Chart of the Day: Anything But Defensive

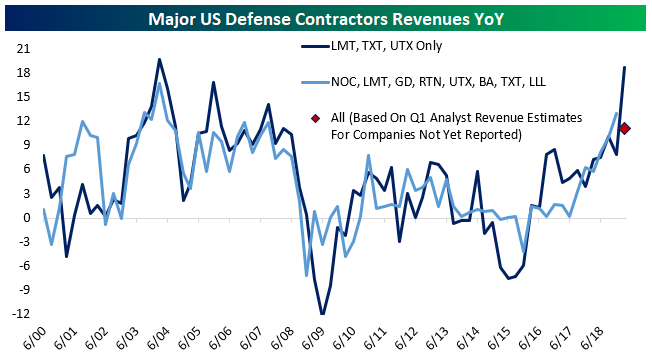

This morning, Lockheed-Martin (LMT) smashed earnings expectations, reporting $5.99 EPS for Q1 versus $4.34 expected. The beat was driven by sales of $14.3bn, exceeding analyst estimates of $12.6bn, and also came with a dramatic upgrade to guidance for all financial metrics this fiscal year. The triple play from LMT joined strong reports from Textron (TXT) and United Technologies (UTX). Together, these three companies are seeing combined revenues grow at a staggering 18.7% YoY, the fastest since defense spending’s huge ramp up following the 9/11 attacks and the invasions of Afghanistan and Iraq. Among other defense contractors, analysts are projecting revenue numbers for Q1 that would indicate a significantly lower revenue growth number, but if the results from LMT, TXT, and UTX are any indication, those forecasts are going to be handily beaten.

So which of the other defense contractors currently look the most attractive?

Continue reading this Chart of the Day by starting a two-week free trial to any of our research membership levels.

Morning Lineup – Earnings Season Wakes, Gold Goes to Sleep

With markets around the world all open following a holiday on Monday for many, the mood is mixed although US futures are right near their highs of the morning. The catalyst in the US is solid earnings reports. Of the nearly 50 names that have reported so far this morning, two-thirds have exceeded EPS forecasts. More impressive, however, is the fact that two-thirds of those companies reporting have also exceeded top-line revenue estimates. It’s only one morning’s worth of data, but it is also the busiest day of earnings so far this reporting period.

We’ve just published today’s Morning Lineup featuring all the news and market indicators you need to know ahead of the trading day. To view the full Morning Lineup, start a two-week free trial to Bespoke Premium.

Here’s an interesting chart to start your day:

As earnings season has come to life, gold has completely flat-lined in the last few trading days. Take a look at the chart below which shows the YTD performance of the SPDR Gold Trust ETF (GLD). Over the last four trading days, the spread between the intraday high and low over that period has been just 0.40%. While that narrow a spread is notable enough, its the third time this year that GLD has gone into one of these four-day nap periods where the spread between the intraday high and low was less than 1%! Like the last two, will this one be another pause that refreshes?

What’s even more notable about the recent narrow range for GLD is that since the ETF started trading in 2005, there has never been a four-day period where the spread between the intraday high and low over those four days has been narrower. Volatility isn’t just lower in the equity market as gold has become increasingly less volatile in recent years.

Start a two-week free trial to Bespoke Premium to see today’s full Morning Lineup report. You’ll receive it in your inbox each morning an hour before the open to get your trading day started.

The Closer — Earnings Flood, HYG Drop, 2s10s Breakout, VIX Curve, Growth Uptick — 4/22/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, while it may have been a quiet day in equities before a massive amount of earnings in the days to come, credit was a different story. High Yield credit fell from open to close for its fifth straight day and the yield curve has steepened, we explain what this could mean going forward. Next, we cover risk sentiment as seen through the VIX. Turning to macroeconomic data, we look at today’s Chicago Fed National Activity Index release which came in weaker than forecast with a revision lower. We finish with a look at our Beige Book Index, updated with last Thursday’s release.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Energy Sector Back Above 200-DMA as Oil Rallies; Energy Stocks and Oil Correlation

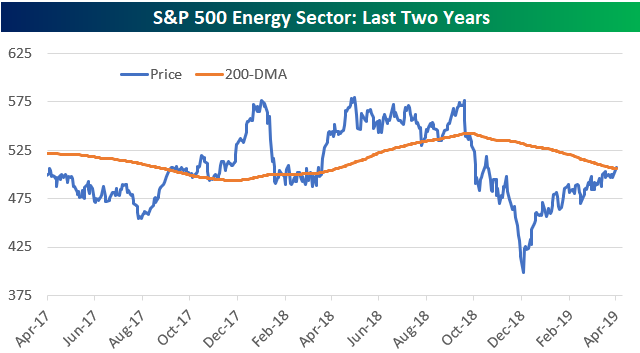

The S&P 500 Energy sector moved above its long-term 200-day moving average today on the back of another sharp move higher for crude oil prices. It was the Energy sector’s first close above its 200-DMA since October 10th, 2018. As shown below, while the sector has rallied significantly off of its December 2018 low, it’s still right in the middle of the range it has been in over the last two years.

