Morning Lineup – Earnings Coming in Strong

We said yesterday that the pace of earnings doesn’t pick up until today, and so far so good. Of the ten companies that have reported earnings this morning, nine have exceeded EPS forecasts and one reported results that were inline with expectations. No misses! While the revenue beat rate this morning hasn’t been nearly as strong (60%), it hasn’t been bad either. Those positive results coupled with a big rally in Asia overnight has US futures looking higher and the S&P 500 on pace for a new YTD high with all-time highs not too far away.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

Equities in China had a good session with the Shanghai Composite rising over 2%, and on a closing basis, this was the highest close since March 2018. Interestingly enough, though, there have been five days since the start of April where the Shanghai Composite traded higher on an intraday basis, so it’s not quite a breakout from its recent consolidation phase.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Breadth, Dealers Don’t Buy, Mexican Labor, Canada Surveys, TICS — 4/15/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we check up on breadth and overbought levels by looking at the percentage of S&P 500 stock reaching new 52 week highs vs lows, distance from the 200-DMA, and RSI. We run the same analysis for the European Stoxx 600. Switching to interest rate markets, we counter concerns that dealer demand has been weak in UST auctions. Pivoting to economic data, we look South and North of the border, examining weakening Mexican labor and secondary industries as well as today’s Bank of Canada quarterly business surveys. We finish with a look at how international investors have turned a cheek to US equities as seen through today’s TIC flows.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Weak Manufacturing Data in the New York Region

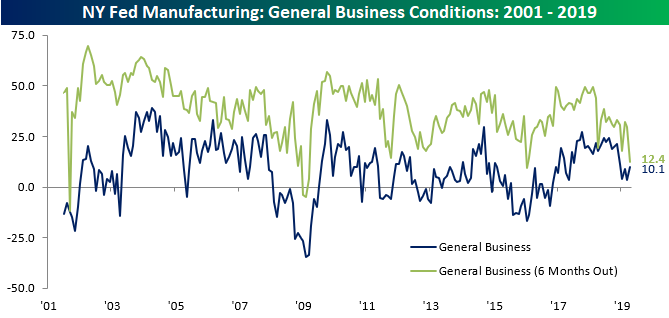

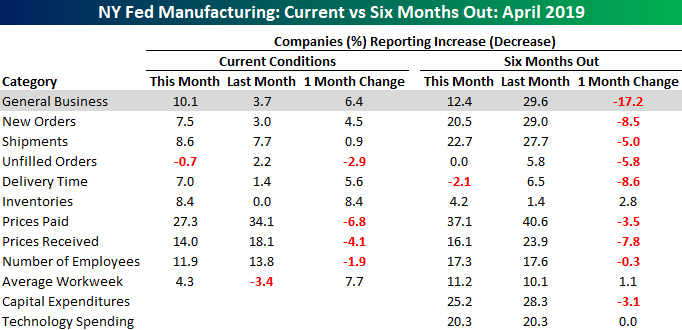

Although the week kicked off with a better than expected Empire Manufacturing report for the month of April, the report itself wasn’t particularly positive. In this morning’s release, the headline General Business Conditions Index came in at a level 10.1 versus last month’s reading of 3.7 and expectations for a reading of 8.0. While General Business conditions improved slightly, expectations declined sharply falling from just under 30 to 12.4.

The disparity in sentiment between current conditions and expectations wasn’t just on display in the headline reading either. The table below breaks out the levels of the current conditions and expectations for each of the report’s nine subcomponents. With respect to Current Conditions, five sub-indices saw m/m improvements this month compared to four that saw declines. When it comes to expectations, though, just two components saw m/m increases while six declined.

With rising sentiment about the present and falling sentiment looking out six months, we really saw a collapse in the spread between the General Conditions readings for the future and the present. People tend to naturally be more optimistic about the future than the present, but in this month’s survey, the spread between the two indices is practically non-existent. In fact, at the current level of 2.3, there have only been two other months since the report began back in 2001 where the spread was narrower, and there has never been a month where expectations were worse. One aspect of the chart below that we would also point out is that in two of the three prior instances where the spread got close to or below current levels, the economy was either in or on the verge of a recession. The exception was exactly a year ago in April 2018 when the spread fell to 1.40, but the fact that manufacturers are seeing little to no improvement over the next six months doesn’t provide a good starting point for economic activity in the region. Start a two-week free trial to Bespoke Institutional to unlock the full Bespoke interactive research portal.

