Apr 22, 2018

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Tech Dystopia

Palantir Knows Everything About You by Peter Waldman, Lizette Chapman, and Jordan Robertson (Bloomberg)

After a JPMorgan team that partnered with data analytics company Palantir went rogue, the company curtailed use of the firm’s services. What makes this concerning is the fact that Palantir also partners with law enforcement around the country, providing police a potentially egregious weapon that can be misused. [Link]

The latest trend for tech interviews: Days of unpaid homework by Melissa McEwen (Quartz)

Tech companies are taking to assigning large batches of work as evidence that potential hires are competent. [Link]

Arrogance Peaks in Silicon Valley by M. G. Siegler (500ish Words)

A righteous and warranted polemic against the insulated bubble of ideas that Silicon Valley has become, out of touch and impatient with society as a whole. [Link]

Tech Utopia

The End of the Joint As We Know It by Alyssa Bereznak (The Ringer)

With former Speaker of the House John Boehner partnering with a marijuana comapny and Senate Minority Leader Schumer calling for national legalization this week, the war on weed appears to be winding down. Get ready for a wave of new ways to imbibe the intoxicant. [Link]

Robot Conquers One of the Hardest Human Tasks: Assembling Ikea Furniture by Niraj Chokshi (NYT)

A robot has successfully assembled a piece of furniture from Ikea, achieving what we ourselves have failed at before and offering a vision of a world without Swedish instructions. [Link; soft paywall, auto-playing video]

Stinks To High Heaven

The UK Refused To Raid A Company Suspected Of Money Laundering, Citing Its Tory Donations by Heidi Blake, Tom Warren, Richard Holmes, and Jane Bradley (Buzzfeed)

In a bombshell piece of investigative reporting, Buzzfeed details a decision not to raid a company despite evidence of wrongdoing because they are a donor to the current government’s party and a charity linked to the Royal Family. [Link]

A Train Full of Poop From New York Is Stranded in a Tiny Alabama Town by Jeff Martin and Jay Reeves (Bloomberg/AP)

New York exports human waste thanks to a federal ban on dumping into oceans, and one train carrying a load of that export is currently stranded to the dismay of a small Alabama town. [Link]

Sports

As Teams Seek More Relief, 13-Man Pitching Staffs Are the New Normal by Jared Diamond (WSJ)

The days of the complete game are long gone, as high pitch speeds and freakishly talented hitters have eroded the starter’s ability to go deep into the later innings. Now, shifts in strategy are again pushing up the number of relief pitchers necessary for a team to function. [Link; paywall]

Everyone Wants To Go Home During Extra Innings — Maybe Even The Umps by Michael Lopez and Brian Mills (538)

By the time innings stretch to double-digits, umpires start to get ready for the end of the game just like the rest of us. [Link]

How the Boston Marathon’s Runner-Up Shocked the Running World by Sara Germano (WSJ)

The first American woman in 33 years won the Boston Marathon, and her story is remarkable: mid-twenties, unknown, unsponsored, and running her second marathon ever. Her story is one of grit more than extreme athletic ability, arguably making it all the more impressive. [Link]

Metals

Treasure island: Rare metals discovery on remote Pacific atoll is worth billions of dollars by Chris Ciaccia (Fox News)

So-called “rare earths” aren’t actually that “rare” but they are certainly valuable and a discovery on a tiny Japanese atoll has been heralded as a game changer worth billions. [Link]

Russia Sanctions Throw Global Aluminum Industry Into Chaos by Thomas Biesheuvel and Jack Farchy (Bloomberg)

Sanctions on Russia’s United Co. Rusal have led to major disruptions in the global aluminum value chain; the company produces both inputs and final outputs, making the entire thing quite a mess. [Link; auto-playing video]

Helpful Hints

27 Incredibly Useful Things You Didn’t Know Chrome Could Do by JR Raphael (Fast Company)

Pretty much exactly what it says on the tin: helpful productivity tips for the ubiquitous Google web browser. [Link]