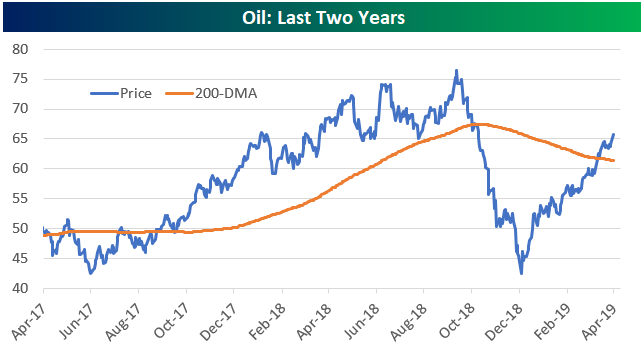

Oil has rallied nearly 60% off of its December low, and as shown below, the commodity eclipsed its 200-DMA a few weeks ago well ahead of the Energy sector.

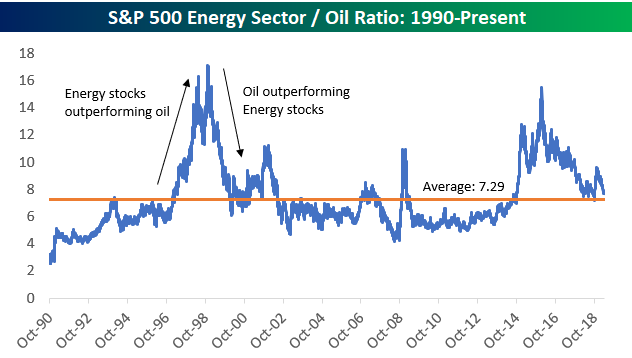

Below is a long-term look at the ratio of Energy stocks to oil. When the line is rising, Energy stocks are outperforming oil. When the line is falling, oil is outperforming Energy stocks.

You can see in the chart that there have been two big periods of strength for Energy stocks (versus oil) over the last 30 years. One period was during the late 1990s when equities in general were on fire, and the other was from 2014 through early 2016 when both oil and Energy stocks were in free-fall (oil fell a lot more). Since oil bottomed in the mid-$20s three years ago, we’ve seen the commodity far outpace Energy stocks. Oil is up 148% off of its lows while Energy stocks are up just 30%.

At any rate, while the ratio is certainly volatile, the current level of 7.7 is just a notch above the long-term average ratio of 7.29.

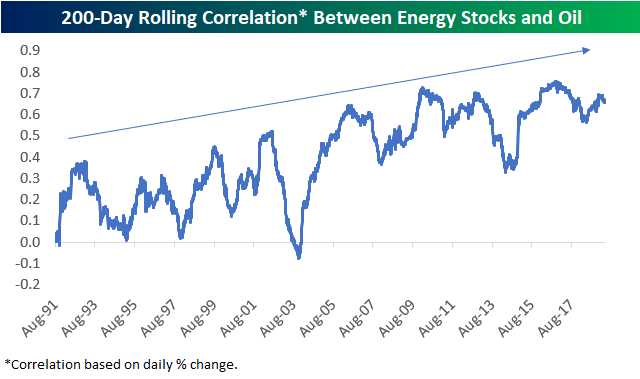

In terms of the day-to-day fluctuations for oil prices and Energy stocks, over the last 30 years we’ve seen the two become more and more correlated. Below is a chart showing the rolling 200-trading day correlation between their daily price movements (%). During the 1990s, the correlation between the two ranged from 0 to 0.5 with even a couple dips into negative territory. Since 2003, though, we’ve seen the correlation increase more and more over time, and it actually hasn’t dipped below 0.50 in a few years now.

Start a two-week free trial to Bespoke Institutional to unlock all that Bespoke’s research has to offer!