Sector Charts – 4/15/19 – Utilities

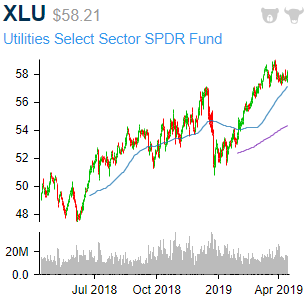

So far in 2019, the Utilities sector has underperformed the other sectors with the exception of Health Care. As of now, it is hovering around a 10% YTD gain; several percentage points less than the other sectors, but still very impressive for a defensive sector. As shown in the chart below, the sector reached a 52-week high in late March but has yet to move back up to these levels.

Looking at the individual stocks within the sector, most of the companies have held solid uptrends for the past year. For the most part, the sector’s individual names have very similar chart patterns to XLU, pulling back in solid uptrends and finding support near the 50-DMA. There are a handful of more unique charts though.

Two names in the sector that have made more headlines than any others in the past year have been PG&E (PCG) and Edison International (EIX) given their accountability in the cause of last year’s devastating California wildfires. While risks are still at play, the stocks have found a bottom and have been in an uptrend since late 2018. News out late last week of potential relief of the companies liabilities led the two to surge, bringing them back to interesting levels. EIX has come all the way back up to levels prior to the wildfires and PCG is back into the range from the first major collapse in the stock. While the charts are unarguably messy, the two no longer seem to be the falling knives that they were not long ago.

Others in the sector have also been on solid runs so far in 2019 like Consolidated Edison (ED) and Public Service Enterprise (PEG). More recently, these two have in fact stalled out a bit after getting fairly overbought. But in the case of ED, it is has found strong support near its prior highs. While it has yet to make a strong push back to highs from around this time last month, it is at the upper end of the range the stock has been at in the past three weeks. Additionally, last quarter the stock reported an earnings Triple Play, the only Utilities stock to do so of the 100 most recent Triple Plays. In other words, the underlying company is still strong even if the stock price has taken a breather. Similarly, PEG has traded in a tight range between $58 and $60 since early March. After consistently working its way off the bottom of this range since the start of April, in today’s trading, the stock has finally broken out of this range moving above $60.

While ED and PEG have been sideways, Southern (SO) and Sempra (SRE) are breaking out to new highs in the past few sessions; continuing along in their tremendous uptrends this year. The two are now up 21.02% and 20.95% YTD, respectively. There is only one stock (AES) that has done better in the sector YTD. Both of these stocks’ explosive runs began after they overtook resistance at their 2018 highs. SRE had actually been flat for most of the year in 2018. Both SO and SRE are in fact overbought at current levels, but not to an extreme degree.

Taken from our Chart Scanner tool, we show the charts of these stocks below.

Start a two-week free trial to Bespoke Premium to access our interactive Chart Scanner, Earnings Triple Plays, and much more.

Dogs of the Dow 2019

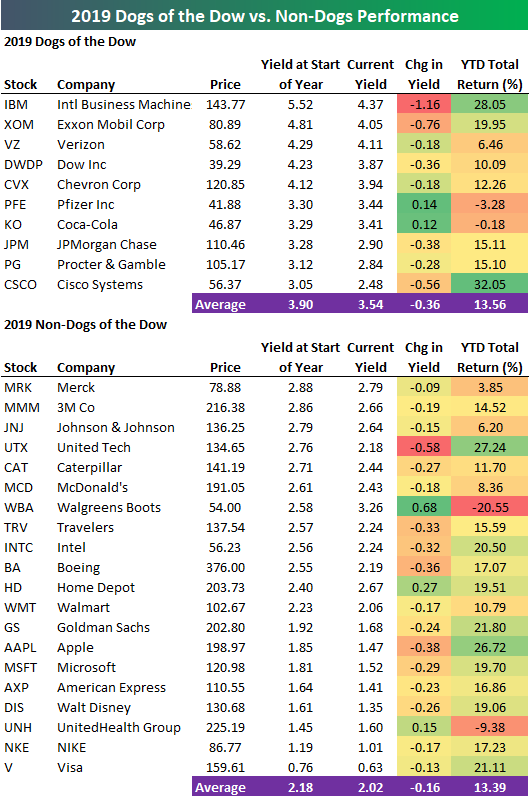

Below is a look at the performance of the Dogs of the Dow strategy so far in 2019. This hands-off, buy-and-hold strategy simply buys the 10 highest yielding Dow Jones Industrial Average stocks at the start of each year.

As shown, the 10 Dogs of the Dow stocks are up 13.56% on a total return basis so far this year. The 20 non-Dogs are up 13.39%, so the performance difference between the two groups is just 17 basis points.