Publishing

Why All My Books Are Now Free (Aka A Lesson In Amazon Money Laundering) (Meb Faber)

An interesting post describing the litany of non-publisher booksellers on Amazon and how they may be used for money laundering. [Link]

Taxes

Americans Spent Record Amounts on Accounting Fees Last Year by Alexandre Tanzi and Vincent Del Giudice (Bloomberg)

Tax preparers of various types hauled in $44bn in revenue in Q4, working out to roughly $135 per person. [Link]

Dining

The Quarterback of the Kitchen? It’s Not Always the Chef by Tejal Rao (NYT)

While the head chef gets the TV shows, the expediter is the real hero, making sure that the complicated dance of the kitchen staff stays in sync and that dishes get to tables quickly. [Link]

Read Bespoke’s most actionable market research by starting a two-week free trial today! Get started here.

Have a great Sunday!

Oct 29, 2017

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Rethinkings

Public Policy After Utopia by Will Wilkinson (Niskanen Center)

A case for evidenced-based policy making and an eschewing of “the perfect world” that radicals of all kinds think they can achieve, but are often unable to show would actually move forward their goals. [Link]

A Peek at Future Jobs Shows Growing Economic Divides by Ben Casselman (NYT)

Huge swathes of the country have employment landscapes dominated by jobs that are estimated to shrink by 2026 per new BLS data. [Link; soft paywall]

Investing

The Morningstar Mirage by Kirsten Grind, Tom McGinty and Sarah Krouse (WSJ)

Investors flock to funds that receive a coveted five star rating from Morningstar, but returns don’t tend to be much higher for funds with more stars. [Link; paywall]

Inflation

How I Accidentally Stiffed My Poor Venezuelan Waiter by Stephen Merelman (Bloomberg)

When the amount of cash you need to accomplish daily tasks rises into the “grocery bags” denomination, even tipping becomes a major challenge. [Link]

The Lighter Side

So This Happened in Our Comments Section Today by Nancy Wartik (NYT)

Never read the comments, except for this one. [Link; soft paywall]

Blockchain

This Company Added the Word ‘Blockchain’ to Its Name and Saw Its Shares Surge 394% by Lisa Pham (Bloomberg)

A company with little to offer got investors to bid up its shares by almost 4x on a simply name change, in case you’re wondering what sentiment around cryptocurrencies looks like. [Link]

Backed by Dollar Scarcity, Price of Bitcoin Caps $10,000 in Zimbabwe by William P (Crypto Analyst)

The exchange which services Zimbabwe has seen an explosion in local prices for bitcoin, driven by huge domestic demand and a lack of arbitrage. [Link]

Tech Dystopia

The 12 Most Desperate Stunts Cities Have Pulled To Woo Amazon’s New H.Q. by Maya Kosoff (Vanity Fair)

Buying (and reviewing!) 1000 separate items, Spotify playlists, noisemeters at hockey games, a 21 foot cactus, free sandwiches, and more. [Link]

Elon Musk Was Wrong About Self-Driving Teslas by Tom Randall (Bloomberg)

Tesla owners are suing over a feature that hasn’t lived up to its much-hyped debut buzz last year, and doesn’t show any sign of being ready soon. [Link]

New Chatbots Will Help People Accept Death by Jordan Pearson (Vice)

While chatbots are proving helpful for people unaware of basic legal and medical planning for the end of their lives, they’re not going to be providing much in terms of spiritual guidance any time soon. [Link]

Food & Drink

‘Fish Fraud’ Is Rampant. Here’s How to Fix It by Elizabeth Dunn (WSJ)

As much as one third of US seafood is mislabeled, and with 90% it imported there’s lots of room for standards in the market to propagate better practices elsewhere around the world. [Link; paywall]

World wine production ‘to hit 50-year low’ (BBC)