Megacap Market Caps

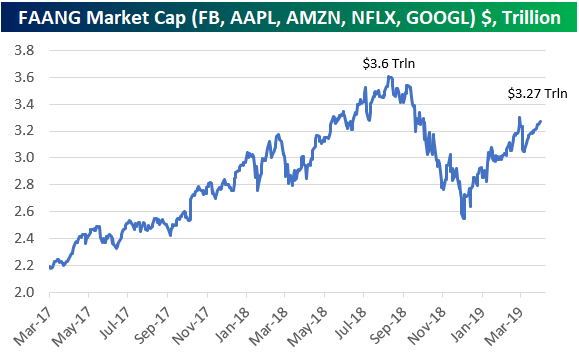

The five FAANG stocks of Facebook (FB), Apple (AAPL), Amazon (AMZN), Netflix (NFLX), and Alphabet (GOOGL) saw their combined market cap fall 30% during the late 2018 sell-off. As shown in the chart below, their combined market cap has climbed back quite a bit since the lows, but it’s still about $330 billion from prior highs. Start a two-week free trial to Bespoke Institutional to access our premium research!

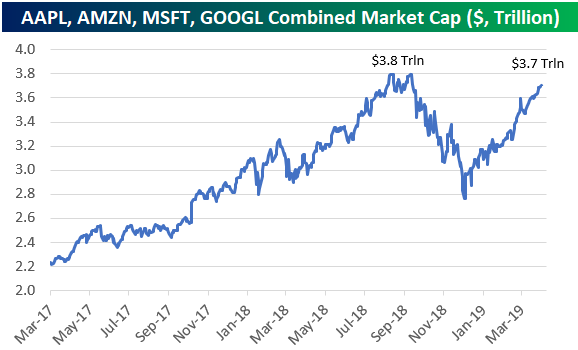

If we just look at the four largest companies in the S&P 500 instead of FAANG, they’re a lot closer to eclipsing the prior combined high of $3.8 trillion. As shown below, Apple (AAPL), Amazon (AMZN), Microsoft (MSFT), and Alphabet (GOOGL) together account for $3.7 trillion in market cap at the moment.

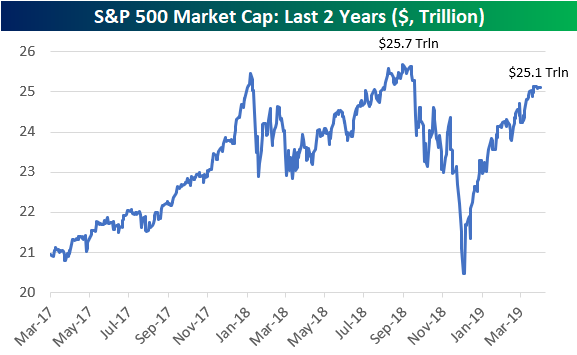

The $3.7 trillion in market cap that the four largest stocks make up accounts for about 14.7% of the S&P 500’s total market cap of $25.1 trillion. The S&P 500 as a whole needs to add another $600 billion in market cap to eclipse its late 2018 high of $25.7 trillion, more than half of which is from the five FAANG stocks.

Sector Charts – 4/22/19 – Financials

Following a long list of the major companies in the sector reporting earnings over the past week, Financials have been the second strongest sector. With a 2.5% gain since the start of last week, the Financial Sector (XLF) has become extremely overbought. Even at these levels, there are a number of attractive charts, some of which thanks to their response to earnings.

Of the companies shown below, American Express (AXP), Goldman Sachs (GS), Morgan Stanley (MS), Torchmark (TMK), and Travelers (TRV) all reported earnings within the past week. The reactions have ranged from explosive, like TMK and TRV, to more subdued, like GS. Running down the list, popular credit card company American Express reported on Thursday beating EPS estimates but also falling short in terms of revenues. The stock still rallied 1.71% in response, bringing it just above highs from late last year and earlier this year. Today, the stock has pulled back slightly but is up from the open.

GS reported one week ago last Monday. Similarly seeing a top line miss and bottom line beat, GS fell 3.82% on the day. While earnings may not have acted as a catalyst, the stock saw some buying in the days since its report, bringing it above its recent range before failing at the 200-DMA.

Reporting mid-week (4/17), Morgan Stanley (MS) beat both EPS and sales estimates leading it to rally 2.64% into extreme overbought territory. The stock has fallen off of these levels but this strong run has been a nice sign following a long term downtrend through most of last year and a flat start to 2019. This recent run higher has brought it out of this year’s range as well as above the 200-day.