Two Tech stocks that are part of this year’s Dogs are up the most, with IBM up 28.05% and Cisco (CSCO) up 32.05%. IBM started the year yielding 5.52%, but its yield is now down to 4.37% after a significant share price gain. CSCO started the year with a yield of 3.05% that is down to 2.48% as of today.

Only two Dogs are down so far this year. Pfizer (PFE) is down the most at -3.28%, while Coca-Cola (KO) is just barely in the red at -0.18%.

Of the 20 non-Dogs, United Tech (UTX) is up the most at +27.24%, while Apple (AAPL) is up the 2nd most at +26.72%. Walgreens Boots (WBA) — the most recently added Dow member — is down the most at -20.55%. UnitedHealth (UNH) is the only other non-Dog that’s in the red for the year with a decline of 9.38%.

Start a two-week free trial to Bespoke Institutional to unlock the full Bespoke interactive research portal.

Chart of the Day: #$@&%* Taxes!

US Economic Indicators — Which Ones Beat or Miss the Most Often?

Our Economic Indicators database is one of the diamonds in the rough of our Bespoke Institutional offering. This interactive online database contains actual and estimated numbers for every single major US economic release going back more than 20 years. If you ever want to do economic analysis and need historical data, this is a very easy place to get it. You can find the database at our new Tools page shown in the image below. (Must be a Bespoke Institutional member to access. Start a two-week free trial now.)

In our Economic Indicators database, we show how often each indicator comes in either stronger or weaker than expected versus consensus economist estimates along with how the market and individual sectors reacted to each report. What’s also different about this database is that rather than show the revised readings for each economic report, we show the actual reading at the time of the release. This helps to see how the market reacted to the data presented rather than a reading that was revised a number of times.

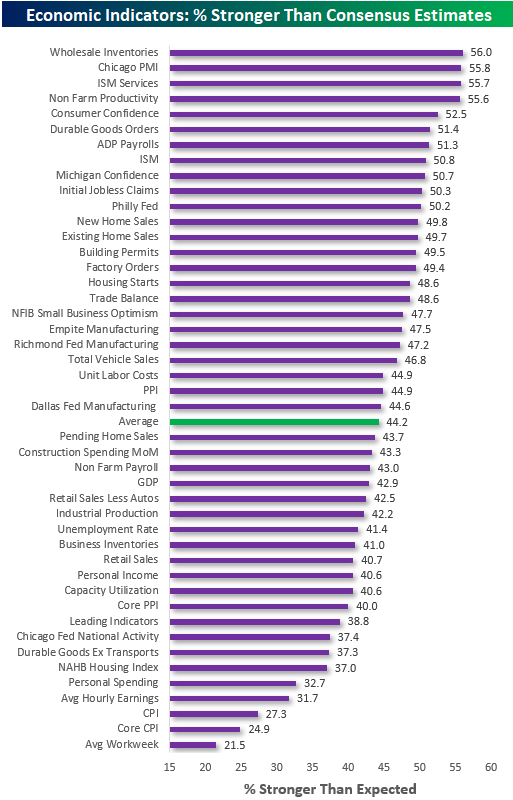

Below is a chart showing the percentage of the time that each of the US economic releases has come in stronger than expected over the last 20 years. Of the 45 indicators that we track, only 11 come in stronger than expected more than 50% of the time. The economic releases with the strongest beat rates are Wholesale Inventories, Chicago PMI, ISM Services, and Non Farm Productivity.

The average “beat rate” for all US economic releases is 44.2%. The indicators that come in stronger than expected the least often are the NAHB Housing survey, Personal Spending, Average Hourly Earnings, CPI, Core CPI, and the Average Workweek. In the case of the CPI inflation reading, not having a strong “beat rate” can actually be considered a good thing!

On the flip side, below is a chart showing how often each economic release comes in weaker than expected. At the top of the list is the Chicago Fed reading that has come in weaker than expected 61.6% of the time over the last 20 years. Notably, the monthly Non-Farm Payrolls report (the most widely followed jobs report each month) ranks second with a “miss rate” of 57%. Durable Goods ex Transports, Dallas Fed, and Pending Home Sales round out the top five.

The average “miss rate” for all economic releases is 45.3%. With an average miss rate of 45.3% and an average beat rate of 44.2%, the remaining 11.5% of reports have come in “inline” with expectations.

Start a two-week free trial to Bespoke Institutional to access our economic indicators database and everything else we have to offer.

