The Bespoke 50 Top Growth Stocks Index — 4/11/19

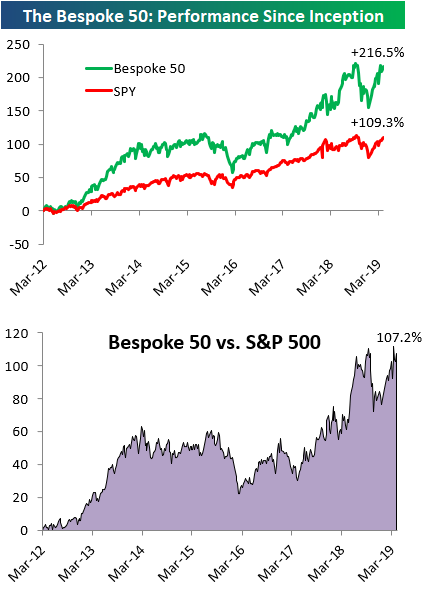

Every Thursday, Bespoke publishes its “Bespoke 50” list of top growth stocks in the Russell 3,000. Our “Bespoke 50” portfolio is made up of the 50 stocks that fit a proprietary growth screen that we created a number of years ago. Since inception in early 2012, the “Bespoke 50” has beaten the S&P 500 by 107.2 percentage points. Through today, the “Bespoke 50” is up 216.5% since inception versus the S&P 500’s gain of 109.3%. Always remember, though, that past performance is no guarantee of future returns.

To view our “Bespoke 50” list of top growth stocks, please start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Initial Jobless Claims Killing It

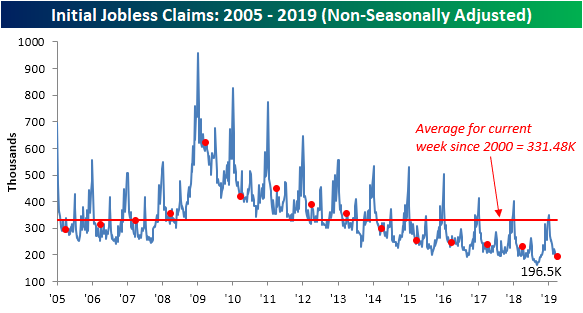

In addition to last week’s print, initial jobless claims data has seemed to have left the worrisome signs from earlier in the year in the rearview mirror. This morning’s stellar print of 196K was the lowest seasonally adjusted number since October 4, 1969 when claims came in at 193K. To further reiterate the strength of this indicator, the streak of consecutive weeks below 300K has now grown to 214; the longest such streak ever. Additionally, with older data having been revised a couple of weeks ago, the streak of readings at or below 250K is back on; now at 65 weeks. That is the second longest streak in the history of the data. The only one longer ended on January 1, 1970 at 89 weeks. Start a two-week free trial to Bespoke Premium to access our interactive economic indicators monitor to keep up to date on Initial Jobless Claims releases as well as many other US and global economic indicators.

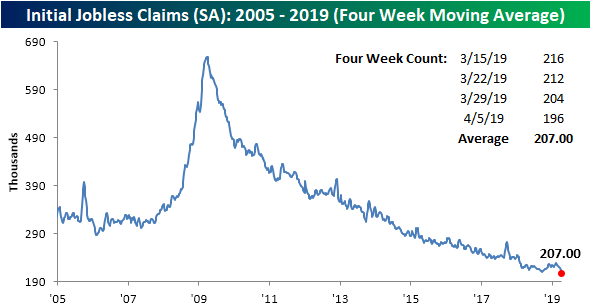

Earlier this year, we highlighted that the less volatile look at initial jobless claims—the four-week moving average—had come in at a 52-week high two weeks in a row; a possible recessionary signal though there were plenty of instances of it happening outside of economic downturns. The tide has completely shifted since that analysis as the four-week average is now at a 52-week low! At 207K, it is also now at its lowest level since late 1969. In other words, it can now be more confidently said those highs were more of a blip rather than a trend higher.