Similar to MS hitting extremely overbought levels, Torchmark (TMK) and Travelers (TRV) both rallied 2.88% and 2.25%, respectively, in response to their earnings last week. For TMK, like American Express, the earnings report was just the push the stock needed to retouch 52-week highs after what was looking like a flat year. Meanwhile, TRV has been in a solid uptrend all year. The stock couldn’t hold onto highs from Thursday’s response to earnings, but it has set a precedent for a move higher.

After a somewhat rough 2018, uptrends are common among Financials this year. After a brutal downtrend all last year, Invesco (IVZ) finally found a bottom alongside the broader market and has been making a series of higher lows and higher highs ever since. At its current levels, it has gotten a bit extended so a pullback like we saw multiple times earlier this year is increasingly possible. Regardless it has had a clean chart and in the past couple of weeks has closed above the 200-DMA for the first time since last March.

While their 2018 downtrends may not have been as long or clean as IVZ, Moody’s (MCO), T Rowe Price (TROW), and S&P Global (SPGI) each have a similar chart to IVZ with a steep downtrend last year and a solid uptrend so far this year. TROW and IVZ both have a lot of progress to still make until they retake last year’s highs, while MCO and SPGI have made considerable pushes and are now solidly above prior highs. Both of these are also a bit more attractive at current levels as they are sitting at the bottom of their uptrend line. TROW and MCO both report later this week while SPGI is out on May 2nd.

Staying on the topic of uptrends, Marsh & McLennan (MMC) did not see the same type of downtrend in 2018, rather it saw a fairly choppy sideways trend with increasing volatility into the end of the year. But following a surge after its February earnings report, the stock has been in a steady uptrend. It is now coming off of overbought levels to the bottom of its uptrend channel and just barely overbought, meaning it could begin to reverse higher, continuing its uptrend soon. Start a two-week free trial to Bespoke Premium to access our interactive Chart Scanner and much more.

Chart of the Day: Who To Trust On Housing?

Key Earnings Reports to Watch This Week

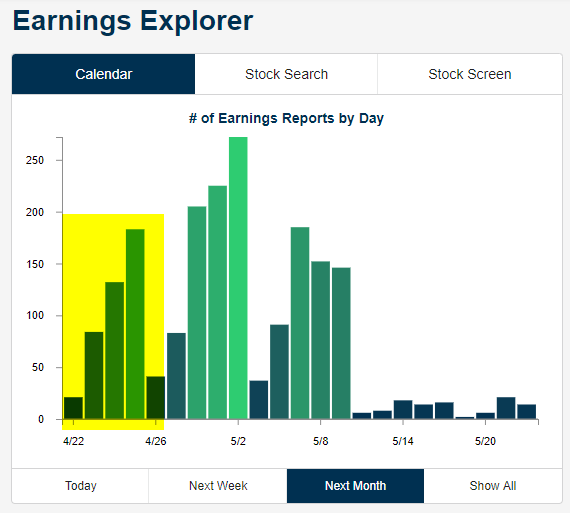

Earnings season really picks up this week with 400+ companies set to report. The chart below shows the number of earnings reports by day over the next month and can be found updated daily at our Earnings Explorer page. Start a two-week free trial to Bespoke Institutional to access this page along with everything else we have to offer!