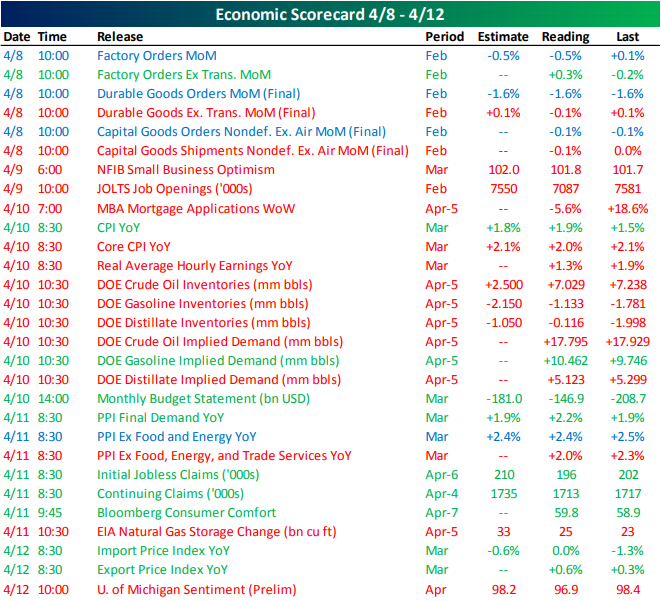

This Week’s Economic Indicators – 4/15/19

Last week was mixed in economic data with some bias towards weaker data points. Factory orders kicked off the week showing a decline inline with expectations. Durable goods and capital goods similarly came in with declines across the board. Tuesday saw misses in both NFIB Small Business Optimism and the JOLTS report while MBA mortgage applications also declined after a couple of strong weeks in a row. Wednesday’s headline CPI beat estimates, but the core measure which controls for volatility in prices like oil, missed forecasts by 0.1%. PPI inflation came in later in the week with a beat in the headline number, but a decline from the previous period in both core measures. Staying on the topic of oil, EIA data on Wednesday showed a second week of crude inventory builds over 7 mm bls, but also showed strong gasoline demand and inventory draws. Preliminary readings for April University of Michigan Sentiment capped off the week with a decline to 96.9 versus the forecasted drop of only 0.2.

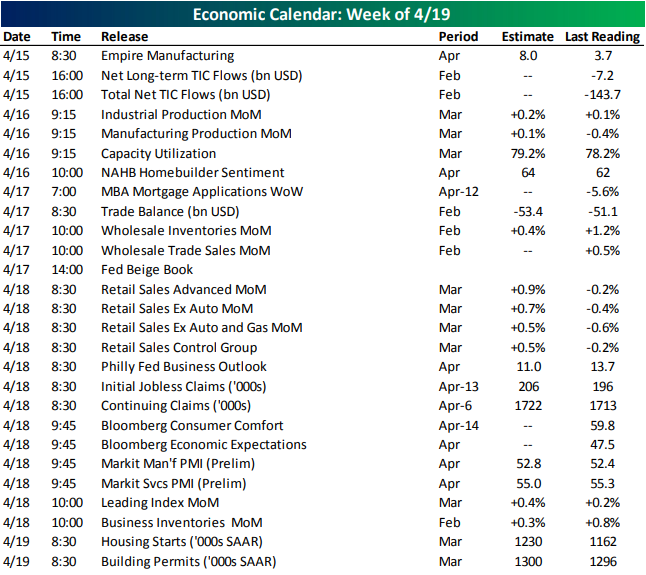

It’s going to be a pretty boring start to the week with Empire Manufacturing and Treasury flows the only releases to note today. Empire Manufacturing came in above estimates at 10.1 earlier this morning. That is also handily above the March print. More manufacturing data will be released tomorrow with Industrial and Manufacturing Production for March. Homebuilder sentiment for April will also be out Tuesday, expecting to rise to 64 from 62 in March. The Trade Balance for February will come out on Wednesday along with the Fed’s Beige Book later on in the afternoon. Thursday will be a particularly busy day with 13 releases scattered throughout the morning. We will hopefully get a better picture on retail sales which has been very volatile this year with March data coming out Tuesday. Month-over-month increases are expected across the board. In manufacturing data, Philly Fed Outlook will be out alongside the Market Flash PMIs for April. The service counterpart will also be released. While markets will be closed for Good Friday, the Federal Government will still be open and releasing data as we will get Housing Starts and Permits. Both are forecasted to show improvements from the February prints.

Use our Economic Monitorsto stay up to date on daily economic releases.

Start a two-week free trial to Bespoke Premium to access our interactive economic indicators monitor and much more.