+15% declines in Italy, Spain, and France brought about by weather mean global grape growth has slowed dramatically. Australia and Argentina will be up while the US crop should be little changed (forest fires in California came after most of the harvest). [Link]

The Thing About Bisquick by Alia Akkam (Taste Cooking)

For our two cents, biscuits don’t need anything more than flour, milk, butter, baking powder, and a bit of honey. But Bisquick is defensible if only for its time saving properties. [Link]

Long Reads

Under The Darkest Sky by Jasmina Keleman (Roads And Kingdoms)

In wide open Texas, the limitless night skies are in need of conservation; not against traditional threats to visibility, but from the even more pernicious footprint of human civilization, light. [Link]

How Martin Luther Changed The World by Joan Acocella (The New Yorker)

While the man who launched the Reformation probably never nailed his 95 Theses to a church door, he was still a fascinating and truly revolutionary character who has deeply shaped our modern world. [Link]

Have a great Sunday!

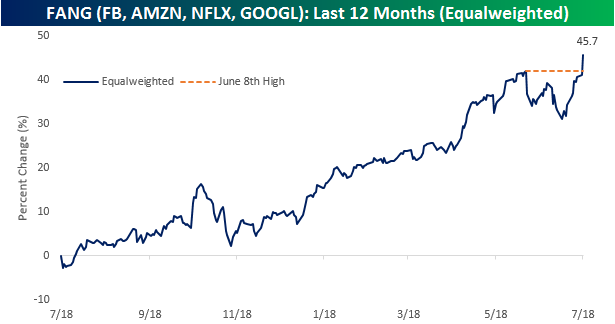

Jul 18, 2017

In the spirit of Mark Twain, the FANG stocks have roared back to life, definitively stating to the market that the reports of their demise have been greatly exaggerated. On an equal-weighted basis (chart below), an index of the four FANG stocks (Facebook, Amazon.com, Netflix, and Google-parent Alphabet) has now completely erased its 8% pullback from its 6/8 high and is now back at new highs. Over the last year alone, these four stocks are up an average of 45.7%. Whenever there is optimism that the Trump Administration will get something passed, high growth tech stocks start to lose momentum, but once it looks like more of the same old Washington gridlock, high growth stocks like FANG really run.

Start a two-week free trial to Bespoke’s research platform to see our full offering.

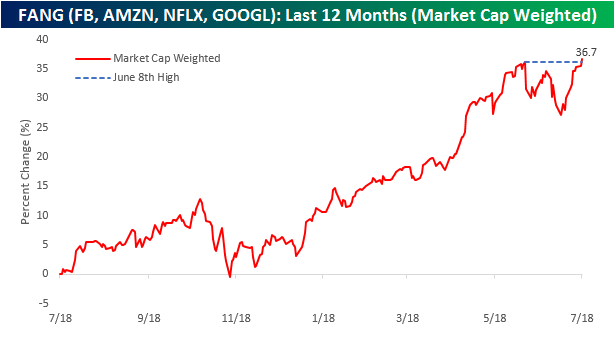

A lot of today’s strength in the performance of the FANG stocks on an equal-weighted basis is the fact that shares of Netflix (NFLX) are up over 12% following its strong earnings report after the close last night. NFLX has a much smaller market cap than the three other stocks that make up the FANG group, but even on a market cap weighted basis, the four FANG stocks are still at new highs. As shown below, a market cap weighted index of the four stocks has also more than erased what in this case was a 7% pullback and is also trading at new highs today. So much for the death of FANG.

Jul 2, 2017

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

See this week’s just-published Bespoke Report newsletter by starting a no-obligation two-week free trial to our premium research platform.