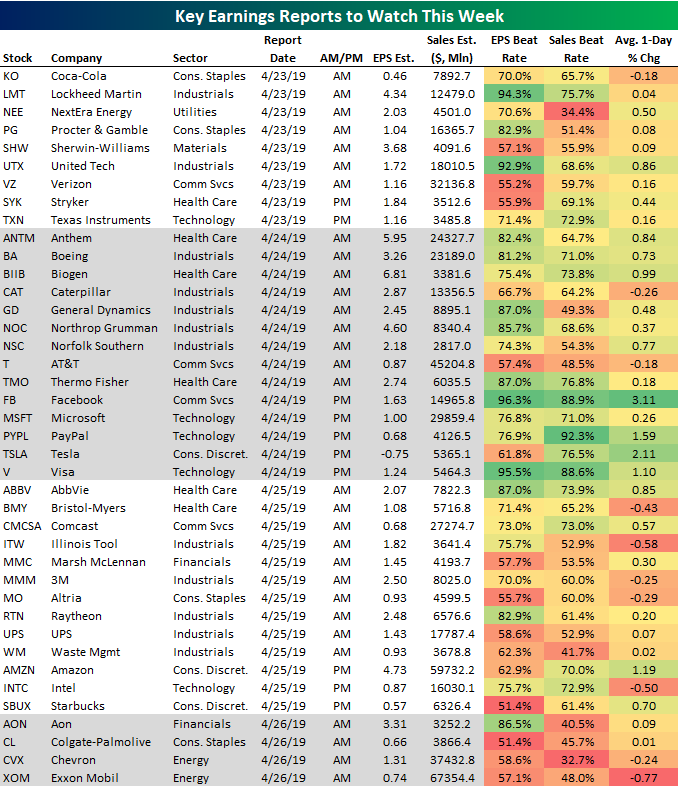

Below is a list of the 40 most important companies set to report earnings this week. These stocks are pulled from our Earnings Calendar table at the same Earnings Explorer page mentioned above.

A number of Dow 30 stocks like Coca-Cola (KO), Procter & Gamble (PG), United-Tech (UTX), and Verizon (VZ) will report Q1 earnings Tuesday morning ahead of the open. On Wednesday, we’ll hear from more big Industrials companies like Boeing (BA), Caterpillar (CAT), General Dynamic (GD), and Northrop Grumman (NOC) in the morning, while in the afternoon, investors will be focused on names like Facebook (FB), Microsoft (MSFT), Tesla (TSLA), and Visa (V).

On Thursday, we’ll get 3M (MMM), Altria (MO), and UPS in the morning, followed by Amazon (AMZN), Intel (INTC), and Starbucks (SBUX) after the close. Finally, Chevron (CVX) and Exxon Mobil (XOM) will round out the week with reports on Friday.

You’ll notice a number of additional data points in the table above to go along with each company’s report date, EPS estimate, and sales estimate. Also included are the historical earnings per share and sales beat rate that we track for every US stock. These two data points show how often a company beats estimates on both the top and bottom line. The final column in the table shows the average one-day price change that the stock has historically experienced on its earnings reaction day. For example, Facebook (FB) has historically averaged a huge gain of 3.11% on its earnings reaction day, while Exxon Mobil (XOM) has averaged a one-day decline of 0.77%.

Within our Earnings Explorer tool, users can pull up key information for individual stocks with our Stock Search feature. Below are snapshots pulled from the Earnings Explorer for Lockheed Martin (LMT), Facebook (FB), and Amazon (AMZN), which all report this week.

You’ll notice huge EPS beat rates for both Lockheed Martin and Facebook. Facebook also has an extremely high sales beat rate. A high beat rate for a stock means that expectations heading into future reports will also be high.

On the right side of the stock-specific snapshot from our tool, there are charts showing historical actual versus estimated EPS and sales so you can easily see how these two important measures are trending. For LMT, sales have really picked up over the last few years after a multi-year sideways period from 2010 through 2016. Facebook has had a few bumps in the road for sales but is still trending higher. When looking through these charts for individual companies, it’s easy to tell which ones are performing well and which ones are struggling.

One company that’s definitely not struggling when it comes to revenues is Amazon (AMZN). In the third snapshot below, you can see a basically parabolic trajectory for AMZN sales over time. In Q1, AMZN sales are projected for $60 billion, which would be $9 billion more than the $51 billion in sales that the company recorded in Q1 2018. There are a number of additional features in our Earnings Explorer that aren’t shown in this write-up. We urge you to try it out and see for yourself just how helpful it is during earnings season! You can access it now with a two-week free trial to Bespoke Institutional.

Qualcomm (QCOM) Continues to Roll

Shares of Qualcomm (QCOM) are trading higher again to kick off the week after last week’s monster surge in the wake of the royalty settlement with Apple (AAPL). In just the last four trading days, the stock has rallied more than 43%. Now, it’s rare enough to see small cap stocks rally 40% in the span of four trading days, but for a mega-cap stock like QCOM, it’s practically unheard of. In just the last four trading days, QCOM”s market cap has jumped by nearly $30 billion from $69 billion to just under $99 billion. In the process, it has passed stocks like CVS, Morgan Stanley (MS), Goldman Sachs (GS), Caterpillar (CAT), Lowe’s (LOW), Starbucks (SBUX), and American Express (AXP) among others.

