Strong Real Incomes, Declining Minimum Wage Coverage

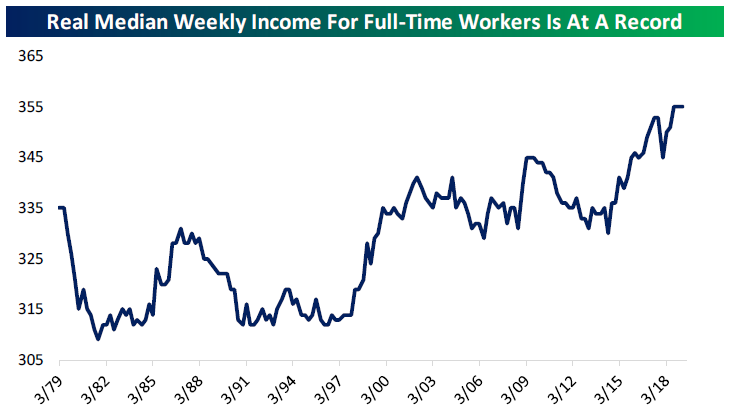

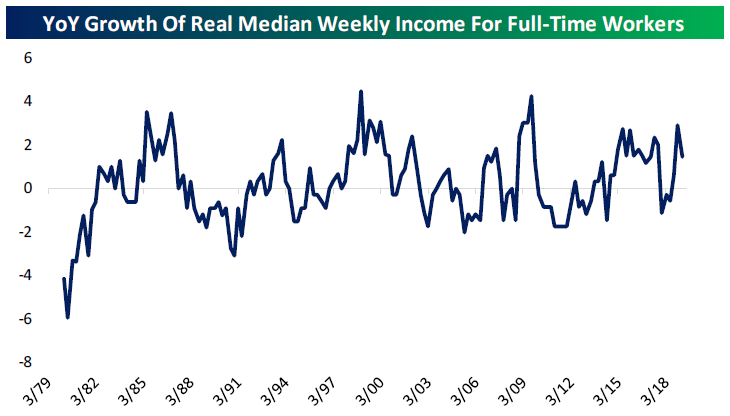

Yesterday the BLS released its quarterly estimate of median weekly income for Q1. After accounting for inflation, in Q1 the median worker with a full-time job took home the same income (seasonally adjusted) as in Q3 and Q4. That’s the first time we’ve seen real weekly pay unchanged for three straight quarters in the history of the data set. While real income growth hasn’t been dramatic recently, there’s definitely been a trend of improvement since the end of 2014.

As far as YoY growth goes, this series had its best year in a decade in the year ending Q4, but slowed YoY in Q1. At 1.4%, that growth is stronger than three-quarters of readings since 1979. In short, real incomes are growing at a healthy pace.

One other interesting data point released in the report is the share of workers nationally who earn the federal minimum wage. As shown in our last chart below, 2018 had only 2.1% of hourly paid workers receiving the minimum wage, the lowest percentage on record since 1979. The combination of state/local minimum wage hikes above the federal rate and a national legislative failure to keep the minimum wage rising with the pace of inflation are the key reasons for the decline to record lows. Start a two-week free trial to Bespoke Institutional to unlock the full Bespoke interactive research portal.

Morning Lineup – Still Settling Up

After a big surge yesterday, shares of Qualcomm (QCOM) are still finding an equilibrium in the wake of yesterday’s settlement with Apple (AAPL). After a bunch of upgrades this morning, the stock is up another 11%. Yesterday’s news between the two companies also gave Intel (INTC) an opportunity to exit the smartphone modem business (AAPL was its primary customer), which was considered an inferior offering to QCOM’s. With that news, INTC’s stock is rallying close to 5% as the knock-on effects of this major deal (details of which are scant) continue to shake out.

In earnings news this morning, the picture isn’t quite as pretty as it was yesterday. Of the thirteen companies that have reported so far today, just 62% have exceeded EPS forecasts while slightly more than half (7) have managed to exceed top line results.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s a snippet from today’s report:

We have a lot to get to in this morning’s report, but below we wanted to highlight one interesting aspect in terms of where global equity markets stand now compared to three months ago. If you haven’t looked at equity index charts from around the world recently, it may surprise you to know that as of yesterday’s close no less than seven major national indices are within 1.5% of new 52 week highs on a closing basis with India and China marking their best closes of the past year. Another 7 major country indices are within 6% of that level, and only one (Malaysia’s Bursa Malaysia Index) is more than 11% below 52-week closing highs.