Investing

Just Like That, a Bad Year for Buybacks Becomes a Good One by Lu Wang (Bloomberg)

With the approval of capital return plans by the Fed this week, banks have boosted the annual buyback totals quite dramatically. [Link]

Ex-Bridgewater Quant Says Smart Beta ETFs Use Factors All Wrong by Dani Burger (Bloomberg)

It turns out that factor-based investing might work better as a way to find shorts. [Link]

Insurance Is the Hot New Way to Avoid Taxes by Sonali Basak and Tom Metcalf (Bloomberg)

Insurance products allow high net worth individuals to see capital compound within policies, untaxed, and disbursed to beneficiaries of the policyholder after they die. [Link]

Labor Markets

Want a $1 Million Paycheck? Skip College and Go Work in a Lumberyard by By Prashant Gopal and Matthew Townsend (Bloomberg)

The popular conception of high paying jobs: that they only come from a college degree and aren’t what you’d call blue collar. That’s not actually the case. [Link]

A Mystery Fed Candidate Won a Seat at the FOMC Table, Then Walked Away by Christopher Condon (Bloomberg)

Prior to the appointment of President Harker to his seat at the head of the Philadelphia Fed, another candidate was considered and even approved by the Board of Governors but turned down the spot. [Link]

Rural America

Rural Youth Chase Big-City Dreams by Dante Chinni (WSJ)

A fascinating accounting of population flows out of small towns and into areas hosting large colleges, then to cities…but not back to the rural counties where they grew up. [Link; paywall]

Social Science

Equity, efficiency and education spending in the United States by Nick Bunker (Washington Center for Equitable Growth)

A new study has shown no trade-offs between efficiency and equity in education spending, a remarkable finding that would be relatively unique in public policy. [Link]

Inequality

Counterintuitive problem: Everyone in a room keeps giving dollars to random others. You’ll never guess what happens next. (Decision Science News)

Random distribution of income does not lead to equality, but instead creates quite a bit of inequality, a counter-intuitive outcome. [Link]

People Differences vs. Place Differences: What Causes Social Mobility? by Robert VerBruggen (Institute for Family Studies)

One factor that can mitigate inequality is high social mobility: if there’s lots of inequality, it’s less damaging if people move up and down across the income spectrum. But social mobility is deeply tied to a number of factors, explored in this piece. [Link]

Seattle Minimum Wage

A ‘very credible’ new study on Seattle’s $15 minimum wage has bad news for liberals by Max Ehrenfreund (WSJ)

Seattle introduced a very large minimum wage hike a few years ago and we’re starting to get data on what it means. The first reaction was that the study showed very large effects (negative ones) on employment and hours. [Link; soft paywall]

The “high road” Seattle labor market and the effects of the minimum wage increase by Ben Zipperer and John Schmitt (Economic Policy Institute)

A contrary argument on reading too far into the findings of the Seattle minimum wage study. The piece lays out some good reasons to be skeptical about the findings. [Link]

The City Knew the Bad Minimum Wage Report Was Coming Out, So It Called Up Berkeley by Daniel Person (Seattle Weekly)

A sideshow to the academic debate about the Seattle study was what appeared to be manipulation by the Seattle Mayor’s office. It’s a bit complicated, but it’s worth reading as an example of how not to conduct oneself as an academic researcher. [Link]

Science Terrifying And Hilarious

Scientists can’t rule out collision with asteroid flying by Earth in 2029 by Mike Wehner (BGR)

99942 Apophis is bound for Earth, and while a collision isn’t forecast, at an estimated approach of less than 20,000 miles the 1200 foot diameter rock with an estimated yield on collision of more than 750 megatons would be a really bad day for the planet if it did end up hitting. [Link]

That Time the TSA Found a Scientist’s 3-D-Printed Mouse Penis by Ed Yong (The Atlantic)

A compilation of the hysterical travails of scientists trying to get through security with their panoply of paraphernalia. [Link]

This Week In The Valley

More Than 50% of Shoppers Turn First to Amazon in Product Search by Spencer Soper (Bloomberg)

Amazon is the first destination for more than half of consumers, a massive advantage for the e-commerce giant. [Link]