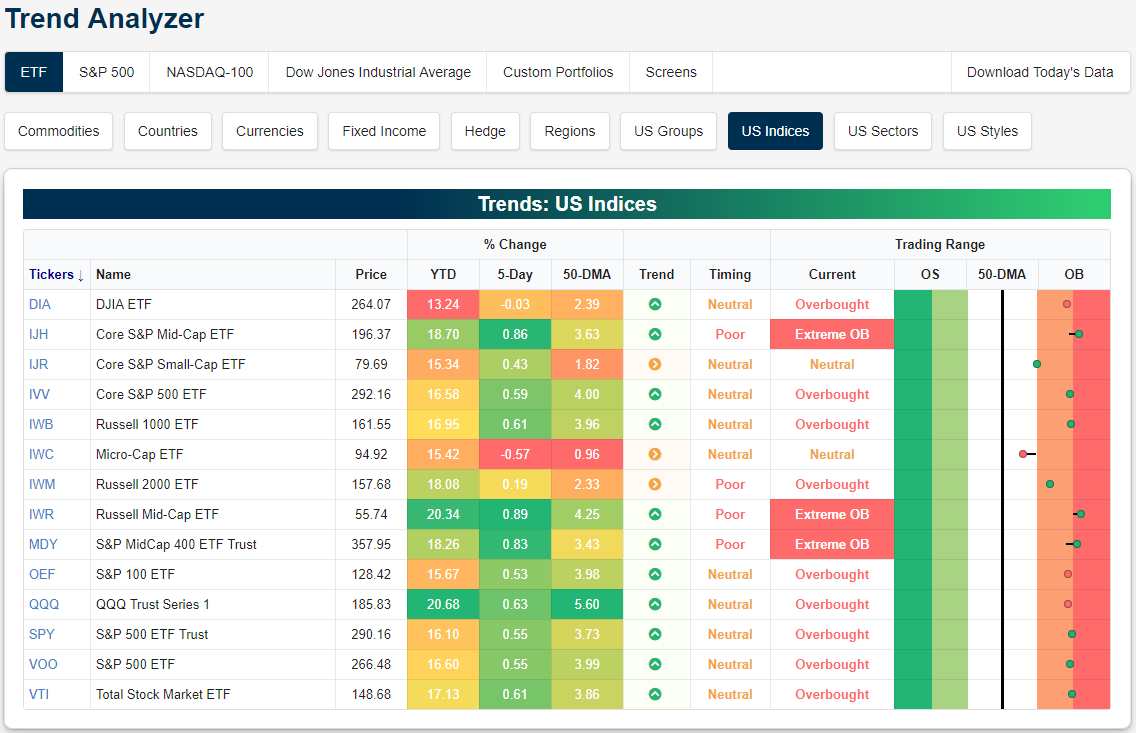

Trend Analyzer – 4/15/19 – Mid Caps Extended

Last week was fairly positive for equities. As shown below, all but two of the major US index ETFs we track with our Trend Analyzer tool were up on the week. Given overbought/oversold levels, it makes sense that the indices did not rocket higher. Things have gotten pretty overbought across the board, especially for mid-caps. Twelve of the fourteen major index ETFs are now overbought with each of the Mid Cap ETFs (IJH, IWR, and MDY) all at extreme levels. These ETFs also outperformed their peers last week. Large and small-caps are on the verge of also becoming extremely overbought. Only the Core S&P Small Cap (IJR) and Micro-Cap (IWC) have been lagging behind and are still neutral, granted IJR is on the border of moving into overbought.

Start a two-week free trial to Bespoke Premium to access our interactive Trend Analyzer tool and much more.

Morning Lineup – All is Not Wells

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

Happy Tax Day! If you have been busy this morning writing out checks to Uncle Sam or grumbling that your refund isn’t as high as you thought it would be, don’t worry about missing a whole lot in the market as things have been pretty quiet so far. The only economic indicator of note today is Empire Manufacturing, and the pace of earnings doesn’t start to pick up until tomorrow.

Whether it was a kitchen sink quarter or not, last Friday’s earnings report from Wells Fargo (WFC) wasn’t received well by the street. After falling more than 2.5% on Friday, analysts had an entire weekend to think about and go over the results, and based on this morning’s research news, they didn’t like what they saw. As shown in the analyst upgrades and downgrades section of our Morning Lineup, Wells Fargo was downgraded this morning by no less than four different firms. Not exactly a ringing endorsement, but one could also make the argument that sentiment towards the stock has become skewed to the negative side.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.