In the left chart below, we show distance from 52-week closing and intraday highs for the global markets covered in our Global Macro Dashboard. What a change it’s been over the last three months. In the second chart at right below, we show the same metrics as-of three months ago. Only 2 indices were within 6% of 52-week highs at that point, and seven were at least 15% below their best levels of the year prior. The risk asset rally since the end of December has lifted a lot of ships. With this kind of backdrop, one would think central banks around the world would be more biased towards tightening than cutting! For an updated set of charts and other metrics covering each of the countries below, make sure to check out our weekly Global Macro Dashboard.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

Bespoke’s Global Macro Dashboard — 4/17/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

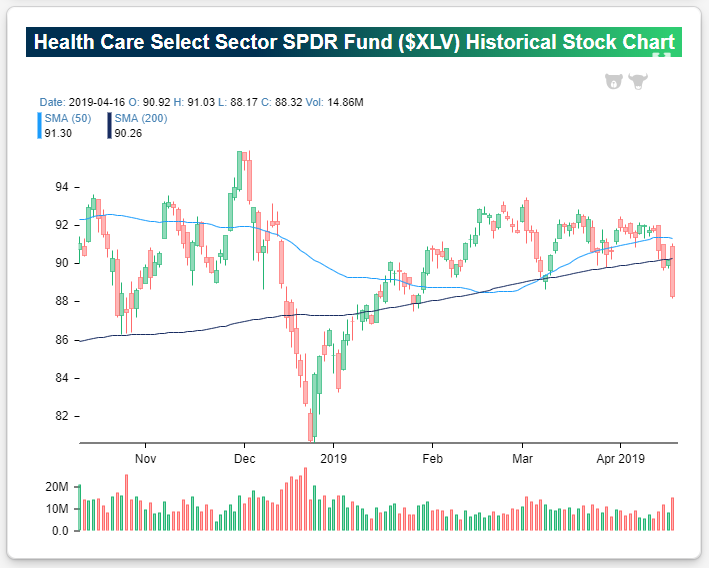

Health Care Continues to Slide in 2019

As shown in the chart below, the Health Care sector ETF (XLV) took a nosedive yesterday to break below its March lows after UnitedHealth (UNH) — which has a pretty big weighting in the sector — fell 4% in reaction to its Q1 earnings report. This weakness has been a trend for Health Care all year now. The sector has been lagging the S&P 500 badly this year, and after yesterday’s declines, Health Care is underperforming the S&P 500 by 14 percentage points YTD.

As shown in our Trend Analyzer snapshot below, every sector is above its 50-day moving average right now except Health Care, which is now trading at extreme oversold levels at more than two standard deviations below its 50-day. Not only is Health Care underperforming this year, but now it’s up just 2% YTD and another day like yesterday will put it in the red for the year.

In the Dow Jones Industrial Average, just four stocks are in the red on the year, and they’re all Health Care names. Both UnitedHealth (UNH) and Pfizer (PFE) are in “extreme” oversold territory, while Merck (MRK) and Walgreens (WBA) are merely oversold. Is Health Care going to eventually outperform given how weak it has been relative to every other sector this year? We analyzed the likelihood in a Chart of the Day yesterday that you can access with a two week free trial to any of our premium research subscriptions. You’ll also gain access to a number of interactive tools whose snapshots were featured in this post.

IBM Can’t Shake the Q1 Blues

Heading into last night’s Q1 2019 earnings report, IBM was the 2nd best performing stock in the Dow Jones Industrial Average on the year. That looks to change this morning with the stock trading down 3.5% ahead of the open on a Q1 revenue miss. The first quarter has been a challenging one for IBM’s stock for a decade now!

Using our Earnings Explorer, below is a snapshot of IBM’s prior 9 first quarter earnings reports dating back to 2010. In our earnings database, we include how the stock price reacted to the report because that essentially tells investors how good or bad an earnings report really was. As shown in the far right column of the table, IBM has traded lower on its last nine Q1 earnings reaction days (the first trading day following its report). With the stock set to open down 3.5% this morning, there’s a strong possibility this Q1 losing streak for IBM will extend to ten years in a row! Start a two-week free trial to Bespoke Institutional to unlock the full Bespoke interactive research portal.