Waymo, Apple Deals Bolster Rental Firms for Ride-Sharing Age by David Welch and Alex Webb (Bloomberg)

Car rental giants Avis and Hertz have signed deals to manage (service and repair) the hardware that Apple and Alphabet Inc are using to help deploy autonomous vehicles. [Link; auto-playing video]

Not A Good Look

NYSE President Calls Short Sellers ‘Icky’ by Annie Massa (Bloomberg)

In a move jeered at by short-sellers across The Street, a New York Stock Exchange executive called short-selling un-American this week. [Link]

Phil’s Insider-Trading Escape by Jeffrey Toobin (Golfworld)

A long read on how Phil Mickelson managed to avoid insider trading charges. [Link]

Potpourri

Why my guitar gently weeps by Geoff Edgers (WaPo)

As young people explore other forms of music, and the venerable guitar hero fades into the past, there’s less interest in playing and owning high-end guitars. [Link; soft paywall]

Old Glories: A Salute to Antique U.S. Flags, and Where to Find One by Steve Garbarino (WSJ)

An oral history of antique flags, which can be both unique and expensive. [Link; paywall]

If Buddhist Monks Trained AI by Alexis C. Madrigal (The Atlantic)

How do Buddhist monks respond to the classic “Trolley” problem, a key philosophical and moral issue for designers of code that will run autonomous vehicles. [Link]

Have a great Sunday!

Jun 18, 2017

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Old Stuff New Ways

Goldman Set Out to Automate IPOs and It Has Come Far, Really Fast by Dakin Campbell (Bloomberg)

Inside the mammoth effort to standardize and digitize the process of launching a company into public markets. [Link]

Tim Cook Says Apple Focused on Autonomous Systems in Cars Push by Alex Webb and Emily Chang (Bloomberg)

Apple is now publicly discussing the secretive project it’s had running for years to develop an autonomous car. [Link, auto-playing video]

New Iron-Aluminum Alloy Is Strong and Light as Titanium, 10% of the Cost by Jamie Condilffe (Gizmodo)

South Korea’s Pohang University and POSCO are partnering to spin up a production line for an extremely light but strong alloy that would come in much cheaper than titanium or carbon fiber, the current high bars in materials. [Link]

Clean Energy

Wind, solar surpassed 10 percent of U.S. electricity in March: EIA by Valerie Volcovici (Reuters)

New monthly data from the EIA showed remarkable progress in renewables’ penetration of US market share; most impressive was the 37% of power generated in Iowa coming from either wind or solar. [Link]

Solar Power Will Kill Coal Faster Than You Think by Jess Shankleman and Hayley Warren (Bloomberg)

A new annual forecast from Bloomberg energy finance estimates coal costs to move above those of solar in 2021 for China, already around the same costs in Germany and the US. [Link, auto-playing video]

World Coal Production Just Had Its Biggest Drop on Record by Rakteem Katakey (Bloomberg)

In 2016 total global coal output dropped by over 200mm oil equivalent tons in 2016, with demand down 1.7% globally and declines on every continent except Africa according to BP’s annual world energy review. [Link, auto-playing video]

Dystopia

American Health Care Tragedies Are Taking Over Crowdfunding by Suzanne Woolley (Bloomberg)

With proposed legislation projected to throw tens of millions of Americans out of the ranks of the insured, crowd funding sites could become the locus of efforts to prevent medical care from bankrupting its recipients. [Link, auto-playing video]

Rigged by Brett Murphy (USA Today)

A review of the debt servitude that truck drivers serving the ports of LA and Long Beach enter into when they start moving goods off ships and towards American consumers. [Link]

Code of Silence by Rebecca Wexler (Washington Monthly)

If an algorithm was deciding your fate, you’d probably want to know how it worked, but for prisoners in many states that’s not in the cards. [Link]

Monetary Policy

Why I Dissented Again by Neel Kashkari (Medium)

America’s most digitally engaged FOMC member is at it again, with a post explaining why he dissented against the most recent FOMC hike. [Link]