The non-seasonally adjusted data deviated a bit from the other versions with an increase from last week’s 183.8K to 195.5K today. This increase is perfectly normal as a rise in claims for the current week of the year can be observed every year going back to 2011. Regardless of the increase WoW, this week’s NSA number is just over half of the average for the current week since 2000. Also being the lowest print for the week of the current cycle, the NSA numbers still appear very strong.

Trend Analyzer – 4/11/19 – Dow Still Down

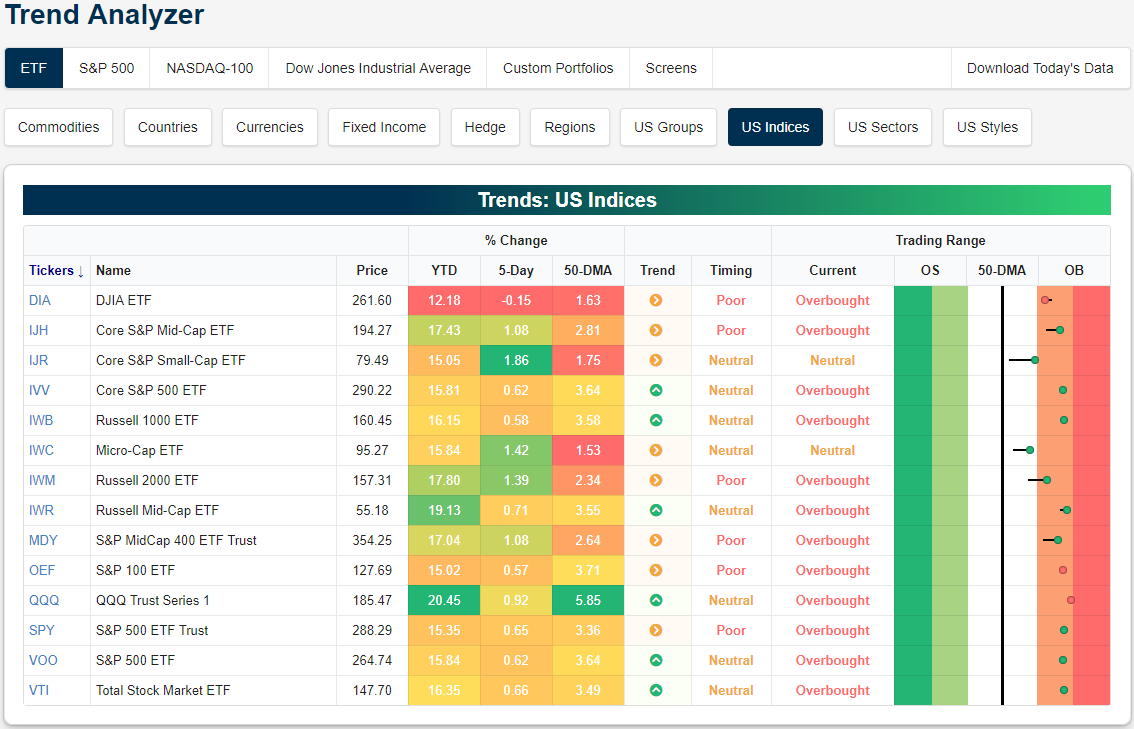

Yesterday’s small gain was still not enough to pare the losses over the past week for the Dow (DIA). DIA is still the only one in the red in the past week and is underperforming the rest of the major indices by an increasingly wide margin. While DIA is up just over 12% YTD, every one of its peers is up at least 15%, with the Russell Mid Cap (IWR) now up 19.13% and the Nasdaq (QQQ) up over 20%!

Small caps have begun to pick up the pace. While still at neutral, the Core S&P Small Cap (IJR) and Micro-Cap (IWC) are up the most in the past week. IJR is up the most at 1.86%. The rest of the major indices are still overbought with many still on the cusp of extreme levels as they have been for the past few days.

Start a two-week free trial to Bespoke Premium to access our interactive Trend Analyzer and much more.

