 31.9%. Even after that decline, the current level of reported optimism remains above all others (outside of last week) since early January, but bullish sentiment still would need to rise another 6 percentage points to move back up to its historical average.

While more investors are not reporting much optimism, fewer are outright bearish. Bearish sentiment fell for a second week in a row falling another 7.9 percentage points to 27.5%. With a little over a quarter of respondents reporting as bearish, this sentiment reading is at the lowest level since November. That is also now the biggest two-week decline in bearish sentiment (22.3 percentage points) since November 2009 when it had fallen 23.74 percentage points in a two-week span.

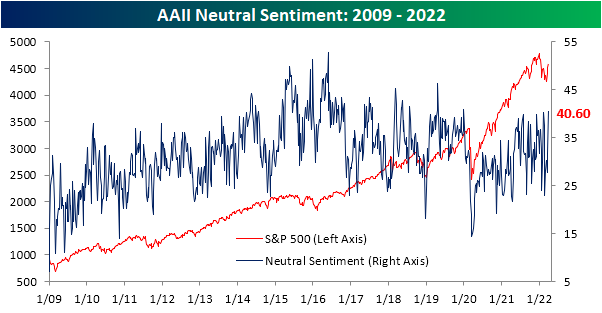

Finally, we would note that given bearish sentiment has plummeted at a historic rate without much of an increase in bullish sentiment, neutral sentiment has picked up the difference. That reading clipped above 40% this week for the highest level since January 2020.

Other sentiment surveys like the Investors Intelligence one and NAAIM’s Exposure Index have also pivoted more bullish this week. As a result, our sentiment composite is close to zero meaning across these three indicators, sentiment is now only just slightly below the historical average. Click here to view Bespoke’s premium membership options.