For QCOM itself, the move over the last four trading days is also reaching historical proportions. The chart below shows the historical rolling four-day rate of change for QCOM, and the current rate of 43.2% now ranks as the second all-time behind only the 53.2% four-day rally in April 1999. What makes that rally in 1999 even more impressive, though, was that even before it started, QCOM was already up 139% YTD after announcing in March of that year that it had settled all outstanding patent litigations with Ericsson related to CDMA technology. After that four day rally, QCOM was up more than 250% YTD and finished the year with a gain of more than 2,600%! The late 1990s sure were fun! Start a two-week free trial to Bespoke Institutional to access all Bespoke’s research and new interactive tools!

This Week’s Economic Indicators – 4/22/19

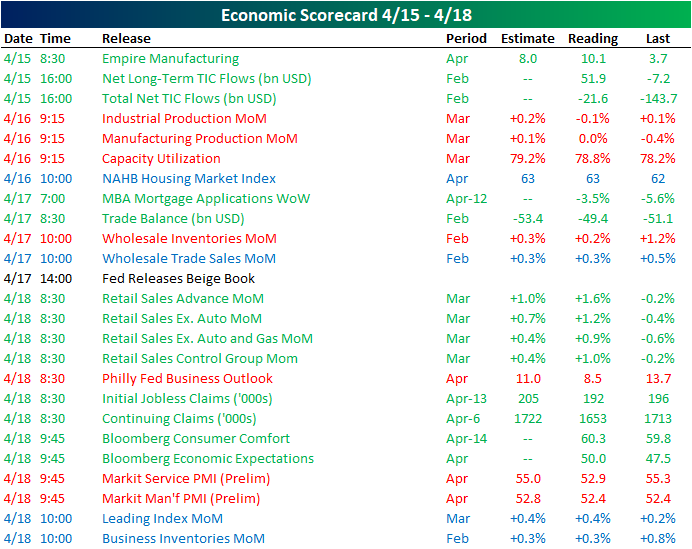

In spite of a shortened week as a result of the Easter Holiday, last week was fairly busy in economic data. There were 26 releases spread throughout the week with just under half coming in better than forecasts or the prior period. Empire Manufacturing for April kicked off the week with a much stronger print of 10.1 versus 3.7 in March. More positive treasury flows were also seen in Monday’s TIC flows. Industrial Production showed weakness on Tuesday while homebuilder sentiment came in line with forecasts of 63. Thursday was filled to the brim with data. March retail sales came in much stronger than the February print and handily above forecasts. The Philly Fed’s Business Outlook Index echoed the weaker manufacturing data from earlier in the week and a weaker preliminary Markit PMI for April. The service portion also came in weaker than forecasts. Initial Jobless Claims continues to surprise as it came in at another 50-year low. Markets may have been closed on Friday, but the government was still open and Housing Starts and Building Permits both released below estimates.

Start a two-week free trial to Bespoke Premium to access our interactive economic indicators monitor and much more.

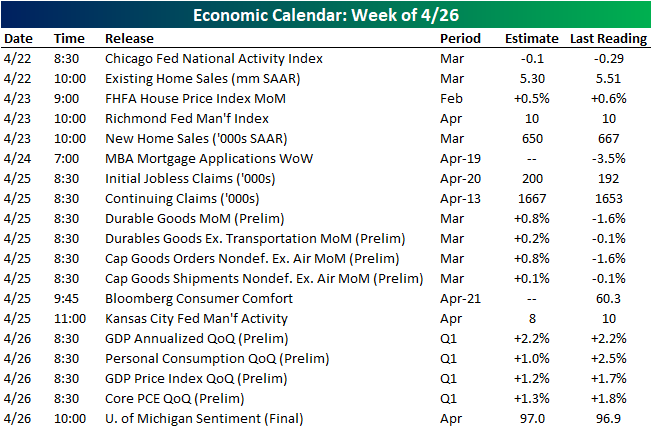

Even though the holiday has passed, this week is much quieter on the data front with only 19 releases. The Chicago Fed’s National Activity Index was the first release this week, coming in lower than forecasts at -0.15, but still improved from the February print of -0.29. Existing home sales also came in weaker this morning at 5.21mm SAAR. Tomorrow we will get FHFA home prices for February. Further in housing data, we will also see New Home Sales for March which are expected to come in slightly lower. The Richmond Fed’s Manufacturing index is also due out tomorrow with no forecasted change. Wednesday will be very light with only MBA Mortgage Applications releasing but things will pick back up on Thursday with Durable and Capital Goods data. We will also see if Initial Jobless Claims can continue to impress at record lows. We cap off the week with the first release of Q1 GDP data. While productivity is not expected to see any change, inflation data is forecasted to come in much softer.