Small Caps: Make Up Your Mind Already

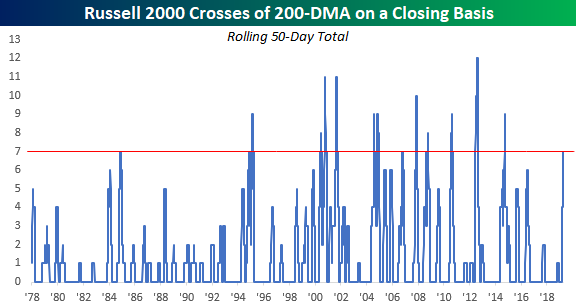

As noted in an earlier post, the Russell 2000 closed back above its 200-DMA yesterday for the 7th cross of that trendline on a closing basis in the last 50 trading days. As shown in the chart below, the last time we saw this many crosses of the 200-DMA in a 50-trading day span was back in 2014. Back then, the number of crosses reached as high as nine and the most ever in a 50-trading day span was 12 back in 2012.

So what, if anything, does the indecisiveness on the part of the Russell 2000 mean for future returns? Is it a sign that eventually the bulls won’t be able to hang on and lower prices are in store, or does it mean that the bears will finally capitulate, and prices will soar?

The chart below shows the Russell 2000 going back to 1978, and in it we have included red dots to show every other time where the Russell 2000 saw seven or more crosses of its 200-DMA in a 50-day span. As you can see, there doesn’t seem to be any clear trend in either direction. The mid-2000s are a perfect case in point. From late 2004 right up through late 2008, we saw multiple occurrences both on the way up and on the way down. As far as market indicators go, this one hasn’t been all that helpful. Start a two-week free trial to Bespoke Premium to access Bespoke’s unbeatable research.

Morning Lineup – 7-Up

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

Newsflow is on the quiet side this morning. Futures, though, are trading higher on the heels of positive price action in Europe. On the economic front, PPI and Jobless Claims will be released at 8:30.

The S&P 500 may be trading in a steady uptrend with higher highs and higher lows all year, but the small-cap Russell 2000 just can’t make up its mind. For the last two months now, small caps have been stuck in a range as Banks and Biotechs, the two largest industries in the index, have been a drag.

The 200-day moving average is generally considered a dividing line between whether an index or stock is in a long-term uptrend or downtrend. In the Russell’s case, it has been oscillating above and below that level for some time now. With yesterday’s close back above the 200-DMA, that now makes it seven times that the index has crossed above or below its 200-DMA on a closing basis in the last 50 trading days. That’s the most number of crosses in that short of a span in more than four years! In order for this trend to break one of those two “Big Bs” in the index (Banks and Biotechs) is going to have to make a move.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — EMFX Ticks Up, Crack Spreads Wider, Inflation Solid, GSS Sampling — 4/10/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at EM currencies which are setting up to break out above their recent range. We then show how crack spreads surged on high gasoline demand as per the EIA data released today. We go further into this release to show how petroleum stockpiles have held up this week. More in economic data, we recap today’s CPI release which missed expectations due to autos and new apparel price methodology. We then turn to inflation indicators which have yet to show a peak in inflation. Stepping out of the ordinary, we move onto the University of Chicago’s General Social Survey for 2018 in which media consumption and government confidence showed some interesting points. We finish with our weekly look at fund flows.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Gas Surge Continues

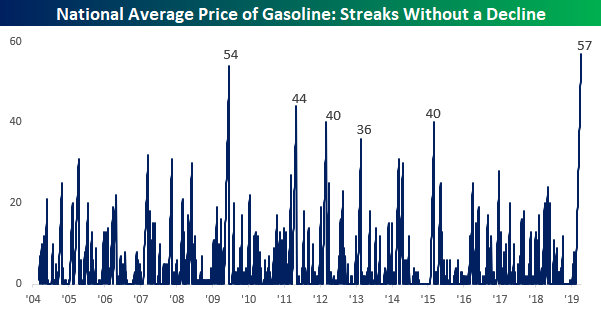

If you regularly fill up your car with gas, you have no doubt noticed that prices have been going up lately. Two weeks ago, we highlighted the fact that gas prices were in the midst of one of their longest streaks without a decline. Since that post in late March, that streak of days where prices have been flat or higher has continued. At a length of 57 days, the current streak now ranks as the longest on record (since at least 2004)!