The Closer — Cyclicals Surge, Autos & Industry, Median Pay, Fedspeak — 4/16/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look into the industries that we consider cyclical which have been outperforming the S&P 500 recently. This could bode well for global manufacturing finding a bottom as well as the durability of the current rally. Of these cyclical industries, we highlight autos, more specifically OEMs and parts retailers, showing how much they make up of the global indices. Turning to macro data, we evaluate today’s industrial production data which saw the March release miss estimates. We also review the quarterly estimate of weekly income for the first quarter, released by the BLS today. We finish with an updated look at our Fedspeak Monitor Index, which has flipped from dovish to hawkish and now is back to dovish once again.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

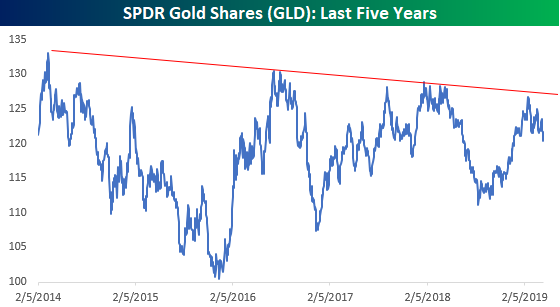

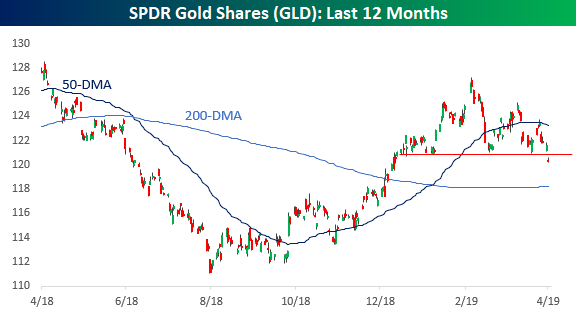

Gold Breaks

After a strong start to the year, gold has been having a tough time since mid-April, and after breaking support at around the $121 level today, the SPDR Gold Shares ETF (GLD) has done more than a roundtrip since the start of the year. With support at this year’s lows now broken, the technical picture doesn’t appear to be too positive for GLD.

Zooming a bit further out than just the last year, the five year chart for GLD doesn’t look much better. From this vantage point, the rally to kick off 2019 marked just one more in a series of lower highs.

From a ten-year window, GLD is still down sharply from its peak above $180 back in 2011. The encouraging aspect of this chart, though, is that this year’s rally does appear to have broken the downtrend that has been in place since that peak. With that in mind, bulls on GLD could look at this recent pullback as a test and kiss-back of the downtrend line at around the $118 level and therefore is not as big of a negative as the break of support in the first chart would suggest. With GLD trading just above $120 now, that will be a key level to watch going forward. Any break significantly below $118 would spell trouble. Start a two-week free trial to Bespoke Institutional to unlock the full Bespoke interactive research portal.

Bespoke Stock Scores — 4/16/19

Sector Charts – 4/16/19 – Consumer Discretionary

The Consumer Discretionary sector has been on a tear this year with the second best YTD gains (19.75%) behind only the Tech sector. This is a sector that is comprised of many names that are huge everyday brands in the life of the American consumer, so the fact that they are doing well suggests that the consumer remains strong.

Beginning with a quick glance at auto parts retailers, Autozone (AZO), Genuine Parts (GPC), and O’Reilly Automotive (ORLY) have all held onto solid uptrends for the past year, even through the volatility late in 2018. In 2019, the angle of these uptrends has increased considerably, and they have now reached extremely overbought levels with 15%+ YTD gains. AZO has gained even more at 26.99%.

Chipotle (CMG), McDonald’s (MCD), and Yum! Brands (YUM) have also seen similarly solid runs. While MCD has been a bit more volatile given its pullback earlier this year, all three stocks have reached 52-week highs lately. CMG has been truly explosive rising 64.96% this year alone! Even at its current levels, though, the stock has not yet reached extreme overbought levels. Of the three, Yum! Brands (YUM) has perhaps been the most steady in its uptrend over the past year.

The major home improvement stores also boast attractive chart patterns. Home Depot (HD) has yet to reach a 52 week high, but the stock has been in a solid uptrend so far this year and now isn’t far off. Major competitor Lowe’s (LOW) has a near identical chart though seems to be a bit further ahead of HD as it hit a 52-week high on Monday. Tractor Supply’s (TSCO) chart may not look as similar to LOW and HD, but it is yet another name with a solid uptrend over the past year, especially since the start of 2019.

Whereas the highlight of most of the sector is the uptrends, Hasbro (HAS) has been a bit of an outlier with its downtrend. But that downtrend may soon be in the rearview mirror as the stock is attempting to break its string of lower highs. The past few day’s trading has brought the stock well above the downtrend line and the 50-DMA. Since the start of the year, HAS has also not made a new low. The next point of resistance to watch would be the 200-DMA, which put a halt to the rally in February. The charts below were all taken from our Chart Scanner tool, and if you start a two-week free trial to Bespoke Premium now, you will receive instant access to this great tool and much more.