Demonetisation update 29 – glimpsing the benefits by Anantha Nageswaran (The Gold Standard)

Part of an ongoing series about the demonetization (that is, the declaration that some bank notes were invalid) which is bringing Indian black markets into the formal economy; tax receipt gains are one beneficiary. [Link]

Investing

How to Take a Crazy Risk Without Going Insane by Jason Zweig (WSJ)

A review of how one investor is handling – and thriving – in the volatile bubble markets that are crypto currencies. [Link]

Tudor’s New Event Hedge Fund Gaining 9% Is Bright Spot for Firm by Hema Parmar (Bloomberg)

Weak returns in macro (down 1.2% YTD through the start of June) are being offset by strong returns in the event-driven equities strategy Tudor also operates. [Link]

Good Stuff

El Capitan, My El Capitan by Daniel Duane (NYT)

A shocking achievement was recorded recently at El Capitan in the Yosemite Valley, where a climber made it all the way to the top without any rope or rest. [Link, soft paywall]

Prankster Tricks Tech Incubator Into Supporting Homeless People by Matthew Gerring (Broke-Ass Stuart)

A rundown of Pinboard founder Maciej Ceglowski’s run to the top of a Hacker News contest designed to provide VC investment to a startup, which Ceglowski handed directly to a homeless shelter instead. [Link]

Bad Stuff

Pakistani man sentenced to death for posting ‘blasphemy’ on Facebook by Colin Lecher (The Verge)

A man in Pakistan will be killed by the state for making “negative remarks” about religious figures, including the prophet Mohammed. [Link]

Mastermind of Lottery Fraud Will Tell How He Rigged Jackpots by Ryan J. Foley and Todd Richmond (Bloomberg/AP)

A former lottery computer programmer and his former judge brother face jail time after defrauding the Multi-State Lottery Association of $3mm. [Link]

NAFTA

U.S. Exports to Mexico Fall as Uncertainty Over Nafta Lingers by Jacob Bunge (WSJ)

US farmers are having a harder time selling south of the border as less grain and meat moves from the US heartland to its largest export market, all driven by a desire to diversify supply in the face of possible restrictions on trade. [Link, paywall]

Islamic Finance

Islamic finance industry frets as Dana Gas deems its sukuk invalid by Bernardo Vizcaino (Reuters)

Sukuk bonds help companies access financing without violating sharia law, which bans charging interest. Dana Gas, listed in Abu Dhabi, decided this week that $700mm of its bonds are no longer compliant with sharia, and that they won’t be repayed; investors will be offered lower-return alternatives. [Link]

End Of An Era

McDonald’s ends Olympics sponsorship deal early by Liana B. Baker and Karolos Grohmann (Reuters)

After 41 years of sponsorship, the Golden Arches is ending its sponsorship of the Olympic Games, preferring to focus on individual athletes and saving hundreds of millions. [Link]

School

The end of the valedictorian? Schools rethink class rankings by Carolyn Thompson (AP)

American high schools are starting to phase out the final ranking of students, with only half of schools still reporting final class ranks. [Link]

Sports

Jets Launch All New Jets Boarding Pass (NY Jets)

Like heading to stadium and chanting J-E-T-S, but hate sitting in the same seat every time? The Jets have a deal for you. [Link]

Mergers and Amiquistions

Message Startup Slack Draws Interest From Amazon.com by Alex Sherman, Eric Newcomer, and Alex Barinka (Bloomberg)

While Amazon closed the week out by dropping almost $14bn on Whole Foods, earlier in the week all the speculation was over whether the company would be buying Slack. [Link]

Health

2.2 billion people are overweight and sick, but we’re still measuring them by a terrible metric by Sara Chodosh (Popular Science)

Inside the deeply flawed Body Mass Index and the alternative measurements which are more accurate as predictors of health trouble. [Link]

Have a great Sunday!