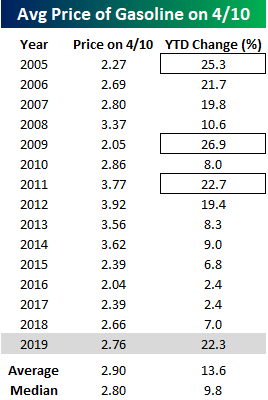

With gas prices moving non-stop to the upside, prices are up much more than average for this time of year. The chart below compares the move in gas prices this year to a composite of prices in every prior year since 2004. With a gain of 22.33% already this year, prices are already higher now than they are at the average peak YTD reading since 2004. Looking at the chart, the pattern of prices so far this year has been similar to the pattern for prior years, but the magnitude of the move has been much stronger. If this pattern continues to hold, we would expect to see gas prices continue to rise right on through the end of May before leveling off for the summer and heading back lower after Labor Day.

Not only have gas prices increased more than average so far this year, but there haven’t been many other years where they were up as much YTD as they are now. Going back to 2004, there have only been three prior years where gas prices were up more YTD as of 4/10 than they are now (2005, 2009, and 2011). The one silver lining is that despite the move higher, the average national price of $2.76 per gallon is still lower than the average ($2.90) and median ($2.80) for this time of year. Start a two-week free trial to Bespoke Premium to access Bespoke’s unbeatable research.

B.I.G. Tips – The Best Performing Stocks on Q1 Earnings

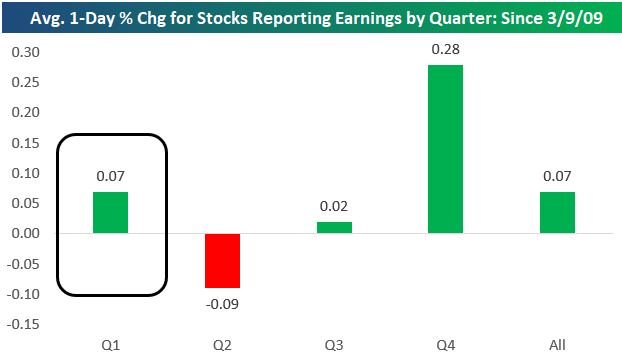

Below is a chart showing the average performance of stocks on their earnings reaction days by earnings season since the start of the bull market back on March 9th, 2009. By far the best period of the year for stocks to report earnings has been the Q4 reporting period, which runs from early January through late February. During this reporting period, stocks have averaged a one-day gain of 0.28% on their earnings reaction days over the last 10 years.

The second best period has been the Q1 reporting period (which is upcoming and runs from early April through late May). During the Q1 earnings season, the average stock has gained 0.07% on its earnings reaction day. (Remember, for stocks that report before the open, their earnings reaction day is that trading day. For stocks that report after the close, their earnings reaction day is the following trading day.)

The Q3 reporting period (early October through late November) sees stocks trade basically flat, while the Q2 earnings season (early July through late August) has actually seen stocks average a decline of 0.09% on their earnings reaction days since the bull market began.

One of the ways we use our Earnings Explorer tool as an idea generator is to look for stocks that typically perform very positively or negatively in certain quarters of the year. With the Q1 reporting period starting up this week, now is a good time to highlight the stocks that have historically performed the best following their Q1 reports. Below is a list of stocks with market caps above $5 billion that have historically performed the best in reaction to their Q1 earnings reports. To make the list, the stock had to have at least 8 years of Q1 reports, so these stocks have been consistently positive during Q1 for a long time.

Please log-in or start a free membership trial to continue reading this report…

Large and Small Caps: Different Groups in the Driver’s Seat

Fixed Income Weekly – 4/10/19

Searching for ways to better understand the fixed income space or looking for actionable ideals in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we take a look at how the markets have been reacting to ECB decisions recently.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!